UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(MARK ONE)

[X] QUARTERLY REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED: September

30, 2014

[ ] TRANSITION REPORT UNDER SECTION

13 OR 15(D) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from ______

to_______

Commission file number 000-51206

| |

| PLANDAÍ BIOTECHNOLOGY, INC. |

| (Name of small business issuer in its charter) |

| Nevada |

45-3642179 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| |

|

1451 North 200 East

Suite #130C

Logan UT |

98102 |

| (Address of principal executive offices) |

(Zip Code) |

| |

| Registrant’s telephone number, including area code: (801) 209-1227 |

| |

|

|

| Securities registered under Section 12(b) of the Exchange Act: |

|

None |

| |

|

|

| Securities registered under Section 12(g) of the Exchange Act: |

|

None |

| |

|

(Title of Class) |

2226 Eastlake Ave #156, Seattle WA 98102

(Former name, former address and former fiscal

year, if changed since last report)

Indicate by check mark

whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§232.405) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| |

|

|

| |

Large accelerated filer ¨ |

Accelerated filer ¨ |

| |

Non-accelerated filer ¨ |

Smaller reporting company x |

Indicate by check mark

whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No

x

State the number of shares outstanding of each

of the issuer’s classes of common equity, as of the latest practicable date: As of November 14, 2014, the issuer had

134,414,536 shares of its common stock issued and outstanding.

The Company is a voluntary filer under the 1934 Securities and Exchange Act.

PART 1 – FINANCIAL INFORMATION

Item 1. Financial Statements

PLANDAI BIOTECHNOLOGY, INC.

CONSOLIDATED BALANCE SHEETS

| | |

| |

|

| | |

|

| | |

| September 30, | | |

| June 30, | |

| | |

| 2014 (Unaudited) | | |

| 2014 (Audited) | |

| ASSETS | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash | |

$ | 1,476,272 | | |

$ | 156,570 | |

| Inventory | |

| 2,204 | | |

| 2,521 | |

| Accounts Receivable | |

| 12,262 | | |

| 8,125 | |

| Related Party Receivable | |

| — | | |

| 426,444 | |

| Other Current Assets | |

| 237,846 | | |

| — | |

| Total Current Assets | |

| 1,728,584 | | |

| 593,659 | |

| | |

| | | |

| | |

| Deposits | |

| 79,070 | | |

| 83,366 | |

| Other Assets | |

| 13 | | |

| 150,630 | |

| Fixed Assets – Net | |

| 9,139,018 | | |

| 8,855,759 | |

| Total Assets | |

$ | 10,946,685 | | |

$ | 9,683,415 | |

| | |

| | | |

| | |

| LIABILITIES & STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts Payable and Accrued Expenses | |

$ | 222,891 | | |

$ | 142,623 | |

| Accrued Interest | |

| 66,277 | | |

| 39,505 | |

| Convertible Note Payable | |

| — | | |

| 18,112 | |

| Derivative Liability | |

| — | | |

| 23,710 | |

| Related Party Payables | |

| — | | |

| 2,949 | |

| Total Current Liabilities | |

| 289,168 | | |

| 226,899 | |

| | |

| | | |

| | |

| Capitalized Lease Obligation | |

| 1,386,039 | | |

| 1,358,982 | |

| Long Term Debt, Net of Discount | |

| 12,962,402 | | |

| 11,636,867 | |

| TOTAL LIABILITIES | |

| 14,637,609 | | |

| 13,222,748 | |

| | |

| | | |

| | |

| STOCKHOLDERS' DEFICIT | |

| | | |

| | |

| Common Stock, authorized 500,000,000 shares, $0.0001 par value $.0001, 134,220,536 and 131,008,628 shares issued and outstanding as of September 30, 2014 and June 30, 2014 | |

| 13,422 | | |

| 13,101 | |

| Additional Paid-In Capital | |

| 22,301,502 | | |

| 21,946,732 | |

| Stock Subscription Payable | |

| 1,830,000 | | |

| 1,480,007 | |

| Retained Deficit | |

| (26,595,140 | ) | |

| (25,957,163 | ) |

| Cumulative Foreign Currency Translation Adjustment | |

| 68,931 | | |

| 314,649 | |

| Total Stockholders’ Deficit | |

| (2,381,285 | ) | |

| (2,202,673 | ) |

| Non-controlling Interest | |

| (1,309,639 | ) | |

| (1,336,660 | ) |

| Equity Allocated to Plandaí Biotechnology | |

| (3,690,924 | ) | |

| (3,539,333 | ) |

| Total Liabilities and Stockholders' Deficit | |

$ | 10,946,685 | | |

$ | 9,683,415 | |

The accompanying notes are an integral part of

these consolidated financial statements. | |

PLANDAI BIOTECHNOLOGY, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

Three Months Ended |

| | |

September 30, | |

September 30, |

| | |

2014 | |

2013 |

| Revenues | |

| 26,387 | | |

$ | 226,953 | |

| Cost of Sales | |

| 160,057 | | |

| 135,397 | |

| Gross Profit | |

| (133,669 | ) | |

| 91,556 | |

| | |

| | | |

| | |

| Expenses: | |

| | | |

| | |

| Payroll | |

| 516,994 | | |

| 124,260 | |

| Professional Services | |

| 305,280 | | |

| 86,800 | |

| Rent | |

| 125,834 | | |

| 178,580 | |

| Utilities | |

| 15,438 | | |

| 16,730 | |

| Insurance | |

| 16,015 | | |

| 12,655 | |

| Depreciation | |

| 46,357 | | |

| 50,055 | |

| General & Administrative | |

| 314,734 | | |

| 68,827 | |

| Total Expenses | |

| 1,340,652 | | |

| 537,907 | |

| | |

| | | |

| | |

| Operating Income (Loss) | |

| (1,474,322 | ) | |

| (446,351 | ) |

| | |

| | | |

| | |

| Other Income (Expense) | |

| | | |

| | |

| Other Income | |

| 981,260 | | |

| — | |

| Derivative Interest | |

| — | | |

| (228,037 | ) |

| Interest Expense | |

| (117,893 | ) | |

| (78,886 | ) |

| Net Income (Loss) | |

| (610,956 | ) | |

$ | (753,274 | ) |

| | |

| | | |

| | |

| Loss Allocated to Non-controlling Interest | |

| (27,021 | ) | |

| 182,342 | |

| | |

| | | |

| | |

| Net Loss, Adjusted | |

| (637,976 | ) | |

$ | (570,932 | ) |

| Other Comprehensive Income (loss): | |

| | | |

| | |

| Foreign Currency Translation Adjustment | |

| (245,718 | ) | |

| (1,726 | ) |

| | |

| | | |

| | |

| Comprehensive (Loss) | |

| (883,694 | ) | |

$ | (572,658 | ) |

Basic & diluted loss per share | |

| (0.01 | ) | |

$ | (0.01 | ) |

Weighted Avg. Shares Outstanding | |

| 132,614,582 | | |

| 106,295,760 | |

| | |

| | | |

| | |

The accompanying notes are an integral

part of these consolidated financial statements.

