Q.E.P. Co., Inc. Reports Fiscal 2010 Record Earnings

May 17 2010 - 12:05PM

Net Sales - $205.9 Million

Net Income - $9.0 Million or $2.57 Per

Diluted Share

Q.E.P. Co., Inc. (Pink Sheets:QEPC) (the "Company") today reported

its consolidated results of operations for the fiscal year ended

February 28, 2010:

| |

Year Ended February

28 |

| (In thousands, except share data) |

2010 |

2009 |

| |

|

|

| Net sales |

$ 205,853 |

$ 203,603 |

| Cost of goods sold |

140,486 |

147,571 |

| Gross profit |

65,367 |

56,032 |

| |

|

|

| Costs and expenses: |

|

|

| Operating expenses |

51,655 |

52,530 |

| Impairment loss on

goodwill |

-- |

7,927 |

| Total costs and expenses |

51,655 |

60,457 |

| |

|

|

| Operating income (loss) |

13,712 |

(4,425) |

| Interest expense, net |

(1,156) |

(1,740) |

| |

|

|

| Income (loss) before provision for income

taxes |

12,556 |

(6,165) |

| Provision for income taxes |

3,579 |

1,090 |

| Net income (loss) |

$ 8,977 |

$ (7,255) |

| |

|

|

| Net income (loss) per share: |

|

|

| Basic |

$ 2.59 |

$ (2.13) |

| Diluted |

$ 2.57 |

$ (2.13) |

| |

|

|

| Weighted average number of common shares

outstanding: |

|

|

| Basic |

3,468 |

3,415 |

| Diluted |

3,496 |

3,415 |

Mr. Lewis Gould, Chairman of the Company's Board of Directors,

commented: "Despite continuing economic uncertainties, we are

delighted with this year's results of operations as well as our

success in positioning the business for future growth. We have

substantially improved operations, reduced working capital

requirements, paid down debt to record low levels, increased our

cash availability and, with the acquisition of ArborCraft,

positioned ourselves to take advantage of expanded market

opportunities." Mr. Gould added "We are continuing to consider new

opportunities for expanding our product lines, increasing our

market share and improving the productivity and efficiency of our

operations."

After a challenging first half fiscal 2010 relative to the first

half of fiscal 2009, sales strengthened during the second half of

fiscal 2010 relative to the second half of the prior fiscal year as

the effects of weakened economic environments appeared to moderate

and the Company benefited from an apparent return to more regular

inventory replenishment programs by its major customers. The

Company's market share also increased as a result of the strategic

targeting of industry opportunities.

Operating improvements started in late fiscal 2009 continued

throughout fiscal 2010 in each of the Company's operations and

included tighter purchasing, inventory and working capital

management, workforce reductions, business restructurings and

reductions in planned expenses. As a result, significant

improvements in the Company's operating income for each of its

worldwide segments were realized. The Company continues to

focus on additional cost management opportunities, including the

current consolidation of its domestic manufacturing and

distribution operations.

Fiscal 2010 gross profit showed substantial improvement

associated with the continuing benefit of operating improvements,

improved product mix and reduced customer discounting. As a percent

of sales, gross profit increased to 31.8% in fiscal 2010 from 27.5%

in fiscal 2009.

Operating expenses for fiscal 2010 compared to fiscal 2009,

excluding the non-cash fiscal 2009 goodwill impairment charge,

decreased slightly. As a percentage of sales, operating expenses

excluding the impairment charge were 25.1% in fiscal 2010 compared

to 25.8% in fiscal 2009 - - also reflecting the cost reduction

measures implemented in late fiscal 2009, although the Company is

experiencing an upward pressure on costs as a result of costs

associated with meeting customer service levels and supporting

higher sales volume. The fiscal 2009 goodwill impairment charge,

which substantially eliminated the carrying value of goodwill,

principally resulted from the decline in the Company's market

valuation at that time.

The Company's results of operations also were favorably impacted

by the fiscal 2010 effective tax rate of 28.5%, principally

reflecting the tax benefit of restructuring a foreign operation and

of other foreign tax benefits. In fiscal 2009, the Company recorded

an income tax provision associated with expenses that are not

deductible for tax purposes, including the goodwill impairment

charges, and valuation allowances related to certain foreign net

operating losses.

The strategic acquisition of ArborCraft on February 12, 2010

expanded the Company's preexisting product offerings of glues,

underlayments and installation tools to include a comprehensive

line of hardwood flooring. The acquisition was completed for a

purchase price equal to the estimated fair value of net assets

acquired.

During fiscal 2010, the Company also restructured each of its

significant credit facilities. In connection with the ArborCraft

acquisition, the Company increased its domestic revolving credit

facility from $27 million to $34 million, established a $6.0

million domestic term loan and issued a subordinated term note of

approximately $3.8 million. Earlier in the 2010 fiscal year,

the Company amended the revolving credit facility of its U.K.

subsidiary and refinanced the revolving credit and term loan

facilities of its Australian subsidiary. In combination, the

Company's additional borrowing capacity at fiscal 2010 year-end

increased to in excess of $19 million while interest expense

decreased approximately $0.6 million for the year and the Company's

outstanding debt - - after the issuance of the ArborCraft

acquisition debt - - decreased approximately $2.7 to approximately

$26.8 million at the end of fiscal 2010.

The Company also announced that it will post its annual

consolidated fiscal 2010 audited financial statements on its

website in the near future.

Q.E.P. Co., Inc., founded in 1979, is a leading worldwide

manufacturer, marketer and distributor of a comprehensive line of

hardwood flooring, flooring installation tools, adhesives and

flooring related products targeted for the professional installer

as well as the do-it-yourselfer. Under brand names including QEP®,

ROBERTS®, Capitol®, Harris®Wood, Vitrex®, PRCI®, BRUTUS® and

Elastiment®, the Company markets over 3,000 flooring and flooring

related products. In addition to a complete hardwood flooring

line, Q.E.P. products are used primarily for surface preparation

and installation of wood, laminate, ceramic tile, carpet and vinyl

flooring. The Company sells its products to home improvement retail

centers and specialty distribution outlets in 50 states and

throughout the world.

This press release contains forward-looking statements,

including statements regarding economic conditions, our strategic

plans, benefits expected to result from the acquisition and the

fair value of net assets acquired, new business opportunities,

potential growth in sales for new products, customer asset

management programs, expense management conditions and capital

availability that involve risks and uncertainties. These

statements are not guarantees of future performance and actual

results could differ materially from our current expectations.

CONTACT: Q.E.P. Co., Inc.

Richard A. Brooke, Senior Vice President and Chief Financial

Officer

561-994-5550

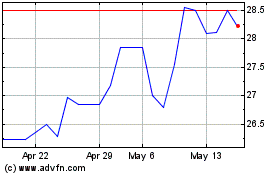

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Mar 2024 to Mar 2025