Current Report Filing (8-k)

September 09 2014 - 3:44PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of

the Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): September 4, 2014

PLANDAÍ BIOTECHNOLOGY, INC.

(Exact Name of Registrant

as Specified in its Charter)

|

Nevada

(State or other jurisdiction of incorporation

or organization) |

Commission File Number

000-51206 |

20-1389815

(I.R.S. Employer

Identification Number) |

2226 Eastlake Avenue East #156, Seattle,

WA 98102

(Address of Principal

Executive Offices and Zip Code)

(858) 461-0423

(Issuer's telephone number)

(Former Name or Former

Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 1 - Registrant’s Business and Operations

Item 1.02 Termination of a Material Definitive Agreement.

On September 3, 2014 the Stock Purchase Agreement between

Plandaí Biotechnology and Lincoln Park Capital Fund, LLC (“Lincoln Park”) was terminated. We previously

reported our entry into the Lincoln Park contract on Form 8-K filed on February 10, 2014. There were no material relationships

between us, or any of our affiliates, and Lincoln Park other than with respect to the contract.

Our contract with Lincoln Park provided us with the right

to request Lincoln Park’s periodic limited purchases of our common stock. In light of our recent announcement regarding bioavailability

results, our management is presently reviewing other financing options that would have a lesser dilutive effect on shareholders;

however, there are no immediate needs or plans to obtain alternative financing. We believe our current cash position is sufficient

to finalize the development of our production facility in South Africa, and begin production and marketing of our products, resulting

in our expectation of more attractive financing opportunities in the future should the need arise.

Our contract with Lincoln Park provided in part that Lincoln

Park would agree to purchase shares of our common stock, conditioned upon a registration of the subject shares being declared effective

by the Securities and Exchange Commission. A total of $300,000 in stock purchases took place under the contract; however,

the Company did not file the registration statement as conditioned in the contract.

Pursuant to Section 11(b) of the contract, there are no early

termination penalties attributable the Agreement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated September 9, 2014

PLANDAI BIOTECHNOLOGY, INC.

By: /s/ Roger Duffield

Roger Duffield

Chief Executive Officer (Principal Executive Officer & Principal

Accounting Officer)

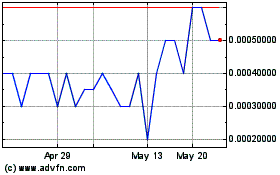

Plandai Biotechnology (PK) (USOTC:PLPL)

Historical Stock Chart

From Nov 2024 to Dec 2024

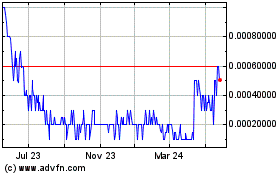

Plandai Biotechnology (PK) (USOTC:PLPL)

Historical Stock Chart

From Dec 2023 to Dec 2024