SSE Raises Medium-Term Guidance; Says Profits Will Grow Again This Year

May 25 2022 - 1:58AM

Dow Jones News

By Jaime Llinares Taboada

SSE PLC on Wednesday raised earnings growth guidance for the

five years to March 2026, reported higher profits for fiscal 2022

and said that they will rise again this year.

The U.K. energy group now expects to deliver an adjusted

earnings per share compound annual growth rate of between 7% and

10% in that five-year period, up from previous forecasts of 5%-7%.

SSE said that this is based on its strong performance in fiscal

2022, higher inflation forecasts, higher and volatile energy

commodity prices and increased value creation potential for its

thermal, hydro and gas storage assets.

The FTSE 100 company reported a pretax profit of 3.48 billion

pounds ($4.36 billion) in the year ended March 31, up from GBP2.42

billion a year earlier.

Adjusted EPS rose 22% to 95.4 pence, within the company's

guidance range of between 92 pence and 97 pence.

The group declared a final dividend of 60.2 pence a share,

bringing the full-year payment to 85.7 pence--up from 81.0 pence in

fiscal 2021. The company's dividend is linked to inflation but will

be cut in fiscal 2024.

SSE said that it expects adjusted EPS of at least 120 pence for

fiscal 2023, and that it has started a sales process for a 25%

share of its SSEN Transmission business which is expected to

formally start in the summer.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

May 25, 2022 02:43 ET (06:43 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

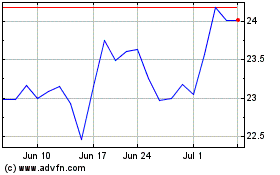

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Feb 2025 to Mar 2025

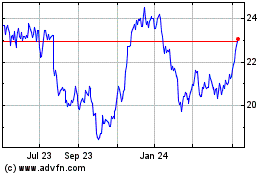

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about SSE PLC (PK) (OTCMarkets): 0 recent articles

More SSE PLC (PK) News Articles