UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number: 001-13184

TECK RESOURCES LIMITED

(Exact name of registrant as specified in its

charter)

Suite 3300 – 550 Burrard Street

Vancouver, British Columbia V6C 0B3

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form

40-F ☒

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

Teck Resources Limited |

|

| |

(Registrant) |

|

| |

|

|

|

| |

|

|

|

| Date: July 24,

2024 |

By: |

/s/ Amanda R. Robinson |

|

| |

|

Amanda R. Robinson |

|

| |

|

Corporate Secretary |

|

EXHIBIT

99.1

News Release

| For Immediate Release |

Date: July 23, 2024 |

| 24-26-TR |

|

Teck Reports Unaudited Second Quarter Results for

2024

Record quarterly copper production and transformation

to pure-play energy transition metals company

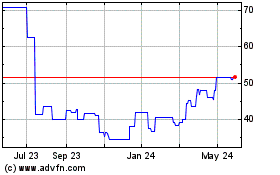

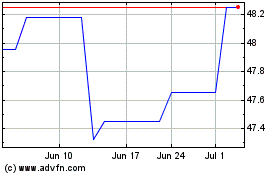

Vancouver, B.C. – Teck Resources Limited (TSX: TECK.A and TECK.B,

NYSE: TECK) (Teck) today announced its unaudited second quarter results for 2024.

"We generated $1.7 billion of Adjusted EBITDA1 in the second

quarter driven by record copper production with QB ramp-up continuing, as well as strong copper market fundamentals with copper prices

reaching all-time highs," said Jonathan Price, President and CEO. "In early July, we completed the sale of our steelmaking coal

business, and we now move forward as a pure-play energy transition metals company with leading copper growth. With cash proceeds of US$7.3

billion we will reduce debt, retain cash to fund our near-term copper growth, and return significant cash to our shareholders."

Highlights

| • | Adjusted EBITDA1 of $1.7 billion in Q2 2024 was

driven by record copper production as Quebrada Blanca (QB) continues to ramp-up operations, as well as strong copper prices and steelmaking

coal sales volumes. Profit from continuing operations before taxes was $658 million in Q2 2024. |

| • | Adjusted profit from continuing operations attributable to

shareholders1 was $413 million, or $0.80 per share, in Q2 2024. Profit from continuing operations attributable to shareholders

was $363 million, $0.70 per share, in Q2 2024. |

| • | On July 11, 2024, we completed the sale of the remaining

77% interest in our steelmaking coal business, Elk Valley Resources (EVR) and received cash proceeds of US$7.3 billion, subject to customary

closing adjustments. We will deploy the cash proceeds to reduce debt, fund our near-term copper growth, and return significant cash to

our shareholders. |

| • | With the proceeds from the sale of the steelmaking coal business,

the Board authorized up to a $2.75 billion share buyback and approved payment of an eligible dividend of $0.625 per share, including a

$0.50 per share supplemental dividend, payable on September 27, 2024 to shareholders of record on September 13, 2024. Combined with the

$500 million share buyback announced in February, total cash returns to shareholders of $3.5 billion from the sale of the steelmaking

coal business have been authorized. |

| • | On July 15, 2024, we purchased US$1.4 billion of our public

notes through a bond tender offer. |

| • | Our liquidity as at July 23, 2024 is $14.3 billion,

including $8.7 billion of cash. We generated cash flows from operations of $1.3 billion in Q2. |

| • | We returned a total of $346 million to shareholders in the

second quarter through the purchase of $282 million of Class B subordinate voting shares pursuant to our normal course issuer bid, and

$64 million paid to shareholders as dividends. |

| • | Record quarterly copper production of 110,400 tonnes in the

second quarter, with QB producing 51,300 tonnes. QB production continues to ramp-up to full production rates with first molybdenum produced

in the quarter. |

| • | Copper prices (LME) averaged US$4.42 per pound in the second

quarter with spot copper prices reaching all-time highs of US$4.92 per pound in the quarter. |

| • | Red Dog had a strong second quarter with zinc production

increasing by 4% from a year ago to 139,400 tonnes and lead production increasing by 23% to 28,900 tonnes. |

Note:

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further

information. |

Financial Summary Q2 2024

Financial Metrics1 (CAD$ in millions, except per share data) | |

Q2 2024 | |

Q2 2023 |

| Revenue | |

$ | 3,873 | | |

$ | 3,519 | |

| Gross profit | |

$ | 1,162 | | |

$ | 1,410 | |

| Gross profit before depreciation and amortization2 | |

$ | 1,828 | | |

$ | 1,841 | |

| Profit from continuing operations before taxes | |

$ | 658 | | |

$ | 805 | |

| Adjusted EBITDA2 | |

$ | 1,670 | | |

$ | 1,479 | |

| Profit from continuing operations attributable to shareholders | |

$ | 363 | | |

$ | 510 | |

| Adjusted profit from continuing operations attributable to shareholders2 | |

$ | 413 | | |

$ | 643 | |

| Basic earnings per share from continuing operations | |

$ | 0.70 | | |

$ | 0.98 | |

| Diluted earnings per share from continuing operations | |

$ | 0.69 | | |

$ | 0.97 | |

| Adjusted basic earnings per share from continuing operations2 | |

$ | 0.80 | | |

$ | 1.24 | |

| Adjusted diluted earnings per share from continuing operations2 | |

$ | 0.79 | | |

$ | 1.22 | |

Notes:

| 1. | The financial metrics presented for each period includes results from our steelmaking coal business because final regulatory approval

of the sale of EVR was not received until July 4, 2024, and EVR was not classified as a discontinued operation as at June 30, 2024. |

| 2. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further

information. |

Key Updates

Executing on Our Copper Growth Strategy

| • | QB copper production of 51,300 tonnes in the second quarter

increased compared to 43,300 tonnes in the first quarter of 2024, as quarter over quarter production ramp-up continues. |

| • | First molybdenum production and sales at QB in the quarter,

as planned, with ramp-up progressing. |

| • | Robust plant design and construction supports debottlenecking,

and we remain focused on recovery and throughput. We continue to expect to be operating at full rates by the end of 2024. |

| • | Throughput has improved and is close to design rates. Recoveries

have improved as we adjust to the clays in the transition ores and improve plant stability. We have confidence in achieving target recoveries

by the end of 2024. We are forecasting slightly lower grades in the second half of 2024 compared to plan due to short term access issues

related to pit de-watering and a localized geotechnical issue. As a result, we have updated our previously disclosed annual 2024 QB production

guidance for copper to 200,000 to 235,000 tonnes and molybdenum to 1.8 to 2.4 thousand tonnes. |

| • | We continued to advance our industry-leading copper growth

portfolio in the second quarter, with the focus on progressing feasibility studies and permitting, advancing detailed engineering work,

and planning for project execution. At QB, we progressed work to define the near term debottlenecking opportunities. We achieved milestones

in the permitting processes for HVC MLE and San Nicolás projects, and advanced the preparation of construction permits and feasibility

study updates to support the next stages of Zafranal project development. |

| 2 | Teck Resources Limited 2024 Second Quarter News Release |

Sale of the Steelmaking Coal Business

| • | On July 11, 2024, we completed the sale of our remaining

77% interest in our steelmaking coal business, EVR, to Glencore and received transaction proceeds of US$7.3 billion, subject to customary

closing adjustments. |

| • | On July 4, 2024, we announced our intention to allocate the

transaction proceeds consistent with Teck's Capital Allocation Framework. This includes the repurchase of up to $2.75 billion of Class

B subordinate voting shares, a one-time supplemental dividend of approximately $250 million, a debt reduction program of up to $2.75 billion,

funding retained for our value-accretive copper growth projects, and approximately $1.0 billion for final taxes and transaction costs. |

| • | In our second quarter 2024 News Release, Management's Discussion

and Analysis, and Condensed Interim Consolidated Financial Statements, EVR continues to be reported in continuing operations because final

regulatory approval of the sale of EVR was not received until July 4, 2024. Beginning in the third quarter of 2024, EVR results will be

presented as discontinued operations. |

Safety and Sustainability Leadership

| • | Our High-Potential Incident (HPI) Frequency rate was 0.11

for the first half of 2024, a 46% reduction in HPI's compared to the same period last year. |