PLANDAI BIOTECHNOLOGY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

| |

|

| | |

For the three months ended September 30, | |

For the three months ended September 30, |

| | |

2014 | |

2013 |

| | |

| | | |

| | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net Loss | |

$ | (610,956 | ) | |

$ | (753,274 | ) |

| Adjustments to reconcile net loss to net cash | |

| | | |

| | |

| provided by operating activities: | |

| | | |

| | |

| Depreciation | |

| 46,357 | | |

| 50,055 | |

| Stock Issued or Payable for Services | |

| 400,000 | | |

| — | |

| Derivative Liability | |

| — | | |

| 228,037 | |

| Capitalized Lease Obligation | |

| 27,057 | | |

| 120,745 | |

| Foreign Currency Translation Adjustment | |

| (245,718 | ) | |

| (1,726 | ) |

| Decrease in Related Party Receivable | |

| 426,444 | | |

| — | |

| (Decrease) Increase in Accounts Receivable | |

| (4,138 | ) | |

| 1,307 | |

| (Increase) Decrease in Deposits & Prepaid Expense | |

| (233,550 | ) | |

| 25 | |

| Decrease in Inventory | |

| 317 | | |

| 1,284 | |

| Decrease in Other Assets | |

| 150,617 | | |

| 270,010 | |

| Increase (Decrease) in Accounts Payable and Accrued Expenses | |

| 80,268 | | |

| (313,890 | ) |

| Decrease in Related Party Payables | |

| (2,949 | ) | |

| (206,581 | ) |

| Increase in Accrued Interest | |

| 26,772 | | |

| 22,668 | |

| Net Cash From (Used in) Operating Activities | |

| 60,521 | | |

| (581,340 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Loans from Related Parties | |

| — | | |

| 1,750 | |

| Purchase of Fixed Assets | |

| (329,615 | ) | |

| (440,748 | ) |

| Net Cash Used in Investing Activities | |

| (329,615 | ) | |

| (438,998 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Increase in Long-term Debt, Net of Discount | |

| 1,350,209 | | |

| 732,008 | |

| Net Borrowings under Convertible Debt | |

| (18,112 | ) | |

| 125,000 | |

| Proceeds from the Sale of Common Stock | |

| 256,700 | | |

| 15,000 | |

| Net Borrowings under Credit Line | |

| — | | |

| 25,000 | |

| Net Cash Provided by Financing Activities | |

| 1,588,797 | | |

| 897,008 | |

| | |

| | | |

| | |

| Net Increase (Decrease) in Cash and Cash Equivalents | |

| 1,319,703 | | |

| (123,330 | ) |

| Cash and Cash Equivalents at Beginning of Period | |

| 156,570 | | |

| 498,917 | |

| Cash and Cash Equivalents at End of Period | |

| 1,476,272 | | |

| 375,587 | |

| | |

| | | |

| | |

| NON-CASH ACTIVITIES | |

| | | |

| | |

| Shares issued to retire debt | |

$ | 24,674 | | |

$ | — | |

| | |

| | | |

| | |

| SUPPLEMENTAL CASH FLOW INFORMATION: | |

| | | |

| | |

| Cash paid during the year for: | |

| | | |

| | |

| Interest | |

$ | 85,402 | | |

$ | — | |

| Income taxes | |

$ | — | | |

$ | — | |

| The accompanying notes are an integral part of

these consolidated financial statements. | |

| | |

PLANDAI BIOTECHNOLOGY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2014

(Unaudited)

NOTE 1 - NATURE OF OPERATIONS AND GOING CONCERN

Plandaí Biotechnology, Inc.’s

(the “Company” or “Plandaí”) consolidated financial statements have been prepared on a going concern

basis, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. The financial

statements do not include any adjustment relating to recoverability and classification of recorded amounts of assets and liabilities

that might be necessary should the Company be unable to continue as a going concern.

The Company's continued existence is dependent

upon its ability to continue to execute its operating plan and to obtain additional debt or equity financing. There can be no assurance

the necessary debt or equity financing will be available, or will be available on terms acceptable to the Company.

Plandaí and its subsidiaries focus on

the production of proprietary botanical extracts for the nutriceutical and pharmaceutical industries. The company grows much of

the live plant material used in its products on a 3,000 hectare estate it operates under a 49-year notarial lease in the Mpumalanga

region of South Africa. Plandaí uses a proprietary extraction process that is designed to yield highly bioavailable products

of pharmaceutical-grade purity. The first product to be brought to market is Phytofare™ Catechin Complex, a green-tea derived

extract that has multiple potential wellness applications. The company’s principle holdings consist of land, farms and infrastructure

in South Africa. The Company is actively pursuing additional financing and has had discussions with various third parties, although

no firm commitments have been obtained. Management believes these efforts will generate sufficient cash flows from future operations

to pay the Company's obligations and realize positive cash flow. There is no assurance any of these transactions will occur.

These financial statements should be read in

conjunction with the Company’s annual report for the year ended June 30, 2014 previously filed on Form 10-K. In management’s

opinion, all adjustments necessary for a fair statement of the results for the interim periods have been made. All adjustments

made were of a normal recurring nature.

Organization

On November 17, 2011, the Company, through

its wholly-owned subsidiary, Plandaí Biotechnologies, Inc., consummated a share exchange with Global Energy Solutions, Inc.

(“GES”), an Irish corporation. Under the terms of the share exchange, GES received 76,000,000 shares of the Company’s

common stock that had been previously issued to Plandaí in exchange for 100% of the issued and outstanding capital of GES.

Concurrent with the share exchange, the Company sold its subsidiary, Diamond Ranch, Ltd., together with its wholly-owned subsidiary,

Executive Seafood, Inc., to a former officer and director of the Company. Under the terms of the sale, the purchasers assumed all

associated debt as consideration. During the three months ended September 30, 2011 and through the date of the share exchange,

Diamond Ranch, Ltd. and Executive Seafood, Inc. generated a net loss of $126,000, and as of September 30, 2011, liabilities exceeded

assets by over $5,000,000. The Company subsequently changed its name to Plandaí Biotechnology, Inc. and dissolved GES.

For accounting purposes, the share exchange

has been treated as a reverse merger since the acquired entity now forms the basis for operations and the transaction resulted

in a change in control, with the acquired company electing to become the successor issuer for reporting purposes. The accompanying

financial statements have been prepared to reflect the assets, liabilities and operations of Plandaí Biotechnology, Inc.

exclusive of Diamond Ranch Foods since the acquisition and sale were executed simultaneously. For equity purposes, the shares issued

to acquire GES (76,000,000 shares) have been shown to be issued and outstanding since inception, with the previous balance outstanding

(25,415,300 shares Common) treated as a new issuance as of the date of the share exchange. The additional paid-in capital and retained

deficit shown are those of Plandaí and its subsidiary operations.

In management’s opinion, all adjustments

necessary for a fair statement of the results for the presented periods have been made. All adjustments made were of a normal

recurring nature.

Basis of Presentation

The Company’s financial statements have

been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

The accompanying financial statements represent the results of operations for the three months ended September 30, 2014.

NOTE 2 – SUMMARY OF ACCOUNTING POLICIES

This summary of accounting policies for Plandaí

Biotechnology, Inc. and its wholly-owned subsidiaries, is presented to assist in understanding the Company's financial statements.

The accounting policies conform to generally accepted accounting principles and have been consistently applied in the preparation

of the financial statements.

Use of Estimates

The financial statements are prepared in conformity

with accounting principles generally accepted in the United States of America. In preparing the financial statements, management

is required to make estimates and assumptions that effect the reported amounts of assets and liabilities and disclosure of contingent

assets and liabilities as of the date of the balance sheet and statement of operations for the year then ended. Actual results

may differ from these estimates. Estimates are used when accounting for allowance for bad debts, collect ability of accounts receivable,

amounts due to service providers, depreciation and litigation contingencies, among others.

Cash and Cash Equivalents

For purposes of the statement of cash flows,

the Company considers all highly liquid debt instruments purchased with a maturity of three months or less to be cash equivalents

to the extent the funds are not being held for investment purposes.

