UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

|

☑

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2019

OR

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

|

For transition period ___ to ____

Commission file number: 000-53737

SINO UNITED WORLDWIDE CONSOLIDATED LTD.

(Name of registrant in its charter)

|

Nevada

|

47-2148252

|

|

(State or jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

|

136-20 38th Ave. Unit 3G,

Flushing, NY 11354

(Address of principal executive offices)

(929) 391-2550

(Registrant's telephone number)

SECURITIES REGISTERED PURSUANT TO SECTION 12(B)

OF

THE EXCHANGE ACT:

None.

SECURITIES REGISTERED PURSUANT TO SECTION 12(G)

OF

THE EXCHANGE ACT:

None.

Indicate by check mark if the registrant is a well-known seasoned

issuer, as defined in Rule 405 of the Securities Act. Yes☐ No☑

Check whether the issuer is not required to file reports pursuant

to Section 13 or 15(d) of the Exchange Act. Yes☐ No☑

Check whether the issuer (1) filed all reports required to be filed

by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter periods that the registrant

was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☑

No☐

Indicate by check mark whether the registrant has submitted electronically

and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes☑ No☐

Check if there is no disclosure of delinquent filers in response

to Item 405 of Regulation S-K contained in this form, and no disclosure will be contained, to the best of the registrant's knowledge,

in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☐

|

Smaller reporting company ☑

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act). Yes☐ No☑.

As of December 31, 2019, the aggregate market

value of the shares of the Registrant’s common stock held by non-affiliates (based upon the closing price of such shares

as reported on the OTC Bulletin Board was approximately $29,718,020 (5,943,604 shares, $5.00 per share).

At December 31, 2019, there were 33,503,604

shares of the registrant’s common stock issued and outstanding.

|

|

PART I

|

|

|

|

Item 1.

|

Business

|

|

3

|

|

Item 1A

|

Risk Factors

|

|

4

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

8

|

|

Item 2.

|

Properties

|

|

8

|

|

Item 3.

|

Legal Proceedings

|

|

8

|

|

Item 4.

|

Mine and Safety Disclosures

|

|

8

|

|

|

PART II

|

|

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

8

|

|

Item 6.

|

Selected Financial Data

|

|

9

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

9

|

|

Item7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

10

|

|

Item 8.

|

Financial Statements and Supplementary Financial Data

|

|

10

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

|

10

|

|

Item 9A

|

Controls and Procedures

|

|

10

|

|

Item 9B.

|

Other Information.

|

|

11

|

|

|

PART III

|

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

|

12

|

|

Item 11.

|

Executive Compensation

|

|

13

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

14

|

|

Item 13.

|

Certain Relationships and Related Party Transactions, and director independence

|

|

15

|

|

Item 14.

|

Principal Accountant Fees and Services

|

|

15

|

|

|

PART IV

|

|

|

|

Item 15.

|

Exhibits, Financial Statements Schedules

|

|

16

|

|

|

SIGNATURES

|

|

17

|

Forward-Looking Statements

Statements contained in this Annual Report

include “forward-looking statements” within the meaning of such term in Section 27A of the Securities Act and Section

21E of the Exchange Act. Forward-looking statements involve known and unknown risks, uncertainties and other factors which could

cause actual financial or operating results, performances or achievements expressed or implied by such forward-looking statements

not to occur or be realized. Forward-looking statements made in this Report generally are based on our best estimates of future

results, performances or achievements, predicated upon current conditions and the most recent results of the companies involved

and their respective industries. Forward-looking statements may be identified by the use of forward-looking terminology such as

“may,” “will,” “could,” “should,” “project,” “expect,”

“believe,” “estimate,” “anticipate,” “intend,” “continue,” “potential,”

“opportunity” or similar terms, variations of those terms or the negative of those terms or other variations of those

terms or comparable words or expressions. Potential risks and uncertainties include, among other things, such factors as:

|

|

•

|

our heavy reliance on limited number of consumers;

|

|

|

•

|

Strong competition in our industry;

|

|

|

•

|

increases in our raw material costs; and

|

|

|

•

|

an inability to fund our capital requirements.

|

Additional disclosures regarding factors that

could cause our results and performance to differ from results or performance anticipated by this annual report are discussed in

Item 1A. “Risk Factors.” Readers are urged to carefully review and consider the various disclosures made by us in this

annual report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that

may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this

annual report speak only as of the date hereof and we disclaim any obligation to provide updates, revisions or amendments to any

forward-looking statements to reflect changes in our expectations or future events.

PART I

We are a Nevada corporation incorporated on

August 30, 2006, under the name Gateway Certifications, Inc. On November 16, 2009, our corporate name was changed to

American Jianye Greentech Holdings, Ltd. on February 13, 2014, our corporate name was changed to AJ Greentech Holdings, Ltd. and

on July 17, 2017, our corporate name was changed to Sino United Worldwide Consolidated Ltd.

From November 2009 until October, 2013, through

our China subsidiaries, we were engaged in design, marketing and distributing of alcohol base clean fuel which are designed to

use less fossil fuel and have less pollution than traditional fuel.

From October 2013 until September, 2017, through

our Taiwan subsidiary, we were engaged in design, marketing and distributing of hardware and software technologies, the driving

record management system (DMS). On September 30, 2017, we spun off Taiwan DMS subsidiaries through stock transfer and debt cancellation

because we felt that, it not our best interest to continue DMS technology business as a result of our decreasing revenue, continued

losses and inability to raise capital for our business.

On August 15, 2019 we signed a Share Exchange

Agreement (SEA) to work together on the distribution of iDrink Smart IoT Vending Machine in the international market. On August

28, 2019, SUIC and iDrink signed a joint venture agreement to distribute iDrink Smart IoT Vending Machine in the US market, through

a new 60:40 joint venture company based in the USA. SUIC and iDrink plan to leverage the exceptional user interface experience

of iDrink Smart IoT Vending Machine, combined with SUIC’s expertise in the fintech service business, to provide solutions

for this key target segment. This joint venture will focus on developing iDrink beverage consumption market in US.

