Net Sales - $261.4

Million

Net Income - $10.2 Million or

$3.01 Per Diluted Share

Q.E.P. CO., INC. (OTC:QEPC.PK) (the "Company")

today reported its consolidated results of operations for the

fiscal year ended February 29, 2012:

| |

Year Ended |

| (In thousands, except per share data) |

February 29, 2012 |

February 28, 2011 |

| |

|

|

| Net sales |

$ 261,408 |

$ 237,886 |

| Cost of goods sold |

182,520 |

164,334 |

| Gross profit |

78,888 |

73,552 |

| Operating expenses |

62,716 |

58,383 |

| Operating income |

16,172 |

15,169 |

| Interest expense, net |

(929) |

(1,363) |

| Income before provision for income taxes |

15,243 |

13,806 |

| Provision for income taxes |

5,022 |

4,372 |

| Net income |

$ 10,221 |

$ 9,434 |

| |

|

|

| Net income per share: |

|

|

| Basic |

$ 3.07 |

$ 2.84 |

| Diluted |

$ 3.01 |

$2.77 |

Lewis Gould, Chairman of the Company's Board of Directors,

commented: "We are very pleased with this fiscal year's results for

both net sales and earnings. During the last quarter, however,

results were affected by pricing pressures within our major

distribution channels and by the continuing impact of elevated cost

levels." Mr. Gould continued, "Retailers throughout the world are

increasingly looking for every opportunity to reduce the costs of

products they buy. We expect these pressures on pricing to

continue." Mr. Gould added, "We will continue to make every effort

to moderate the influence of changes in both market pricing and

cost conditions by enhancing our sales and marketing programs

outside of our traditional channels and through aggressive

management of our supply chain. Perhaps most importantly, however,

we will pursue synergistic acquisitions that strategically

reposition our sales base beyond our existing core business. As

always, we will focus our efforts on growth in net assets, strong

cash flow and increased share value."

Net sales during fiscal year 2012 increased in every quarter as

compared to fiscal year 2011 resulting in a year over year increase

of $23.5 million or 9.9%. The year over year increase reflects the

growth of the Company's U.S.-based flooring products as well as

growth in its European operations from an expansion of its market

share. Each of the Company's international operations also

benefited from the effects of the strengthening of local currencies

against the US dollar, although the relative strength of those

currencies during the second half of the fiscal year moderated.

The Company's gross margin improved during the first half of

fiscal year 2012 as compared to the comparable periods in fiscal

year 2011 from an overall improvement in product mix, increased

production volumes in certain manufacturing operations and the

improved purchasing power of our international operations

associated with the strengthening of local currencies against the

US dollar. During the second half of fiscal 2012, however, margins

declined as compared to the comparable periods in fiscal year 2011

primarily as a result of the impact of commodity and other cost

increases as well as reduced pricing in major distribution channels

late in the year.

Operating expenses for fiscal year 2012 include $1.3 million of

non-cash restructuring charges associated with the Company's

Argentine operations. Similarly, prior year operating expenses

include $0.9 million of primarily non-cash restructuring charges

associated with other Latin American operations. The Company

realized tax benefits related to these restructurings totaling $1.0

million in the current fiscal year and $0.7 million in the last

fiscal year.

Operating expenses before the restructuring charges for fiscal

2012 were $61.4 million or 23.5% of net sales compared to $57.5

million or 24.2% of net sales in fiscal 2011. While operating

expenses have increased with the growth in the Company's sales and

with changes in currency exchange rates, the fiscal year-to-date

decrease in those expenses as a percentage of net sales principally

reflects increased leveraging of fixed costs.

The Company's results of operations also benefited from a

decrease in interest expense resulting from continued decreases in

outstanding borrowings throughout fiscal year 2012.

The provision for income taxes as a percentage of income before

taxes for fiscal 2012 was 32.9% compared to 31.7% for fiscal 2011.

The change in effective tax rate during the current fiscal year as

compared to fiscal 2011 principally reflects changes in prior year

tax accruals and benefits associated with our international

operations.

