Q.E.P. CO., INC. (Nasdaq:QEPC), today announced financial results

for its fiscal 2007 second quarter and six months ended August 31,

2006. All May 31, 2006 and prior financial results have been

restated for the change in the accounting of the Company�s put

warrant liability. The Company�s amended February 28, 2006 Form

10-K and amended May 31, 2006 Form 10-Q have been filed with the

SEC. For the fiscal 2007 second quarter, net sales increased 2.9

percent to $54.5 million, compared with $52.9 million for the

fiscal 2006 second quarter. For the first six months of fiscal

2007, net sales increased 5.6 percent to $108.6 million, compared

with $102.8 million for the same period last fiscal year. Sales

outside North America accounted for approximately 21 percent of

sales in the fiscal 2007 second quarter and 22 percent of

year-to-date sales. The gross profit for the fiscal 2007 second

quarter increased to $14.9 million from $14.4 million in the same

period last year. Gross profit, as a percentage of sales for the

fiscal 2007 second quarter, was 27.3 percent, compared to 27.2

percent for the fiscal 2006 second quarter. For the first six

months of fiscal 2007, gross profit increased 4.8 percent to $30.1

million, compared with $28.8 million for the comparable period last

fiscal year. As a percentage of sales, gross profit was 27.7

percent for the first six months of fiscal 2007, compared to 28.0

percent for the same period last fiscal year. For the fiscal 2007

second quarter, the Company reported a net loss of $6.7 million, or

a loss of $1.94 per share, compared to a net loss of $375,000, or a

loss of $0.11 per share for the second quarter last fiscal year.

The net loss for the first six months of fiscal 2007 was $6.4

million, or a loss of $1.85 per share, compared to net income of

$2.2 million, or $0.58 per diluted share for the same period last

year. The fiscal 2007 results for the three and six month periods

ending August 31, 2006 include a goodwill impairment charge of $7.6

million. The goodwill impairment adjustment was necessary under

accounting standards as the Company�s equity market capitalization

during the second quarter of fiscal 2007 was less than the fair

value of the Company�s net assets. While net income adjusted for

the change in the put warrant liability, and non-recurring items is

not a measure of financial performance under generally accepted

accounting principles, the Company believes that the measure

provides meaningful comparisons of the Company�s current and

projected operating performance with its historical results. The

Company reported net income for the fiscal 2007 second quarter,

after adjusting for the change in the put warrant liability and

other non-recurring items, of $437,000, or $0.12 per diluted share,

compared with $6,000, or $0.00 per diluted share in the fiscal 2006

second quarter. For the fiscal 2007 six month period, the Company

reported net income, after the previously announced non-recurring

items, of $682,000, or $0.18 per diluted share, compared to

$572,000, or $0.15 per diluted share in the fiscal 2006 comparable

period. A reconciliation of net income to net income adjusted for

the change in the put warrant liability and non-recurring items is

included within the financial information at the end of this press

release. The Company reported $671,000 of cash and cash equivalents

at August 31, 2006. The Company�s working capital increased

$205,000 to $8.1 million as of August 31, 2006 compared to $7.9

million at February 28, 2006, our previous fiscal year end. For the

second quarter of fiscal 2007, the Company generated over $1.3

million of cash from operations as compared to cash used in

operations of $1.7 million in the second quarter of fiscal 2006.

