false

--05-31

0001718500

0001718500

2024-01-12

2024-01-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 12, 2024

REVIV3

PROCARE COMPANY

(Exact

name of registrant as specified in its charter)

| |

|

|

|

|

| Delaware |

|

000-56351 |

|

47-4125218 |

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| |

|

|

|

|

| 901

Fremont Avenue, Unit 158, Alhambra, CA |

|

91803 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (888) 638-8883

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Exchange Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| None |

N/A |

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

3.03 | Material

Modification to Rights of Security Holders. |

To

the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated

herein by reference.

| Item

5.03 | Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On

January 12, 2024, Reviv3 Procare Company (the “Company”) filed a Certificate of Amendment (the “Amendment”) to

the Company’s Amended and Restated Certificate of Incorporation, with the Delaware Secretary of State to implement a reverse stock

split of the Company’s issued shares of common stock, par value $0.0001 per share at a ratio of one (1) for twenty (20) approved by the

Company’s Board of Directors, effective at 12:01 a.m. Eastern Time on January 16, 2024 (the “Reverse Stock Split”). As

a result of the Reverse Stock Split, every twenty (20) shares of the Company’s issued common stock will automatically be combined

into one (1) share of common stock. The Reverse Stock Split will affect all stockholders uniformly and will not alter any stockholders’

percentage interest in the Company’s common stock, except to the extent that the Reverse Stock Split results in any of our stockholders

receiving whole shares in lieu of fractional shares as further described below. Any fractional shares resulting from the Reverse Stock

Split will be rounded up to the nearest whole share. Proportionate adjustments for the Reverse Stock Split will be made to the exercise

prices and number of shares issuable under the Company’s equity incentive plan, and the number of shares underlying outstanding

equity awards, as applicable. Similarly, the conversion provisions of the Company’s Series A Preferred Stock will also be proportionately

adjusted in connection with the Reverse Stock Split. The Reverse Stock Split will not change the par value of the common stock, modify

any voting rights or other terms of the common stock, or change the number of authorized shares of the Company.

The

Company expects that its common stock will begin trading on a post-Reverse Stock Split basis under the Company’s existing trading

symbol “RVIV” when the market opens on January 16, 2024. The ticker symbol will temporarily be appended with “D”

to signify the effectiveness of the Reverse Stock Split. The new CUSIP number for the Company’s common stock post-Reverse Stock Split

is 76151R206.

The

foregoing summary of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of

the Amendment, a copy of which is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

On

January 16, 2024, the Company issued a press release announcing the Reverse Stock Split. A copy of the press release is attached as Exhibit

99.1 to this report.

Cautionary

Note Regarding Forward Looking Statements

This

Current Report on Form 8-K contains certain “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements represent

our expectations, beliefs, intentions or strategies concerning future events, including, but not limited to, any statements regarding

the Reverse Stock Split, of which is subject to various risks and uncertainties. When used in this Current Report and Form 8-K,

the words or phrases “will,” “expects,” or similar expressions and variations thereof are intended to identify

such forward-looking statements. However, any statements contained in this Current Report on Form 8-K that are not statements of historical

fact may be deemed to be forward-looking statements. Furthermore, such forward-looking statements speak only as of the date of this Current

Report and Form 8-K. We caution that these statements by their nature involve risks and uncertainties, certain of which are beyond our

control, and actual results may differ materially depending on a variety of important factors. For example, there can be no assurance

that the Reverse Stock Split will be successful. These forward-looking statements are not guarantees of our future performance and involve

risks, uncertainties, estimates and assumptions that are difficult to predict. We do not assume the obligation to update any forward-looking

statement, except as required by applicable law.

| Item

9.01 | Financial

Statements and Exhibits. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

| |

REVIV3

PROCARE COMPANY |

| |

|

| Date:

January 16, 2024 |

/s/

Jeff Toghraie |

| |

Name: |

Jeff

Toghraie |

|

Title: |

Chief

Executive Officer |

| |

|

|

CERTIFICATE OF AMENDMENT

TO THE AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

REVIV3 PROCARE COMPANY

REVIV3 PROCARE COMPANY (the “Corporation”),

a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”),

does hereby certify as follows:

| |

1. |

This Certificate of Amendment (the “Certificate of Amendment”) amends the provisions of the Corporation’s Amended and Restated Certificate of Incorporation filed with the Secretary of State of the State of Delaware on June 9, 2015, as amended by that Certificate of Amendment filed on June 13, 2022 (the “Certificate of Incorporation”). |

| |

2. |

Paragraph A of Article IV of the Certificate of Incorporation of the Corporation shall be amended to insert the following immediately following the first sentence of Paragraph A of Article IV as follows: |