Net income for fiscal 2012 increased 8.3% to $10.2 million from

$9.4 million in fiscal 2011. Net income per diluted share for

fiscal 2012 increased to $3.01 from $2.77 in fiscal 2011.

Earnings before interest, taxes, depreciation and amortization

(EBITDA) excluding the effects of restructuring charges increased

7.6% in fiscal 2012 to $20.1 million as compared to $18.6 million

for fiscal 2011, a return on net sales of approximately 7.7% in

both years:

| |

Fiscal Year |

| |

2012 |

2011 |

| Net income |

$ 10,221 |

$ 9,434 |

| Add back: |

|

|

| Restructuring charges |

1,273 |

915 |

| Interest |

929 |

1,363 |

| Provision for income taxes |

5,022 |

4,372 |

| Depreciation and amortization |

2,613 |

2,565 |

| EBITDA before restructuring

charges |

$ 20,058 |

$ 18,649 |

Cash provided by operations for fiscal 2012 was $12.2 million as

compared to $9.5 million in fiscal 2011, reflecting both improved

operating results and improved management of working capital. Cash

from operations during fiscal 2012 was used to reduce debt by $8.9

million, to purchase both additional treasury shares and the

business of Porta-Nails, Inc., and for investments in new IT

systems to improve productivity.

Working capital at the end of the Company's fiscal year 2012 was

$35.9 million, an increase of $8.3 million from $27.6 million at

the end of the 2011 fiscal year. Aggregate debt at the end of

the Company's fiscal year 2012 was reduced to $12.7 million or

28.0% of equity from $21.7 million or 61.5% of equity at the end of

the 2011 fiscal year.

The Company will be hosting a

conference call to discuss these results and to answer your

questions at 10:00 a.m. Eastern Time on Tuesday, May 8, 2012. If

you would like to join the conference call, dial 1-888-846-5003

toll free from the U.S. or 1-480-629-9856 internationally

approximately 10 minutes prior to the start time and ask for the

Q.E.P. Co., Inc. Fiscal Year 2012 Conference Call / Conference ID

4535314. A replay of the conference call will be available until

midnight May 15th by calling 1-877-870-5176 toll free from the U.S.

and entering pin number 4535314; internationally, please call

1-858-384-5517 using the same pin number.

The Company is posting its consolidated fiscal 2012 audited

financial statements on the Investor section of its website at

www.qepcorporate.com today. The Company expects to announce

its first quarter fiscal year 2013 results during the week

beginning June 18, 2012.

Q.E.P. Co., Inc., founded in 1979, is a leading worldwide

manufacturer, marketer and distributor of a comprehensive line of

hardwood flooring, flooring installation tools, adhesives and

flooring related products targeted for the professional installer

as well as the do-it-yourselfer. Under brand names including QEP®,

ROBERTS®, Capitol®, Harris®Wood, Vitrex®, PRCI®, BRUTUS®

Porta-Nailer® and Elastiment®, the Company markets over 3,000

flooring and flooring related products. In addition to a

complete hardwood flooring line, Q.E.P. products are used primarily

for surface preparation and installation of wood, laminate, ceramic

tile, carpet and vinyl flooring. The Company sells its products to

home improvement retail centers and specialty distribution outlets

in 50 states and throughout the world.

This press release contains forward-looking statements,

including statements regarding pricing pressures, cost increases,

efforts to moderate the influence of changes in market pricing and

cost conditions, demand for our products, potential sales growth

associated with new customers and products, potential acquisitions,

the ability to realize synergies from and other benefits of

acquisitions, access to financing, the availability of product

supply, and operating expenses levels. These statements are not

guarantees of future performance and actual results could differ

materially from our current expectations.

CONTACT: Q.E.P. Co., Inc.

Richard A. Brooke

Senior Vice President and

Chief Financial Officer

561-994-5550

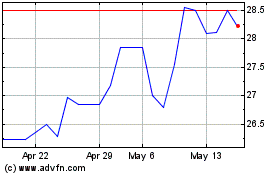

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Mar 2024 to Mar 2025