Revenue recognition

The Company presently derives its revenue from

the sale of timber and agricultural products produced on its farm and tea estate holdings in South Africa. Revenue is recognized

when the product is delivered to the customer. Once production of the Company’s Phytofare™ botanical extracts commence

in 2014, revenues will be recognized when product is shipped.

Concentration of Credit Risk

The Company has no significant off-balance

sheet concentrations of credit risk such as foreign exchange contracts, options contracts or other foreign hedging arrangements.

Property and equipment

Property and equipment are stated at cost less

accumulated depreciation and amortization. The Company provides for depreciation and amortization using the straight-line

method over the estimated useful lives of the related assets, which range from three to five years. Maintenance and

repair costs are expensed as they are incurred while renewals and improvements which extend the useful life of an asset are capitalized. At

the time of retirement or disposal of property and equipment, the cost and related accumulated depreciation and amortization are

removed from the accounts and any resulting gain or loss is reflected in the results of operations.

Impairment of Long-Lived Assets

In accordance with ASC Topic 360, formerly

SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets, the Company reviews its long-lived assets

for impairment whenever events or changes in circumstances indicate that the carrying amount of these assets may not be fully recoverable.

The assessment of possible impairment is based on the Company’s ability to recover the carrying value of its asset based

on estimates of its undiscounted future cash flows. If these estimated future cash flows are less than the carrying value of the

asset, an impairment charge is recognized for the difference between the asset's estimated fair value and its carrying value. As

of the date of these financial statements, the Company is not aware of any items or events that would cause it to adjust the recorded

value of its long-lived assets for impairment.

Net Loss per common share

The Company adopted FASB ASC Topic 260, Earnings

Per Share. Basic earnings per share is based on the weighted effect of all common shares issued and outstanding and is calculated

by dividing net income (loss) available to common stockholders by the weighted average shares outstanding during the period. Diluted

earnings per share is calculated by dividing net income available to common stockholders by the weighted average number of common

shares used in the basic earnings per share calculation plus the number of common shares, if any, that would be issued assuming

conversion of all potentially dilutive securities outstanding. For all periods diluted earnings per share is not presented, as

potentially issuable securities are anti-dilutive.

The Company

issued warrants to purchase 5,000,000 shares of the Company’s common stock which have a strike price of $0.01/share; however,

since the Company incurred a loss for all periods presented, the warrants are considered anti-dilutive. During the quarter ended

September 30, 2014, a total of 1,666,667 warrants were exercised resulting in the issuance of 1,629,212 shares of restricted common

stock.

Income Taxes

The Company accounts for income taxes under

ASC Topic 740, formerly SFAS No. 109, Accounting for Income Taxes, as clarified by ASC Topic 740, formerly FASB Interpretation

No. 48, Accounting for Uncertainty in Income Taxes, (“FIN No. 48”). Deferred tax assets and liabilities are

determined based upon differences between financial reporting and tax bases of assets and liabilities and are measured using the

enacted tax rates and laws that will be in effect when the differences are expected to reverse. A valuation allowance is provided

when it is more likely than not that some portion or all of a deferred tax asset will not be realized.

The Company adopted the provisions of ASC Topic

740, formerly FIN No. 48 on January 1, 2007. Previously, the Company had accounted for tax contingencies in accordance with Statement

of Financial Accounting Standards No. 5, Accounting for Contingencies. As required by ASC Topic 450, formerly FIN No. 48,

the Company recognizes the financial statement benefit of a tax position only after determining that the relevant tax authority

would more likely than not sustain the position following an audit. For tax positions meeting the more-likely-than-not threshold,

the amount recognized in the financial statements is the largest benefit that has a greater than 50 percent likelihood of being

realized upon ultimate settlement with the relevant tax authority. At the adoption date, the Company applied ASC Topic 740, formerly

FIN No. 48 to all tax positions for which the statute of limitations remained open. As a result of the implementation of ASC Topic

740, formerly FIN No. 48, the Company did not recognize any change in the liability for unrecognized tax benefits.

The Company is subject to income taxes in the

U.S. federal jurisdiction and that of South Africa. Tax regulations within each jurisdiction are subject to the interpretation

of the related tax laws and regulations and require significant judgment to apply. With few exceptions, the Company is no longer

subject to U.S. federal, state and local income tax examinations by tax authorities for the years before April 1, 2007.

The Company is not currently under examination

by any federal or state jurisdiction.

The Company’s policy is to record tax-related

interest and penalties as a component of operating expenses.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

Emerging Growth Company

We qualify as an “emerging

growth company” under the 2012 JOBS Act. Section 107 of the JOBS Act provides that an emerging growth company can take advantage

of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting

standards. As an emerging growth company, we can delay the adoption of certain accounting standards until those standards would

otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period.

Fair Value of Financial Instruments

Fair value of certain of the Company’s

financial instruments including cash and cash equivalents, accounts receivable, account payable, accrued expenses, notes payables,

and other accrued liabilities approximate cost because of their short maturities. The Company measures and reports fair value in

accordance with ASC 820, “Fair Value Measurements and Disclosure” defines fair value, establishes a framework for measuring

fair value in accordance with generally accepted accounting principles and expands disclosures about fair value investments.

Fair value, as defined in ASC 820, is the

price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants

at the measurement date. The fair value of an asset should reflect its highest and best use by market participants, principal

(or most advantageous) markets, and an in-use or an in-exchange valuation premise. The fair value of a liability should reflect

the risk of nonperformance, which includes, among other things, the Company’s credit risk.

Valuation techniques are generally classified

into three categories: the market approach; the income approach; and the cost approach. The selection and application of one or

more of the techniques may require significant judgment and are primarily dependent upon the characteristics of the asset or liability,

and the quality and availability of inputs. Valuation techniques used to measure fair value under ASC 820 must maximize the use

of observable inputs and minimize the use of unobservable inputs. ASC 820 also provides fair value hierarchy for inputs and resulting

measurement as follows:

Level 1

Quoted prices (unadjusted) in active markets

that are accessible at the measurement date for identical assets or liabilities; The Company values it’s available for sale

securities using Level 1.

Level 2

Quoted prices for similar assets or liabilities

in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; inputs other than

quoted prices that are observable for the asset or liability; and inputs that are derived principally from or corroborated by observable

market data for substantially the full term of the assets or liabilities; and

Level 3

Unobservable inputs for the asset or liability

that are supported by little or no market activity and that are significant to the fair values.

Fair value measurements are required to be

disclosed by the Level within the fair value hierarchy in which the fair value measurements in their entirety fall. Fair value

measurements using significant unobservable inputs (in Level 3 measurements) are subject to expanded disclosure requirements including

a reconciliation of the beginning and ending balances, separately presenting changes during the period attributable to the following:

(i) total gains or losses for the period (realized and unrealized), segregating those gains or losses included in earnings, and

a description of where those gains or losses included in earning are reported in the statement of income.

Advertising

Advertising costs are expensed as incurred.

Principles of Consolidation

Plandaí Biotechnology, Inc. and its

subsidiaries, are encompassed in the following entities, which have been consolidated in the accompanying financial statements:

| Plandaí Biotechnologies, Inc. |

100% owned by Plandaí Biotechnology, Inc. |

|

| Plandaí Biotechnology – Uruguay SA |

100% owned by Plandaí Biotechnology, Inc. |

|

| Phyto Pharmacare, Inc. |

100% owned by Plandaí Biotechnology, Inc. |

|

| Dunn Roman Holdings—Africa Ltd |

100% owned by Plandaí Biotechnology, Inc. |

|

| Red Gold Biotechnologies (Pty) Ltd. |

100% owned by Dunn Roman Holdings-Africa |

|

| Breakwood Trading 22 (Pty) Ltd. |

74% owned by Dunn Roman Holdings-Africa |

|

| Green Gold Biotechnologies (Pty) Ltd. |

84% owned by Dunn Roman Holdings-Africa |

|

All intercompany balances have been eliminated

in consolidation.