“As of the Effective

Time, a one-for-twenty reverse stock split of the Corporation’s Common Stock shall become effective, pursuant to which each twenty

(20) shares of Common Stock issued and held of record by each stockholder of the Corporation immediately prior to the Effective Time shall

be reclassified and combined into one (1) validly issued, fully-paid and nonassessable share of Common Stock automatically and without

any action by the holder thereof upon the Effective Time and shall represent one share of Common Stock from and after the Effective Time

(such reclassification and combination of shares, the “Reverse Stock Split”). The par value of the Corporation’s

Common Stock following the Reverse Stock Split shall remain at $0.0001 per share.

No fractional shares

of Common Stock shall be issued as a result of the Reverse Stock Split. In lieu thereof, any holder who would otherwise be entitled to

a fractional share of Common Stock as a result of the Reverse Stock Split, following the Effective Time, shall be entitled to receive

one (1) additional whole share of Common Stock; provided, however, that, whether or not fractional shares would be issuable as a result

of the Reverse Stock Split shall be determined on the basis of (a) the total number of shares of Common Stock that were issued and outstanding

immediately prior to the Effective Time and (b) the aggregate number of shares of Common Stock after the Effective Time into which the

shares of Common Stock have been reclassified; and with respect to holders of shares of Common Stock in book-entry form in the records

of the Corporation’s transfer agent that were issued and outstanding immediately prior to the Effective Time, any holder who would

otherwise be entitled to a fractional share of Common Stock as a result of the Reverse Stock Split, following the Effective Time, shall

be entitled to receive one (1) additional share of Common Stock automatically and without any action by the holder.

Beginning at the Effective

Time, each certificate representing pre-Reverse Stock Split shares of Common Stock will be deemed for all corporate purposes to evidence

ownership of post-Reverse Stock Split shares.”

| |

3. |

Pursuant to Section 242 of the DGCL, the Board of Directors of the Corporation has duly adopted, and a majority of the outstanding stock entitled to vote thereon has duly approved, the amendment to the Certificate of Incorporation set forth in this Certificate of Amendment. |

| |

4. |

This Certificate of Amendment shall become effective as of January 16, 2024 at 12:01 a.m. Eastern Time (the “Effective Time”). |

| |

5. |

All other provisions of the Certificate of Incorporation shall remain in full force and effect. |

IN WITNESS WHEREOF, the

Corporation has caused this Certificate of Amendment to be executed by the undersigned duly authorized officer this 12th day of January,

2024.

| |

REVIV3 PROCARE COMPANY |

|

| |

/s/ Jeff Toghraie |

|

| |

Name: Jeff Toghraie |

|

| |

Title: Chief Executive Officer |

|

REVIV3

PREPARES FOR NYSE AMERICAN LISTING WITH

REVERSE STOCK SPLIT

1-for-20

Reverse Stock Split Intended to Meet NYSE American Listing Requirements

LOS

ANGELES, CA, January 16, 2024 (GLOBE NEWSWIRE) -- Reviv3 Procare Company (“Reviv3,” “we,” “us,” “our,”

or the “Company”) (OTCQB: RVIV), an emerging global consumer products company for AXIL® hearing protection and enhancement

products and Reviv3® hair and skin care products, today announced that on January 12, 2024, it filed a Certificate of Amendment to

its Amended and Restated Certificate of Incorporation to effect a one (1) for twenty (20) reverse stock split of its common stock, par

value $00001 per share (the “Common Stock”, effective as of 12:01 a.m. Eastern Standard Time on January 16, 2024 (the “Reverse

Stock Split”). The Reverse Stock Split was completed in accordance with the authorization provided by the written consent of a

majority of the Company’s stockholders holding a majority of our issued and outstanding shares of the Common Stock on October 31,

2023 and disclosed in a Definitive Information Statement on Schedule 14C filed with the Securities and Exchange Commission (the “SEC”)

on December 4, 2023.

