UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C.

20549

FORM 10-K/A

Amendment No. 1

(Mark One)

| x | ANNUAL

REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

FOR THE FISCAL

YEAR ENDED MAY 31, 2015

| ¨ | TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition

period from _________ to __________

Commission File

Number 0-54205

HUAYUE ELECTRONICS, INC.

(Name of Registrant in its Charter)

| Delaware |

20-2188353 |

(State of Other Jurisdiction of incorporation or

organization) |

(I.R.S.) Employer I.D. No.) |

475 Park Avenue South, 30th Floor,

New York, NY 10016

(Address of Principal Executive Offices)

Issuer’s

Telephone Number: 646-478-2676

Securities Registered Pursuant to Section

12(b) of the Exchange Act: NONE

Securities Registered Pursuant to Section

12(g) of the Exchange Act:

COMMON STOCK,

$0.001 PAR VALUE

(Title of Class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 406 of the Securities Act. Yes

¨ No x

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes

¨ No x

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes x No

¨

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) Yes x No

¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein,

and will not be contained, to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K or any amendment

to this Form 10-K. x

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check One)

Large

accelerated filer ¨

Accelerated filer ¨ Non-accelerated

filer ¨ Smaller

reporting company x

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨

No x

As of November 30, 2014, the last day

of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the common stock held by

non-affiliates was $9,350,000 based upon the closing sale price on November 30, 2014 of $0.55 per share.

As of September 15, 2015, there were

24,325,741 shares of common stock outstanding.

Documents incorporated by reference:

NO

EXPLANATORY NOTE

In this Amendment No.

1 to Annual Report on Form 10-K, or this 10-K/A, we will refer to Huayue Electronics Inc., a Delaware corporation, as “our

company,” “we,” “us,” and “our.”

We are filing this

Form 10-K/A to amend certain disclosures in our Annual Report on Form 10-K for the fiscal year ended May 31, 2015, as originally

filed with the Securities and Exchange Commission on September 15, 2015 (our “Report”), to amend Note 9 to our audited

financial statements included in Item 8 of our Report and to add to such financial statements the report of Canuswa Accounting

& Tax Service Inc., our independent registered public accounting firm.

As required by Rule

12b-15 of the Securities Exchange Act of 1934, as amended, new certifications by our principal executive officer and principal

financial officer are being filed as exhibits herewith, and as such, we have included Item 13 of Part III, “Exhibits,”

as part of this Form 10-K/A. As further required by Rule 12b-15, this Form 10-K/A sets forth the complete text of each item as

amended.

This Form 10-K/A does

not affect any section of our Report not specifically discussed herein and continues to speak as of the date of our Report. Other

than as specially reflected in this Form 10-K/A, this Form 10-K/A does not reflect events occurring after the filing of our Report

or modify or update any related disclosures. Accordingly, this Form 10-K/A should be read in conjunction with our other filings

made with the SEC subsequent to the filing of our Report.

PART II

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. |

Index to the

Consolidated Financial Statements

CANUSWA ACCOUNTING & TAX SERVICES INC.

16301

NE 8th Street, Suite 138, Bellevue, WA 98008

Tel:

408-329-6249/425-516-7453

E-mail: info@canuswa.com

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

To the Board of Directors and Stockholders

Huayue Electronics Inc.

We have audited the accompanying balance sheets of Huayue

Electronics Inc. as of May 31, 2015 and the related statements of operation, changes in shareholders’ equity and cash flows

for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility

is to express an opinion on these financial statements based on our audit. The consolidated financial statements of the Company

as of and for the year ended May 31, 2014, were audited by other auditors; whose report dated Sept. 15, 2014; express an unqualified

opinion on those consolidated financial statements.

We conducted our audit in accordance with the standards of the

Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have,

nor were we engaged to perform an audit of its internal control over financial reporting. Our audits included consideration of

internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances,

but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting.

Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures

in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by

management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable

basis for our opinion.

In our opinion, the financial statements referred to

above present fairly, in all material respects, the financial position of Huayue Electronics Inc. as of May 31, 2015 and the results

of its operation and its cash flows for the years then ended in conformity with U.S. generally accepted accounting principles.

/s/ Canuswa Accounting & Tax Services Inc.

Bellevue, WA 98008

Oct. 08, 2015

REPORT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

of:

Huayue Electronics, Inc.

We have audited the accompanying consolidated

balance sheet of Huayue Electronics, Inc. (the “Company”) as of May 31, 2014, and the related consolidated statements

of income and comprehensive income, stockholders’ equity, and cash flows for the fiscal year then ended. The C ompany’s

management is responsible for these consolidated financial statements. Our responsibility is to express an opinion on these consolidated

financial statements based on our audit.

We conducted our audit in accordance

with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform

the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement.

The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting.

Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are

appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s

internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis,

evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the

accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial

statement presentation. We believe that our audit provide a reasonable basis for our opinion.

In our opinion, the consolidated financial

statements referred to above present fairly, in all material respects, the consolidated financial position of Huayue Electronics,

Inc. as of May 31, 2014, and the consolidated results of their operations and their cash flows for the fiscal year then ended in

conformity with accounting principles generally accepted in the United States of America.

/s/ KCCW Accountancy Corp.

