FIRST QUARTER SALES – $80.2

MILLION FIRST QUARTER NET INCOME – $2.2 MILLION VS

$1.3 MILLION LAST YEAR

Q.E.P. CO., INC. (OTC:QEPC.PK) (the “Company”)

today reported its consolidated results of operations for the first

quarter of its fiscal year ending February 28, 2017.

The Company reported net sales of $80.2 million for

the quarter ended May 31, 2016, an increase of $1.9 million or 2.4%

from the $78.3 million reported in the same period of fiscal

2016. As a percentage of net sales, gross margin was 28.2% in

the first quarter of fiscal 2017 compared to 27.1% in the first

quarter of fiscal 2016.

Lewis Gould, Chairman, commented: "I am encouraged

by the progress we have made this quarter despite continuing

headwinds with the strong US dollar, increases in health care costs

and other items. Despite this the Company has worked towards

positive results this quarter, developing new and innovative

products and sales growth in North America. We are working

very hard to continue to flatten our supply chain and lower our

costs, while continuing to strengthen our balance sheet with

improved working capital and lower debt.”

Net sales for the three month period ended May 31,

2016 as compared to the comparable period in the prior fiscal year

reflect growth across multiple product lines in the US and

Australia, partially offset by reduced sales in Europe. Foreign

exchange rates weakened against the US dollar year over year and

continue to affect the translation of the Company’s international

operations.

The Company’s gross profit increased $1.4 million

or 6.4% to $22.6 million and gross margin improved by 1.1%.

Gross margin benefited from cost reductions on certain products as

well as favorable product mix.

Operating expenses for the first quarter of fiscal

2017 were $18.8 million or 23.5% of net sales, compared to $19.0

million or 24.2% of net sales in the comparable fiscal 2016

period. Lower shipping cost was partially offset by the

timing of increased marketing expenses associated with the

introduction of new flooring products in North America and

Australia.

The decrease in interest expense during the first

quarter of fiscal 2017 as compared to fiscal 2016 is principally

the result of debt payments made under term loan facilities during

fiscal 2016.

The provision for income taxes as a percentage of

income before taxes for the first quarter of fiscal 2017 was 37.5%,

compared to 35.0% for the comparable period of fiscal 2016. The

effective tax rate in both fiscal years reflects the relative

contribution of the Company’s earnings sourced from its

international operations.

Net income for the first quarter of fiscal 2017 and

2016 was $2.2 million and $1.3 million, respectively, or $0.68 and

$0.39, respectively, per diluted share.

For the first quarter of fiscal 2017, earnings

before interest, taxes, depreciation and amortization (EBITDA) was

$4.8 million, compared to $3.3 million for the first quarter of

fiscal 2016.

| |

|

For the Three Months |

| |

|

Ended May 31, |

| |

|

|

2016 |

|

|

2015 |

|

| Net

income |

$ |

2,185 |

|

$ |

1,268 |

|

| Add: |

Interest expense,

net |

|

281 |

|

|

320 |

|

| |

Provision for income

taxes |

|

1,311 |

|

|

683 |

|

| |

Depreciation and

amortization |

|

1,016 |

|

|

1,070 |

|

| EBITDA |

|

$ |

4,793 |

|

$ |

3,341 |

|

| |

Cash provided by operations during the first

quarter of fiscal 2017 was $0.9 million as compared to $3.0 million

in the first quarter of fiscal 2016. During the first quarter

of fiscal 2017, increased earnings were principally used to fund

increases in working capital and pay down debt. During the

first quarter of fiscal 2016, earnings and changes in working

capital were used, along with cash balances, to reduce debt. In

both periods, the Company’s capital expenditures were funded

through cash from operations.

Working capital at the end of the Company’s fiscal

2017 first quarter was $40.8 million compared to $38.7 million at

the end of the 2016 fiscal year. Aggregate debt, net of cash

balances, at the end of the Company’s fiscal 2017 first quarter was

$20.4 million or 28.8% of equity, an increase of $0.3 million

compared to $20.1 million or 29.4% of equity at the end of the 2016

fiscal year.

The Company will be hosting

a conference call to discuss these results and to answer

your questions at 10:00 a.m. Eastern Time on Thursday, July 7,

2016. If you would like to join the conference call, dial

1-888-505-4368 toll free from the US or 1-719-325-2458

internationally approximately 10 minutes prior to the start time

and ask for the Q.E.P. Co., Inc. First-Quarter Conference Call /

Conference ID 9556342. A replay of the conference call will be

available until midnight July 14, 2016 by calling 1-877-870-5176

toll free from the US and entering pin number 9556342;

internationally, please call 1-858-384-5517 using the same pin

number.