For the first six months of fiscal 2007, the Company generated

$83,000 as compared to $342,000 for the same period last year. The

Company will host a conference call at 10:30 a.m. Eastern Time on

Wednesday, October 25, 2006 to discuss this press release and to

answer questions. To participate in the conference call, please

dial 800-922-0755 five to 10 minutes before the call is scheduled

to begin. While we hope you will be able to join us for the call,

we have arranged to have the teleconference session available for

replay from 12:00 p.m. Eastern Time on October 25 until midnight on

November 1. The number to hear the teleconference replay is

1-877-519-4471. The access code for the replay is 8035907. The

financial information to be discussed during the conference call is

included in the Company�s Form 10-Q filed with the Securities and

Exchange Commission (�SEC�) on October 23, 2006 and will be added

to Q.E.P.�s website at www.qep.com in the Investor Relations

section. Certain statements in this press release are

forward-looking statements, which are made pursuant to the

safe-harbor provisions of the Securities Litigation Reform Act of

1995. The forward-looking statements are made only as of the date

of this report and are subject to risks and uncertainties which

could cause actual results to differ materially from those

discussed in the forward-looking statements and from historical

results of operations. Among the risks and uncertainties that could

cause such a difference are our assumptions relating to the

expected growth in sales of our products, the continued success of

our manufacturing processes, continued increases in the cost of raw

materials and finished goods, improvements in productivity and cost

reductions, the continued success of initiatives with certain of

our customers, the success of our price increases initiatives, and

the success of our sales and marketing efforts. A more detailed

discussion of risks attendant to the forward-looking statements

included in this press release are set forth in the

�Forward-Looking Statements� section of our Annual Report on Form

10-K for the year ended February�28,�2006, as amended, filed with

the SEC, and in other reports already filed with the SEC. Q.E.P.

CO., Inc. and Subsidiaries Consolidated Balance Sheets (In

thousands, except share data) � August 31, 2006 February 28, 2006 �

ASSETS CURRENT ASSETS Cash and cash equivalents $ 671� $ 852�

Accounts receivable, less allowance for doubtful accounts of

approximately $248 and $361 as of August 31, 2006 and February 28,

2006, respectively 32,171� 33,258� Inventories 31,562� 34,128�

Prepaid expenses and other current assets 2,991� 3,717� Deferred

income taxes 660� 617� Total current assets 68,055� 72,572� �

Property and equipment, net 7,666� 8,296� Goodwill 9,453� 16,799�

Other intangible assets, net 2,958� 3,109� Other assets 220� 310� �

Total Assets $ 88,352� $ 101,086� � LIABILITIES AND SHAREHOLDERS'

EQUITY CURRENT LIABILITIES Trade accounts payable $ 18,193� $

24,041� Accrued liabilities 7,510� 7,655� Lines of credit 28,905�

26,284� Current maturities of long-term debt 4,397� 4,431� Put

warrant liability 982� 2,298� Total current liabilities 59,987�

64,709� � Notes payable 3,658� 4,950� Other long-term debt 2,888�

4,197� Deferred income taxes 217� 213� Total Liabilities 66,750�

74,069� � Commitments and Contingencies --� --� � SHAREHOLDERS'

EQUITY Preferred stock, 2,500,000 shares authorized, $1.00 par

value; 336,660 shares issued and outstanding at August 31, 2006 and

February 28, 2006, respectively 337� � 337� Common stock;

20,000,000 shares authorized, $.001 par value; 3,484,841 and

3,458,341 shares issued and outstanding at August 31, 2006 and

February 28, 2006, respectively � � 3� 3� Additional paid-in

capital 9,781� 9,539� Retained earnings 14,792� 21,205� Treasury

stock; 82,940 shares and 70,940 held at cost outstanding at August

31, 2006 and February 28, 2006, (639) (543) Accumulated other

comprehensive income (2,672) (3,524) 21,602� 27,017� TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY $ 88,352� $ 101,086� Q.E.P.

CO., Inc. and Subsidiaries Consolidated Statements of Operations

(In thousands except per share data) (Unaudited) � For the Three

Months Ended August 31, For the Six Months Ended August 31, 2006�

2005� 2006� 2005� As Restated As Restated Net sales $ 54,476� $

52,947� $ 108,608� $ 102,818� Cost of goods sold 39,612� 38,546�

78,478� 74,068� Gross profit 14,864� 14,401� 30,130� 28,750� �

Operating costs and expenses: Shipping 5,557� 5,286� 11,105�

10,320� General and administrative 5,083� 4,640� 10,135� 9,222�

Selling and marketing 3,733� 3,666� 7,291� 7,110� Impairment loss

on goodwill and other intangibles 7,598� -� 7,598� -� Other expense

(income), net (1) (12) (3) (1,164) Total operating costs and

expenses 21,970� 13,580� 36,126� 25,488� � Operating income (loss)