On October 15, 2019, SUIC and iDrink has established

a 50:50 joint venture company in Malaysia. The joint venture “iDrink SUIC Malaysia Sdn Bhd” will accelerate development

and distribution of iDrink Smart IoT Vending Machines in the ASEAN emerging markets. This joint company aims to create seamless

smart IoT beverage vending services as gateway to the millions of beverage consumers in the region. SUIC

has expertise in identifying new trends and technologies and a strong understanding of the ASEAN ecosystem that will move forward

iDrink business in the region’s beverage and food sector.

We will continue to strengthen our competencies

in other high technology and blockchain related businesses, such as the revolutionary sound wave technology with industrial applications,

blockchain technology, fintech services, AI and other high potential critical blockchain projects.

Employees

The Company currently has 5 partners and employees in Taiwan office,

5 partners and employees in Malaysia office and 2 partners and employees in the U.S. office.

RISKS RELATED TO OUR BUSINESS

You should carefully consider the risks described

below before buying our common stock. If any of the risks described below actually occurs, that event could cause the trading price

of our common stock to decline, and you could lose all or part of your investment.

Downturns in general economic and

market conditions could materially and adversely affect our business.

The IT-communications, mobile apps and blockchain

industries are most susceptible to, and greatly affected by economic downturns and policy uncertainties. We have encountered and

will continue to encounter risks and difficulties frequently experienced by growing companies in rapidly changing industries, including

increased expenses as we continue to grow our business. If we do not manage these risks and overcome these difficulties successfully,

our business will suffer.

If we are not able to compete effectively

with other competitors, our prospects for future growth will be jeopardized.

There is significant competition in both the

software industry and the blockchain industry with more established companies. We are not only competing with other software and

blockchain providers but also with companies offering different kind of software and blockchain solutions, which are usually more

established and have greater resources to devote to research and development, manufacturing and marketing than we have. Our competitors

may promote these software and blockchain solutions which are more readily accepted by customers than our products and maybe required

to reduce the prices of our products in order to remain competitive. Our competitors may also seek to use our financial

difficulties in marketing against us.

If critical components become unavailable

or contract manufacturers delay their production, our business will be negatively impacted.

Stability of component supply is crucial to

determine our manufacturing process. As some critical components, such as solar panels, are supplied by certain third party component

manufacturers, we may be unable to acquire necessary amounts of key components at competitive prices. Outsourcing the

production of certain parts and components is one way to reduce manufacturing costs. We have selected these particular manufacturers

based on their ability to consistently produce these products according to our requirements and ensure the best quality product

at the most cost effective price. Contrarily, the loss of all or one of these suppliers or delays in obtaining shipments could

have an adverse effect on our operations until an alternative supplier could be found, if one may be located at all. This

may cause us to breach our contracts and lose sales.

If our contract manufacturers fail to

meet our requirements for quality, quantity and timeliness, our business growth could be harmed.

We design and procure key components and outsource

our products to contract manufacturers. These manufacturers procure most of the raw materials for us and provide all necessary

facilities and labor to manufacture our products. If these companies are to terminate their agreements with us without adequate

notice or fail to provide the required capacity and quality on a timely basis, we would be unable to process and deliver our lighting

products to our customers.

Our products could contain defects, or

they may be installed or operated incorrectly, which could reduce sales of those products or result in claims against us.

Although we have experienced quality control

and assurance personnel and established thorough quality assurance practices to ensure good product quality, defects still may

be found in the future in our existing or future products. End-users could lose their confidence in our products and

company when they unexpectedly use defective products. This could result in loss of revenue, loss of profit margin, or loss of

market share. Moreover, these defects could cause us to incur significant warranty, support and repair costs, and harm our relationship

with our customers.

If we are unable to recruit and retain

qualified personnel, our business could be harmed.

Our growth and success highly depend on qualified

personnel. It is an inevitable part of business to make all efforts to recruit and retain skilled technical, sales, marketing,

managerial, manufacturing, and administrative personnel. Competition among the industry could cause us difficultly to recruit or

retain a sufficient number of qualified technical personnel, which could harm our ability to develop new products. If we are unable

to attract and retain necessary key talents, it definitely will harm our ability to develop competitive product and keep good customers

and could adversely affect our business and operating results.

Currency fluctuations may adversely affect our operating results.

Company generates revenues and incurs expenses

and liabilities in both U.S. Dollars and in foreign currency. However, it will report its financial results in the United States

in U.S. Dollars. As a result, our financial results will be subject to the effects of exchange rate fluctuations between these

currencies. Any events that result in a devaluation of the foreign currency versus the U.S. Dollar will have an adverse effect

on our reported results. We have not entered into agreements or purchased instruments to hedge our exchange rate risks.

We are not likely to hold annual shareholder meetings in the

near future.

Management does not expect to hold annual meetings

of shareholders in the near future, due to the expense involved. The current members of the Board of Directors were appointed to

that position by the previous directors. If other directors are added to the Board in the future, it is likely that the current

directors will appoint them.

Risks Related to our Common Stock

There is a limited market for our common

stock, which may make it difficult for you to sell your stock.

Our common stock trades on the OTC under the

symbol “SUIC.” There is a limited trading market for our common stock and there is frequently no trading in our common

stock. As of December 31, 2019, the last reported sale price was $2.00 per share. Accordingly, there can be no assurance

as to the liquidity of any markets that may develop for our common stock, the ability of holders of our common stock to sell our

common stock, or the prices at which holders may be able to sell our common stock.

Because our common stock is a penny stock,

you may have difficulty selling them in the secondary trading market.

Federal regulations under the Securities Exchange

Act of 1934 regulate the trading of “penny stock,” which are generally defined as any security not listed on a national

securities exchange or Nasdaq, priced at less than $5.00 per share and offered by an issuer with limited net tangible assets and

revenues. Our common stock is a penny stock and may not be traded unless a disclosure schedule explaining the penny stock market

and the risks associated therewith is delivered to a potential purchaser prior to any trade.

