PERVASIP RELEASES SHAREHOLDER LETTER

August 20 2015 - 7:53AM

InvestorsHub NewsWire

WHITE PLAINS, N.Y., August 20,

2015 – Paul

Riss, chief executive officer of Pervasip Corp. (USOTC:

PVSP) (“Pervasip” or the “Company”), issued the following

letter today to the shareholders of Pervasip:

Dear Shareholders:

I am pleased to provide this update. As

previously reported, we’ve been executing our plans to improve our

balance sheet and capital structure to meet the anticipated

financial and other requirements of potential new investors, joint

venture partners, licensors and acquisition

targets.

This remains an exciting and dynamic time for

us. Our first objective is to build shareholder value, and to do so

in ways that are accretive to all of our collective share holdings.

Your interests are important to us. However, they are also

important and transparent to prospective new shareholders –

especially, for example, acquisition targets and their various

stakeholders during due diligence and negotiations. We believe that

consistent shareholder communication is important, however,

restraint for limited durations may be required or appropriate from

time to time as we respond to opportunities to build value. We

appreciate your continued patience and discretion as we do

so.

We have much to report and have a plan to do so,

but will focus today on our restructuring progress and objectives.

We have successfully eliminated $2,065,614 of $8,265,793 in debt

during 2015 as a result of our debt restructuring plans. The

remainder includes $4,884,559 in debt that is subject to agreements

calling for full satisfaction and elimination in exchange for cash

payments totaling $170,000. We accordingly expect that debt to be

eliminated before year end. An additional $1,212,326, for a total

of $8,162,499 of the $8,265,793 in debt at the start of 2015 – or

99% of the starting balance, is expected to be eliminated or

converted into restricted equity before year end.

We are taking steps to improve our share

structure, including the elimination of all classes of preferred

stock except for the new class of preferred (Series H) used to

complete our recent acquisitions, and we already eliminated one

billion shares of common stock issued to FLUX Carbon Corporation

(“FCC”). We have also finalized terms and are currently working on

debt restructuring, investment, joint venture, license and

acquisition agreements for transactions that we expect will involve

issuance of approximately 20% of our share ownership in the form of

restricted Series H shares. Once finalized, and when taken with

previously issued restricted Series H shares, those agreements will

correspond to about 80% of our share structure in the form of

restricted Series H stock and 20% in the form of common stock (all

of which shares are in the public float). Significantly, FCC has

agreed to continue to reduce its ownership to offset the dilutive

impact of any and all debt conversions that occur moving forward

until all existing convertible debt is satisfied.

We have no intention of completing a reverse

stock split for the foreseeable future. However, our share

structure and outstanding shares will need to be addressed if we

are to achieve our ultimate plan of up-listing. We intend to submit

a petition to do so after completing our restructuring and

acquisition plans and achieving targeted valuation and listing

goals – and we hope to be in a position to do so in the latter half

of 2016.

We continue to see extraordinary opportunities

in front of us, and our technology focus is an essential aspect of

our plan to build shareholder value with those opportunities. We

believe that our existing and planned new acquisitions and

technologies collectively, on an integrated basis, provide us with

the ability to create new recurring revenue streams and enhance

existing retail margins. We will speak more to that in the coming

months as we execute our outreach plans.

In the meantime, despite our silence for the

last month, this has been an exciting summer with the completion of

the Plaid Canary Corporation and Grow Big Supply LLC acquisition –

a transaction expected to bring in excess of $5 million in

annualized revenue with targeted operating income margins of about

5%. We believe that the completion of that transaction has helped

us to negotiate for investment, restructuring, licensing and

acquisition terms at valuations much better than our current stock

price. We hope to complete those over the next four to six weeks

and will provide further updates as appropriate.

We are grateful for your continued support and

we look forward to our next communication.

Best regards,

Paul Riss

Chief Executive Officer

Pervasip Corp.

About Pervasip

Corp.

Pervasip develops and delivers products and

technologies to emerging agricultural markets, with a focus on

improving grow conditions, yields and value in hydroponic and other

indoor grow facility applications.

Forward Looking

Statements

The information contained herein includes

forward-looking statements. These statements relate to future

events or to our future financial performance, and involve known

and unknown risks, uncertainties and other factors that may cause

our actual results, levels of activity, performance, or

achievements to be materially different from any future results,

levels of activity, performance or achievements expressed or

implied by these forward-looking statements. You should not

place undue reliance on forward-looking statements since they

involve known and unknown risks, uncertainties and other factors

which are, in some cases, beyond our control and which could, and

likely will, materially affect actual results, levels of activity,

performance or achievements. Any forward-looking statement

reflects our current views with respect to future events and is

subject to these and other risks, uncertainties and assumptions

relating to our operations, results of operations, growth strategy

and liquidity. We assume no obligation to publicly update or

revise these forward-looking statements for any reason, or to

update the reasons actual results could differ materially from

those anticipated in these forward-looking statements, even if new

information becomes available in the future.

Additional Information

Pervasip Corp.

Paul H. Riss, CEO

paul@growbigsupply.com

914-750-9339

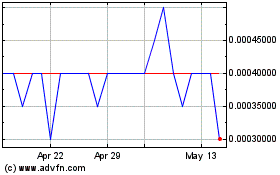

Pervasip (PK) (USOTC:PVSP)

Historical Stock Chart

From Oct 2024 to Nov 2024

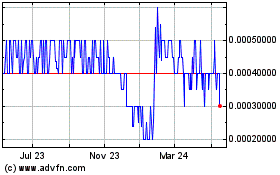

Pervasip (PK) (USOTC:PVSP)

Historical Stock Chart

From Nov 2023 to Nov 2024