(7,106) 821� (5,996) 3,262� � Change in put warrant liability

1,231� (381) 1,316� 962� Interest expense, net (732) (643) (1,456)

(1,131) � Income (loss) before provision for income taxes (6,607)

(203) (6,136) 3,093� � Provision (benefit) for income taxes 124�

172� 265� 851� � Net income (loss) $ (6,731) $ (375) $ (6,401) $

2,242� � Net income (loss) per share: Basic $ (1.94) $ (0.11) $

(1.85) $ 0.65� Diluted $ (1.94) $ (0.11) $ (1.85) $ 0.58� �

Weighted-average number of common shares outstanding Basic 3,474�

3,458� 3,469� 3,458� Diluted 3,474� 3,458� 3,469� 3,834� Net Income

(Loss) Compared to Net Income Adjusted for the Change in the Put

Warrant Liability and Non-Recurring Items (In thousands except per

share data) While Net Income Adjusted for the Change in the Put

Warrant Liability and Non-Recurring Items is not a measure of

financial performance under generally accepted accounting

principles, the Company believes that the measure provides

meaningful comparisons of the Company�s current and projected

operating performance with its historical results. The Company uses

Net Income Adjusted for the Change in the Put Warrant Liability and

Non-Recurring Items as an internal measure of its business and

believes it is utilized as an important measure of performance by

the investment community. Net Income Adjusted for the Change in the

Put Warrant Liability and Non-Recurring Items is not meant to be

considered a substitute or replacement for Net Income as prepared

in accordance with generally accepted accounting principles. The

reconciliation of Net Income to Net Income Adjusted for the Change

in the Put Warrant Liability and Non-Recurring Items is as follows:

For the Three Months Ended For the Six Months Ended August 31,

August 31, 2006� 2005� 2006� 2005� (As Restated) (As Restated) �

Net income (loss), as reported (a) $ (6,731) $ (375) $ (6,401) $

2,242� � Add back (deduct): Impairment loss on goodwill and other

intangible assets 7,598� -� 7,598� -� Realization of currency

translation loss related to the disposition of certain assets and

obligations of the Holland subsidiary 447� -� 447� -� Loss related

to the disposition of certain assets and obligations of the Holland

subsidiary, net of tax benefit 354� -� 354� -� Gain on sale of

carpet seaming tape business, net of tax -� -� -� (708) Change in

put warrant liability (1,231) 381� (1,316) (962) Net income

adjusted for the change in the put warrant liability and

non-recurring items (b) $ 437� $ 6� $ 682� $ 572� � Earnings (loss)

per share, as reported: Basic ((a)/(c)) $ (1.94) $ (0.11) $ (1.85)

$ 0.65� Diluted ((a)/(d)) $ (1.94) $ (0.11) $ (1.85) $ 0.58� �

Weighted average number of shares outstanding, as reported: Basic

(c) 3,474� 3,458� 3,468� 3,458� Diluted (d) 3,474� 3,458� 3,468�

3,834� � Earnings per share adjusted for the change in the put

warrant liability and non-recurring items: Basic ((b)/(e)) $ 0.13�

$ 0.00� $ 0.20� $ 0.17� Diluted ((b)/(f)) $ 0.12� $ 0.00� $ 0.18� $

0.15� � Weighted average number of shares outstanding as adjusted

for the change in the put warrant liability and non-recurring

items: Basic (e) 3,473� 3,458� 3,468� 3,458� Diluted (f) 3,728�

3,820� 3,783� 3,834� Q.E.P. CO., Inc. and Subsidiaries Consolidated

Statements of Cash Flows (In Thousands) (Unaudited) For the Six

Months Ended August 31, 2006� 2005� -- As Restated -- Cash flows

from operating activities: Net income (loss) $ (6,401) $ 2,242� �

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: � Depreciation and amortization 1,284� 2,048�

