Porsche SE: Debt Reduced Significantly After Capital Increase

April 29 2011 - 9:15AM

Dow Jones News

German sportscar maker Porsche Automobile Holding SE (PAH3.XE)

said Friday its net liquidity has improved significantly following

the successful completion of its capital increase.

MAIN FACTS:

-As of the reporting date for the first three months of the

fiscal year 2011 (31 March 2011), net liquidity was still -EUR6.7

billion.

-In April 2011, the capital increase produced issue proceeds of

some EUR4.9 billion at Porsche SE, which was fully utilized to

repay liabilities to banks.

-As a result, net liquidity is -EUR1.8 billion before the

expected inflow of dividends from the investments.

-As a result of the repayment of liabilities to banks, the

future interest expenses of Porsche SE will decrease

significantly

-First-quarter profit after tax came in at EUR691 million,

mainly due to the very good development of its investments at

Porsche and Volkswagen AG (VOW.XE).

-Profits from investments accounted for at equity were EUR606

million in the first three months.

-Frankfurt Bureau, Dow Jones Newswires; 49-69-29725-500

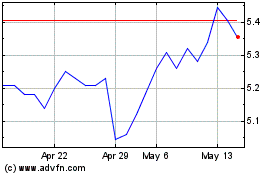

Porsche Automobile (PK) (USOTC:POAHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Porsche Automobile (PK) (USOTC:POAHY)

Historical Stock Chart

From Jul 2023 to Jul 2024

Real-Time news about Porsche Automobile Holding SE (PK) (OTCMarkets): 0 recent articles

More Porsche Automobil Holding SE ADS News Articles