Diamond Bar, California

September 15, 2014 (January 7,

2015 as to the effects of the restatement discussed in Note 3)

Huayue Electronics Inc.

Consolidated Balance Sheets

(In US Dollars)

| Assets | |

| | |

| |

| Current Assets: | |

May 31, 2015 | | |

May 31, 2014 | |

| | |

| | |

(Restated) | |

| Assets from discontinued operations (Note 2) | |

$ | 8,703,090 | | |

$ | 9,890,531 | |

| Total Current Assets | |

| 8,703,090 | | |

| 9,890,531 | |

| Assets from discontinued operations (Note 2) | |

| 4,161,668 | | |

| 13,959,482 | |

| Total Assets | |

| 12,864,758 | | |

| 23,850,013 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 48,750 | | |

$ | – | |

| Liabilities from discontinued operations (Note 2) | |

| 11,928,595 | | |

| 10,038,813 | |

| Total Current Liabilities | |

| 11,977,345 | | |

| 10,038,813 | |

| Liabilities from discontinued operations (Note 2) | |

| 337,590 | | |

| 164,487 | |

| Total Liabilities | |

| 12,314,935 | | |

| 10,203,300 | |

| | |

| | | |

| | |

| Stockholders' Equity: | |

| | | |

| | |

| |

| | | |

| | |

Common

stock, $0.001 par value, 60,000,000 shares authorized;

34,325,241

and 31,325,241 shares issued and outstanding at May 31, 2015 and 2014, respectively | |

| 34,325 | | |

| 31,325 | |

| Additional paid-in capital | |

| 6,866,355 | | |

| 6,866,355 | |

| Accumulated other comprehensive income | |

| – | | |

| 139,612 | |

| Retained earnings (deficit) | |

| (6,350,857 | ) | |

| 6,609,421 | |

| Total Stockholders' Equity | |

| 549,823 | | |

| 13,646,713 | |

| Total Liabilities and Stockholders' Equity | |

$ | 12,864,758 | | |

$ | 23,850,013 | |

See accompanying notes to consolidated financial statements

Huayue Electronics Inc.

Consolidated Statements of Income

and Comprehensive Income

(In US Dollars)

| | |

For the Fiscal

Years Ended | |

| | |

May

31, 2015 | | |

May

31, 2014 | |

| | |

| | |

(Restated) | |

| Net sales | |

$ | – | | |

$ | – | |

| Cost of goods sold | |

| – | | |

| – | |

| Gross profit | |

| – | | |

| – | |

| Operating expenses: | |

| | | |

| | |

| Professional fees | |

| 18,750 | | |

| – | |

| General and administrative | |

| 30,000 | | |

| – | |

| Total operating expenses | |

| 48,750 | | |

| – | |

| Loss from operations | |

| (48,750 | ) | |

| – | |

| | |

| | | |

| | |

| Income tax provision | |

| – | | |

| – | |

| Net loss from continuing operations | |

| (48,750 | ) | |

| – | |

| | |

| | | |

| | |

| Net (loss) income from discontinued operations, net of taxes (Note 2) | |

| (13,048,140 | ) | |

| 2,291,071 | |

| | |

| | | |

| | |

| Net (loss) income | |

$ | (13,096,890 | ) | |

$ | 2,291,071 | |

| | |

| | | |

| | |

| Foreign currency translation loss | |

| – | | |

| (158,828 | ) |

| | |

| | | |

| | |

| Net comprehensive (loss) income | |

| (13,096,890 | ) | |

| 2,132,243 | |

| | |

| | | |

| | |

| Basic and diluted (loss) income from continuing operations | |

$ | (0.00 | ) | |

$ | – | |

| Basic and diluted (loss) income from discontinued operations | |

$ | (0.41 | ) | |

$ | 0.07 | |

| Basic and diluted (loss) income per share | |

$ | (0.41 | ) | |

$ | 0.07 | |

| | |

| | | |

| | |

| Weighted average number of common shares | |

| 31,637,570 | | |

| 31,325,241 | |

See accompanying notes to consolidated financial statements

Huayue Electronics Inc.

Consolidated Statements of Changes in

Stockholders’ Equity

(In US Dollars)

| | |

| | |

| | |

| | |

| | |

Accumulated | | |

| |

| | |

Common Stock | | |

Additional | | |

Retained | | |

Other | | |

| |

| | |

($0.001 par value) | | |

Paid-in | | |

Earnings / | | |

Comprehensive | | |

Stockholders' | |

| | |

Shares | | |

Amount | | |

Capital | | |

(Deficit) | | |

Income | | |

Equity | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at June 1, 2013 | |

| 31,325,241 | | |

$ | 31,325 | | |

$ | 6,866,355 | | |

$ | 4,318,350 | | |

$ | 298,440 | | |

$ | 11,514,470 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income from discontinued operations (Restated) | |

| – | | |

| – | | |

| – | | |

| 2,291,071 | | |

| – | | |

| 2,291,071 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation loss (Restated) | |

| – | | |

| – | | |

| – | | |

| – | | |

| (158,828 | ) | |

| (158,828 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at May

31, 2014 (Restated) | |

| 31,325,241 | | |

| 31,325 | | |

| 6,866,355 | | |

| 6,609,421 | | |

| 139,612 | | |

| 13,646,713 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common stock issued pursuant to related party

