Talon International, Inc. Reports 2013 Fourth Quarter and Fiscal

Year Financial Results

Significant Year-Over-Year Revenue and Operating Income

Increases

LOS ANGELES, CA--(Marketwired - Mar 24, 2014) - Talon

International, Inc. (OTCQB: TALN), a leading global supplier of

zippers, apparel fasteners, trim and interlining products, reported

financial results for the fourth quarter and year ended December

31, 2013.

Highlights

- Total Sales in 2013 exceeded $52 million -- an

18.0% increase over 2012.

- Talon Brand zipper sales increased 30.3% over zipper sales

in 2012.

- Operating income in 2013 of $2.8 million -- nearly 3 times

the operating income in 2012.

Financial Results

Total sales for the year ended December 31, 2013 were $52.4

million reflecting an 18% year-over-year increase compared to

2012. Zipper sales were $28.8 million in 2013, as compared to

$22.1 million for the same period in 2012; an increase of more than

30% as the Company's products achieved a greater share from major

retail branded customers and new specialty apparel customers

adopted the Talon product. Trim sales of $23.6 million in 2013

reflected a 5% increase from 2012, as specialty customers continued

to grow their core programs with the Company. Sales for 2013

included $79,000 of Tekfit patented stretchable waistbands, which

more than doubled Tekfit sales achieved in 2012, reflecting test

marketing programs of several major retailers considering the

adoption of this product into their core product

categories. Total sales for the fourth quarter ended December

31, 2013 were $11.9 million, reflecting a 5% increase above the

same period in 2012. Total sales for the quarter include $5.6

million in Zipper sales, up approximately $600,000, and $6.3

million in Trim sales which were $72,000 lower than the same period

in 2012.

"We are very pleased with our performance in fiscal year 2013,"

noted Lonnie Schnell, Talon's Chief Executive Officer. "We saw

solid performance in 2013 from all of our product lines as we

continued to strengthen our position with core customers as well as

build upon our global brand nominations. We ended the year with our

seventh consecutive quarterly increase in revenues and quarterly

net income results," Schnell continued.

Gross profit for the year ended December 31, 2013 was $17.0

million or 32.4% of sales, as compared to $14.5 million for the

year ended December 31, 2012; an increase of $2.5 million. Gross

profit for the quarter ended December 31, 2013 was $3.7 million,

effectively the same as the gross profit for the same quarter in

2012. The gross profit increase for the year as compared to the

same period in 2012 was principally attributable to the higher

sales, and an improved mix of sales to specialty retailers as

opposed to discount mass merchandisers.

Operating expenses for the year ended December 31, 2013 were

$14.2 million, reflecting an increase of $0.7 million or just 5.6%

over the total operating expenses for the year in 2012. Operating

expenses for the fourth quarter of 2013 were $3.6 million, which is

$79,000 greater than the operating expenses during the fourth

quarter of 2012. Sales and marketing expenses for the year ended

December 31, 2013 were $5.9 million, approximately $1.0 million

greater than sales and marketing expenses in 2012 as the Company

continued expanding and strengthening its sales presence in the

U.S., Europe and Asia. General and administrative expenses for

the year ended December 31, 2013 totaled $8.3 million, a decrease

of approximately $165,000 as the Company carefully maintained cost

controls for the year and also benefited from a $350,000 settlement

from its trademark infringement litigation. Sales and marketing

expenses for the quarter ended December 31, 2013 were $1.5 million;

the same as for the fourth quarter in 2012. General and

administrative expenses for the quarter ended December 31, 2013

totaled $2.1 million, increasing only $59,000 over the general and

administrative expense for the same period in 2012.

"The combination of double digit growth in our revenues for the

year, solid gross margin results and careful control of our

operating costs, drove the increase in our income from operations

to $2.8 million for the year ended December 31, 2013 as compared to

only $995,000 in 2012. We believe our business model is solid, and

our sales and marketing strategies are strong, allowing us to now

build quickly upon our base and bring substantial incremental

increases to our shareholders," noted Schnell.