Q.E.P. Co., Inc., founded in 1979, is a world

class, worldwide provider of innovative, quality and value-driven

flooring and industrial solutions. As a leading manufacturer,

marketer and distributor, QEP delivers a comprehensive line of

hardwood and laminate flooring, flooring installation tools,

adhesives and flooring related products targeted for the

professional installer as well as the do-it-yourselfer. In

addition, the Company provides industrial tools with cutting edge

technology to the industrial trades. Under brand names including

QEP®, ROBERTS®, Capitol®, Harris®Wood, Fausfloor®, Vitrex®,

Homelux®, TileRite®, PRCI®, Nupla®, HISCO®, Plasplugs®, Ludell®,

Porta-Nails®, Tomecanic®, Bénètiere® and Elastiment®, the Company

sells its products to home improvement retail centers, specialty

distribution outlets, municipalities and industrial solution

providers in 50 states and throughout the world.

This press release contains forward-looking

statements, including statements regarding economic conditions,

sales growth, product development and marketing, operating

expenses, cost savings, cash flow, debt and currency exchange

rates. These statements are not guarantees of future performance

and actual results could differ materially from our current

expectations.

-Financial Information

Follows-

| |

|

|

|

| Q.E.P. CO., INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF

EARNINGS |

| (In thousands except per share data) |

| (Unaudited) |

| |

|

|

|

|

|

For the Three

Months |

|

|

Ended May

31, |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

|

Net sales |

$ |

80,178 |

|

|

$ |

78,267 |

|

| Cost of

goods sold |

|

57,569 |

|

|

|

57,025 |

|

|

Gross profit |

|

22,609 |

|

|

|

21,242 |

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

| Shipping |

|

6,657 |

|

|

|

7,310 |

|

| General and administrative |

|

6,418 |

|

|

|

6,256 |

|

| Selling and marketing |

|

5,921 |

|

|

|

5,491 |

|

| Other income, net |

|

(164 |

) |

|

|

(86 |

) |

| Total operating expenses |

|

18,832 |

|

|

|

18,971 |

|

|

|

|

|

|

|

Operating income |

|

3,777 |

|

|

|

2,271 |

|

|

|

|

|

|

| Interest

expense, net |

|

(281 |

) |

|

|

(320 |

) |

|

|

|

|

|

|

Income before provision for income taxes |

|

3,496 |

|

|

|

1,951 |

|

|

|

|

|

|

|

Provision for income taxes |

|

1,311 |

|

|

|

683 |

|

|

|

|

|

|

|

Net income |

$ |

2,185 |

|

|

$ |

1,268 |

|

|

|

|

|

|

|

Net income per share: |

|

|

|

| Basic |

$ |

0.68 |

|

|

$ |

0.39 |

|

| Diluted |

$ |

0.68 |

|

|

$ |

0.39 |

|

|

|

|

|

|

| Weighted average

number of common |

|

|

|

| shares

outstanding: |

|

|

|

| Basic |

|

3,195 |

|

|

|

3,212 |

|

| Diluted |

|

3,219 |

|

|

|

3,235 |

|

| |

|

|

|

| |

|

|

|

| Q.E.P. CO., INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME |

| (In thousands) |

| (Unaudited) |

| |

|

|

|

|

|

For the Three Months |

|

|

Ended May 31, |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

| Net

income |

$ |

2,185 |

|

|

$ |

1,268 |

|

| |

|

|

|

| Unrealized currency

translation adjustments |

|

504 |

|

|

|

(118 |

) |

| |

|

|

|

| Comprehensive

income |

$ |

2,689 |

|

|

$ |

1,150 |

|

| |

|

|

|

| |

|

|

|

| Q.E.P. CO., INC. AND SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS |

| (In thousands except per share values) |

| |

|

|

|

|

|

May 31, 2016

(Unaudited) |

|

February 29,

2016 |

|

|

|

|

|

|

ASSETS |

|

|

|

|

Cash |

$ |

14,053 |

|

|

$ |

15,923 |

|

|

Restricted Cash |

|

1,724 |

|

|

|

- |

|

| Accounts

receivable, less allowance for doubtful accounts of $419 |

|

|

|

| and $377 as of May 31, 2016 and

February 29, 2016, respectively |

|

40,609 |

|

|

|

39,491 |

|

|

Inventories |

|

43,870 |

|

|

|

42,797 |

|

| Prepaid

expenses and other current assets |

|

2,711 |

|

|

|

2,234 |

|

|

Current assets |

|

102,967 |

|

|

|

100,445 |

|

|

|

|

|

|

| Property