In addition, because our common stock is a

penny stock, broker-dealers may not process trades in our stock and brokers that do permit trades in our stock must take certain

steps prior to selling a penny stock. These steps include:

|

|

●

|

Obtaining financial and investment information from the investor;

|

|

|

●

|

Obtaining a written suitability questionnaire and purchase agreement signed by the investor; and

|

|

|

●

|

Providing the investor a written identification of the shares being offered and the quantity of the shares.

|

If these penny stock rules are not followed

by the broker-dealer, the purchaser has no obligation to purchase the shares. The application of these comprehensive rules will

make it more difficult for broker-dealers to sell our common stock and our stockholders, therefore, may have difficulty in selling

their shares in the secondary trading market, and some broker-dealers will not process purchases or sales of penny stocks.

Our stock price may be volatile and your

investment in our common stock could suffer a decline in value.

As of December 31, 2019, there has only been

limited trading activity in our common stock. There can be no assurance that a market will ever develop in our common

stock in the future. If a market does not develop then stockholders would be unable to sell any of our common stock

likely resulting in a complete loss of any funds they invested.

Should a market develop, the price may fluctuate

significantly in response to a number of factors, many of which are beyond our control. These factors include:

|

|

●

|

the market’s perception as to our ability to develop or acquire a business;

|

|

|

●

|

our ability or perceived ability to obtain necessary funding for operations;

|

|

|

●

|

if we do develop or acquire any business, such factors as:

|

|

o

|

acceptance of our products in the industry;

|

|

o

|

announcements of technological innovations or new products by us or our competitors;

|

|

o

|

the effect of any regulatory issues relating to the business;

|

|

o

|

if the business is conducted in a country outside of the United States, risks associated with that country, its currency, including currency regulations, its government’s policy toward United States entities operating in the country;

|

|

o

|

government regulatory action affecting our products or our competitors’ products in both the United States and foreign countries;

|

|

o

|

developments or disputes concerning patent or proprietary rights;

|

|

o

|

the effects of environmental conditions and regulations;

|

|

o

|

economic conditions in the United States or abroad;

|

|

o

|

actual or anticipated fluctuations in our operating results;

|

|

o

|

broad market fluctuations; and

|

|

o

|

changes in financial estimates by

securities analysts.

|

We cannot assure you that we will be able to

adequately address these additional risks. If we were unable to do so, our operations might suffer. Additionally, if we engage

in a business or acquire a company located outside of the United States, it is likely that substantially all of our assets would

be located outside of the United States and some of our executive officers and directors might reside outside of the United States.

As a result, it may not be possible for investors in the United States to enforce their legal rights, to effect service of process

upon our directors or executive officers or to enforce judgments of United States courts predicated upon civil liabilities and

criminal penalties of our directors and executive officers under Federal securities laws.

We do not intend to pay any cash dividends

in the foreseeable future.

We have not paid any cash dividends on our

common stock and do not intend to pay cash dividends on our common stock in the foreseeable future.

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

Not applicable for smaller reporting companies.

Our company has a rental office which is located

at 136-20 38th Ave. Unit 3G Flushing, NY 11314, USA. Telephone no. is 929-391-2550.

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

None.

|

ITEM 4.

|

MINE AND SAFETY DISCLOSURES

|

Not Applicable.

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

Market for Our Common Stock

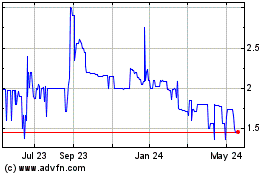

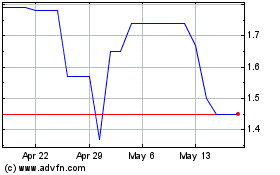

The following table sets forth, for the periods

indicated, the high and low closing prices of our common stock. These prices reflect inter-dealer prices, without retail mark-up,

mark-down or commission, and may not represent actual transactions.

|

|

|

Closing Prices (1)

|

|

|

|

|

High

|

|

|

Low

|

|

|

Year Ended December 31, 2019

|

|

|

|

|

|

|

|

|

|

1st Quarter

|

|

$

|

5.00

|

|

|

$

|

5.00

|

|

|

2nd Quarter

|

|

$

|

5.00

|

|

|

$

|

5.00

|

|

|

3rd Quarter

|

|

$

|

5.00

|

|

|

$

|

2.00

|

|

|

4th Quarter

|

|

$

|

2.00

|

|

|

$

|

1.09

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2018

|

|

|

|

|

|

|

|

|

|

1st Quarter

|

|

$

|

12.10

|

|

|

$

|

12.10

|

|

|

2nd Quarter

|

|

$

|

12.10

|

|

|

$

|

12.10

|

|

|

3rd Quarter

|

|

$

|

12.10

|

|

|

$

|

5.00

|

|

|

4th Quarter

|

|

$

|

5.00

|

|

|

$

|

3.99

|

|

|

(1)

|

The above tables set forth the range of high and low closing prices per share of our common stock as reported by OTC Bulletin Board and the Pink Sheets, as applicable, for the periods indicated.

|

Approximate Number of Holders of Our Common Stock

On December 31, 2019, there were approximately

60 stockholders of record of our common stock.

Dividend Policy

The Company has not declared or paid cash dividends or made distributions

in the past, and we do not anticipate that we will pay cash dividends or make distributions in the foreseeable future. We currently

intend to retain and reinvest future earnings, if any, to finance our operations.

Recent Sales of Unregistered Securities

None.

Repurchase of Equity Securities.

There is no sale of unregistered securities during the fiscal years

ending December 31, 2018 and December 31, 2019.

Securities Authorized for Issuance under Equity Compensation

Plans

We currently do not have any equity compensation plans.

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

Not applicable for smaller reporting companies.

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

Most Recent accounting pronouncements

Refer to note 2 in the accompanying financial

statements.