The income before income taxes for the year ended December 31,

2013 was $2.7 million. At December 31, 2013, the Company

recognized approximately $7.5 million in deferred income tax

benefits against which it had previously provided valuation

reserves because it was unlikely it could assure future earnings

sufficient to utilize these tax benefits. The Company has now

determined that more likely than not, it will generate sufficient

future earnings to realize these tax benefits, and consequently the

valuation reserves have been removed. As a result of this

position, the net income for the year ended December 31, 2013 was

$9.7 million as compared to $679,000 for the same period in

2012. The net income for the quarter ended December 31, 2013

was $7,488,000 as compared to net income of $27,000 for the same

quarter in 2012.

Net income per share applicable to common shareholders for the

year ended December 31, 2013 was $0.24 per diluted share as

compared to a net loss per share applicable to common shareholders

of $0.12 per diluted share for the same period in 2012. The

net income per share for fiscal year 2013 includes the one-time

benefit from the tax adjustment noted above, as well as a one-time

benefit from the redemption of the preferred shares that was

reported in the third quarter. The net income per share

applicable to common shareholders for the year ended December 31,

2012 includes $0.15 per share previously allocated to the preferred

shares, which are now fully redeemed.

Total shareholders' equity increased to a positive $4.4 million

at December 31, 2013 as compared to a net shareholders' deficit of

$16.0 million at December 31, 2012. The increase in

shareholders' equity of $20.5 million is principally the result of

the net earnings from operations, the income tax benefit upon

recognition of the deferred tax assets, the gain realized upon the

redemption of the previously outstanding preferred shares and the

related private placement of common stock.

Forward Looking Statements

This release contains forward-looking statements made in

reliance upon the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include,

but are not limited to, the Company's views on market growth,

changing trends in apparel retailing, new product introductions,

and the Company's ability to execute on its sales strategies, and

are generally identified by phrases such as "thinks,"

"anticipates," "believes," "estimates," "expects," "intends,"

"plans," and similar words. Forward-looking statements are not

guarantees of future performance and are inherently subject to

uncertainties and other factors which could cause actual results to

differ materially from the forward-looking statement. These

statements are based upon, among other things, assumptions made by,

and information currently available to, management, including

management's own knowledge and assessment of the Company's

industry, competition and capital requirements. These and other

risks are more fully described in the Company's filings with the

Securities and Exchange Commission including the Company's most

recently filed Annual Report on Form 10-K and Quarterly Report on

Form 10-Q, which should be read in conjunction herewith for a

further discussion of important factors that could cause actual

results to differ materially from those in the forward-looking

statements. The Company undertakes no obligation to publicly update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise.

Conference Call

Talon International will hold a conference call on Monday, March

24, 2014, to discuss its fourth quarter and year-end financial

results for 2013. Talon's CEO Lonnie D. Schnell will host the call

starting at 4:30 P.M. Eastern Time. A question and answer session

will follow the presentation.

To participate, dial the appropriate number 5-10 minutes prior

to the start time, request the Talon International conference call

and provide the conference ID.

Date: Monday, March 24, 2013 Time: 4:30 p.m. Eastern Time (1:30

p.m. Pacific Time) Domestic callers: 1-877-300-8521

International callers: 1-412-317-6026

Conference ID#: TALON

A replay of the call will be available after 7:30 p.m. Eastern

Time on the same day and until April 24, 2014. The toll-free replay

call-in number is 1-877-870-5176 for

domestic callers and 1-858-384-5517 for

international. Pin number 10043114.

About Talon International, Inc. Talon International, Inc. is a

major supplier of custom zippers, complete trim solutions and

stretch technology products to manufacturers of fashion apparel,

specialty retailers, mass merchandisers, brand licensees and major

retailers worldwide. Talon develops, manufactures and distributes

custom zippers exclusively under its Talon® brand ("The World's

Original Zipper Since 1893"); designs, develops, manufactures, and

distributes complete apparel trim solutions and products; and

provides stretch technology for specialty waistbands all under its

trademark and world renowned brands, Talon®, and TekFit® to major

apparel brands and retailers. Leading retailers worldwide recognize

and use Talon products including Abercrombie and Fitch, Polo Ralph

Lauren, Kohl's, J.C. Penney, Fat Face, Victoria's Secret, Wal-Mart,

Tom Tailor, Phillips-Van Heusen, Juicy Couture, and many others.