acquisition | |

| 3,000,000 | | |

| 3,000 | | |

| – | | |

| (3,000 | ) | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss from continuing operations | |

| – | | |

| – | | |

| – | | |

| (48,750 | ) | |

| – | | |

| (48,750 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss from discontinued operations | |

| – | | |

| – | | |

| – | | |

| (13,048,140 | ) | |

| – | | |

| (13,048,140 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Realization of accumulated other

comprehensive income | |

| – | | |

| – | | |

| – | | |

| 139,612 | | |

| (139,612 | ) | |

| – | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at May 31, 2015 | |

| 34,325,241 | | |

$ | 34,325 | | |

$ | 6,866,355 | | |

$ | (6,350,857 | ) | |

$ | – | | |

$ | 549,823 | |

See accompanying notes to consolidated financial statements

Huayue Electronics Inc.

Consolidated Statements of Cash Flows

(In US Dollars)

| | |

For the Fiscal

Years Ended | |

| | |

May

31, 2015 | | |

May

31, 2014 | |

| | |

| | |

(Restated) | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net

(loss) income | |

$ | (13,096,890 | ) | |

$ | 2,291,071 | |

| Adjustments

to reconcile net (loss) income to net cash (used in) provided by operating activities: | |

| | | |

| | |

| Net loss (income)

from discontinued operations | |

| 13,048,140 | | |

| (2,291,071 | ) |

| Changes in operating

assets and liabilities: | |

| | | |

| | |

| Accounts

payable and accrued expenses | |

| 48,750 | | |

| – | |

| Net cash used

in operating activities - continuing operations | |

| – | | |

| – | |

| Net

cash (used in) provided by operating activities - discontinued operations | |

| (1,768,627 | ) | |

| 5,770,579 | |

| Net cash (used

in) provided by operating activities | |

| (1,768,627 | ) | |

| 5,770,579 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Net cash used

in investing activities - continuing operations | |

| – | | |

| – | |

| Net

cash used in investing activities - discontinued operations | |

| – | | |

| (5,560,286 | ) |

| Net cash used

in investing activities | |

| – | | |

| (5,560,286 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Net cash used

in financing activities - continuing operations | |

| – | | |

| – | |

| Net

cash provided by (used in) financing activities - discontinued operations | |

| 1,496,441 | | |

| (130,508 | ) |

| Net cash provided

by (used in) financing activities | |

| 1,496,441 | | |

| (130,508 | ) |

| | |

| | | |

| | |

| Effect of exchange rate on cash and

cash equivalents - discontinued operations | |

| (24,289 | ) | |

| (4,214 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash and

cash equivalents | |

| (296,475 | ) | |

| 75,571 | |

| | |

| | | |

| | |

| Cash at beginning of year - discontinued

operations | |

| 344,636 | | |

| 269,065 | |

| Less: Cash at end

of year - discontinued operations | |

| (48,161 | ) | |

| (344,636 | ) |

| Cash at end of

year - continuing operations | |

$ | – | | |

$ | – | |

| | |

| | | |

| | |

| Supplemental schedule of non-cash financing

activities: | |

| | | |

| | |

| Common

stock issued pursuant to related party acquisition | |

$ | 3,000 | | |

$ | – | |

See accompanying notes to consolidated financial statements

HUAYUE ELECTRONICS,

INC.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

NOTE 1 – ORGANIZATION AND

BASIS OF PRESENTATION

Huayue Electronics, Inc. (the

“Company”) was incorporated in Delaware on November 19, 2010 under the name China International Enterprise Corp.

In 2011, the Company changed its name to HXT Holdings, Inc. On September 2, 2011, the Company acquired all of the outstanding

capital stock of China Metal Holding, Inc. (“China Metal”), a privately-owned corporation formed in the State of

Delaware. China Metal is a holding company whose only asset, held through a subsidiary, is 100% of the registered capital of

Changzhou Huayue Electronics Company, Limited (“Changzhou Huayue”), a limited liability company organized under

the laws of the People’s Republic of China (“China” or “PRC”). Changzhou Huayue is engaged in

developing, manufacturing and selling high frequency induction lights and electrolytic capacitors. Changzhou Huayue’s

offices and manufacturing facilities are located in China. Effective November 2, 2011, the Company changed its name to Huayue

Electronics, Inc.

On April 23, 2015, the Company entered into

a Partnership Interest Purchase Agreement to purchase 51% of the limited liability partnership interests in SavWatt Kaz

Ltd. (“SavWatt”), a limited liability partnership formed under the laws of Kazakhstan. Effective this date, SavWatt’s

operations will be included in the Company’s consolidated financial position and results. SavWatt Kaz was formed by

Sutton Global Associates, Inc. (see Note 6) on April 8, 2015 to engage in the business of manufacturing and distributing energy

efficient products in Kazakhstan and other former Soviet Union countries.

In May 2015, the

Company approved plans to dispose of China Metal, including its subsidiary Changzhou Huayue. Refer to Note 2 for further discussion.

On July 24, 2015

the Company amended its name to Tarsier Ltd., subject to shareholder notification.