Impact of Most Recent Accounting Pronouncements

There were no recent accounting pronouncements that have had a material

effect on the Company’s financial position or results of operations.

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

|

Not required for smaller reporting companies.

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY FINANCIAL DATA

|

Financial Statements

The full text of our audited financial statements as of December

31, 2019 and 2018 begins on page F-1 of this Report.

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

|

The Company changed its auditor on March 31,

2019. Please refer to 8-K dated April 1, 2019.

The Company changed its auditor on September

3, 2019. Please refer to 8-K dated September 6, 2019.

|

ITEM 9A.

|

CONTROLS AND PROCEDURES.

|

Evaluation of disclosure controls and procedures.

The Company maintains a set of disclosure controls

and procedures designed to ensure that information required to be disclosed by the Company in the reports filed under the Securities

Exchange Act, is recorded, processed, summarized and reported within the time periods specified by the SEC's rules and forms. Disclosure

controls are also designed with the objective of ensuring that this information is accumulated and communicated to the Company's

management, including the Company's chief executive officer and chief financial officer, as appropriate, to allow timely decisions

regarding required disclosure.

During the course of internal evaluation, following

control weaknesses are noted for the fiscal year ended December 31, 2019 that required correction:

|

|

●

|

No independent director exists in the Board of Directors, and the directors have a little understanding

about U.S. GAAP and Sarbanes-Oxley Act 404 requirements in 2019.

|

Based upon their evaluation as of the end of

the period covered by this annual report, the Company's chief executive officer and chief financial officer concluded that, due

to the significant deficiencies in internal control over financial reporting described below, the Company's disclosure controls

and procedures are not effective as of December 31, 2019.

Changes in internal controls.

The term “internal control over financial

reporting” (defined in SEC Rule 13a-15(f)) refers to the process of a company that is designed to provide reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance

with generally accepted accounting principles. The Company’s management, with the participation of the Chief Executive Officer

and Chief Financial Officer, has evaluated any changes in the Company’s internal control over financial reporting that occurred

during the fourth quarter of the year covered by this annual report, and they have concluded that there was no change to the Company’s

internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the Company’s

internal control over financial reporting.

Management's Report on Internal Control over Financial Reporting.

Our management is responsible for establishing

and maintaining adequate internal control over financial reporting for the company in accordance with as defined in Rules 13a-15(f)

and 15d-15(f) under the Exchange Act. Our internal control over financial reporting is designed to provide reasonable assurance

regarding the (i) effectiveness and efficiency of operations, (ii) reliability of financial reporting and the preparation of financial

statements for external purposes in accordance with generally accepted accounting principles, and (iii) compliance with applicable

laws and regulations. Our internal controls framework is based on the criteria set forth in the Internal Control - Integrated Framework

issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

Due to inherent limitations, internal control

over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future periods

are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance

with the policies and procedures may deteriorate.

A material weakness in internal controls is

a deficiency in internal control, or combination of control deficiencies, that adversely affects the Company’s ability to

initiate, authorize, record, process, or report external financial data reliably in accordance with accounting principles generally

accepted in the United States of America such that there is more than a remote likelihood that a material misstatement of the Company’s

annual or interim financial statements that is more than inconsequential will not be prevented or detected. In the course of making

our assessment of the effectiveness of internal controls over financial reporting, we identified some material weaknesses in our

internal control over financial reporting.

We lack sufficient personnel with the appropriate

level of knowledge, experience and training in the application of accounting operations of our company. This weakness causes us

to not fully identify and resolve accounting and disclosure issues that could lead to a failure to perform timely internal control

and reviews.

Management is currently reviewing its staffing

and systems in order to remedy the weaknesses identified in this assessment. However, because of the above condition, management’s

assessment is that the Company’s internal controls over financial reporting were not effective as of December 31, 2019. Additionally,

the Registrant’s management has concluded that the Registrant has a material weakness associated with its U.S. GAAP expertise.

This Annual Report does not include an attestation

report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s

report was not subject to attestation by the Company’s registered public accounting firm pursuant to temporary rules of the

Securities and Exchange Commission that permit the Company to provide only management’s report in this annual report.

|

ITEM 9B.

|

OTHER INFORMATION.

|

None.

PART III

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

|

The following table sets forth: (1) names and

ages of all persons who presently are and who have been selected as directors and executive officers of the Registrant; (2) all

positions and offices with the Registrant held by each such person; (3) any period during which he or she has served as such. All

directors hold office until the next annual meeting of our shareholders and until their successors have been qualified to be elected.

Officers serve at the inclination of the Board of Directors.

|

Name (1)

|

|

Age

|

|

Title (2)

|

|

Yanru Zhou

|

|

26

|

|

Chief Executive Officer and Chief Finance Officer

|

|

Bill Tan Yee Wei

|

|

48

|

|

Chief Technology Officer, Director

|

|

Yu-Hung Chen

|

|

51

|

|

Director

|

On Feb 28, 2018. the board of Director (the

“Board”) of the Company appointed Yanru Zhou as Chief Executive Officer of the firm. Ms. Zhou, 26, received her undergraduate

education in China.

On December 31, 2019, the Board of Directors

(the “Board”) of the Company appointed Bill Tan Yee Wei as Chief Technology Officer of the firm. Mr. Wei 48, has more

than 18 years of total working experiences in different industries with Lean Manufacturing and Six Sigma Black Belt skills. He

has hands on experiences in supply chain management, procurement, quality assurance, inventory, sales, production, logistics, project

management, transport management and distribution exposure. Mr. Wei has received his Bachelor of Science, Mechanical Engineer degree

at West Virginia University Institute of Technology, WV, USA.

On December 31, 2019,

the Board of the Company appointed Yu-Hung Chen as Director of the firm. Mr. Chen, 51, is a co-founder and the CEO of the Sun Tech

Co. Ltd. and Soundnet Co. Ltd. (http://www.e-safe.com.tw/about_us/). He has served and worked for Sun Tech since inception in year

1989 and led the company to its success. He was educated in Taiwan.

