UPDATE: Swiss Watch Makers Face EU Scrutiny

August 05 2011 - 11:48AM

Dow Jones News

Swiss watch manufacturers are facing regulatory scrutiny in the

European Union amid an industry-wide investigation that aims to

establish whether luxury watch makers such as Compagnie Financiere

Richemont SA (CFR.VX) are refusing to supply spare parts to

independent repairers.

The European Commission probe, which follows an antitrust

investigation in Switzerland on the future supply of watch

components, comes after a years-long legal battle between watch

manufacturers and the European Confederation of Watch & Clock

Repairer's Associations, or CEAHR, that claims some watch makers,

especially from Switzerland, refuse shipment of spare parts.

"It's difficult for us to get any spare parts from firms such as

Richemont, especially for luxury brands such as Jaeger-LeCoultre"

said Martin Taylor, general manager at the British Horological

Institute, which is a member of CEAHR. "While we are very happy

with Rolex, it's mixed with Swatch [Group SA (UHR.VX)]. We have no

problems to get spare parts for Omega but we experience a lot of

difficulties with luxury brands such as Breguet."

On its website, CEAHR claims that the practice of the main Swiss

brands is hurting watch repairers and customers. It said that "free

competition no longer exists" and that this supply practice entails

the risk that customers may overpay and suffer delays when urged to

send watches to the original manufacturer.

Swatch confirmed the probe, saying "it concerns almost the

entire watch industry" and said it was "confident" about the

outcome of the investigation. Richemont declined to comment, while

Rolex couldn't be immediately reached. The European Commission,

which had turned down an earlier request from CEAHR, declined to

identify the companies involved in the investigation.

Swiss watch makers, although hurt by the strong Swiss franc, are

experiencing an unprecedented boom, especially in regions such as

Asia, where demand for luxury brands has been strong over the past

few quarters. The lucrative business has also attracted many new

participants to the market, which has irked traditional players,

whose efforts were instrumental in turning the ailing sector around

in the 1980s.

Because of the huge demand, Swatch, which is the world's largest

producer of mechanical parts, has asked the Swiss Competition

Commission, or WEKO, to launch an investigation into whether the

company can reduce the supply of watch components to

competitors.

Swatch's strong position in the components area is a legacy of

the time it helped to restructure the Swiss watch industry, when it

was one of the rare companies to invest in this sector. It has

urged other watch makers to launch their own component units as its

manufacturing unit, ETA SA Manufacture Horlogere Suisse, is

struggling to meet Swatch's own demand.

Switzerland's WEKO said its own investigation is ongoing and

isn't linked to the EU antitrust investigation. When WEKO launched

its investigation in June, it had asked Swatch to continue

supplying parts to competitors this year. But as part of WEKO's

additional measures that accompany its investigation, the

commission is allowing Swatch to partially reduce the supply of

watch parts in 2012. Neither WEKO nor the European Commission said

when they expect to close their investigations.

-By Goran Mijuk, Dow Jones Newswires, +41 43 443 80 47;

goran.mijuk@dowjones.com

(Alessandro Torello in Brussels contributed to this

article.)

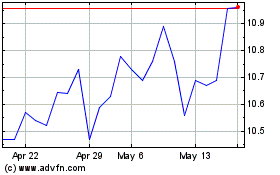

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

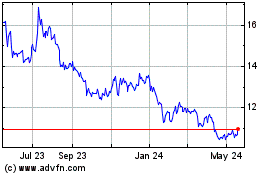

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Jul 2023 to Jul 2024