Impairment loss on goodwill and other intangibles 7,598� -� Change

in fair value of put warrant liability (1,316) (962) Write-off of

Holland accumulated foreign translation 447� -� Bad debt expense

70� 223� Gain on sale of business -� (1,120) Stock-based

compensation expense 120� -� Deferred income taxes (40) (148)

Changes in assets and liabilities, net of acquisitions: Accounts

receivable 1,017� (2,704) Inventories 2,567� (490) Prepaid expenses

and other current assets 726� 421� Other assets 12� (307) Trade

accounts payable and accrued liabilities (6,001) 1,139� Net cash

provided by operating activities 83� 342� � Cash flows from

investing activities: Capital expenditures (353) (816)

Acquisitions, net of cash acquired -� (2,330) Net cash used in

investing activities (353) (3,146) � Cash flows from financing

activities: Net (payments) borrowings under lines of credit 2,164�

(48) Borrowings of long-term debt -� 3,209� Repayments of long-term

debt (1,390) (955) Repayments of acquisition debt (1,380) (482)

Payments related to the purchase of treasury stock (60) (60)

Proceeds from exercise of stock options 129� 10� Dividends (10) (8)

Net cash (used in) provided by financing activities (547) 1,666� �

Effect of exchange rate changes on cash 636� (271) � Net decrease

in cash (181) (1,409) � Cash and cash equivalents at beginning of

period 852� 1,869� � Cash and cash equivalents at end of period $

671� $ 460� � Q.E.P. CO., INC. (Nasdaq:QEPC), today announced

financial results for its fiscal 2007 second quarter and six months

ended August 31, 2006. All May 31, 2006 and prior financial results

have been restated for the change in the accounting of the

Company's put warrant liability. The Company's amended February 28,

2006 Form 10-K and amended May 31, 2006 Form 10-Q have been filed

with the SEC. For the fiscal 2007 second quarter, net sales

increased 2.9 percent to $54.5 million, compared with $52.9 million

for the fiscal 2006 second quarter. For the first six months of

fiscal 2007, net sales increased 5.6 percent to $108.6 million,

compared with $102.8 million for the same period last fiscal year.

Sales outside North America accounted for approximately 21 percent

of sales in the fiscal 2007 second quarter and 22 percent of

year-to-date sales. The gross profit for the fiscal 2007 second

quarter increased to $14.9 million from $14.4 million in the same

period last year. Gross profit, as a percentage of sales for the

fiscal 2007 second quarter, was 27.3 percent, compared to 27.2

percent for the fiscal 2006 second quarter. For the first six

months of fiscal 2007, gross profit increased 4.8 percent to $30.1

million, compared with $28.8 million for the comparable period last

fiscal year. As a percentage of sales, gross profit was 27.7

percent for the first six months of fiscal 2007, compared to 28.0

percent for the same period last fiscal year. For the fiscal 2007

second quarter, the Company reported a net loss of $6.7 million, or

a loss of $1.94 per share, compared to a net loss of $375,000, or a

loss of $0.11 per share for the second quarter last fiscal year.