Nominating, Compensation and Audit Committees

The Board of Directors does not have an audit

committee, a compensation committee or a nominating committee, due to the small size of the Board. The Board does also not have

an “audit committee financial expert” within the definition given by the Regulations of the Securities and Exchange

Commission.

Section 16(A) Beneficial Ownership Reporting Compliance

Under U.S. securities laws, directors, certain

executive officers and persons holding more than 10% of our common stock must report their initial ownership of the common stock,

and any changes in that ownership, to the SEC.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors

or executive officers has been convicted in a criminal proceeding, excluding traffic violations or similar misdemeanors, or has

been a party to any judicial or administrative proceeding during the past five years that resulted in a judgment, decree or final

order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities laws (except

where not subsequently dismissed without sanction or settlement), or from engaging in any type of business practice, or a finding

of any violation of federal or state securities laws. To the best of our knowledge, no petition under the federal bankruptcy laws

or any state insolvency law was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for

the business or property of any of our directors or officers, or any partnership in which any of our directors or officers was

a general partner at or within two years before the time of such filing, or any corporation or business association of which any

of our directors or officers was an executive officer at or within two years before the time of such filing. Except as set forth

in our discussion below in “Certain Relationships and Related Transactions, and Director Independence,” none of our

directors, director nominees or executive officers has been involved in any transactions with us or any of our directors, executive

officers, affiliates or associates which are required to be disclosed pursuant to the rules and regulations of the SEC.

Code of Ethics

The Board of Directors has not adopted a code

of ethics applicable to the Company’s executive officers. The Board believes that the small number of individuals involved

in the Company’s management makes such a code unnecessary.

Board Attendance

During 2019, the board of directors did not

hold any meetings. All actions were taken by actions in writing.

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

The following summary compensation table indicates

the cash and non-cash compensation earned during the years ended December 31, 2019 and December 31, 2018 by each person who served

as chief executive officer during the year ended December 31, 2019.

SUMMARY COMPENSATION TABLE

|

|

|

Fiscal

|

|

Salary

|

|

|

Bonus

|

|

|

Stock Awards

|

|

|

All Other Compensation

|

|

|

Total

|

|

|

Name and Principal Position

|

|

Year

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

($)

|

|

|

Yanru Zhou Chief Executive and Financial Officer (1)

|

|

2019

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

(1) Ms. Yanru Zhou has served as chief executive

and financial officer since Feb. 28 2018 to December 31, 2019. She signed a new employment agreement effective January 1,

2020 whereby she is entitled to a compensation of 10,000 shares of stock of the Company each year.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bill Tan Yee Wei Chief Technology Officer (2)

|

|

2019

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

(2) Mr. Wei is appointed as Chief Technology Officer

on December 31, 2019. He signed a new employment agreement effective January 1, 2020 whereby he is entitled to a compensation

of 10,000 shares of stock of the Company each year.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yu-Hung Chen, Director (3)

|

|

2019

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

(3) Ms. Yu-hung Chen is appointed as Director on

December 31, 2019. He waived any compensation for his services.

|

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth for each named executive officer

certain information concerning the outstanding equity awards as of December 31, 2019.

|

|

|

Option awards

|

|

|

Stock awards

|

|

|

Name

and Principal

Position

|

|

Number

of

Securities

Underlying

Unexercised

Options

Exercisable

|

|

|

Number

of

Securities

Underlying

Unexercised

Options

Unexercisable

|

|

|

Option

Exercise

Price

($)

|

|

|

Option

Expiration

Date

|

|

|

Number

of

Shares

or

Units

of Stock

that

Have Not

Vested

|

|

|

Market

Value

of

Shares

or

Units

of

Stock

that

Have

Not

Vested

|

|

|

Equity

Incentive

Plan

Awards:

Number

of

Unearned

Shares,

Units

or

Other

Rights

that

Have

Not

Vested

|

|

|

Equity

Incentive

Plan

Awards:

Market

or

Payout

Value

of

Unearned

Shares,

Units

or

Other

Rights

that

Have

Not

Vested

|

|

|

Yanru Zhou

CEO

|

|

|

—

|

|

|

|

—

|

|

|

$

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Bill Tan Yee Wei CTO

|

|

|

—

|

|

|

|

—

|

|

|

$

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Yu-Hung Chen Director

|

|

|

—

|

|

|

|

—

|

|

|

$

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

Remuneration of Directors

None of the members of the Board of Directors receives remuneration

for service on the Board.

Equity Compensation Plan Information

We do not have any compensation plan as of

December 31, 2019.

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

|

Security Ownership of Certain Beneficial Owners and Management

The following table summarizes certain information

regarding the beneficial ownership (as such term is defined in Rule 13d-3 under the Securities Exchange Act of 1934) of outstanding

Registrant Common Stock as of December 31, 2019 by (i) each person known by us to be the beneficial owner of more than 5% of the

outstanding Common Stock, (ii) each of our directors, (iii) each of our named executive officers, and (iv) all executive officers

and directors as a group. Except as indicated in the footnotes below, the security and stockholders listed below possess sole voting

and investment power with respect to their shares.

|

Names of Beneficial Owners (1)

|

|

Amount

and Nature

of

Beneficial

Ownership

(1)

|

|

|

Percentage

of

Class

(1)

|

|

Yanru Zhou

|

|

|

5,500,000

|

|

|

|

16.41%

|

|

A&U Capital Partner Ltd.

|

|

|

3,000,000

|

|

|

|

8.95%

|

|

Youxin Peng

|

|

|

5,500,000

|

|

|

|

16.41%

|

|

Zhirong Peng

|

|

|

5,500,000

|

|

|

|

16.41%

|

|

North America Chinese Financial Association

|

|

|

5,500,000

|

|

|

|

16.41%

|

|

All Directors and Executive Officers as a Group (1 persons)

|

|

|

25,060,000

|

|

|

|

74.79%

|

(1) "Beneficial Owner" means having

or sharing, directly or indirectly (i) voting power, which includes the power to vote or to direct the voting, or (ii) investment

power, which includes the power to dispose or to direct the disposition, of shares of the common stock of an issuer. The definition

of beneficial ownership includes shares, underlying options or warrants to purchase common stock, or other securities convertible

into common stock, that currently are exercisable or convertible or that will become exercisable or convertible within 60 days.