The consolidated

financial statements of the Company are prepared in accordance with accounting principles generally accepted in the United States

of America (“US GAAP”). The financial statements reflect the financial position, results of operations and cash flows

of the parent entity, Huayue Electronics, and its subsidiary, SavWatt, which did not have any operations for the year ended May

31, 2015. The consolidated financial statements also present the financial position, results of operations and cash flows of the

discontinued entity, China Metal, as of May 31, 2015 and 2014 and for the fiscal years then ended.

NOTE 2 – DISCONTINUED OPERATIONS

In May 2015, the

Company approved plans to dispose of its subsidiary China Metal, including China Metal’s wholly-owned subsidiary, Changzhou

Huayue. Management elected to dispose of the entities because the Company intends to focus its operations outside of China and

rather in the U.S. and other foreign markets. On June 2, 2015, the Company entered into a Stock Purchase Agreement to sell 100%

of the issued and outstanding shares of common stock of China Metal. The Company completed the sale on June 9, 2015.

In accordance with

ASC 205-20, China Metal, and its wholly-owned subsidiary Changzhou Huayue, have been presented as a discontinued business in the

consolidated financial statements for the fiscal year ended May 31, 2015. Previously reported results for the comparable year ended

May 31, 2014 have been reclassified to reflect this presentation.

The operational results of China Metal are

presented in the “Net income from discontinued operations, net of taxes” line item on the consolidated statements of

income. The assets and liabilities of the discontinued business are presented on the consolidated balance sheets as assets and

liabilities from discontinued operations.

HUAYUE ELECTRONICS,

INC.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

On June 12, 2015,

the Company completed its sale of China Metal. The Company purchased 10,000,000 shares of HUAY common shares from the seller at

a market value of $0.55 per share for an aggregate purchase price of $5,500,000. The Company delivered to the seller 100% of the

outstanding capital stock of China Metal.

The major components

of net (loss) income from discontinued operations were as follows:

| | |

Fiscal Year Ended May 31, | |

| | |

2015 | | |

2014 | |

| | |

| | |

(Restated) | |

| Net sales | |

$ | 6,930,162 | | |

$ | 12,239,726 | |

| Cost of goods sold | |

| 4,425,503 | | |

| 8,122,277 | |

| Gross profit | |

| 2,504,659 | | |

| 4,117,449 | |

| Selling expenses | |

| 31,362 | | |

| 58,037 | |

| General and administrative expenses | |

| 7,412,847 | | |

| 1,500,862 | |

| (Loss) income from operations | |

| (15,659,804 | ) | |

| 2,558,550 | |

| (Loss) income before income taxes | |

| (15,504,124 | ) | |

| 2,695,378 | |

| Net (loss) income | |

| (13,178,506 | ) | |

| 2,291,071 | |

| Realization of discontinued operations accumulated other comprehensive income (loss) | |

| 130,365 | | |

| - | |

| Net (loss) income from discontinued operations, net of taxes | |

$ | (13,048,140 | ) | |

$ | 2,291,071 | |

The major classes of assets and liabilities

from discontinued operations were as follows:

| | |

As of May 31, | |

| | |

2015 | | |

2014 | |

| | |

| | |

(Restated) | |

| Cash | |

$ | 48,161 | | |

$ | 344,636 | |

| Accounts and other receivables | |

| 2,776,773 | | |

| 7,415,964 | |

| Advances to suppliers | |

| 1,866,075 | | |

| 288,183 | |

| Investment in sales-type lease | |

| 2,384,088 | | |

| 1,000,168 | |

| Total current assets | |

| 8,703,090 | | |

| 9,890,531 | |

| Property and equipment | |

| 1,045,827 | | |

| 12,740,996 | |

| Investment in sales-type lease - noncurrent | |

| 2,950,151 | | |

| 1,184,000 | |

| Total assets | |

$ | 12,864,758 | | |

$ | 23,850,013 | |

| | |

| | | |

| | |

| Short-term loans | |

| 2,984,834 | | |

| 2,960,474 | |

| Accounts payable | |

| 2,630,700 | | |

| 3,062,789 | |

| Taxes payable | |

| 2,685,297 | | |

| 2,940,416 | |

| Due to related parties | |

| 2,136,921 | | |

| 592,095 | |

| Total current liabilities | |

| 11,928,595 | | |

| 10,038,813 | |

| Total liabilities | |

$ | 12,266,185 | | |

$ | 10,203,300 | |

HUAYUE ELECTRONICS,

INC.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

NOTE 3 - RESTATEMENT OF PREVIOUSLY

ISSUED FINANCIAL STATEMENTS

Subsequent to the

filing of its Annual Report on Form 10K for the year ended May 31, 2014, the Company reviewed its measurement for inventory valuation,

and determined that the estimate for the inventory valuation had been understated. Certain sales transactions occurred through

the date the financial statements were issued in which the sales price of certain products was substantially lower than its cost,

indicating that the book value of all similar inventory should be reduced. In accordance with ASC 855, “Subsequent Event”,

management reassessed and recorded a loss of $1,553,366 on reduction of inventory to the lower of cost or market for the fiscal

year ended May 31, 2014.