| • | Teck was named one of the Best 50 Corporate Citizens in Canada

by Corporate Knights for the 18th consecutive year. |

Guidance

| • | Our previously disclosed guidance has been updated for changes

to our 2024 annual copper and molybdenum production, and copper net cash unit costs1 as a result of changes to our 2024 annual

production and net cash unit cost1 guidance for QB. |

| • | Our 2024 annual copper production guidance has been revised

to 435,000 to 500,000 tonnes. Our 2024 annual molybdenum production guidance has been revised to 4.3 to 5.5 thousand tonnes. Copper net

cash units costs1 (including QB) guidance has been revised to US$1.90 to $2.30 per pound. |

| • | Given the completion of the sale of EVR on July 11, 2024,

we have removed all steelmaking coal business unit information from our Outlook and Guidance disclosures. Our guidance is outlined in

summary below and our usual guidance tables, including three-year production guidance, can be found on pages 28-32 of Teck’s second

quarter results for 2024 at the link below. |

| 3 | Teck Resources Limited 2024 Second Quarter News Release |

| 2024 Guidance – Summary |

Current |

| Production Guidance |

|

| Copper (000’s tonnes) |

435 - 500 |

| Zinc (000’s tonnes) |

565 - 630 |

| Refined zinc (000’s tonnes) |

275 - 290 |

| Sales Guidance – Q3 2024 |

|

| Red Dog zinc in concentrate sales (000’s tonnes) |

250 - 290 |

| Unit Cost Guidance |

|

| Copper net cash unit costs (US$/lb.)1 |

1.90 - 2.30 |

| Zinc net cash unit costs (US$/lb.)1 |

0.55 - 0.65 |

Note:

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further

information. |

Click here to view Teck’s full second

quarter results for 2024.

WEBCAST

Teck will host an Investor Conference Call to discuss its Q2/2024 financial

results at 11:00 AM Eastern time, 8:00 AM Pacific time, on July 24, 2024. A live audio webcast

of the conference call, together with supporting presentation slides, will be available at our website at www.teck.com.

The webcast will be archived at www.teck.com.

Fraser Phillips, Senior Vice President,

Investor Relations and Strategic Analysis: 604.699.4621

Dale Steeves, Director, Stakeholder Relations:

236.987.7405

| 4 | Teck Resources Limited 2024 Second Quarter News Release |

USE OF NON-GAAP FINANCIAL MEASURES AND RATIOS

Our annual financial statements are prepared in accordance with IFRS®

Accounting Standards as issued by the International Accounting Standards Board (IASB). Our interim financial results are prepared in accordance

with IAS 34, Interim Financial Reporting (IAS 34). This document refers to a number of non-GAAP financial measures and non-GAAP

ratios, which are not measures recognized under IFRS Accounting Standards and do not have a standardized meaning prescribed by IFRS Accounting

Standards or by Generally Accepted Accounting Principles (GAAP) in the United States.

The non-GAAP financial measures and non-GAAP ratios described below do not

have standardized meanings under IFRS Accounting Standards, may differ from those used by other issuers, and may not be comparable to

similar financial measures and ratios reported by other issuers. These financial measures and ratios have been derived from our financial

statements and applied on a consistent basis as appropriate. We disclose these financial measures and ratios because we believe they assist

readers in understanding the results of our operations and financial position and provide further information about our financial results

to investors. These measures should not be considered in isolation or used as a substitute for other measures of performance prepared

in accordance with IFRS Accounting Standards.

Adjusted profit from continuing operations

attributable to shareholders – For adjusted profit from continuing operations attributable to shareholders, we adjust

profit from continuing operations attributable to shareholders as reported to remove the after-tax effect of certain types of transactions

that reflect measurement changes on our balance sheet or are not indicative of our normal operating activities.

EBITDA – EBITDA is profit

before net finance expense, provision for income taxes, and depreciation and amortization.

Adjusted EBITDA – Adjusted

EBITDA is EBITDA before the pre-tax effect of the adjustments that we make to adjusted profit from continuing operations attributable

to shareholders as described above.

Adjusted profit from continuing operations attributable to shareholders,

EBITDA and Adjusted EBITDA highlight items and allow us and readers to analyze the rest of our results more clearly. We believe that disclosing

these measures assists readers in understanding the ongoing cash-generating potential of our business in order to provide liquidity to

fund working capital needs, service outstanding debt, fund future capital expenditures and investment opportunities, and pay dividends.