Unless otherwise indicated, the beneficial owner has sole voting and investment power.

(2) For each shareholder, the calculation of

the percentage of beneficial ownership is based upon 33,503,604 shares of Common Stock outstanding as of December 31, 2019,

and shares of Common Stock subject to options, warrants and/or conversion rights held by the shareholder that are currently exercisable

or exercisable within 60 days, which are deemed to be outstanding and to be beneficially owned by the shareholder holding such

options, warrants, or conversion rights. The percentage ownership of any shareholder is determined by assuming that the shareholder

has exercised all options, warrants and conversion rights to obtain additional securities and that no other shareholder has exercised

such rights.

Equity Compensation Plan Information

As of the date of this Form 10-K, the Company

has not authorized any equity compensation plan, nor has our Board of Directors authorized the reservation or issuance of any securities

under any equity compensation plan.

Changes in Control

There are no arrangements known to us, including any pledge by any

person of our securities, the operation of which may at a subsequent date result in a change in control of the Company.

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS.

|

Transactions with Related Persons

During the year of 2019, the Company advances from related parties

$ 0.

Director Independence

Currently, we have no independent directors

on our Board of Directors, and therefore have no formal procedures in effect for reviewing and pre-approving any transactions between

us, our directors, officers and other affiliates. We will use our best efforts to insure that all transactions are on terms at

least as favorable to the Company as we would negotiate with unrelated third parties.

|

ITEM 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES.

|

|

|

|

2019

|

|

|

2018

|

|

|

Audit fees(1)

|

|

$

|

8,000

|

|

|

$

|

10,000

|

|

|

Audit-related fees

|

|

$

|

|

|

|

$

|

—

|

|

|

Tax fees(2)

|

|

$

|

|

|

|

$

|

—

|

|

|

All other fees

|

|

$

|

|

|

|

$

|

—

|

|

|

Total

|

|

$

|

8,000

|

|

|

$

|

10,000

|

|

|

|

(1)

|

Consists of fees billed for the audit of our annual financial statements, review of financial statements included in our Quarterly Reports on Form 10-Q and services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements.

|

|

|

(2)

|

“Tax Fees” consisted of fees billed for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning.

|

Pre-Approval Policies and Procedures

Under the Sarbanes-Oxley Act of 2002, all audit

and non-audit services performed by our auditors must be approved in advance by our Board to assure that such services do not impair

the auditors’ independence from us. In accordance with its policies and procedures, our Board pre-approved the audit service

performed by James Pai CPA PLLC, for our financial statements as of and for the year ended December 31, 2019.

PART IV

|

ITEM 15.

|

EXHIBITS, FINANCIAL STATEMENTS SCHEDULES.

|

|

Exhibit No.

|

|

Description

|

|

3.1(1)

|

|

Articles of Incorporation

|

|

3.2(1)

|

|

By-Laws

|

|

4.1(1)

|

|

Form of Share Certificate

|

|

10.1(1)

|

|

Private Placement Memorandum

|

|

10.2(1)

|

|

Subscription Agreement

|

|

10.3(1)

|

|

Registration Rights Agreement

|

|

31.1

|

|

Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002*

|

|

31.2

|

|

Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002*

|

|

32.1

|

|

Certification of the Chief Executive Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002*

|

|

32.2

|

|

Certification of the Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002*

|

|

101

|

|

The following materials from our Annual Report on Form 10-K

for the year ended December 31, 2019, formatted in XBRL (extensible Business Reporting Language): (i) the Balance Sheets,

(ii) the Statements of Operations, (iii) the Statements of Stockholders' Equity (iv) the Statements of Cash Flows, and

(v) Notes to Financial Statements.*

|

(1) Filed as exhibits to the registrant’s Form SB-2 filed

with the Commission on June 29, 2007.

(2) Filed as exhibits to the registrant’s Form 8-K filed with

the Commission on Oct. 1, 2013.

(3) Filed as exhibits to the registrant’s Form 8-K filed with

the Commission on February 19, 2014.

* Filed herewith.

SIGNATURES

Pursuant to the requirements of Section 13 or

15(d) of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

Sino United Worldwide Consolidated Ltd.

|

|

|

|

|

Date: May 25, 2020

|

By:

|

/s/ Yanru Zhou

|

|

|

|

Yanru Zhou

Chief Executive Officer

|

Pursuant to the requirements of the Securities

Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities

and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/ Yanru Zhou

|

|

Chief Financial Officer, Director

|

|

5/25/2020

|

|

Yanru Zhou

|

|

(Principal Financial Officer)

|

|

|

|

|

|

|

|

|

|

/s/ Yanru Zhou

|

|

Chief Executive Officer

|

|

5/25/2020

|

|

Yanru Zhou

|

|

|

|

|

Sino United Worldwide Consolidated Ltd. and

Subsidiary

December 31, 2018 and 2019

Index to the financial statements

|

Contents

|

Page(s)

|

|

Report of Independent Registered Public Accounting Firm

|

F-1

|

|

Balance Sheets

|

F-2

|

|

Statements of Income and Comprehensive Income

|

F-3

|

|

Statement of Stockholders’ Equity

|

F-4

|

|

Statements of Cash Flows

|

F-5

|

|

Notes to the Financial Statements

|

F-6

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

To the Board of Directors and Stockholders Sino United Worldwide

Consolidated Ltd.