The effects of

the adjustments on the Company’s previously issued balance sheet as of May 31, 2014 is summarized as follows:

| | |

Previously | | |

Impact of | | |

| |

| | |

Reported | | |

Restatement | | |

Restated | |

| Assets: | |

| | | |

| | | |

| | |

| Inventory, net | |

$ | 1,972,209 | | |

$ | (1,523,760 | ) | |

$ | 448,449 | |

| Deferred tax assets | |

| 164,567 | | |

| 228,564 | | |

| 393,131 | |

| Total current assets | |

| 11,185,727 | | |

| (1,296,196 | ) | |

| 9,890,531 | |

| Total assets | |

| 25,145,209 | | |

| (1,295,196 | ) | |

| 23,850,013 | |

| | |

| | | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | | |

| | |

| Statutory reserves | |

| 768,133 | | |

| (132,036 | ) | |

| 636,097 | |

| Accumulated other comprehensive income | |

| 114,447 | | |

| 25,165 | | |

| 139,612 | |

| Retained earnings | |

| 7,161,649 | | |

| (1,188,325 | ) | |

| 5,973,324 | |

| Total stockholders’ equity | |

| 14,941,909 | | |

| (1,295,196 | ) | |

| 13,646,713 | |

| Total liabilities and stockholders’ equity | |

$ | 25,145,209 | | |

$ | (1,295,196 | ) | |

$ | 23,850,013 | |

Note -

The restatement above refers to the operations of the discontinued entity. Statutory reserves were reclassified into retained earnings per the consolidated financial statements.

NOTE 4 - SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Principles of consolidation

The consolidated

financial statements include the financial statements of the Company and its subsidiaries. All inter-company transactions and balances

are eliminated in consolidation.

Use of estimates

The preparation

of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements,

as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Significant accounting estimates reflected in the Company’s consolidated financial statements include: the allowance for

bad debt, the valuation of inventory, and estimated useful lives and impairment of property and equipment. Actual results

could differ from those estimated by management.

HUAYUE ELECTRONICS,

INC.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

Non-controlling interests

Non-controlling

interests in our subsidiaries are recorded in accordance with the provisions of ASC 810 “Consolidation”, and are reported

as a component of equity, separate from the parent company’s equity. Purchase or sale of equity interests that do not result

in a change of control are accounted for as equity transactions. Results of operations attributable to the non-controlling interests

are included in our consolidated results of operations and, upon loss of control, the interest sold, as well as interest retained,

if any, will be reported at fair value with any gain or loss recognized in earnings.

There is a non-controlling

interest who owns 49% of the partnership interest in the Company’s subsidiary, SavWatt Kaz, Ltd. There were no non-controlling

interest balances per the financial statements as SavWatt did not have any operations for the year ended May 31, 2015.

Cash and cash equivalents

For purposes of

the statement of cash flow, the Company considers all highly liquid investments with an original maturity of three months or less

to be cash equivalents.

Revenue recognition

The Company’s

revenue is derived from the sale of products. The Company’s revenue recognition policies are in compliance with Staff Accounting

Bulletin 104, included in the Accounting Standards Codification (“ASC”) as ASC 605, Revenue Recognition.

Our determination to recognize revenue is based on the following:

| · | Persuasive evidence that an arrangement (sales contract) exists between a willing customer and the Company that outlines

the terms of

the sale (including customer information, product specification, quantity of goods, purchase price and payment

terms). |

| · | Delivery is considered to have occurred when the risks, rewards and ownership of the products are transferred from us to our

customers. |

| · | The Company’s price to the customer is fixed and determinable as specifically outlined in the sales contract. |

| · | For customers to whom credit terms are extended, the Company assesses a number of factors to determine whether

collection

from them

is probable,

including past transaction history with them and their credit-worthiness. All credit extended to customers is

pre-approved by management. If Management determines that collection is not reasonably assured, the Company will defer the

recognition of

revenue until

collection becomes reasonably assured, which is generally upon receipt of payment. |

Payments received

before satisfaction of all of the relevant criteria for revenue recognition are recorded as advance from customers.

Income taxes

The Company accounts

for income tax under the asset and liability method as stipulated by ASC 740, which requires recognition of deferred tax assets

and liabilities for the expected future tax consequences of the events that have been included in the financial statements or tax

returns. Deferred income taxes will be recognized if significant temporary differences between tax and financial statements occur.

Valuation allowances are established against net deferred tax assets when it is more likely than not that some portion or all of

the deferred tax asset will not be realized. As of May 31, 2015 and 2014, no valuation allowance is considered necessary.

HUAYUE ELECTRONICS,

INC.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

An uncertain tax

position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained in

a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that

is greater than 50% likely of being realized on examination. For tax positions not meeting the “more likely than not”

test, no tax benefit is recorded. Penalties and interest incurred related to underpayment of income tax are classified as income

tax expense in the period incurred. No significant penalties or interest relating to income taxes have been incurred during the

fiscal years ended May 31, 2015 and 2014.

Fair value of financial instruments

The Financial Accounting

Standards Board’s ASC Topic 820, “Fair Value Measurements”, defines fair value, establishes a three-level valuation

hierarchy for fair value measurements and enhances disclosure requirements.

The three levels

are defined as follows:

Level

1 - inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level

2 - inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, quoted market

prices for identical or similar assets in markets that are not active, inputs other than quoted prices that are observable, and

inputs derived from or corroborated by observable market data.

