SSE Plans Stake Sales, Dividend Cut to Fund GBP12.5 Billion Investment Plan; Shares Fall -- Update

November 17 2021 - 3:29AM

Dow Jones News

By Jaime Llinares Taboada

Shares in SSE PLC fell Wednesday morning after the company

unveiled plans to cut the dividend and sell stakes in its

electricity network divisions to speed up investment on energy

infrastructure through fiscal 2026.

The energy company's Net Zero Acceleration Program includes a

capital investment plan of 12.5 billion pounds ($16.79 billion) to

2026, it said. This represents a 65% increase in annual investment

on the previous plan, or GBP1 billion a year. The money allocated

to expand the renewables business will account for 40% of the

total, and has more than doubled from the previous program.

To fund it, SSE plans to rebase the dividend to 60 pence a share

in fiscal 2024, the company said. This compares with plans to pay

81 pence plus inflation for the current year ending March 31, 2022.

SSE said that the dividend cut will be followed by annual growth of

at least 5% to March 2026, and that it expects to pay at least 350

pence a share across the five years to fiscal 2026.

In addition, the capital-expenditure plan will also be funded

through the sale of a 25% stake in both SSEN Transmission and SSEN

Distribution businesses, the company said.

In the six months ended Sept. 30, these two divisions

contributed GBP335.0 million to the group's GBP376.8 million

adjusted operating profit, as renewable power generation was hurt

by unfavorable weather, it said.

"The big question for the market in advance of today was how

this [capital-expenditure plans] would be funded. SSE has gone for

the tried and tested route of asset disposals, and has confirmed

market fears that this would come with a dividend cut," RBC Capital

Markets said.

Shares at 0839 GMT were down 5.4% at 1,569 pence.

SSE said the investment plan will add 4 gigawatts of renewable

capacity, doubling current capacity, and increase the asset value

of its power networks to GBP9 billion--net of assumed 25% stake

sales.

As a result, the company said it expects to increase its

adjusted earnings per share at a compound annual growth rate of 5%

to 7% to March 2026.

"Today's announcement means SSE will maximize its long-term

potential and capture growth opportunities during a critical time

for the energy sector, strengthening and growing its core

businesses, creating jobs, delivering for wider society and

offering attractive shareholder returns," Chief Executive Alistair

Phillips-Davies said.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

November 17, 2021 04:14 ET (09:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

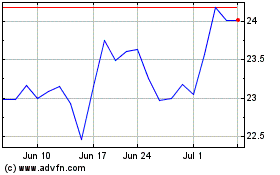

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Feb 2025 to Mar 2025

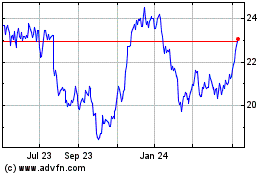

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Mar 2024 to Mar 2025