Austria's Raiffeisen Bank to Scale Back Russian Business as It Weighs Exit

March 30 2023 - 8:36AM

Dow Jones News

By Mauro Orru

Raiffeisen Bank International AG said it would reduce its

business activities in Russia as it weighs options to exit the

country altogether, a pivotal moment for the Austrian bank that,

unlike countless Western companies, opted to maintain operations in

Russia after the invasion of Ukraine.

The lender said Thursday that it would continue to reduce loans

to customers as well as the volume of foreign-currency

transactions, thus shrinking its payments business. The bank said

it was considering leaving Russia in March last year, just weeks

after Moscow launched a full-scale invasion of Ukraine.

It reduced loans to customers and ringfenced Raiffeisenbank

Russia's capital, but never left Russia, in stark contrast with

many Western firms from all sorts of industries.

"The RBI Group will continue to progress potential transactions

which would result in the sale or spin-off of Raiffeisenbank Russia

and deconsolidation of Raiffeisenbank Russia from the RBI Group, in

full compliance with local and international laws and regulation

and in consultation with the relevant competent authorities," the

bank said.

Raiffeisen entered the Russian market in 1996 and didn't shrink

its business after the Crimea annexation in 2014, unlike many

global banking peers. It is one of the European banks with the

largest exposure to Russia, with more than 9,500 employees there at

the end of 2022, according to the bank's annual report.

However, Raiffeisen said its capital-buffer ratio, known as core

equity tier 1, or CET1, would remain robust even if the bank were

to deconsolidate its Russian business.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

March 30, 2023 09:21 ET (13:21 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

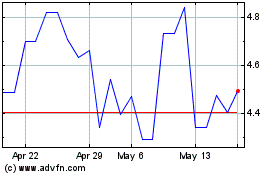

Raiffeisen Bank (PK) (USOTC:RAIFY)

Historical Stock Chart

From Oct 2024 to Nov 2024

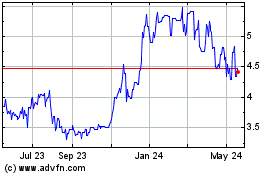

Raiffeisen Bank (PK) (USOTC:RAIFY)

Historical Stock Chart

From Nov 2023 to Nov 2024