and equipment, net |

|

19,113 |

|

|

|

19,538 |

|

| Deferred

income taxes, net |

|

5,291 |

|

|

|

5,288 |

|

|

Intangibles, net |

|

16,118 |

|

|

|

15,717 |

|

| Other

assets |

|

518 |

|

|

|

550 |

|

|

|

|

|

|

|

Total Assets |

$ |

144,007 |

|

|

$ |

141,538 |

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| Trade

accounts payable |

$ |

20,462 |

|

|

$ |

18,432 |

|

| Accrued

liabilities |

|

15,614 |

|

|

|

17,854 |

|

| Income

taxes payable |

|

356 |

|

|

|

383 |

|

| Lines of

credit |

|

23,701 |

|

|

|

23,093 |

|

| Current

maturities of notes payable |

|

2,026 |

|

|

|

2,032 |

|

|

Current liabilities |

|

62,159 |

|

|

|

61,794 |

|

|

|

|

|

|

| Notes

payable |

|

10,435 |

|

|

|

10,899 |

|

| Other

long term liabilities |

|

589 |

|

|

|

589 |

|

|

Total Liabilities |

|

73,183 |

|

|

|

73,282 |

|

|

|

|

|

|

|

Preferred stock, 2,500 shares authorized, $1.00 par value; 337

shares |

|

|

|

| issued and outstanding at May 31,

2016 and February 29, 2016 |

|

337 |

|

|

|

337 |

|

| Common

stock, 20,000 shares authorized, $.001 par value; 3,802 and |

|

|

|

| 3,802 shares issued, and 3,190 and

3,198 shares outstanding at |

|

|

|

| May 31, 2016 and February 29, 2016,

respectively |

|

4 |

|

|

|

4 |

|

|

Additional paid-in capital |

|

10,752 |

|

|

|

10,737 |

|

| Retained

earnings |

|

70,133 |

|

|

|

67,952 |

|

| Treasury

stock, 612 and 604 shares held at cost at May 31, 2016 |

|

|

|

| and February 29, 2016,

respectively |

|

(7,016 |

) |

|

|

(6,884 |

) |

|

Accumulated other comprehensive income |

|

(3,386 |

) |

|

|

(3,890 |

) |

|

Shareholders' Equity |

|

70,824 |

|

|

|

68,256 |

|

|

|

|

|

|

|

Total Liabilities and Shareholders' Equity |

$ |

144,007 |

|

|

$ |

141,538 |

|

| |

|

|

|

| |

|

|

|

| Q.E.P. CO., INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (In thousands) |

| (Unaudited) |

| |

|

|

|

| |

For the Three

Months |

| |

Ended May

31, |

| |

|

2016 |

|

|

|

2015 |

|

| |

|

|

|

| Operating

activities: |

|

|

|

| Net income |

$ |

2,185 |

|

|

$ |

1,268 |

|

| Adjustments to reconcile

net income to net cash |

|

|

|

| provided by operating

activities: |

|

|

|

| Depreciation and amortization |

|

1,016 |

|

|

|

1,070 |

|

| Other non-cash adjustments |

|

35 |

|

|

|

70 |

|

| Changes in assets and

liabilities, net of acquisition: |

|

|

|

| Accounts receivable |

|

(907 |

) |

|

|

(4,726 |

) |

| Inventories |

|

(836 |

) |

|

|

(1,234 |

) |

| Prepaid expenses and other

assets |

|

(438 |

) |

|

|

(235 |

) |

| Trade accounts payable and accrued

liabilities |

|

(140 |

) |

|

|

6,763 |

|

| Net cash provided by

operating activities |

|

915 |

|

|

|

2,976 |

|

| |

|

|

|

| Investing

activities: |

|

|

|

| Proceeds from sale of property |

|

- |

|

|

|

328 |

|

| Capital expenditures |

|

(243 |

) |

|

|

(536 |

) |

| Net cash used in investing

activities |

|

(243 |

) |

|

|

(208 |

) |

| |

|

|

|

| Financing

activities: |

|

|

|

| Net borrowings (repayments) under

lines of credit |

|

(463 |

) |

|

|

1,457 |

|

| Net borrowings (repayments) of

notes payable |

|

(470 |

) |

|

|

(6,096 |

) |

| Purchase of treasury stock |

|

(30 |

) |

|

|

(30 |

) |

| Dividends |

|

(4 |

) |

|

|

(3 |

) |

| Net cash provided by (used in)

financing activities |

|

(967 |

) |

|

|

(4,672 |

) |

| |

|

|

|

| Effect of exchange

rate changes on cash |

|

149 |

|

|

|

(2 |

) |

| |

|

|

|

| Net (decrease)

increase in cash |

|

(146 |

) |

|

|

(1,906 |

) |

| Cash at beginning of period |

|

15,923 |

|

|

|

10,576 |

|

| Cash at end of

period |

$ |

15,777 |

|

|

$ |

8,670 |

|

| |

|

|

|

CONTACT:

Q.E.P. Co., Inc.

Mark S. Walter

Chief Financial Officer

561-994-5550

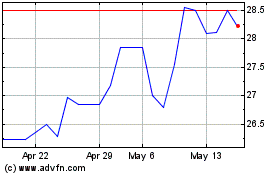

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Dec 2023 to Dec 2024