Basis for opinion

We have audited the accompanying balance sheets

of Sino United Worldwide Consolidated Ltd. (the “Company”) as of December 31, 2019 and 2018 the related statements

of operations, stockholders’ equity and cash flows for the year then ended. These financial statements are the responsibility

of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audit in accordance with the

standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the

audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not

required to have, nor were we engaged to perform an audit of its internal control over financial reporting. Our audit included

consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the

circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial

reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts

and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates

made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable

basis for our opinion.

Opinion on the Financial Statements

In our opinion, the financial statements referred

to above present fairly, in all material respects, the financial position of Sino United Worldwide Consolidated Ltd.as of December

31, 2019 and the results of its operations and its cash flows for the years then ended in conformity with accounting principles

generally accepted in the United States of America.

Consideration of the Company’s Ability

to Continue as a Going Concern

The accompanying financial statements have

been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to financial statements, the Company’s

accumulated deficit and lack of assets raise substantial doubt about its ability to continue as a going concern. The financial

statements do not include any adjustments that might result from the outcome of this uncertainty.

James Pai CPA

We have served as the company’s auditor since 2020

May 25, 2020.

New York, NY

|

Sino United Worldwide Consolidated Ltd.

|

|

Balance Sheets

|

|

|

|

|

|

December 31,

2019

|

|

|

December 31,

2018

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

13,435

|

|

|

$

|

25,882

|

|

|

Accounts receivable, net

|

|

|

105,000

|

|

|

|

20,000

|

|

|

Loans receivable

|

|

|

50,000

|

|

|

|

—

|

|

|

Total Current Assets

|

|

|

168,435

|

|

|

|

45,882

|

|

|

Total Assets

|

|

$

|

168,435

|

|

|

$

|

45,882

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIENCY

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Credit card payable

|

|

$

|

9,352

|

|

|

$

|

14,641

|

|

|

Convertible promissory notes- other

|

|

|

190,000

|

|

|

|

85,000

|

|

|

Accrued expenses and other liabilities

|

|

|

53,647

|

|

|

|

25,064

|

|

|

Total Current Liabilities

|

|

|

252,999

|

|

|

|

124,705

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

|

Stockholders’ Deficiency

|

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value, 394,500,000 shares authorized; 33,503,604 shares issued and outstanding

|

|

|

33,504

|

|

|

|

33,504

|

|

|

Additional paid-in capital

|

|

|

1,647,731

|

|

|

|

1,647,731

|

|

|

Accumulated deficit

|

|

|

(1,765,799

|

)

|

|

|

(1,760,058

|

)

|

|

Total Stockholders' Deficiency

|

|

|

(84,564

|

)

|

|

|

(78,823

|

)

|

|

Total Liabilities and Stockholders' Deficiency

|

|

$

|

168,435

|

|

|

$

|

45,882

|

|

See accompanying notes to the financial

statements.

|

Sino United Worldwide Consolidated Ltd.

Statements of Comprehensive Loss

|

|

|

|

Years Ended December 31,

|

|

|

|

2019

|

|

2018

|

|

Revenue

|

|

$

|

105,000

|

|

|

$

|

120,000

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

97,469

|

|

|

|

114,325

|

|

|

Total operating expenses

|

|

|

97,469

|

|

|

|

114,325

|

|

|

Income (Loss) from operations

|

|

|

7,531

|

|

|

|

5,675

|

|

|

Other expense:

|

|

|

|

|

|

|

|

|

|

Interest expense - related party

|

|

|

—

|

|

|

|

(1,291

|

)

|

|

Interest expense – other

|

|

|

(13,270

|

)

|

|

|

(4,699

|

)

|

|

Total other expense:

|

|

|

(13,270

|

)

|

|

|

(5,990

|

)

|

|

Income (Loss) from continuing operations before income tax provision

|

|

|

(5,739

|

)

|

|

|

(315

|

)

|

|

Income tax provision

|

|

|

—

|

|

|

|

—

|

|

|

Income (Loss) from continuing operations

|

|

|

(5,739

|

)

|

|

|

(315

|

)

|

|

Net Income (Loss)

|

|

$

|

(5,739

|

)

|

|

$

|

(315

|

)

|

|

Earnings (loss) per share

|

|

|

|

|

|

|

|

|

|

Basic - continuing operation

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

- discontinuing operation

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

Total

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

Diluted - continuing operation

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

- discontinuing operation

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

Total

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

33,503,604

|

|

|

|

33,503,604

|

|

|

Diluted

|

|

|

33,503,604

|

|

|

|

33,503,604

|

|

See accompanying notes to the financial statements.

Sino United Worldwide Consolidated Ltd.

Statements of Stockholders' Equity (Deficiency)

|

|

|

Common Stock

|

|

|

|

|

|

|

|

|

|

|

|

Number of Shares

|

|

Amount

|

|

Additional Paid-in Capital

|

|

Accumulated Earnings

(Deficit)

|

|

Accumulated Other Income (Loss)

|

|

Total

|

|

Balance, December 31, 2017

|

|

|

33,503,604

|

|

|

|

33,504

|

|

|

|

1,647,731

|

|

|

|

(1,759,743

|

)

|

|

|

—

|

|

|

|

(78,508

|

)

|

|

Net income (loss)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(315

|

)

|

|

|

—

|

|

|

|

(315

|

)

|

|

Balance, December 31, 2018

|

|

|

33,503,604

|

|

|

|

33,504

|

|

|

|

1,647,731

|

|

|

|

(1,760,058

|

)

|

|

|

—

|

|

|

|

(78,823

|

)

|

|

Shares issued

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Net income (loss)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(5,739

|

)

|

|

|

—

|

|

|

|

(5,739

|

)

|

|

Balance, December 31, 2019

|

|

|

33,503,604

|

|

|

|

33,504

|

|

|

|

1,647,731

|

|

|

|

(1,765,799

|

)

|

|

|

—

|

|

|

|

(84,564

|

)

|

See accompanying notes to the financial

statements.

|

Sino United Worldwide Consolidated Ltd.