The net loss for the first six months of fiscal 2007 was $6.4

million, or a loss of $1.85 per share, compared to net income of

$2.2 million, or $0.58 per diluted share for the same period last

year. The fiscal 2007 results for the three and six month periods

ending August 31, 2006 include a goodwill impairment charge of $7.6

million. The goodwill impairment adjustment was necessary under

accounting standards as the Company's equity market capitalization

during the second quarter of fiscal 2007 was less than the fair

value of the Company's net assets. While net income adjusted for

the change in the put warrant liability, and non-recurring items is

not a measure of financial performance under generally accepted

accounting principles, the Company believes that the measure

provides meaningful comparisons of the Company's current and

projected operating performance with its historical results. The

Company reported net income for the fiscal 2007 second quarter,

after adjusting for the change in the put warrant liability and

other non-recurring items, of $437,000, or $0.12 per diluted share,

compared with $6,000, or $0.00 per diluted share in the fiscal 2006

second quarter. For the fiscal 2007 six month period, the Company

reported net income, after the previously announced non-recurring

items, of $682,000, or $0.18 per diluted share, compared to

$572,000, or $0.15 per diluted share in the fiscal 2006 comparable

period. A reconciliation of net income to net income adjusted for

the change in the put warrant liability and non-recurring items is

included within the financial information at the end of this press

release. The Company reported $671,000 of cash and cash equivalents

at August 31, 2006. The Company's working capital increased

$205,000 to $8.1 million as of August 31, 2006 compared to $7.9

million at February 28, 2006, our previous fiscal year end. For the

second quarter of fiscal 2007, the Company generated over $1.3

million of cash from operations as compared to cash used in

operations of $1.7 million in the second quarter of fiscal 2006.

For the first six months of fiscal 2007, the Company generated

$83,000 as compared to $342,000 for the same period last year. The

Company will host a conference call at 10:30 a.m. Eastern Time on

Wednesday, October 25, 2006 to discuss this press release and to

answer questions. To participate in the conference call, please

dial 800-922-0755 five to 10 minutes before the call is scheduled

to begin. While we hope you will be able to join us for the call,

we have arranged to have the teleconference session available for

replay from 12:00 p.m. Eastern Time on October 25 until midnight on

November 1. The number to hear the teleconference replay is

1-877-519-4471. The access code for the replay is 8035907. The

financial information to be discussed during the conference call is

included in the Company's Form 10-Q filed with the Securities and

Exchange Commission ("SEC") on October 23, 2006 and will be added

to Q.E.P.'s website at www.qep.com in the Investor Relations

section. Certain statements in this press release are

forward-looking statements, which are made pursuant to the

safe-harbor provisions of the Securities Litigation Reform Act of

1995. The forward-looking statements are made only as of the date

of this report and are subject to risks and uncertainties which

could cause actual results to differ materially from those

discussed in the forward-looking statements and from historical

results of operations. Among the risks and uncertainties that could

cause such a difference are our assumptions relating to the

expected growth in sales of our products, the continued success of

our manufacturing processes, continued increases in the cost of raw

materials and finished goods, improvements in productivity and cost

reductions, the continued success of initiatives with certain of

our customers, the success of our price increases initiatives, and

the success of our sales and marketing efforts. A more detailed

discussion of risks attendant to the forward-looking statements

included in this press release are set forth in the

"Forward-Looking Statements" section of our Annual Report on Form

10-K for the year ended February 28, 2006, as amended, filed with

the SEC, and in other reports already filed with the SEC. -0- *T

Q.E.P. CO., Inc. and Subsidiaries Consolidated Balance Sheets (In

thousands, except share data) August 31, 2006 February 28, 2006

--------------- ----------------- ASSETS CURRENT ASSETS Cash and

cash equivalents $671 $852 Accounts receivable, less allowance for

doubtful accounts of approximately $248 and $361 as of August 31,

2006 and February 28, 2006, respectively 32,171 33,258 Inventories

31,562 34,128 Prepaid expenses and other current assets 2,991 3,717

Deferred income taxes 660 617 --------------- -----------------

Total current assets 68,055 72,572 Property and equipment, net

7,666 8,296 Goodwill 9,453 16,799 Other intangible assets, net

2,958 3,109 Other assets 220 310 --------------- -----------------

Total Assets $88,352 $101,086 =============== =================

LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT LIABILITIES Trade

accounts payable $18,193 $24,041 Accrued liabilities 7,510 7,655

Lines of credit 28,905 26,284 Current maturities of long-term debt

4,397 4,431 Put warrant liability 982 2,298 ---------------

----------------- Total current liabilities 59,987 64,709 Notes

payable 3,658 4,950 Other long-term debt 2,888 4,197 Deferred

income taxes 217 213 --------------- ----------------- Total

Liabilities 66,750 74,069 Commitments and Contingencies -- --

SHAREHOLDERS' EQUITY Preferred stock, 2,500,000 shares authorized,

$1.00 par value; 336,660 shares issued and outstanding at August

31, 2006 and February 28, 2006, respectively 337 337 Common stock;