Straight-lining of Lease Obligation

Plandaí’s subsidiaries have two

long-term, material leases which either have escalating terms or included several months of “free” rent, including

the 49-year notarial lease for the Senteeko Tea Estate. In accordance with US Generally Accepted Accounting Principles, the Company

has calculated a straight-line monthly cost on the leases and recorded the corresponding difference between the amount actually

paid and the amount calculated as a Capitalized Lease Obligation. As of September 30, 2014, the amount of this deferred liability

was $1,386,039.

Plandaí’s subsidiary, Dunn Roman

Holdings – Africa (Pty) Ltd., executed a sublease on the Bonakado Farm in South Africa to a third party. Bonakado currently

farms avocado and macadamia nuts, neither of which factor into the company’s future business model. The lease is for 20 years

and includes 24 months of deferred rent while the farm is rehabilitated by the sub-lessor. In accordance with US Generally Accepted

Accounting Principles, the Company has calculated a straight-line monthly value attributable to the lease and recorded the corresponding

difference between the amount actually paid and the amount calculated as a Lease Receivable in Other Assets. As of September 30,

2014, the amount of this receivable was $56,684 (R638,223).

Recent Accounting Pronouncements

Recent accounting pronouncements that the Company

has adopted or that will be required to adopt in the future are summarized below.

Financial Accounting Statement No. 52, Foreign

Currency Translation (FAS 52), sets forth the appropriate accounting treatment under U.S. GAAP for companies that consolidate the

results of foreign operations denominated in local currencies. FAS 52 requires that all assets and liabilities be translated at

the current spot rate at the date of translation. Equity items, other than retained earnings, are translated at the spot rates

in effect on each related transaction date. Retained earnings are translated at the weighted-average rate for the relevant year

and income statement items are translated at the average rate for the period, except where specific identification is practicable.

The resulting adjustment is not recognized in current earnings, but rather as a component of other comprehensive income. The Company

adopted FAS 52 in the year ended June 30, 2012 and has chosen US dollars as the local currency. The effect of adopting FAS 52 have

been reflected in the accompanying consolidated financial statements.

Statement of Financial

Accounting Standards No. 35, Capitalization of Interest Costs, establishes standards for capitalizing interest cost as part

of the historical cost of acquiring certain assets. To qualify for interest capitalization, assets must require a period of time

to get them ready for their intended use. In the year Ended June 30, 2012, the Company borrowed funds to commence the construction

of a manufacturing facility which is expected to be completed during 2013. The company accordingly adopted FAS 35 and capitalized

interest associated with the borrowing.

Statement of Financial Accounting Standards

No. 160, Non-controlling Interests in Consolidated Financial Statements, establishes standards for accounting for noncontrolling

interest, sometimes called a minority interest, which is that portion of equity in a subsidiary not attributable, directly or indirectly,

to a parent. FAS 160 requires that the minority portion of equity and net income/loss from operations of consolidated entities

be reflected in the financial statements. The Company previously adopted FAS 160 and has reflected the impact in the accompanying

consolidated financial statements.

Other recent accounting pronouncements issued

by the FASB (including its Emerging Issues Task Force), the AICPA, and the SEC did not or are not believed by management to have

a material impact on the Company's present or future financial statements.

NOTE 3 – ACQUISITION OF RED GOLD BIOTECHNOLOGIES, A RELATED

PARTY ENTITY

In July of 2014, the Company through its wholly

owned subsidiary Dunn Roman Holdings acquired 100% of the issued and outstanding stock of Red Gold Biotechnologies (PTY) Ltd. (“Red

Gold”), a related party to the Company. Red Gold is a related party to the Company through our chief executive officer Roger

Duffield whom is the sole shareholder of Red Gold. As of June 30, 2014, the Company had advanced $426,444 to Red Gold. This loan

which was recorded as a Related Party Receivable as of June 30, 2014 was eliminated in consolidation in the September 30, 2014

consolidated balance sheets. There was no economic benefit to Roger Duffield as a result of this acquisition as the entity acquired

was established in South Africa for tax reporting purposes.

The Company has accounted for the acquisition

of Red Gold as a reorganization of entities under common control. In reorganizations of entities under common control, the balances

of the acquired entity are carried over at historical costs with no goodwill or excess consideration recorded. Pursuant to FASB

141, the financial activity of the acquiree (Red Gold) in a reorganization of entities under common control is presented as if

the acquiree was consolidated at the beginning of the period.

NOTE 4 – FIXED ASSETS

Fixed assets, stated at cost, less accumulated

depreciation at September 30, 2014 and June 30, 2014 consisted of the following:

| | |

September 30,

2014 | |

June 30,

2014 |

| | |

| | | |

| | |

| Total Fixed Assets | |

$ | 9,452,426 | | |

$ | 9,142,227 | |

| Less: Accumulated Depreciation | |

| (313,408 | ) | |

| (286,468 | ) |

| | |

| | | |

| | |

| Fixed Assets, net | |

$ | 9,139,018 | | |

$ | 8,855,759 | |

| | |

| | | |

| | |

Depreciation expense

Depreciation expense for the three months ended

September 30, 2014 and 2013 was $46,357 and $50,055.

NOTE 5 – CONVERTIBLE NOTES PAYABLE

& DERIVATIVE LIABILITY

On August 20, 2013, the Company executed two

convertible promissory notes totaling $550,000. The notes bear interest at the rate of 8% per annum and became due and payable

six months from the date of issuance. During the first 90 days from issuance, the notes were repayable without incurring any interest

charges. The Company was advanced $210,000 against the two notes. As of June 30, 2014, a total of $205,368 of the unpaid principal

plus accrued interest had been converted into 2,997,035 shares of restricted common stock, leaving a balance of $18,112. During

the three months ended September 30, 2014, the principle balance of $18,112 plus $6,562 of accrued interest was converted into

144,296 shares of common stock.

As of September 30, 2014 and June 30, 2014,

the Company had a convertible notes payable balance of $-0- and $18,112.

Derivative Liability

The Company recorded a derivative liability

of $23,710 as of June 30, 2014 representing the estimate value of the shares over and above the amount of debentures that would

be issued on conversion. During the year ended June 30, 2014, the Company recorded $1,758,026 as derivative interest expense which

was then offset against additional paid in capital when the debentures were converted. As of September 30, 2014, the Company had

no outstanding convertible instruments and all remaining derivative liability was written off to Additional Paid-in Capital.

NOTE 6 – LONG-TERM DEBT

In June 2012, the Company, through the majority-owned

subsidiaries of Dunn Roman Holdings, Inc., executed final loan documents on a 100 million Rand (approx. $9.5 million USD) financing

with the Land and Agriculture Bank of South Africa. The total loan is comprised of multiple agreements totaling, between Green

Gold Biotechnologies (Pty) Ltd. and Breakwood Trading 22(Pty) Ltd., 100 million rand. The loans all bear interest at the rate of

prime plus 0.5% per annum and are all due in seven years. In addition, the loans have a 25-month “holiday” in which

no payments or interest are due until 25 months after the first drawn down of funds. The loans are collateralized by the assets

and operations, including the Senteeko lease, agriculture production and receivables of Dunn Roman Holdings, which is the African

operating arm of Plandaí. In addition, Dunn Roman Holdings was required to grant a 15% profit share agreement to the Land

Bank which extends through the duration of the loan agreements (7 years unless pre-paid). The profit share agreement extends only

to profits generated by Dunn Roman Holdings exclusive of operations of Plandaí and outside of South Africa. By way of loan

covenants, the borrowing entities are required to maintain a debt to equity ratio of 1.5:1, interest coverage ratio of 1.5:1, and

security coverage ratio of 1:1. However, the Company consistently notified the Bank of this situation. The Company has requested

written documentation as to the Bank’s intention. The Bank has not provided this documentation in writing, however they have

given verbal approval. In addition, they have not started any action against the Company.