The Company is headquartered in the greater Los Angeles area, and

has offices and facilities throughout the United States, United

Kingdom, Hong Kong, China, Taiwan, India, Indonesia and

Bangladesh.

| |

|

| |

|

| TALON INTERNATIONAL, INC. |

|

| CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME |

|

| |

|

| |

|

Quarters Ended December 31, |

|

|

Years Ended December 31, |

|

| |

|

(Unaudited) |

|

|

(Audited) |

|

| |

|

2013 |

|

|

2012 |

|

|

2013 |

|

|

2012 |

|

| Net sales |

|

$ |

11,938,636 |

|

|

$ |

11,386,356 |

|

|

$ |

52,447,387 |

|

|

$ |

44,600,872 |

|

| Cost of goods sold |

|

|

8,278,085 |

|

|

|

7,706,312 |

|

|

|

35,474,536 |

|

|

|

30,140,471 |

|

| |

Gross

profit |

|

|

3,660,551 |

|

|

|

3,680,044 |

|

|

|

16,972,851 |

|

|

|

14,460,401 |

|

| Sales and marketing expenses |

|

|

1,524,345 |

|

|

|

1,505,013 |

|

|

|

5,889,087 |

|

|

|

4,974,037 |

|

| General and administrative expenses |

|

|

2,115,483 |

|

|

|

2,056,027 |

|

|

|

8,326,540 |

|

|

|

8,491,596 |

|

| |

Total

operating expenses |

|

|

3,639,828 |

|

|

|

3,561,040 |

|

|

|

14,215,627 |

|

|

|

13,465,633 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

20,723 |

|

|

|

119,004 |

|

|

|

2,757,224 |

|

|

|

994,768 |

|

| Interest expense, net |

|

|

14,561 |

|

|

|

(402 |

) |

|

|

25,777 |

|

|

|

47,308 |

|

| Income before provision for income taxes |

|

|

6,162 |

|

|

|

119,406 |

|

|

|

2,731,447 |

|

|

|

947,460 |

|

| Provision for (benefit from) income taxes, net |

|

|

(7,481,801 |

) |

|

|

92,428 |

|

|

|

(6,999,640 |

) |

|

|

268,113 |

|

| Net income |

|

$ |

7,487,963 |

|

|

$ |

26,978 |

|

|

$ |

9,731,087 |

|

|

$ |

679,347 |

|

| Available to Preferred Stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Series B Preferred Stock liquidation preference

increase |

|

|

- |

|

|

|

(899,221 |

) |

|

|

(1,914,470 |

) |

|

|

(3,307,478 |

) |

| Series B Preferred Stock redemption discount, net |

|

|

- |

|

|

|

- |

|

|

|

6,939,257 |

|

|

|

- |

|

| Net income (loss) applicable to Common

Stockholders |

|

$ |

7,487,963 |

|

|

$ |

(872,243 |

) |

|

$ |

14,755,874 |

|

|

$ |

(2,628,131 |

) |

| Per share amounts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

0.08 |

|

|

$ |

- |

|

|

$ |

0.17 |

|

|

$ |

0.03 |

|

| Net income (applicable to) redeemed from Preferred

Stockholders |

|

|

- |

|

|

|

(0.04 |

) |

|

|

0.09 |

|

|

|

(0.15 |

) |

| Basic net income (loss) applicable to Common

Stockholders |

|

$ |

0.08 |

|

|

$ |

(0.04 |

) |

|

$ |

0.26 |

|

|

$ |

(0.12 |

) |

| Diluted net income (loss) applicable to Common

Stockholders |

|

$ |

0.08 |

|

|

$ |

(0.04 |

) |

|

$ |

0.24 |

|

|

$ |

(0.12 |

) |

| Weighted average number of common shares outstanding -

Basic |

|

|

91,573,195 |

|

|

|

23,400,808 |

|

|

|

56,213,272 |

|

|

|

22,458,185 |

|

| Weighted average number of common shares outstanding -

Diluted |

|

|

95,002,235 |

|

|

|

23,400,808 |

|

|

|

60,554,721 |

|

|

|

22,458,185 |

|

| Net income |

|

$ |

7,487,963 |

|

|

$ |

26,978 |

|

|

$ |

9,731,087 |

|

|

$ |

679,347 |

|

| Other comprehensive income (loss) - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Foreign currency translation |