Adjusted basic earnings per share from continuing

operations – Adjusted basic earnings per share from continuing operations is adjusted profit from continuing operations

attributable to shareholders divided by average number of shares outstanding in the period.

Adjusted diluted earnings per share from

continuing operations – Adjusted diluted earnings per share from continuing operations is adjusted profit from continuing

operations attributable to shareholders divided by average number of fully diluted shares in a period.

Gross profit before depreciation and amortization

– Gross profit before depreciation and amortization is gross profit with depreciation and amortization expense added back. We believe

this measure assists us and readers to assess our ability to generate cash flow from our business units or operations.

Total cash unit costs –

Total cash unit costs for our copper and zinc operations includes adjusted cash costs of sales, as described below, plus the smelter and

refining charges added back in determining adjusted revenue. This presentation allows a comparison of total cash unit costs, including

smelter charges, to the underlying price of copper or zinc in order to assess the margin for the mine on a per unit basis.

| 5 | Teck Resources Limited 2024 Second Quarter News Release |

Net cash unit costs – Net

cash unit costs of principal product, after deducting co-product and by-product margins, are also a common industry measure. By deducting

the co- and by-product margin per unit of the principal product, the margin for the mine on a per unit basis may be presented in a single

metric for comparison to other operations.

Adjusted cash cost of sales –

Adjusted cash cost of sales for our copper and zinc operations is defined as the cost of the product delivered to the port of shipment,

excluding depreciation and amortization charges, any one-time collective agreement charges or inventory write-down provisions and by-product

cost of sales. It is common practice in the industry to exclude depreciation and amortization, as these costs are non-cash, and discounted

cash flow valuation models used in the industry substitute expectations of future capital spending for these amounts.

| 6 | Teck Resources Limited 2024 Second Quarter News Release |

Profit from Continuing Operations Attributable to Shareholders

and Adjusted Profit from Continuing Operations Attributable to Shareholders

| | |

Three months ended

June 30, | |

Six months ended

June 30, |

| (CAD$ in millions) | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

| |

| |

| |

|

| Profit from continuing operations attributable to shareholders1 | |

$ | 363 | | |

$ | 510 | | |

$ | 706 | | |

$ | 1,676 | |

| Add (deduct) on an after-tax basis: | |

| | | |

| | | |

| | | |

| | |

| QB variable consideration to IMSA and ENAMI | |

| 32 | | |

| 69 | | |

| 42 | | |

| 71 | |

| Environmental costs | |

| 5 | | |

| 3 | | |

| (12 | ) | |

| 16 | |

| Inventory write-downs | |

| — | | |

| — | | |

| 19 | | |

| — | |

| Share-based compensation | |

| 22 | | |

| 42 | | |

| 49 | | |

| 60 | |

| Commodity derivatives | |

| (29 | ) | |

| 23 | | |

| (27 | ) | |

| 19 | |

| Loss (gain) on disposal or contribution of assets | |

| 9 | | |

| — | | |

| 3 | | |

| (186 | ) |

| Elkview business interruption claim | |

| — | | |

| (81 | ) | |

| — | | |

| (149 | ) |

| Other | |

| 11 | | |

| 77 | | |

| 25 | | |

| 66 | |

| Adjusted profit from continuing operations attributable to shareholders1 | |

$ | 413 | | |

$ | 643 | | |

$ | 805 | | |

$ | 1,573 | |

| Basic earnings per share from continuing operations | |

$ | 0.70 | | |

$ | 0.98 | | |

$ | 1.36 | | |

$ | 3.25 | |

| Diluted earnings per share from continuing operations | |

$ | 0.69 | | |

$ | 0.97 | | |

$ | 1.35 | | |

$ | 3.20 | |

| Adjusted basic earnings per share from continuing operations | |

$ | 0.80 | | |

$ | 1.24 | | |

$ | 1.55 | | |

$ | 3.05 | |

| Adjusted diluted earnings per share from continuing operations | |

$ | 0.79 | | |

$ | 1.22 | | |

$ | 1.54 | | |

$ | 3.00 | |

| 1. | Profit from continuing operations attributable to shareholders and adjusted

profit from continuing operations attributable to shareholders for each period reported includes results from our steelmaking coal business