20,000,000 shares authorized, $.001 par value; 3,484,841 and

3,458,341 shares issued and outstanding at August 31, 2006 and

February 28, 2006, respectively 3 3 Additional paid-in capital

9,781 9,539 Retained earnings 14,792 21,205 Treasury stock; 82,940

shares and 70,940 held at cost outstanding at August 31, 2006 and

February 28, 2006, (639) (543) Accumulated other comprehensive

income (2,672) (3,524) --------------- ----------------- 21,602

27,017 --------------- ----------------- TOTAL LIABILITIES AND

SHAREHOLDERS' EQUITY $88,352 $101,086 ===============

================= *T -0- *T Q.E.P. CO., Inc. and Subsidiaries

Consolidated Statements of Operations (In thousands except per

share data) (Unaudited) For the Three Months For the Six Months

Ended Ended August 31, August 31, ---------------------

-------------------- 2006 2005 2006 2005 ----------- ---------

---------- --------- As As Restated Restated Net sales $54,476

$52,947 $108,608 $102,818 Cost of goods sold 39,612 38,546 78,478

74,068 ----------- --------- ---------- --------- Gross profit

14,864 14,401 30,130 28,750 Operating costs and expenses: Shipping

5,557 5,286 11,105 10,320 General and administrative 5,083 4,640

10,135 9,222 Selling and marketing 3,733 3,666 7,291 7,110

Impairment loss on goodwill and other intangibles 7,598 - 7,598 -

Other expense (income), net (1) (12) (3) (1,164) -----------

--------- ---------- --------- Total operating costs and expenses

21,970 13,580 36,126 25,488 ----------- --------- ----------

--------- Operating income (loss) (7,106) 821 (5,996) 3,262 Change

in put warrant liability 1,231 (381) 1,316 962 Interest expense,

net (732) (643) (1,456) (1,131) ----------- --------- ----------

--------- Income (loss) before provision for income taxes (6,607)

(203) (6,136) 3,093 Provision (benefit) for income taxes 124 172

265 851 ----------- --------- ---------- --------- Net income

(loss) $(6,731) $(375) $(6,401) $2,242 =========== =========

========== ========= Net income (loss) per share: Basic $(1.94)

$(0.11) $(1.85) $0.65 =========== ========= ========== =========

Diluted $(1.94) $(0.11) $(1.85) $0.58 =========== =========

========== ========= Weighted-average number of common shares

outstanding Basic 3,474 3,458 3,469 3,458 =========== =========

========== ========= Diluted 3,474 3,458 3,469 3,834 ===========

========= ========== ========= *T -0- *T Net Income (Loss) Compared

to Net Income Adjusted for the Change in the Put Warrant Liability

and Non-Recurring Items (In thousands except per share data) *T

While Net Income Adjusted for the Change in the Put Warrant

Liability and Non-Recurring Items is not a measure of financial

performance under generally accepted accounting principles, the

Company believes that the measure provides meaningful comparisons

of the Company's current and projected operating performance with

its historical results. The Company uses Net Income Adjusted for

the Change in the Put Warrant Liability and Non-Recurring Items as

an internal measure of its business and believes it is utilized as

an important measure of performance by the investment community.

