Quarterly Sales – $79.7

Million

Quarterly Net Income – $1.1

Million

BOCA RATON, Fla., June 24, 2014 (GLOBE NEWSWIRE) --

Q.E.P. CO., INC. (OTC:QEPC.PK) (the "Company")

today reported its consolidated results of operations for the first

quarter of its fiscal year ending February 28, 2015.

The Company reported net sales of $79.7 million for the three

months ended May 31, 2014, a decrease of $3.7 million from the

$83.4 million reported in the same period of fiscal 2014. As a

percentage of net sales, gross profit was 27.7% in the first three

months of fiscal 2015 compared to 28.4% in the first three months

of fiscal 2014.

Lewis Gould, Chairman of the Company's Board of Directors,

commented: "We believe that while we transition through some

significant changes in our businesses, the Company is making

substantial progress toward its strategic objectives. The Company

completed the purchase of Faus and is in the process of integrating

its operations with the Company's pre-existing U.S. operations, a

consolidation that is continuing and painful. We are also

modernizing our manufacturing plant in Clinton, Massachusetts, for

increased efficiency while we are continually adding new products.

We have expanded our credit facilities, which is reflected on our

balance sheet. All of this is occurring while we develop new

initiatives for the coming year." Mr. Gould concluded, "I am

confident that the results of our sales and consolidation

activities will result in better shareholder value over the coming

year while we continue this transition."

The change in net sales for the current fiscal quarter as

compared to the first quarter of fiscal year 2014 principally

reflects the beneficial impact of the fiscal 2014 acquisitions of

Faus and Plasplugs and growth in our European operations offset by

a decline from a significant North American customer's discontinued

purchases of certain products during the second quarter of fiscal

2014 and, to a lesser degree, the planned exit from certain low

profit products and the net negative translation impact from

changes in currency exchange rates.

The Company's gross margin was 27.7% for the first quarter of

fiscal 2015 as compared to 28.4% for the first quarter of the prior

fiscal year. The change in gross margin reflects both the

incremental contribution and generally more favorable product mix

of acquisitions and the increased purchasing power from overall

changes in currency exchange rates offset by discontinued purchases

of certain products by a significant customer and an increase in

the costs of certain raw materials.

Operating expenses for the first three months of fiscal 2015

were $20.1 million, compared to $20.2 million for the same period

in fiscal 2014, or 25.3% and 24.3% of net sales, respectively.

Operating expenses declined modestly within North America and were

positively affected internationally by overall movements in

currency exchange rates offset by increases in certain European

operating expenses principally associated with the integration of

acquisitions.

Non-operating income for the first three months of fiscal 2014

represents the gain related to the sale and leaseback of a Company

facility in Canada, net of selling costs and the present value of

future lease payments.

The provision for income taxes as a percentage of income before

taxes for the first three months of fiscal 2015 and 2014 was 33.7%

and 22.2%, respectively. The effective tax rate in fiscal 2014

reflected the impact of the sale of our Canadian property.

Net income for the first three months of fiscal 2015 and 2014

was $1.1 million and $5.1 million, respectively, or $0.33 and

$1.56, respectively, per diluted share.

Earnings before interest, taxes, depreciation and amortization

(EBITDA) before non-operating income for the first quarter of

fiscal 2015 decreased to $3.3 million as compared to $4.6 million

for the fiscal 2014 first quarter:

| |

|

For the Three

Months Ended May 31, |

| |

|

2014 |

2013 |

| |

|

|

|

| Net income |

|

$ 1,088 |

$ 5,142 |

| Add back (deduct): |

Interest |

300 |

254 |

| |

Provision for income taxes |

554 |

1,466 |

| |

Depreciation and amortization |

1,319 |

1,082 |

| |

Non-operating income |

-- |

(3,379) |

| EBITDA before

non-operating income |

$ 3,261 |

$ 4,565 |

Cash used in operations was $0.2 million for the first quarter

of fiscal 2015 whereas operations provided $1.2 million of cash

flow during the first quarter of fiscal 2014 and reflected

additional investments in working capital in both periods. Funding

for the Company's acquisition activities as well as for capital

expenditures and its ongoing treasury stock program was provided by

borrowings and the proceeds from the sale of a Canadian

property.

During the first quarter of the current fiscal year the Company

borrowed $9.0 million under a new term loan facility in connection

with its Faus acquisition and used the proceeds to reduce the

balance outstanding under the Company's lines of credits. In

addition, during the first quarter of the current fiscal year, the

Company amended its principal loan agreements to provide further

new term loan facilities in the amount of $10.9 million, increase

its borrowing limit, reduce interest rates and extend the maturity

date of the loan agreements to June 2017.

