Rothschild's Reitz Eyes Long Term M&A Chances Post-Crisis

May 31 2010 - 6:53AM

Dow Jones News

European debt worries have muted investment bankers' prospects

for big capital markets and merger deals so far this year, but will

ultimately provide a basis for consolidation in Europe and around

the world, said Martin Reitz, head of investment banking for

Germany at private bank Rothschild.

"We saw a very positive development this year in investment

banking before the situation in Greece worsened. The crisis had a

dampening effect," said Reitz, who is still confident about

Rothschild's own prospects for the business. "The current crisis is

also a chance because the sense of urgency is there."

Reitz believes slow growth prospects for Europe will result in

mergers and acquisitions activity in future years as companies are

forced to become more efficient. Banks, service providers and

industrial companies are all sectors ripe for consolidation in

Germany, he said.

Cross-border M&A deals will also pick up in coming years as

developing economies gain a more important role in the global

economy.

"Pressure on European companies to become active in developing

countries will continue to increase. At the same time, we can

expect an impressive uptick in the number of companies from

developing countries who take stakes in European firms with strong

technological or market positions," he said.

Reitz was tapped from UBS by Rothschild last year as

family-owned Rothschild sought to strengthen its investment banking

ranks in Germany with several key hires. Reitz made his mark at UBS

AG (UBS) as co-head of investment banking in Germany.

In recent years in Germany, Rothschild has won high profile

mandates for blue-chip deals like Volkswagen AG's (VOW.XE) merger

with Porsche Automobile Holding SE (PAH3.XE) and CVC Capital

Partner's stake buy in Evonik Industries AG. Rothschild

consistently ranks among the top investment banks competing for

German M&A advisory deals alongside the likes of Goldman Sachs

Group Inc. (GS), Deutsche Bank AG (DB) and JP Morgan (JPM),

according to the industry rankings.

In Germany's sprawling banking market, there is particular room

for consolidation and restructuring in the state-controlled

Landesbank sector, Reitz said.

The Landesbanken "have to get their business models back on

track. It will take some time before they achieve satisfying

returns on equity."

Germany's Landesbanken were particularly hit in Germany by the

financial crisis due to their dependence on exotic securities and

other high-risk investments as earnings sources. Critics have for

years urged them to consolidate.

"There are definitely long-term options for the Landesbanken

that can be profitable," although they are unlikely to earn as much

as private banks as long as regulation restricts the kinds of

business they can do, Reitz said.

Eyeing the broader economic environment, Reitz called for a

balance between savings and growth.

"The high indebtedness of many European countries can only be

resolved by putting massive savings measures into place. The

savings must occur in an intelligent way to preserve the countries'

futures," he said.

-By William Launder and Madeleine Nissen; Dow Jones Newswires;

+49 69 29 725 515; william.launder@dowjones.com

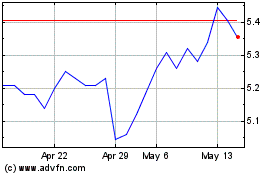

Porsche Automobile (PK) (USOTC:POAHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Porsche Automobile (PK) (USOTC:POAHY)

Historical Stock Chart

From Jul 2023 to Jul 2024