Net Income Adjusted for the Change in the Put Warrant Liability and

Non-Recurring Items is not meant to be considered a substitute or

replacement for Net Income as prepared in accordance with generally

accepted accounting principles. The reconciliation of Net Income to

Net Income Adjusted for the Change in the Put Warrant Liability and

Non-Recurring Items is as follows: -0- *T For the Three For the Six

Months Ended Months Ended August 31, August 31, -------------------

------------------- 2006 2005 2006 2005 -------- ----------

-------- ---------- (As (As Restated) Restated) Net income (loss),

as reported (a) $(6,731) $(375) $(6,401) $2,242 Add back (deduct):

Impairment loss on goodwill and other intangible assets 7,598 -

7,598 - Realization of currency translation loss related to the

disposition of certain assets and obligations of the Holland

subsidiary 447 - 447 - Loss related to the disposition of certain

assets and obligations of the Holland subsidiary, net of tax

benefit 354 - 354 - Gain on sale of carpet seaming tape business,

net of tax - - - (708) Change in put warrant liability (1,231) 381

(1,316) (962) -------- ---------- -------- ---------- Net income

adjusted for the change in the put warrant liability and

non-recurring items (b) $437 $6 $682 $572 ======== ==========

======== ========== Earnings (loss) per share, as reported: Basic

((a)/(c)) $(1.94) $(0.11) $(1.85) $0.65 Diluted ((a)/(d)) $(1.94)

$(0.11) $(1.85) $0.58 Weighted average number of shares

outstanding, as reported: Basic (c) 3,474 3,458 3,468 3,458 Diluted

(d) 3,474 3,458 3,468 3,834 Earnings per share adjusted for the

change in the put warrant liability and non-recurring items: Basic

((b)/(e)) $0.13 $0.00 $0.20 $0.17 Diluted ((b)/(f)) $0.12 $0.00

$0.18 $0.15 Weighted average number of shares outstanding as

adjusted for the change in the put warrant liability and non-

recurring items: Basic (e) 3,473 3,458 3,468 3,458 Diluted (f)

3,728 3,820 3,783 3,834 *T -0- *T Q.E.P. CO., Inc. and Subsidiaries

Consolidated Statements of Cash Flows (In Thousands) (Unaudited)

For the Six Months Ended August 31,

------------------------------------ 2006 2005 ------------------

----------------- -- As Restated -- Cash flows from operating

activities: Net income (loss) $(6,401) $2,242 Adjustments to

reconcile net income (loss) to net cash provided by operating

activities: Depreciation and amortization 1,284 2,048 Impairment

loss on goodwill and other intangibles 7,598 - Change in fair value

of put warrant liability (1,316) (962) Write-off of Holland

accumulated foreign translation 447 - Bad debt expense 70 223 Gain

on sale of business - (1,120) Stock-based compensation expense 120

- Deferred income taxes (40) (148) Changes in assets and

liabilities, net of acquisitions: Accounts receivable 1,017 (2,704)

Inventories 2,567 (490) Prepaid expenses and other current assets

726 421 Other assets 12 (307) Trade accounts payable and accrued

liabilities (6,001) 1,139 ------------------ ----------------- Net

cash provided by operating activities 83 342 ------------------

----------------- Cash flows from investing activities: Capital

expenditures (353) (816) Acquisitions, net of cash acquired -

(2,330) ------------------ ----------------- Net cash used in

investing activities (353) (3,146) ------------------

----------------- Cash flows from financing activities: Net

(payments) borrowings under lines of credit 2,164 (48) Borrowings

of long-term debt - 3,209 Repayments of long-term debt (1,390)

(955) Repayments of acquisition debt (1,380) (482) Payments related

to the purchase of treasury stock (60) (60) Proceeds from exercise

of stock options 129 10 Dividends (10) (8) ------------------

----------------- Net cash (used in) provided by financing

activities (547) 1,666 ------------------ ----------------- Effect

of exchange rate changes on cash 636 (271) ------------------

----------------- Net decrease in cash (181) (1,409) Cash and cash

equivalents at beginning of period 852 1,869 ------------------

----------------- Cash and cash equivalents at end of period $671

$460 ================== ================= *T

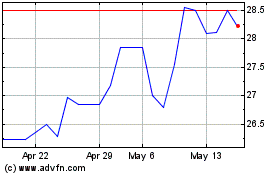

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Mar 2024 to Mar 2025