Working capital at the end of the Company's fiscal 2015 first

quarter was $38.8 million, an increase of $10.0 million from $28.8

million at the end of the 2014 fiscal year, principally due to cash

held from the Company's new term loan facilities. Accordingly,

aggregate debt at the end of the Company's fiscal 2015 first

quarter rose to $52.4 million from $41.4 million at the end of the

2014 fiscal year. Total debt to equity stood at 0.77 as of May 31,

2014.

The Company will be hosting a conference call to discuss

these results and to answer your questions at 10:00 a.m. Eastern

Time on Thursday, June 26, 2014. If you would like to join the

conference call, dial 1-888-461-2024 toll free from the US or

1-719-325-2429 internationally approximately 10 minutes prior to

the start time and ask for the Q.E.P. Co., Inc. First Quarter

Conference Call / Conference ID 1615576. A replay of the conference

call will be available until midnight July 3rd by calling

1-877-870-5176 toll free from the US and entering pin number

1615576; internationally, please call 1-858-384-5517 using the same

pin number.

Q.E.P. Co., Inc., founded in 1979, is a world class, worldwide

provider of innovative, quality and value-driven flooring and

industrial solutions. As a leading manufacturer, marketer and

distributor, QEP delivers a comprehensive line of hardwood and

laminate flooring, flooring installation tools, adhesives and

flooring related products targeted for the professional installer

as well as the do-it-yourselfer. In addition, the Company provides

industrial tools with cutting edge technology to the industrial

trades. Under brand names including QEP®, ROBERTS®, Capitol®,

Harris®Wood, Fausfloor®, Vitrex®, Homelux®, TileRite®, PRCI®,

Nupla®, HISCO®, Plasplugs, Ludell®, Porta-Nails®, Tomecanic®,

Bénètiere® and Elastiment®, the Company markets over 7,000

products. The Company sells its products to home improvement retail

centers, specialty distribution outlets, municipalities and

industrial solution providers in 50 states and throughout the

world.

This press release contains forward-looking statements,

including statements regarding future market position and

profitability, potential acquisition opportunities and benefits,

capital availability and shareholder value. These statements are

not guarantees of future performance and actual results could

differ materially from our current expectations.