As of September 30, 2014, a total of $7,827,613,

including accrued interest, had been drawn down against the loans by Green Gold Biotechnologies (Pty) Ltd., which was used to purchase

fixed assets that will be employed in South Africa to produce the company’s botanical extracts. Additionally, $2,202,247

had been drawn down against the loans by Breakwood Trading22 (Pty) Ltd. to fund the rehabilitation of the Senteeko Tea Estate,

including the repair of roads, bridges, and onsite worker housing, and the pruning, weeding and fertilizing of plantation.

During the year ended June 30, 2012, the Company

issued 1,500,000 shares of restricted common stock to three individuals in exchange for shares of Dunn Roman Holdings stock which

had been previously issued. The acquired Dunn Roman shares were then provided to thirds parties in order to comply with the BEE

provisions associated with the loan from the Land Bank of South Africa, which required that 15% of Dunn Roman be black owned. The

Company has therefore determined to treat the value of the shares issued to acquire the Dunn Roman stock ($585,000) as a cost of

securing the financing and recorded as a loan discount which will be amortized over the life of the loan (7 years) once payment

of the loan commences.

On November 25, 2013, the company borrowed

$250,000 from an unrelated third party. The note bears interest at 6% per annum and is due June 30, 2015. On February 11, 2014,

the company borrowed an additional $950,000 from this same entity and under identical terms, bringing the total to $1,200,000.

During the quarter ended September 30, 2014 the Company borrowed and additional $2,300,000 from this same entity and under identical

terms, bringing the total to $3,500,000. The Company has recorded accrued interest pertaining to the outstanding loan in the amount

of $66,277.

As of the dates presented, the long-term loan

balances were as follows:

| | |

September 30,

2014 | |

June 30,

2014 |

| Loan Principle - Unrelated third party | |

$ | 3,500,000 | | |

$ | 1,200,000 | |

| Loan Principle - Land and Agriculture Bank of South Africa | |

| 10,047,402 | | |

| 11,021,867 | |

| Less: Discount | |

| (585,000 | ) | |

| (585,000 | ) |

| Net Loan per Books | |

$ | 12,962,402 | | |

$ | 11,636,867 | |

| | |

| | | |

| | |

NOTE 7 – OTHER INCOME

Other income consists of monies paid from CRS

Technologies as part of a settlement agreement resulting from delays in completing the Senteeko factory in South Africa. The Company,

through its subsidiary Dunn Roman Holdings – Africa, contracted CRS to construct the tea and citrus extraction facility.

Due to several delays, CRS agreed to pay a penalty of $2,000,000, which is being treated as Other Income as received. In the three

months ended September 30, 2014, the Company received $799,547 from CRS under the settlement.

NOTE 8 – CURRENCY ADJUSTMENT

The Company’s principle operations are

located in South Africa and the primary currency used is the South African Rand. Accordingly, the financial statements are first

prepared in using Rand and then converted to US Dollars for reporting purposes, with the average conversion rate being used for

income statement purposes and the closing exchange rate as of September 30, 2014 applied to the balance sheet. Differences resulting

from the fluctuation in the exchange rate are recorded as an offset to equity in the balance sheet. As of September 30, 2014 and

December 31, 2013, the cumulative currency translation adjustments were $66,374 and $314,649.

NOTE 9 – COMMON STOCK

During the three months ended September 30, 2014, the Company issued

a total of 3,211,908 shares of restricted common stock as follows:

- The Company issued 1,168,400 restricted common shares for $256,700

cash.

- The Company issued 200,000 restricted common shares for services valued

at $50,000.

- The Company issued 144,296 restricted common shares for the conversion

of convertible debt and interest in the amount of $24,674.

- The Company issued 1,629,212 common shares pursuant to the execution

of 1,666,666 warrants with a strike price of $0.01.

- The Company issued 70,000 common shares pursuant to the acquisition

of the remaining 2% interest in Dunn Roman.

Common Stock Issuable

Pursuant to three agreements executed on March

1, 2013 by the Company with two of its officers and one consultant, the Company is obligated to issue 4,000,000 common shares at

the end of each completed year for services rendered to the Company. For the quarter ended September 30, 2014, with regards to

the future issuance of 4,000,000 shares, the Company accrued additional compensation expense for services completed in the amount

of $350,000. As of September 30, 2014, the common shares issuable pursuant to the employment agreements had not yet been issued;

therefore, the Company recorded $1,830,000 to common stock issuable.

NOTE 10– NON-CONTROLLING INTEREST

Plandaí owns 100% of Dunn Roman Holdings—Africa,

which in turn owns 74% of Breakwood Trading 22 (Pty), Ltd. and 84% of Green Gold Biotechnologies (Pty), Ltd., in order to be compliant

with the Black Economic Empowerment rules imposed by the South African Land Bank. While the Company, under the Equity Method of

Accounting, is required to consolidate 100% of the operations of its majority-owned subsidiaries, that portion of subsidiary net

equity attributable to the minority ownership, together with an allocated portion of net income or net loss incurred by the subsidiaries,

must be reflected on the consolidated financial statements. On the balance sheet, minority interest has been shown in the Equity

Section, separated from the equity of Plandaí, while on the income statement, the minority shareholder allocation of net

loss has been shown in the Consolidated Statement of Operations.

NOTE 11 – CAPITALIZED LEASE OBLIGATIONS

Plandaí’s subsidiaries have two

long-term, material leases which either have escalating terms or included several months of “free” rent, including

the 49-year notarial lease for the Senteeko Tea Estate. In accordance with US Generally Accepted Accounting Principles, the Company

has calculated a straight-line monthly cost on the leases and recorded the corresponding difference between the amount actually

paid and the amount calculated as a Capitalized Lease Obligation. As of September 30, 2014, the amount of this deferred liability

was $1,386,039.

Plandaí’s subsidiary, Dunn

Roman Holdings – Africa (Pty) Ltd., executed a sublease on the Bonakado Farm in South Africa to a third party. Bonakado

currently farms avocado and macadamia nuts, neither of which factor into the company’s future business model. The lease

is for 20 years and includes 24 months of deferred rent while the farm is rehabilitated by the sub-lessor. In accordance with

US Generally Accepted Accounting Principles, the Company has calculated a straight-line monthly value attributable to the

lease and recorded the corresponding difference between the amount actually paid and the amount calculated as a Lease

Receivable in Other Assets. As of September 30, 2014, the amount of this receivable was $56,684 (R638,223).

NOTE 12 – RELATED PARTY TRANSACTION

In addition to the loans payable and receivables

as discussed above, the Company had the following related party transactions during the quarter ended September 30, 2014.