Level

3 - inputs to the valuation methodology are unobservable.

The Company’s accounts payable

and accrued expenses approximate fair values due to their short-term maturities.

Foreign currency translation

The functional

currency of the U.S. parent company is USD. The functional currency of the discontinued subsidiary is RMB and its reporting currency

is U.S dollars for the purpose of these financial statements. The accounts of the Chinese subsidiary were translated

into USD in accordance with ASC Topic 830 “Foreign Currency Matters,” According to Topic 830, all assets and liabilities

were translated at the exchange rate on the balance sheet date; stockholders’ equity is translated at historical rates and

statement of income items are translated at the weighted average exchange rate for the period. The resulting translation adjustments

are reported under other comprehensive income in accordance with ASC Topic 220, “Comprehensive Income.” Gains and losses

resulting from the translations of foreign currency transactions and balances are reflected in the statements of income and other

comprehensive income.

Reclassification

Certain prior period

amounts have been reclassified to conform to the current period presentation. The reclassification had no impact on net income

or cash.

Certain items of

the discontinued entity, such as statutory reserves, were reclassified to retained earnings

in the consolidated statements of changes in stockholders’ equity.

NOTE 5 - STOCKHOLDERS’ EQUITY

Pursuant to the

Partnership Interest Purchase Agreement dated April 23, 2015, the Company issued 3,000,000 common shares to a related party. Refer

to Note 6 for further discussion.

HUAYUE ELECTRONICS,

INC.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

As of May 31, 2015

and 2014, the Company had 34,325,241 and 31,325,241 shares issued and outstanding, respectively.

NOTE 6 – RELATED PARTY TRANSACTIONS

An individual or

entity is considered to be a related party if the person or the entity has the ability, directly or indirectly, to control the

other party or exercise significant influence over the other party in making financial and operational decisions. An individual

or entity is also considered to be related if the person or the entity is subject to common control or common significant influence.

On April 23,

2015, the Company issued 3,000,000 common shares to Sutton Global Associates, Inc. (“Sutton Global”), the owner

of SavWatt Kaz Ltd., for a 51% controlling interest in SavWatt. Sutton Global is controlled by the chief executive officer

of the Company. At May 31, 2015, Sutton Global owned 8.7% of the Company’s outstanding common stock.

In accordance with

ASC Topic 805-50-05, ‘Transactions Between Entities Under Common Control’, the acquisition of SavWatt was recorded

at carrying value, i.e. the par value of common stock. The par value of common shares issued of $3,000 is treated as a distribution

to the shareholder and a reduction to retained earnings in the consolidated statements of changes in stockholders’ equity.

In May 2015, the

Company approved plans to sell 100% of China Metal as part of its disposition plans. Per the Stock Purchase Agreement dated June

2, 2015, the buyer is an officer and director of China Metal and Changzhou Huayue. The sale was recorded as an arm’s-length

transaction.

In April 2015,

Shudong Pan, Han Zhou and Qing Biao resigned as Chief Executive Officer, Chief Financial Officer and Secretary, respectively, of

the Company. Mr. Pan and Mr. Zhou will continue as Chief Executive Officer and Chief Financial Officer, respectively, of the discontinued

Chinese entities.

Related parties

of the discontinued entity at May 31, 2015 and May 31, 2014 consist of the following:

| Name of entity or individual |

|

Relationship with the Discontinued Entity |

| Changzhou Wujin Hengtong Metal Steel Wires Co. Ltd. |

|

Entity controlled by Ms. Pan Yile’s family members |

| Changzhou Hanyu Electronic Co., Ltd |

|

Entity controlled by Mr. Pan Shudong’s sister |

| Chuangzhou Ruiyuan Steel Pipe Co. Ltd |

|

Entity controlled by Mr. Pan Shudong’s sister |

| Changzhou Shiji Jinyue Packaging Co.,Ltd |

|

Entity controlled by Mr. Pan Shudong’s brother in law |

| Changzhou Laiyue Electronic Co.,Ltd |

|

Entity controlled by Mr. Pan Shudong |

| Changzhou Jinyue Electronic Co.,Ltd |

|

Entity controlled by Mr. Pan Shudong’s brother in-law |

| (i) | Due from related parties |

At May 31, 2015 and 2014, there were no

amounts due from related parties.

| (ii) | Due to related parties |

Due to related parties at May

31, 2015 and 2014 consisted of the following:

| | |

| May 31, 2015 | | |

| May 31, 2014 | |

| Changzhou Wujin Hengtong Metal | |

$ | 282,349 | | |

$ | 320,051 | |

| Changzhou Shiji Jinyue Packaging | |

| 838,980 | | |

| - | |

| Ruiyuan Steel Pipe Co. Ltd Changzhou | |

| - | | |

| 192,031 | |

| Changzhou Laiyue Electronic | |

| 6,944 | | |

| - | |

| Changzhou Jinyue Electronic | |

| 886,092 | | |

| - | |

| Hanyu Electronic Co., Ltd | |

| - | | |

| 80,013 | |

| Li Ximmei | |

| 122,556 | | |

| - | |

| Due to related parties | |

$ | 2,136,921 | | |

$ | 592,095 | |

Due to related parties were unsecured,

had no written agreement were due on demand with no maturity date, and bare no interest.

