Q.E.P. Co., Inc., Reports Fiscal 2006 Third-Quarter and Nine-Month Financial Results; Quarterly Sales Increase 25.6% to $54.3 Mi

January 12 2006 - 7:00AM

Business Wire

Q.E.P. Co., Inc. (Nasdaq:QEPC), today announced financial results

for its fiscal 2006 third quarter ended November 30, 2005. Net

sales in the 2006 third quarter and nine months were records in

their respective periods. For the fiscal 2006 third quarter, net

sales increased 25.6 percent to $54.3 million, compared with $43.2

million in the fiscal 2005 third quarter. For the fiscal 2006 nine

months, net sales increased 24.1 percent to $159.9 million,

compared with $128.9 million for the same period last fiscal year.

Sales of flooring adhesives, including acquired operations,

accounted for $4.0 million of the increase in sales for the fiscal

2006 third quarter and $13.2 million of the increase in sales for

the fiscal 2006 nine months. Acquisitions other than flooring

adhesives contributed an additional $1.0 million to the increase in

sales for the fiscal 2006 third quarter and $3.6 million to the

increase in sales for the nine months of fiscal 2006. Changes in

foreign currency exchange rates accounted for approximately

$139,000 of the sales increase in the fiscal 2006 third quarter and

approximately $1.7 million in the fiscal 2006 nine months. Gross

profit for the quarter was 29.1 percent of net sales as compared

with 32.1 percent for the same period a year ago. The gross profit

for the fiscal 2006 nine months was 29.6 percent compared to 33.2

percent in the same period last year. The decline in gross profit

for both the third quarter and nine months continued to include the

effects of increases in the costs of raw materials and finished

goods related to, among other matters, higher costs for crude oil

and other industrial commodities, and the relative increase in

flooring adhesives sales that have lower overall margins than

specialty tools. The Company's pricing of individual product

offerings have modestly increased throughout the fiscal year to

offset a portion of cost increases. While the Company's ability to

increase pricing is traditionally behind cost increases, the

Company remains committed to seeking additional price increases

that reflect the impact of continued cost increases. In addition,

the Company's third quarter gross profit was impacted by costs

associated with the disposal of inventories related to the

restructuring of one of the Company's foreign operations. The

restructuring also included $490,000 of operating expenses

principally related to personnel reductions. For the fiscal 2006

third quarter, net income was $283,000, or $0.08 per diluted share,

compared with $1.2 million, or $0.33 per diluted share, for the

third quarter last fiscal year. Net income for the fiscal 2006 nine

months declined to $1.4 million, or $0.39 per diluted share, from

$3.6 million, or $0.98 per diluted share, in the same period last

fiscal year. Lewis Gould, Q.E.P.'s Chairman and Chief Executive

Officer, stated: "We remain pleased with the consistent strength of

our top-line growth. We have recorded year-over-year increases in

sales in 33 of the last 35 quarters. Though our profitability

continues to be impacted by the increased costs of purchases, we

remain focused on realizing price increases that fairly reflect

those cost increases and ensuring that we control the growth in

operating costs. "During the quarter we were successful in raising

prices on some of our products that have been under pressure from

higher commodity prices. We integrated our Dalton manufacturing

facility and distribution center into our North American

operations. We began a direct shipping program that we believe will

result in improvements in operating profitability. Our balance

sheet is healthy. We are committed to our business plan and believe

that increases in profitability will follow improvements in pricing

and the continued management of operating expenses," concluded Mr.

Gould. The Company will host a conference call at 10:00 a.m.

Eastern Time today to discuss this press release and to answer

questions. To participate in the conference call, please dial

800-922-0755 five to 10 minutes before the call is scheduled to

begin. The financial information to be discussed during the

conference call will be included in the Company's Form 10-Q filing

with the Securities and Exchange Commission ("SEC") later today and

will subsequently be added to Q.E.P.'s website at www.qep.com in

the Investor Relations section. Certain statements in this press

release, including statements regarding our expectations regarding

continued manufacturing efficiencies, increases in our gross and

operating profit margins, our ability to manage operating expenses,

and our ability to implement additional price increases are

forward-looking statements, which are made pursuant to the

safe-harbor provisions of the Securities Litigation Reform Act of

1995. The forward-looking statements are made only as of the date

of this report and are subject to risks and uncertainties which

could cause actual results to differ materially from those

discussed in the forward-looking statements and from historical

results of operations. Among the risks and uncertainties that could

cause such a difference are the Company's assumptions relating to

the expected growth in sales of its products, the continued success

of the Company's manufacturing processes, continued increases in

the cost of raw materials and finished goods, improvements in

productivity and cost reductions, the continued success of

initiatives with certain of the Company's customers, the success of

the Company's price increases initiatives, and the success of the

Company's sales and marketing efforts. A more detailed discussion

of risks attendant to the forward-looking statements included in

this press release are set forth in the "Forward-Looking

Statements" section of the Company's Annual Report on Form 10-K for

the year ended February 28, 2005, filed with the SEC, and in other

reports already filed with the SEC. -Financial Information Follows-

-0- *T Q.E.P. CO., INC., AND SUBSIDIARIES CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (UNAUDITED) (In thousands, except per-share

data) Nine Months Ended Three Months Ended ---------------------

--------------------- 11/30/05 11/30/04 11/30/05 11/30/04

---------- ---------- ---------- ---------- Net sales $159,947

$128,905 $54,275 $43,209 Cost of goods sold 112,539 86,085 38,472

29,320 ---------- ---------- ---------- ---------- Gross profit

47,408 42,820 15,803 13,889 Costs and expenses Shipping 15,416

12,827 5,095 4,130 General and administrative 13,329 11,016 4,231

3,561 Selling and marketing 14,972 12,303 5,008 4,101 Restructuring

costs 615 -- 490 -- Other (income) expense (1,144) 126 (137) (4)

---------- ---------- ---------- ---------- Operating income 4,220

6,548 1,116 2,101 Interest expense, net 1,812 997 681 367

---------- ---------- ---------- ---------- Income before provision

for income taxes 2,408 5,551 435 1,734 Provision for income taxes

1,003 1,972 152 533 ---------- ---------- ---------- ---------- Net

income $1,405 $3,579 $283 $1,201 ========== ========== ==========

========== Basic earnings per common share $0.40 $1.04 $0.08 $0.35

========== ========== ========== ========== Diluted earnings per

common share $0.39 $0.98 $0.08 $0.33 ========== ==========

========== ========== Weighted average number of diluted common

shares outstanding 3,605,305 3,649,086 3,596,359 3,652,132

CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands) 11/30/05

2/28/05 ----------- -------- (UNAUDITED) Assets Current Assets Cash

and cash equivalents $1,095 $1,869 Accounts receivable 31,341

27,016 Inventories 31,992 29,929 Other current assets 2,099 2,504

----------- -------- 66,527 61,318 Property and equipment, net

8,204 9,186 Other assets 20,363 16,604 ----------- -------- Total

Assets $95,094 $87,108 =========== ======== Liabilities and

Shareholders' Equity Current liabilities (including current portion

of debt and, at 11/30/05, warrant put liability) $55,067 $49,949

Long-term debt 9,994 6,532 Warrant put liability -- 782

Shareholders' equity 30,033 29,845 ----------- -------- Total

Liabilities and Shareholders' Equity $95,094 $87,108 ===========

======== *T

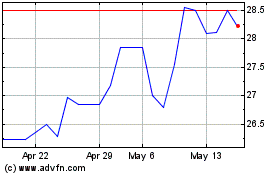

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Mar 2024 to Mar 2025