EUROPE MARKETS: European Stocks Hold Near Month Highs

September 06 2019 - 6:46AM

Dow Jones News

By Mark Cobley

European stocks were holding near month-long highs on Friday

morning, having now made up all their losses since global markets

plunged in early August on mounting trade-war fears. Investors were

cheered overnight by positive data on the U.S. economy and the

Trump Administration's plans to resume negotiations with China

(http://www.marketwatch.com/story/china-says-trade-talks-with-us-to-take-place-in-october-2019-09-05).

Among the region's individual markets, Germany's DAX was the

strongest gainer, rising 0.3% in early trading, despite continuing

indications the country's economy may be weakening. Poor July data

(http://www.marketwatch.com/story/german-industrial-production-slumps-in-july-2019-09-06)

for the country's total industrial production on Friday followed

similarly lackluster numbers

(http://www.marketwatch.com/story/german-manufacturing-orders-slump-in-july-2019-09-05)

on manufacturing the day before.

With German exporters starkly exposed to uncertainty over trade,

stock investors may be hopeful that the latest move to restart

U.S.-China talks will end up boosting Europe's largest economy.

Elsewhere, there was a slight fall for Italy's FTSE MIB index ,

while France's CAC 40 and the U.K.'s FTSE 100 were treading water.

Investors are awaiting a key indicator of the health of the U.S.

economy, the August jobs report

(http://www.marketwatch.com/story/us-likely-added-173000-jobs-in-august-but-watch-out-for-an-end-of-summer-surprise-2019-09-05),

with economists predicting unemployment will stick near 50-year

lows.

The euro was also flat against the U.S. dollar, while the

British pound fell back 0.3% following a week of gains, as several

defeats for Britain's government meant the prospect of a rapid,

disorderly EU exit on October 31 appeared to recede.

Among individual stocks, Paris-listed catering group Sodexo

(SW.FR) was one of the region's biggest fallers today, slumping

more than 4% after analysts at Barclays downgraded the stock

(http://www.marketwatch.com/story/sodexo-slumps-as-barclays-downgrades-to-underweight-2019-09-06).

Norwegian telecoms firm Telenor (TEL.OS) also slid more than 4%,

after it confirmed that a potential deal to merge its Asian

operations with rival Axiata was off.

Shares in U.K.-listed security group G4S (GFS.LN) , meanwhile,

soared almost 9% on a report that the U.S.-listed Brinks Company

(https://news.sky.com/story/us-cash-handling-giant-brinks-plots-raid-on-1bn-g4s-arm-11803439)

is planning a GBP1bn bid for part of the business. British network

Sky News said the two firms are in talks but other bidders might

yet emerge.

(END) Dow Jones Newswires

September 06, 2019 07:31 ET (11:31 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

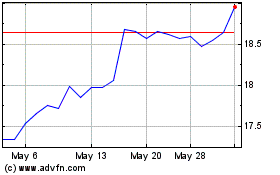

Sodexo (PK) (USOTC:SDXAY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sodexo (PK) (USOTC:SDXAY)

Historical Stock Chart

From Nov 2023 to Nov 2024