NOTE 7 – COMMITMENTS AND CONTINGENCIES

On April 27, 2015, the Company entered into

an employment agreement with Isaac H. Sutton to serve as Chief Executive Officer of the Company. The agreement provides for an

initial term of three years and will terminate on April 27, 2018. The employment agreement will be extended automatically for successive

one-year periods thereafter unless the Company or Mr. Sutton gives written notice to the other to allow the employment agreement

to expire. Mr. Sutton will be paid an initial annual base salary of $120,000. In addition, Mr. Sutton will be eligible to receive

each year an incentive bonus in an amount up to 100% of his base salary and a revenue bonus in an amount equal to 0.75% of the

amount by which the Company’s net revenues in such year exceed $25 million.

HUAYUE ELECTRONICS,

INC.

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

Subject to the approval of the Board,

the Company will also grant to Mr. Sutton a stock option to purchase 3,000,000 shares of the Company’s common stock at a

price per share not less than the per-share fair market value of the common stock on the date of grant. The option will vest with

respect to one-third of the shares on the first anniversary of the date of grant and as to the remaining two-thirds of the shares

in 24 equal monthly installments thereafter.

The employment

agreement also provides that Mr. Sutton will be entitled to participate in any short-term and long- term incentive plans generally

available to executive officers of the Company, to participate with other executive officers in any of the Company’s employee

fringe benefit plans, and to be reimbursed for certain business-related expenses. In addition, the employment agreement provides

for certain benefits upon termination of Mr. Sutton’s employment under certain circumstances, including a change of control

of the Company, as defined in the employment agreement, and to certain death benefits.

NOTE 8 – RECENT

ACCOUNTING PRONOUNCEMENTS

In April 2014,

the FASB issued authoritative guidance, which specifies that only disposals, such as a disposal of a major line of business, representing

a strategic shift in operations should be presented as discontinued operations. In addition, the new guidance requires expanded

disclosures about discontinued operations that will provide financial statement users with more information about the assets, liabilities,

income, and expenses of discontinued operations. The Company has adopted the guidance as described in Note 2.

NOTE 9 - SUBSEQUENT

EVENTS

Pursuant to the

Stock Purchase Agreement dated June 2, 2015, the Company sold 100% of the issued and outstanding common shares of its wholly-owned

subsidiary, China Metal, to Shudong Pan, the Company’s Chairman of the Board and Chief Executive Officer at such time, in

consideration of 10,000,000 shares of the Company’s outstanding common stock. The sale was completed on June 12, 2015.

On June 12, 2015,

the Board and shareholders approved the increase of authorized common stock from 60,000,000 to 150,000,000 shares. The Board also

approved the increase of authorized preferred stock from 1,000,000 to 10,000,000 shares.

On June 12, 2015,

the Board accepted the resignations of Shudong Pan and Ximmei Li from the Board of Directors. The Board appointed Dr. Yunzhoung

Wu and Yile Lisa Pan to the Board of Directors effective immediately.

On July 24, 2015,

the Board elected Miller Mays III and Randall Satin to the Board of Directors.

In August 2015,

the Company agreed to issue options to purchase 2,000,000 shares of common stock per consulting agreements. These options, as well

as the options per Isaac H. Sutton’s employment agreement, are subject to Board approval at the time of this report.

On September 10,

2015, the Company entered into a purchase agreement to acquire 100% of the limited liability membership interests of BlueCo Energy

LLC, a New York limited liability company (“BlueCo”), in consideration for the issuance of 20,000,0000 common shares.

Upon closing, the Company will issue the common shares to GoCOM Corporation, a Nevada corporation (“GoCOM”), which

is controlled by Isaac H. Sutton.

PART

IV

| ITEM 15. | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES |

| 3.1 |

Certificate of Incorporation - filed as an exhibit to the Company’s Registration Statement on Form 8-A on November 19, 2010 and incorporated herein by reference. |

| |

|

| 3.2 |

Certificate of Amendment of Certificate of Incorporation dated August 16, 2006 - filed as an exhibit to the Company’s Registration Statement on Form 8-A on November 19, 2010 and incorporated herein by reference. |

| |

|

| 3.3 |

Certificate of Amendment of Certificate of Incorporation dated October 17, 2011 - filed as an exhibit to the Company’s Current Report on Form 8-K on November 3, 2011 and incorporated herein by reference. |

| |

|

| 3.4 |

Bylaws - Filed as an exhibit to the Company’s Registration Statement on Form 8-A on November 19, 2010 and incorporated herein by reference. |

| |

|

| 10.1 |

Entrusted Management Agreement dated September 31, 2011 among HXT Holdings, Inc., Pan Shudong and Li Xinmei - filed as an exhibit to the Company’s Current Report on Form 8-K on September 2, 2011 and incorporated herein by reference. |

| |

|

| 10.2 |

Partnership Interest Purchase Agreement, dated as of April 23,

2015, by and between the Company and Sutton Global Associates Inc. – filed as exhibit 2.1 to the Company’s Current

Report on Form 8-K filed with the SEC on May 1, 2015 and incorporated herein by reference (The exhibits and schedules to the Asset