As

previously disclosed, the Company has applied for listing on the NYSE American stock Exchange (the “NYSE American”). The

Reverse Stock Split was implemented in connection with the NYSE American listing application. The NYSE American requires, among other

items, an initial bid price of least $3.00 per share. Reducing the number of outstanding shares of our Common Stock should, absent other

factors, increase the per share market price of our Common Stock to a price that allows us to meet the NYSE American initial listing

requirements. The Company continues to take steps to satisfy other requirements, but there can be no assurance that the Company will

meet all the requirements for its NYSE American listing.

The

Common Stock will begin trading on a split-adjusted basis under the existing trading symbol “RVIV” when the market opens

on January 16, 2024. The ticker symbol will temporarily be appended with “D” to signify the effectiveness of the Reverse Stock

Split.

“This

reverse split represents another major step toward our Common Stock being traded on a listed U.S. exchange,” commented Reviv3 CEO,

Jeff Toghraie. “We believe a NYSE American listing will elevate our visibility and broaden awareness of our success in the financial

community, particularly with institutional and retail investors, and provide our shareholders with greater liquidity and enhance shareholder

value. These benefits will be timely, as we prepare to effect a corporate rebranding to “AXIL Brands, Inc.” in connection

with the anticipated exchange listing, and the introduction of a number of new hearing enhancement and protection products expected to

be released this calendar year.”

The

Reverse Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests

in us, except to the extent that the Reverse Stock Split results in any of our stockholders owning a fractional share, which will be

rounded up to the nearest whole share. The Reverse Stock Split will reduce the number of issued and outstanding Common Stock from 117,076,949

pre-split shares to 5,853,936 post-split shares, subject to adjustments for rounding of fractional shares. Proportional adjustments will

be made to any outstanding preferred shares or options.

About

Reviv3

Reviv3

Procare Company (OTCQB: RVIV) is an emerging global e-commerce consumer products company. The Company is a manufacturer and marketer

of premium hearing enhancement and protection products, including ear plugs, earmuffs, and ear buds, under the AXIL® brand and premium

hair and skincare products under its in-house Reviv3 Procare brand - selling products in the United States, Canada, the European Union

and throughout Asia. To learn more, please visit the Company’s website at www.reviv3.com and, for the AXIL® brand,

visit www.goaxil.com.

Forward-Looking

Statements

This

press release contains a number of forward-looking statements within the meaning of the federal securities laws. The use of words such

as “intend,” “continue,” “will,” “prepare,” “should,” and “would,”

among others, generally identify forward-looking statements. These forward-looking statements are based on currently available information,

and management’s beliefs, projections, and current expectations, and are subject to a number of significant risks and uncertainties,

many of which are beyond management’s control and may cause Reviv3’s results, performance or achievements to differ materially

from any future results, performance or achievements expressed or implied by these forward-looking statements including the risk that

the Reverse Stock Split won’t increase the price of our Common Stock and otherwise have its intended effect and risks associated

with listing our shares on NYSE American.. There can be no assurance as to any of these matters, and potential investors are urged to

consider these factors carefully in evaluating the forward-looking statements. Other important factors that may cause actual results

to differ materially from those expressed in the forward-looking statements are discussed in the Company’s filings with the SEC.

These forward-looking statements speak only as of the date hereof. Except as required by law, Reviv3 does not assume any obligation to

update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

For

a discussion of these risks and uncertainties, please see our filings with the SEC. Our public filings with the SEC are available from

commercial document retrieval services and at the website maintained by the SEC at http://www.sec.gov.

Investor

Relations:

Reviv3

Investor Relations Team

(888)

638-8883

investors@reviv3.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

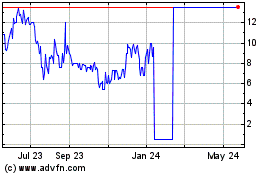

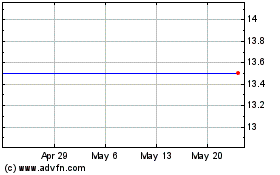

Reviv3 Procare (QB) (USOTC:RVIV)

Historical Stock Chart

From Apr 2024 to May 2024

Reviv3 Procare (QB) (USOTC:RVIV)

Historical Stock Chart

From May 2023 to May 2024