Related Party Loan Receivable

As of June 30, 2014, the Company was owed a

total of $426,444 from a company, Red Gold Biotechnologies (Pty) Ltd., of which Roger Duffield, our Chief Executive Officer, was

the sole director. Red Gold Biotechnologies was established to process and invoice payments to third party vendors associated with

construction of the Senteeko production facility in order to maximize the refund of VAT (Value Added Tax) from South Africa. Accordingly,

construction costs paid directly by Dunn Roman were recorded as a receivable from Red Gold. Subsequent to June 30, 2014, the company

was merged with Dunn Roman Holdings-Africa, Plandaí’ wholly-owned subsidiary, and the receivable balance was transferred

to fixed assets. There were no revenues or expenses associated with Red Gold and Mr. Duffield derived no economic benefit from

the transaction. All VAT refunds were deposited with Dunn Roman.

Compensation to Officers and Management

Pursuant to three agreements executed on March

1, 2013 by the Company with two of its officers and one consultant, the Company is obligated to issue 4,000,000 common shares at

the end of each completed year for services rendered to the Company. For the quarter ended September 30, 2014, with regards to

the future issuance of 4,000,000 shares, the Company recorded compensation expense for services completed in the amount of $350,000.

NOTE 13 – WARRANTS

On January 28, 2014, the Company signed an

agreement with Diego Pellicer, Inc. under which the Company received a license to use the Diego Pellicer name and likeness on a

future cannabis-based extract which is under development. As consideration for the license, warrants to purchase 5,000,000 shares

of the Company’s common stock were issued at a purchase price of $0.01 per share. Based on the closing bid price of the common

stock of $1.15 on the date the warrants were issued, the Company recorded a value of $5,705,022 as an asset; however, as the cannabis

extract is still in development, the intangible licenses asset balance was fully impaired leaving a zero asset balance. Accordingly,

the Company recorded an impairment expense of $5,705,022 was recorded in prior periods. Should the cannabis extract come to market,

the value of the license will be reevaluated.

During the quarter ended September 30, 2014,

a total of 1,666,666 warrants were exercised resulting in the issuance of 1,629,212 common shares.

| |

|

|

Warrants Outstanding |

|

| |

|

|

Weighted |

|

|

| Warrants |

|

|

Average |

|

Warrants |

| Exercisable |

Exercise |

|

Remaining |

|

Exercisable |

| June 30, |

Price ($) per |

|

Contractual |

Exercised |

September 30, |

| 2014 |

Share |

|

Life |

Warrants |

2014 |

| |

|

|

|

|

|

| 5,000,000 |

$ 0.01 |

|

9.25 years |

1,666,666 |

3,333,334 |

NOTE 14 – SUBSEQUENT EVENTS

Management was evaluated subsequent events

pursuant to the requirements of ASC Topic 855 and has determined that besides listed below, no material subsequent events exist

through the date of this filing.

- A total of 194,000 shares of restricted common stock were issued to

four unrelated individuals in exchange for consulting services valued at $62,750.

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This statement includes projections of

future results and "forward looking statements" as that term is defined in Section 27A of the Securities Act of 1933

as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934 as amended (the "Exchange

Act"). All statements that are included in this Quarterly Report, other than statements of historical fact, are forward looking

statements. Although management believes that the expectations reflected in these forward looking statements are reasonable, it

can give no assurance that such expectations will prove to have been correct.

BUSINESS

Plandaí Biotechnology, Inc.,

(the “Company”) through its recent acquisition of Global Energy Solutions, Ltd. and its subsidiaries, focuses on the

farming of whole fruits, vegetables and live plant material and the production of proprietary functional foods and botanical extracts

for the health and wellness industry. Its principle holdings consist of land, farms and infrastructure in South Africa.

The Company was incorporated, as

Jerry's Inc., in the State of Florida on November 30, 1942. The company catered airline flights and operated coffee shops, lounges

and gift shops at airports and other facilities located in Florida, Alabama and Georgia. The company's airline catering services

included the preparation of meals in kitchens located at, or adjacent to, airports and the distribution of meals and beverages

for service on commercial airline flights. The company also provided certain ancillary services, including, among others, the preparation

of beverage service carts, the unloading and cleaning of plates, utensils and other accessories arriving on incoming aircraft,

and the inventory management and storage of airline-owned dining service equipment. In March of 2004 we moved our domicile to Nevada

and changed our name to Diamond Ranch Foods, Ltd. Diamond Ranch Foods, Ltd. was engaged in the meat processing and distribution

industry. Operations consisted of packing, processing, custom meat cutting, portion controlled meats, private labeling, and distribution

of our products to a diversified customer base, including, but not limited to; in-home food service businesses, retailers, hotels,

restaurants and institutions, deli and catering operators, and industry suppliers. On November 17, 2011, the Company, through its

wholly-owned subsidiary, Plandaí Biotechnologies, Inc. consummated a share exchange with Global Energy Solutions Corporation

Limited, an Irish corporation. Under the terms of the Share Exchange, GES received 76,000,000 shares of Diamond Ranch that had

been previously issued to Plandaí Biotechnologies, Inc. in exchange for 100% of the issued and outstanding capital of GES. On

November 21, 2011, the Company filed an amendment to the articles of incorporation to change the name of the company to Plandaí

Biotechnology, Inc.

We will continue to seek to raise additional

capital through the sale of common stock to fund the expansion of our company. There can be no assurance that we will be successful

in raising the capital required and without additional funds we would be unable to expand our plant, acquire other companies, or

further implement our business plan. In April 2012, through our subsidiary companies, we secured a 100 million Rand (approximately

$13 million) financing with the Land and Agriculture Bank of South Africa which will be used to build infrastructure and further

operations. During the previous nine months, we have borrowed $3,500,000 from an unaffiliated third party under a twelve month

promissory note due and payable June 30, 2015 and earning interest at 6% per annum.

PRODUCTS AND SERVICES

Plandaí has a proprietary technology

that extracts a high level of bio-available compounds and phytonutrients from polyphenols found in organic matter, including green

tea leaves, citrus and many other plants. Various tests have been conducted over the past ten years using this technology to generate

functional chemical compounds possessing nutritive properties that act effectively as preventive agents in the healthcare field.

Polyphenols from green tea are an excellent source antioxidant and anti-carcinogenic substances. The Company leases 8,000 acres

of agriculture land in Mpumalanga, South Africa, under a 49-year notarial lease, which includes over a thousand acres of cultivated

green tea. In addition, the Company has recently completed a 30,000 sq. ft. state-of-the-art extraction facility on site which

is expected to come online before the end of Year 2014. Plandaí intends to use its plantation leases to focus on the farming

of whole fruits, vegetables and live plant material and the production of proprietary botanical extracts for the health and wellness

industry using its proprietary extraction technology and the extraction facility.

Many botanical extracts have demonstrated varying

degrees of health benefit, and many pharmaceutical drugs are either derived directly from plant extracts or are synthetic analogs

of phytonutrient molecules. Green tea leaf, for example, has shown promising in-vitro results as an anti-oxidant, with hundreds

of different published studies demonstrating its potential usefulness in weight loss, anti-viral, anti-cancer, and anti-parasitic

applications, amongst others.

The company is presently developing for market

two unique extracts: Phytofare™ Catechin Complex and Phytofare™ Limonoid Glycoside Complex. The catechin complex is

derived from green tea harvested locally on the Senteeko Tea Estate in Mpumalanga, South Africa, and then processed on a state-of-the-art

extraction facility constructed onsite using funds obtained from the Land and Agriculture Bank of South Africa. The facility is

expected to become operational before the end of Year 2014, with initial sales commencing fourth quarter 2014. The limonoid glycoside

product is extracted from lemons which are sourced from local plantations in South Africa and then produced in the same factory

that makes the green tea product. The Phytofare™ Limonoid Glycoside Complex will be introduced to the market in July 2015.

On August 30, 2013, Plandaí entered

into a license agreement with North-West University in Potchefstroom, South Africa, which granted the company the exclusive right

to use the University’s Pheroid™ technology to product nano-entrapped botanical extracts for human and animal use.