Statements of Cash Flows

|

|

|

|

Years Ended December 31,

|

|

|

|

2019

|

|

2018

|

|

CASH FLOW FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(5,739

|

)

|

|

$

|

(315

|

)

|

|

Net loss from discontinued operation

|

|

|

—

|

|

|

|

—

|

|

|

Net loss from continuing operation

|

|

|

(5,739

|

)

|

|

|

(315

|

)

|

|

Adjustment to reconcile net loss to net cash provided by (used in) operating activities:

|

|

|

|

|

|

|

|

|

|

Change in operating assets and liabilities

|

|

|

|

|

|

|

|

|

|

Increase in accounts receivable

|

|

|

(85,000

|

)

|

|

|

(5,000

|

)

|

|

Increase in loans receivable

|

|

|

(50,000

|

)

|

|

|

—

|

|

|

Decrease in credit card payable

|

|

|

(5,289

|

)

|

|

|

10,011

|

|

|

Increase in accrued expenses and other current liabilities

|

|

|

28,582

|

|

|

|

(18,858

|

)

|

|

Net cash used in continuing operation

|

|

|

(117,446

|

)

|

|

|

(14,162

|

)

|

|

Net

cash provided by discontinued operation

|

|

|

—

|

|

|

|

—

|

|

|

Net cash used in operating activities

|

|

|

(117,446

|

)

|

|

|

(14,162

|

)

|

|

CASH FLOW FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net cash used in continuing operation

|

|

|

—

|

|

|

|

—

|

|

|

Net cash used in discontinued operation

|

|

|

—

|

|

|

|

—

|

|

|

Net cash used in investing activities

|

|

|

—

|

|

|

|

—

|

|

|

CASH FLOW FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Proceeds from non-related party loan

|

|

|

105,000

|

|

|

|

20,000

|

|

|

Loan payable - related party

|

|

|

—

|

|

|

|

(30,000

|

)

|

|

Proceeds from issuance of common stock

|

|

|

—

|

|

|

|

—

|

|

|

Net cash

provided by continuing operation

|

|

|

105,000

|

|

|

|

(10,000

|

)

|

|

Net cash used in discontinued operation

|

|

|

—

|

|

|

|

—

|

|

|

Net cash provided by(used in) financing activities

|

|

|

105,000

|

|

|

|

(10,000

|

)

|

|

Effect of exchange rate changes on cash

|

|

|

|

|

|

|

|

|

|

INCREASE(DECREASE) IN CASH

|

|

|

(12,446

|

)

|

|

|

(24,162

|

)

|

|

Cash - beginning of year

|

|

|

25,881

|

|

|

|

50,044

|

|

|

Cash - end of year

|

|

$

|

13,435

|

|

|

$

|

25,882

|

|

|

Supplement disclosure information

|

|

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

|

13,270

|

|

|

|

5,990

|

|

|

Cash paid for interest-discontinued operation

|

|

|

—

|

|

|

|

—

|

|

|

Cash paid for income taxes

|

|

|

—

|

|

|

|

—

|

|

|

Cash paid for income taxes-discontinued operation

|

|

|

—

|

|

|

|

—

|

|

|

Non-cash financing activities

|

|

|

|

|

|

|

|

|

|

Debt discount incurred from beneficial conversion feature

|

|

|

—

|

|

|

|

—

|

|

|

Due to related parties balance were settled by sale of subsidiary

|

|

|

—

|

|

|

|

—

|

|

The accompanying notes are an integral part

of these financial statements.

Sino United Worldwide Consolidated Ltd.

Notes to the Financial Statements

Note 1 – Organization and Basis of presentation

Organization

The accompanying financial statements of the

Company have been prepared in accordance with accounting principles generally accepted in the United States of America (“US

GAAP”) and include the accounts of the Company and its wholly owned subsidiary. All inter-company transactions and balances

are eliminated in consolidation.

Certain amounts in last year’s financial

statements have been reclassified to conform to current year presentation.

Note 2 – Going Concern

The accompanying financial statements have

been prepared assuming that the Company will continue as a going concern. The Company had a working capital deficit of $84,564,

an accumulated deficit of $1,765,799 and stockholders’ deficiency was $84,564 as of December 31, 2019. The Company did not

generate cash or income from its continuing operation. These factors, among others, raise substantial doubt about the Company’s

ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome

of this uncertainty.

The company is developing new businesses in

various fields. There is no assurance that the Company will be able to either (1) achieve a level of revenues adequate to generate

sufficient cash flow from operations; or (2) obtain additional financing through either private placement, public offerings and/or

bank financing necessary to support the Company’s working capital requirements. To the extent that funds generated from any

private placements, public offering and/or bank financing are insufficient to support the Company’s working capital requirements,

the Company will have to raise additional working capital from additional financing. No assurance can be given that additional

financing will be available, or if available, will be on terms acceptable to the Company. If adequate working capital is not available,

the Company may not be able continue its operations.

NOTE 3 – Summary of Significant Accounting

Policies

Use of Estimates

The preparation of financial statements in

conformity with accounting principles generally accepted in the United States of America requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities

at the date of the financial statements and the amount of revenues and expenses during the reporting periods. Management makes

these estimates using the best information available at the time the estimates are made. However, actual results could differ materially

from those results. Significant accounting estimates reflected in the Company’s financial statements included the valuation

of accounts receivable, the estimated useful lives of long-term assets, the valuation of short term investment and the valuation

of deferred tax assets.

Cash and cash equivalents

Cash and cash equivalents include cash on hand

and deposits placed with banks or other financial institutions, which are unrestricted as to withdrawal and use and with an original

maturity of three months or less. The Company maintains its cash in bank deposit accounts. Cash accounts are guaranteed by the

Federal Deposit Insurance Corporation up to $250,000. The Company has not experienced any losses in such accounts and believes

it is not exposed to any significant credit risk on such cash.

Accounts Receivable and Allowance for Doubtful

Accounts

Accounts receivable are recorded at the invoiced