|

|

(3,769 |

) |

|

|

15,981 |

|

|

|

47,303 |

|

|

|

5,253 |

|

| Total comprehensive income |

|

$ |

7,484,194 |

|

|

$ |

42,959 |

|

|

$ |

9,778,390 |

|

|

$ |

684,600 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TALON INTERNATIONAL, INC. |

|

| CONSOLIDATED BALANCE SHEETS |

|

| (Audited) |

|

| |

|

| |

|

December 31, |

|

| |

|

2013 |

|

|

2012 |

|

| |

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| |

Cash

and cash equivalents |

|

$ |

3,779,508 |

|

|

$ |

8,927,333 |

|

| |

Accounts receivable, net |

|

|

3,576,925 |

|

|

|

3,635,136 |

|

| |

Inventories, net |

|

|

800,240 |

|

|

|

730,503 |

|

| |

Prepaid expenses and other current assets |

|

|

973,836 |

|

|

|

456,460 |

|

| Total current assets |

|

|

9,130,509 |

|

|

|

13,749,432 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment, net |

|

|

614,592 |

|

|

|

763,770 |

|

| Intangible assets, net |

|

|

4,267,110 |

|

|

|

4,279,943 |

|

| Deferred income tax assets, net |

|

|

6,050,402 |

|

|

|

- |

|

| Other assets |

|

|

460,226 |

|

|

|

182,671 |

|

| Total assets |

|

$ |

20,522,839 |

|

|

$ |

18,975,816 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities, Preferred Stock and Stockholders' Equity

(Deficit) |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| |

Accounts payable |

|

$ |

7,158,938 |

|

|

$ |

7,866,662 |

|

| |

Accrued incentive payments |

|

|

667,500 |

|

|

|

332,815 |

|

| |

Other

accrued expenses |

|

|

2,213,264 |

|

|

|

1,690,720 |

|

| |

Revolving credit loan |

|

|

1,000,000 |

|

|

|

- |

|

| |

Current portion of term loan payable |

|

|

1,666,667 |

|

|

|

- |

|

| |

Current portion of capital lease obligations |

|

|

- |

|

|

|

3,247 |

|

| Total current liabilities |

|

|

12,706,369 |

|

|

|

9,893,444 |

|

| |

|

|

|

|

|

|

|

|

| Term loan payable, net of current portion |

|

|

3,333,333 |

|

|

|

- |

|

| Deferred income tax liabilities |

|

|

30,388 |

|

|

|

945,543 |

|

| Other liabilities |

|

|

22,169 |

|

|

|

186,051 |

|

| Total liabilities |

|

|

16,092,259 |

|

|

|

11,025,038 |

|

| |

|

|

|

|

|

|

|

|

| Series B Convertible Preferred Stock, $0.001 par value;

no shares authorized, issued or outstanding at December 31, 2013;

407,160 shares authorized, issued and outstanding at December 31,

2012 |

|

|

- |

|

|

|

23,979,216 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders' Equity (Deficit): |

|

|

|

|

|

|

|

|

| |

Common Stock, $0.001 par value, 300,000,000 shares

authorized;91,342,215 and 23,400,808 shares issued and outstanding

at December 31, 2013 and December 31, 2012, respectively |

|

|

91,342 |

|

|

|

23,401 |

|

| |

Additional paid-in capital |

|

|

64,046,631 |

|

|

|

58,458,731 |

|

| |

Accumulated deficit |

|

|

(59,822,178 |

) |

|

|

(74,578,052 |

) |

| |

Accumulated other comprehensive income |

|

|

114,785 |

|

|

|

67,482 |

|

| Total stockholders' equity (deficit) |

|

|

4,430,580 |

|

|

|

(16,028,438 |

) |

| Total liabilities, preferred stock and stockholders'

equity (deficit) |

|

$ |

20,522,839 |

|

|

$ |

18,975,816 |

|

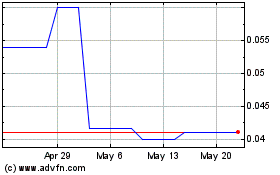

Talon (PK) (USOTC:TALN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Talon (PK) (USOTC:TALN)

Historical Stock Chart

From Jan 2024 to Jan 2025