The company believes that this technology will enable it to develop products with much higher absorption coefficients in both topical

use and oral consumption.

The Company is actively pursuing research on

additional botanical extracts that have known or suspected pharmaceutical properties. This research includes developing a non-psychoactive

cannabinoid extract through the Company’s wholly-owned subsidiary, Cannabis Biosciences, Inc. Cannabis Biosciences has concluded

its investigative research on cannabis and developed a method of extraction which it believes can produce a complete cannabis complex

in a highly bioavailable format but without psychoactive effects. The Company is actively seeking to obtain a license that will

permit it to produce its cannabinoid extract and conduct laboratory research on live cannabis plant. Provided that the company

can produce such an extract, the plan is to commence animal research on neural disorders such as Parkinson’s, Alzheimer’s,

MS, epilepsy, and post-concussion syndrome in order to determine definitively if cannabis possesses medicinal properties meriting

further human trials.

COMPETITION

The Company faces competition from a variety

of sources. There are several large producers of farm products including green tea and there are numerous companies that develop

and market nutriceutical products that include bio-available compounds including those from green tea and citrus extracts. Many

of these competitors benefit from established distribution, market-ready products, and greater levels of financing. Plandaí

intends to compete by producing higher quality and higher concentration extracts, producing at lower costs, and controlling a vertically

integrated market that includes all stages from farming through production and marketing. The company’s unique patent-pending

technology, combined with the patented Pheroid™ technology, should provide several unique market advantages in the form of

higher absorption, increased bioavailability, and lower dosage requirements.

CUSTOMERS

Plandaí will market to nutriceutical

and supplement companies that require high-quality bio-available extracts for their products. As pharmaceutical products clear

their human clinical trials and receive market approval from the FDA, Plandaí will enlist distribution companies to sell

to various end user outlets. In addition, the Company anticipates having surplus farm products including timber, fruits, and nuts

which will be sold to local markets.

SALES

For the three months ended September

30, 2014, revenues were $26,387 compared to revenues of $226,953 for the quarter ended September 30, 2013. Sales in 2014 consisted

of timber from the company’s tea estate in South Africa whereas sales in 2013 included the sale of avocado and macadamia

nuts from the Company’s Bonakado farm which has subsequently been sublet. Sales of Phytofare™ extracts are not expected

to commence until January 2015, following the completion of the commercial-grade extraction facility in December 2014.

Cost of sales for the quarter ended September

30, 2014 was $160,057 compared with $135,397 in the prior year, which consists of expenses incurred with managing and operating

the Senteeko Tea Estate. In future periods, costs associated with running the factory will be included in cost of sales.

EXPENSES

Our total expenses for the three months ended

September 30, 2014 were $1,340,652 compared to $537,907 for the same period of the prior year. Expenses in 2014 consisted primarily

of salaries of $516,994, professional services of $305,280 and general and administrative expenses of $314,734. Comparable expenses

in 2013 consisted of salaries of $124,260, professional services of $86,800 and general and administrative expenses of $68,827.

Salaries increased due to the accrual of stock issuable under employment contracts of $350,000. Professional services increased

due to higher legal fees.

LIQUIDITY AND CAPITAL RESOURCES

For the three months ended September

30, 2014, the Company generated cash from operating activities totaling $60,521, which was primarily attributable to a loss from

operations offset by the value of stock issued for services and a decrease in related party receivables. , Cash used in investing

activities was $329,615, which consisted of the purchase of fixed assets to be used in production. Cash provided by financing activities

was $1,588,797 generated by third party loans of $2,300,000 and the sale of common stock of $256,700. As of September 30, 2013,

the Company had current assets of $1,728,584 compared to current liabilities of $289,168.

PLAN OF OPERATION

The Company's long-term existence is

dependent upon our ability to execute our operating plan and to obtain additional debt or equity financing to fund payment of

obligations and provide working capital for operations. In April 2012, the Company through majority-owned subsidiaries of Dunn

Roman Holdings Africa (Pty) Limited, executed final loan documents on a 100 million Rand (approx. $13 million USD) financing with

the Land and Agriculture Bank of South Africa and has begun rehabilitating the Senteeko Tea Estate so that it can begin yielding

green tea feedstock by the end of 2013. The company has also completed construction of the factory and associated equipment necessary

to begin the extraction process on live botanical matter, including green tea and citrus, with a goal to have the factory operational

by the end of 2014. Once the facility is tested and operational, the company will commence processing green tea material for its

Phytofare™ Catechin Complex in December 2014.

CRITICAL ACCOUNTING POLICIES

The preparation of our

financial statements in conformity with accounting principles generally accepted in the United States requires us to make estimates

and judgments that affect our reported assets, liabilities, revenues, and expenses, and the disclosure of contingent assets and

liabilities. We base our estimates and judgments on historical experience and on various other assumptions we believe to be reasonable

under the circumstances. Future events, however, may differ markedly from our current expectations and assumptions. While there

are a number of significant accounting policies affecting our financial statements, we believe the following critical accounting

policies involve the most complex, difficult and subjective estimates and judgments.

Revenue recognition

The Company derives its

revenue from the production and sale of farm goods, raw materials and the sale of bioavailable extracts in both raw material and

finished product form. Revenues are recognized when product is ordered and delivered. Product shipped on consignment is not counted

in revenue until sold.

Intangible and Long-Lived

Assets

We follow

Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 360,

“Property Plant and Equipment”, which establishes a “primary asset” approach to determine the cash

flow estimation period for a group of assets and liabilities that represents the unit of accounting for a long lived asset to

be held and used. Long-lived assets to be held and used are reviewed for impairment whenever events or changes in

circumstances indicate that the carrying amount of an asset may not be recoverable. The carrying amount of a long-lived asset

is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual

disposition of the asset. Long-lived assets to be disposed of are reported at the lower of carrying amount or fair value less

cost to sell.

Goodwill is accounted

for in accordance with ASC Topic 350, “Intangibles – Goodwill and Other”. We assess the impairment of long-lived

assets, including goodwill and intangibles on an annual basis or whenever events or changes in circumstances indicate that the

fair value is less than its carrying value. Factors that we consider important which could trigger an impairment review include

poor economic performance relative to historical or projected future operating results, significant negative industry, economic

or company specific trends, changes in the manner of our use of the assets or the plans for our business, market price of our common

stock, and loss of key personnel. We have determined that there was no impairment of goodwill during 2013 or 2012. The share exchange

did not result in the recording of goodwill and there is not currently any goodwill recorded.

Potential Derivative

Instruments

We periodically assess

our financial and equity instruments to determine if they require derivative accounting. Instruments which may potentially require

derivative accounting are conversion features of debt and common stock equivalents in excess of available authorized common shares.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

Non-Controlling Interest

Plandaí owns 100% of Dunn Roman Holdings—Africa,

which in turn owns 74% of Breakwood Trading 22 (Pty, Ltd. and 84% Green Gold Biotechnologies (Pty), Ltd., in order to be compliant

with the Black Economic Empowerment rules imposed by the South African Land Bank. While the Company, under the Equity Method of

Accounting, is required to consolidate 100% of the operations of its majority-owned subsidiaries, that portion of subsidiary net

equity attributable to the minority ownership, together with an allocated portion of net income or net loss incurred by the subsidiaries,

must be reflected on the consolidated financial statements. On the balance sheet, minority interest has been shown in the Equity

Section, separated from the equity of Plandaí, while on the income statement, the non-controlling shareholder allocation

of net loss has been shown in the Consolidated Statement of Operations.