Purchase Agreement have been omitted. The Company will furnish such exhibits and schedules to the SEC upon request.) |

| |

|

| 10.3 |

Employment Agreement dated as of April 22, 2015 between the

Company and Isaac H. Sutton – filed as exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC

on May 1, 2015 and incorporated herein by reference.

|

| 10.4 |

Stock Purchase Agreement, dated June 12, 2015, between the Company and Shudang Pan – filed as exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the SEC on June 25, 2015 and incorporated herein by reference. |

| |

|

| 10.5 |

Shareholders’ Agreement dated as of June 12, 2015 among the Company and Shudang Pan, Xinmei Li, Kuanlian Peng, Hao Wang, Jianxin Li, Shurong Li and Sutton Global Associates Inc. – filed as exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on June 25, 2015 and incorporated herein by reference. |

| 10.6* |

Membership Interest Purchase Agreement dated

as of September 10, 2015 between the Company and GoCOM Corporation. (The exhibits and schedules to the

Membership Interest Agreement have been omitted. The Company will furnish such exhibits and schedules to the SEC upon

request.) |

| |

|

| 21 |

Subsidiaries – 51% ownership interest in SavWatt Kazakhstan Ltd., a limited liability partnership organized under the laws of Kazakhstan. |

| |

|

| 31** |

Rule 13a-14(a) Certification of principal executive officer and principal financial officer |

| |

|

| 32** |

Rule 13a-14(b) Certification of principal executive officer and principal financial officer |

| |

|

| 101 INS** |

XBRL Instance Document |

| |

|

| 101 SCH** |

XBRL Schema Document |

| |

|

| 101 CAL** |

XBRL Calculation Linkbase Document |

| |

|

| 101 DEF** |

XBRL Definition Linkbase Document |

| |

|

| 101 LAB** |

XBRL Labels Linkbase Document |

| |

|

| 101 PRE** |

XBRL Presentation Linkbase Document |

| | * | Previously filed |

| ** | Filed herewith |

SIGNATURES

Pursuant to the

requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed

on its behalf by the undersigned, thereunto duly authorized.

|

|

HUAYUE ELECTRONICS, INC. |

| |

|

|

| Date: October 13, 2015 |

By: |

/s/ Isaac H. Sutton |

| |

Name: |

Isaac H. Sutton |

| |

Title: |

Chief Executive Officer |

EXHIBIT 31

Rule 13a-14(a) Certification

I, Isaac H. Sutton, certify that:

1. I have reviewed this Amendment No. 1 to annual report

on Form 10-K of Huayue Electronics, Inc.;

2. Based on my knowledge, this report does not contain any untrue

statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances

under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other

financial information included in this report, fairly present in all material respects the financial condition, results of operations

and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officers and I are

responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-14 and 15d-14)

and internal controls over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and

have:

a) Designed such disclosure controls and procedures, or caused

such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the

registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the

period in which this report is being prepared;

b) Designed such internal controls over financial reporting,

or caused such internal controls over financial reporting to be designed under our supervision, to provide reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance

with generally accepted accounting principles;

c) Evaluated the effectiveness of the registrant’s disclosure

controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures,

as of the end of the period covered by this report based on such evaluation; and

d) Disclosed in this report any change in the registrant’s

internal controls over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s

fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect,

the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officers and I have

disclosed, based on our most recent evaluation of internal controls over financial reporting, to the registrant’s auditors

and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a) All significant deficiencies and material weaknesses in the

design or operation of internal controls over financial reporting which are reasonably likely to adversely affect the registrant’s

ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management

or other employees who have a significant role in the registrant’s internal controls over financial reporting.

| Date:October 13, 2015 |

/s/Isaac H. Sutton |

| |

Isaac H. Sutton |

| |

Chief Executive Officer |

| |

(Principal Executive Officer and Principal Financial Officer) |

EXHIBIT 32

Rule 13a-14(a) Certification

The undersigned officer certifies that, to the best of

my knowledge and belief, this Amendment No. 1 to annual report on Form 10-K fully complies with the requirements of Section

13(a) or 15(d) of the Securities Exchange Act of 1934, and that the information contained in the report fairly presents,

in all material respects, the financial condition and results of operations of Huayue Electronics, Inc.

A signed original of this written statement required by Section

906 has been provided to Huayue Electronics, Inc. and will be retained by Huayue Electronics, Inc. and furnished to the Securities

and Exchange Commission or its staff upon request.

| Date: October 13, 2015 |

/s/Isaac H. Sutton |

| |

Isaac H. Sutton |

| |

Chief Executive Officer |

| |

(Principal Executive Officer and Principal Financial Officer) |

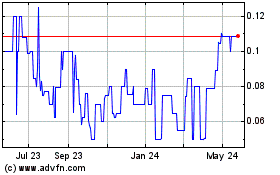

Tarsier (CE) (USOTC:TAER)

Historical Stock Chart

From Mar 2025 to Apr 2025

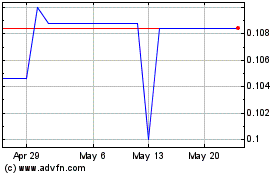

Tarsier (CE) (USOTC:TAER)

Historical Stock Chart

From Apr 2024 to Apr 2025