-Financial Information

Follows-

| Q.E.P. CO., INC. AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS

OF EARNINGS |

| (In thousands except per share

data) |

| (Unaudited) |

| |

|

|

| |

For the Three Months

Ended May 31, |

| |

2014 |

2013 |

| |

|

|

| Net sales |

$ 79,707 |

$ 83,399 |

| Cost of goods sold |

57,628 |

59,676 |

| Gross profit |

22,079 |

23,723 |

| |

|

|

| Operating expenses: |

|

|

| Shipping |

7,516 |

7,941 |

| General and administrative |

6,588 |

6,426 |

| Selling and marketing |

6,155 |

6,038 |

| Other income, net |

(122) |

(165) |

| Total operating expenses |

20,137 |

20,240 |

| |

|

|

| Operating income |

1,942 |

3,483 |

| |

|

|

| Non-operating income |

-- |

3,379 |

| Interest expense, net |

(300) |

(254) |

| |

|

|

| Income before provision for income

taxes |

1,642 |

6,608 |

| |

|

|

| Provision for income taxes |

554 |

1,466 |

| |

|

|

| Net income |

$ 1,088 |

$ 5,142 |

| |

|

|

| Net income per share: |

|

|

| Basic |

$ 0.33 |

$ 1.57 |

| Diluted |

$ 0.33 |

$ 1.56 |

| |

|

|

| Weighted average number of common

shares outstanding: |

|

|

| Basic |

3,258 |

3,276 |

| Diluted |

3,280 |

3,300 |

| |

| Q.E.P. CO., INC. AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME |

| (In thousands) |

| (Unaudited) |

| |

|

|

| |

For the Three

Months Ended May 31, |

| |

2014 |

2013 |

| |

|

|

| Net income |

$ 1,088 |

$ 5,142 |

| |

|

|

| Unrealized currency translation

adjustments |

286 |

(351) |

| |

|

|

| Comprehensive income |

$ 1,374 |

$ 4,791 |

| |

| Q.E.P. CO., INC. AND

SUBSIDIARIES |

| CONSOLIDATED BALANCE

SHEETS |

| (In thousands) |

| |

|

|

| |

May 31, 2014

(Unaudited) |

February 28,

2014 |

| |

|

|

| ASSETS |

|

|

| Cash |

$ 12,759 |

$ 2,621 |

| Accounts receivable, less allowance for

doubtful accounts of $394 and $382 as of May 31, 2014 and February

28, 2014, respectively |

47,785 |

45,726 |

| Inventories |

41,960 |

42,906 |

| Prepaid expenses and other current

assets |

3,820 |

3,338 |

| Deferred income taxes |

744 |

744 |

| Current assets |

107,068 |

95,335 |

| |

|

|

| Property and equipment, net |

23,599 |

24,353 |

| Deferred income taxes |

3,933 |

3,926 |

| Intangibles, net |

21,437 |

21,697 |

| Other assets |

529 |

470 |

| |

|

|

| Total Assets |

$ 156,566 |

$ 145,781 |

| |

|

|

| LIABILITIES AND SHAREHOLDERS'

EQUITY |

|

|

| |

|

|

| Trade accounts payable |

$ 19,008 |

$ 21,989 |

| Accrued liabilities |

16,311 |

14,613 |

| Lines of credit |

28,567 |

28,173 |

| Current maturities of notes payable |

4,387 |

1,746 |

| Current liabilities |

68,273 |

66,521 |

| |

|

|

| Notes payable |

19,444 |

11,487 |

| Other long term liabilities |

838 |

931 |

| Total Liabilities |

88,555 |

78,939 |

| |

|

|

| Preferred stock, 2,500 shares authorized,

$1.00 par value; 337 shares issued and outstanding at May 31, 2014

and February 28, 2014 |

337 |

337 |

| Common stock, 20,000 shares authorized, $.001

par value; 3,801 shares issued; 3,250 and 3,262 shares outstanding

at May 31, 2014 and February 28, 2014, respectively |

4 |

4 |

| Additional paid-in capital |

10,634 |

10,620 |

| Retained earnings |

63,215 |

62,130 |

| Treasury stock, 550 and 539 shares held at

cost at May 31, 2014 and February 28, 2014, respectively |

(5,917) |

(5,701) |

| Accumulated other comprehensive income |

(262) |

(548) |

| Shareholders' Equity |

68,011 |

66,842 |

| |

|

|

| Total Liabilities and Shareholders'

Equity |

$ 156,566 |

$ 145,781 |

| |

| Q.E.P. CO., INC. AND

SUBSIDIARIES |

| CONSOLIDATED STATEMENTS

OF CASH FLOWS |

| (In thousands) |

| (Unaudited) |

| |

|

|

| |

For the Three

Months Ended May 31, |

| |

2014 |

2013 |

| |

|

|

| Operating activities: |

|

|

| Net income |

$ 1,088 |

$ 5,142 |

| Adjustments to reconcile net income to net

cash provided by operating activities: |

|

|

| Depreciation and

amortization |

1,319 |

1,082 |

| Non-operating income |

-- |

(3,379) |

| Other non-cash adjustments |

26 |

55 |

| Changes in assets and liabilities, net of

acquisitions: |

|

|

| Accounts receivable |

(1,923) |

(5,323) |

| Inventories |

1,283 |

613 |

| Prepaid expenses and other

assets |

(383) |

(462) |

| Trade accounts payable and

accrued liabilities |

(1,611) |

3,518 |

| Net cash provided (used) by operating

activities |

(201) |

1,246 |

| |

|

|

| Investing activities: |

|

|

| Acquisitions |

(254) |

(23,495) |

| Proceeds from sale of

property |

52 |

4,630 |

| Capital expenditures |

(163) |

(188) |

| Net cash used in investing

activities |

(365) |

(19,053) |

| |

|

|

| Financing activities: |

|

|

| Net

borrowings (repayments) under lines of credit |

(8,724) |

20,321 |

| Borrowings of notes

payable |

19,880 |

-- |

| Repayments of notes

payable |

(331) |

(1,415) |

| Purchase of treasury stock |

(119) |

(57) |

| Dividends and other |

(3) |

14 |

| Net cash used in financing

activities |

10,703 |

18,863 |

| |

|

|

| Effect of exchange rate changes on

cash |

1 |

(5) |

| |

|

|

| Net increase in cash |

10,138 |

1,051 |

| Cash at beginning of

period |

2,621 |

737 |

| Cash at end of period |

$ 12,759 |

$ 1,788 |

CONTACT: Q.E.P. Co., Inc.

Richard A. Brooke

Senior Vice President and

Chief Financial Officer

561-994-5550

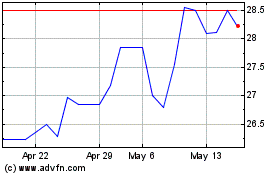

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Dec 2023 to Dec 2024