Currency Translation Adjustment

The Company maintains significant operations

in South Africa, where the currency is the Rand. The subsidiary financial statements are therefore converted into US dollars prior

to consolidation with the parent entity, Plandaí Biotechnology, Inc. US GAAP requires that the weighted average exchange

rate be applied to the foreign income statements and that the closing exchange rate as of the period end date be applied to the

balance sheet. The cumulative foreign currency adjustment is included in the equity section of the balance sheet.

ITEM 3. QUANTITATIVE AND QUALITIVE DISCLOSURES ABOUT MARKET

RISK RISKS RELATED TO OUR BUSINESS

We Have Historically Lost Money and Losses May Continue in the

Future

We have historically lost money. The

loss for the fiscal year ended June 30, 2014 was $15,533,819 and future losses are likely to occur. Accordingly, we may experience

significant liquidity and cash flow problems if we are not able to raise additional capital as needed and on acceptable terms.

No assurances can be given we will be successful in reaching or maintaining profitable operations.

We Will Need to Raise Additional Capital to Finance Operations

Our operations have relied almost entirely

on external financing to fund our operations. Such financing has historically come from a combination of borrowings and from

the sale of common stock and assets to third parties. We will need to raise additional capital to fund our anticipated operating

expenses and future expansion. Among other things, external financing will be required to cover our operating costs. We

cannot assure you that financing whether from external sources or related parties will be available if needed or on favorable terms.

The sale of our common stock to raise capital may cause dilution to our existing shareholders. Our inability to obtain

adequate financing will result in the need to curtail business operations. Any of these events would be materially harmful

to our business and may result in a lower stock price.

There is Substantial Doubt About Our Ability to Continue as a

Going Concern Due to Recurring Losses and Working Capital Shortages, Which Means that We May Not Be Able to Continue Operations

Unless We Obtain Additional Funding

The report of our independent accountants on

our June 30, 2014 financial statements include an explanatory paragraph indicating that there is substantial doubt about our ability

to continue as a going concern due to recurring losses and working capital shortages. Our ability to continue as a going

concern will be determined by our ability to obtain additional funding. Our financial statements do not include any adjustments

that might result from the outcome of this uncertainty.

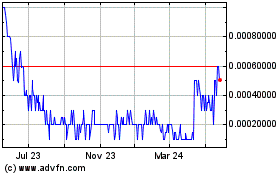

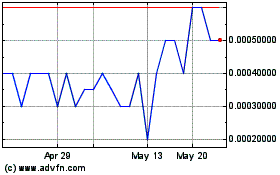

Our Common Stock May Be Affected By Limited Trading Volume and

May Fluctuate Significantly

There has been a limited public market for

our common stock and there can be no assurance that an active trading market for our common stock will develop. As a result,

this could adversely affect our shareholders' ability to sell our common stock in short time periods, or possibly at all. Our

common stock has experienced, and is likely to experience in the future, significant price and volume fluctuations that could adversely

affect the market price of our common stock without regard to our operating performance. In addition, we believe that factors

such as quarterly fluctuations in our financial results and changes in the overall economy or the condition of the financial markets

could cause the price of our common stock to fluctuate substantially. Substantial fluctuations in our stock price could significantly

reduce the price of our stock.

There is no Assurance of Continued Public Trading Market and

Being a Low Priced Security may Affect the Market Value of Our Stock

To date, there has been only a limited

public market for our common stock. Our common stock is currently quoted on the OTCBB. As a result, an investor may find it difficult

to dispose of, or to obtain accurate quotations as to the market value of our stock. Our stock is subject to the low-priced security

or so called "penny stock" rules that impose additional sales practice requirements on broker-dealers who sell such securities.

The Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure in connection with any trades involving

a stock defined as a penny stock (generally, according to recent regulations adopted by the SEC, any equity security that has a

market price of less than $5.00 per share, subject to certain exceptions that we no longer meet). For example, brokers/dealers

selling such securities must, prior to effecting the transaction, provide their customers with a document that discloses the risks

of investing in such securities. Included in this document are the following:

- the bid and offer price quotes in and

for the "penny stock," and the number of shares to which the quoted prices apply,

- the brokerage firm's compensation for

the trade, and

- the compensation received by the brokerage

firm's sales person for the trade.

In addition, the brokerage firm must send the investor:

- a monthly account statement that gives

an estimate of the value of each "penny stock" in the investor's account, and

- a written statement of the investor's financial situation

and investment goals.

If the person purchasing the securities

is someone other than an accredited investor or an established customer of the broker/dealer, the broker/dealer must also

approve the potential customer's account by obtaining information concerning the customer's financial situation, investment

experience and investment objectives. The broker/dealer must also make a determination whether the transaction is suitable

for the customer and whether the customer has sufficient knowledge and experience in financial matters to be reasonably

expected to be capable of evaluating the risk of transactions in such securities. Accordingly, the Commission's rules may

limit the number of potential purchasers of the shares of our common stock.

Resale restrictions on transferring "penny

stocks" are sometimes imposed by some states, which may make transaction in our stock more difficult and may reduce the value

of the investment. Various state securities laws pose restrictions on transferring "penny stocks" and as a result, investors

in our common stock may have the ability to sell their shares of our common stock impaired.

There can be no assurance we will have

market makers in our stock. If the number of market makers in our stock should decline, the liquidity of our common stock could

be impaired, not only in the number of shares of common stock which could be bought and sold, but also through possible delays

in the timing of transactions, and lower prices for the common stock than might otherwise prevail. Furthermore, the lack of market

makers could result in persons being unable to buy or sell shares of the common stock on any secondary market.

We Could Fail to Retain or Attract Key Personnel

Our future success depends in significant part

on the continued services of Roger Duffield, our President. We cannot assure you we would be able to find an appropriate

replacement for key personnel. Any loss or interruption of our key personnel's services could adversely affect our ability

to develop our business plan. We have no employment agreements or life insurance on Mr. Duffield.

Nevada Law and Our Charter May Inhibit a Takeover of Our Company

That Stockholders May Consider Favorable

Provisions of Nevada law, such as its business

combination statute, may have the effect of delaying, deferring or preventing a change in control of our company. As a result,

these provisions could limit the price some investors might be willing to pay in the future for shares of our common stock.

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures

(as defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)

that are designed to be effective in providing reasonable assurance that information required to be disclosed in our reports under

the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the

Securities and Exchange Commission (the “SEC”), and that such information is accumulated and communicated to our management

to allow timely decisions regarding required disclosure.

In designing and evaluating disclosure controls

and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only

reasonable, not absolute assurance of achieving the desired objectives. Also, the design of a control system must reflect the fact

that there are resource constraints and the benefits of controls must be considered relative to their costs. Because of the inherent

limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances

of fraud, if any, have been detected. These inherent limitations include the realities that judgments in decision-making can be

faulty and that breakdowns can occur because of simple error or mistake. The design of any system of controls is based, in part,

upon certain assumptions about the likelihood of future events and there can be no assurance that any design will succeed in achieving

its stated goals under all potential future conditions.

As of the end of the period covered

by this report, we carried out an evaluation, under the supervision and with the participation of management, including

our chief executive officer and principal financial officer, of the effectiveness of the design and operation of our

disclosure controls and procedures. Based upon that evaluation, management concluded that our disclosure controls and

procedures are effective as of September 30, 2014 to cause the information required to be disclosed by us in reports that we

file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods prescribed by

SEC, and that such information is accumulated and communicated to management, including our chief executive officer and

principal financial officer, as appropriate, to allow timely decisions regarding required disclosure.

Changes in Internal Control over Financial Reporting

There was no change in our internal controls