because final regulatory approval of the sale of EVR was not received until July 4, 2024, and EVR was not classified as a discontinued

operation as at June 30, 2024. |

| 7 | Teck Resources Limited 2024 Second Quarter News Release |

Reconciliation of Basic Earnings per share from Continuing

Operations to Adjusted Basic Earnings per share from Continuing Operations

| | |

Three months ended June 30, | |

Six months ended June 30, |

| (Per share amounts) | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

| |

| |

| |

|

| Basic earnings per share from continuing operations | |

$ | 0.70 | | |

$ | 0.98 | | |

$ | 1.36 | | |

$ | 3.25 | |

| Add (deduct): | |

| | | |

| | | |

| | | |

| | |

| QB variable consideration to IMSA and ENAMI | |

| 0.06 | | |

| 0.14 | | |

| 0.08 | | |

| 0.14 | |

| Environmental costs | |

| 0.01 | | |

| — | | |

| (0.02 | ) | |

| 0.03 | |

| Inventory write-downs | |

| — | | |

| — | | |

| 0.04 | | |

| — | |

| Share-based compensation | |

| 0.04 | | |

| 0.08 | | |

| 0.09 | | |

| 0.11 | |

| Commodity derivatives | |

| (0.05 | ) | |

| 0.05 | | |

| (0.05 | ) | |

| 0.04 | |

| Loss (gain) on disposal or contribution of assets | |

| 0.02 | | |

| — | | |

| 0.01 | | |

| (0.36 | ) |

| Elkview business interruption claim | |

| — | | |

| (0.16 | ) | |

| — | | |

| (0.29 | ) |

| Other | |

| 0.02 | | |

| 0.15 | | |

| 0.04 | | |

| 0.13 | |

| Adjusted basic earnings per share from continuing operations | |

$ | 0.80 | | |

$ | 1.24 | | |

$ | 1.55 | | |

$ | 3.05 | |

Reconciliation of Diluted Earnings per share from Continuing

Operations to Adjusted Diluted Earnings per share from Continuing Operations

| | |

Three months ended

June 30, | |

Six months ended

June 30, |

| (Per share amounts) | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

| |

| |

| |

|

| Diluted earnings per share from continuing operations | |

$ | 0.69 | | |

$ | 0.97 | | |

$ | 1.35 | | |

$ | 3.20 | |

| Add (deduct): | |

| | | |

| | | |

| | | |

| | |

| QB variable consideration to IMSA and ENAMI | |

| 0.06 | | |

| 0.13 | | |

| 0.08 | | |

| 0.13 | |

| Environmental costs | |

| 0.01 | | |

| 0.01 | | |

| (0.02 | ) | |

| 0.03 | |

| Inventory write-downs | |

| — | | |

| — | | |

| 0.04 | | |

| — | |

| Share-based compensation | |

| 0.04 | | |

| 0.08 | | |

| 0.09 | | |

| 0.11 | |

| Commodity derivatives | |

| (0.05 | ) | |

| 0.04 | | |

| (0.05 | ) | |

| 0.04 | |

| Loss (gain) on disposal or contribution of assets | |

| 0.02 | | |

| — | | |

| 0.01 | | |

| (0.35 | ) |

| Elkview business interruption claim | |

| — | | |

| (0.15 | ) | |

| — | | |

| (0.28 | ) |

| Other | |

| 0.02 | | |

| 0.14 | | |

| 0.04 | | |

| 0.12 | |

| Adjusted diluted earnings per share from continuing operations | |

$ | 0.79 | | |

$ | 1.22 | | |

$ | 1.54 | | |

$ | 3.00 | |

| 8 | Teck Resources Limited 2024 Second Quarter News Release |

Reconciliation of EBITDA and Adjusted EBITDA

| | |

Three months ended

June 30, | |

Six months ended

June 30, |

| (CAD$ in millions) | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

| |

| |

| |

|

| Profit from continuing operations before taxes | |

$ | 658 | | |

$ | 805 | | |

$ | 1,399 | | |

$ | 2,661 | |

| Finance expense net of finance income | |

| 253 | | |

| 39 | | |

| 484 | | |

| 69 | |

| Depreciation and amortization | |

| 666 | | |

| 431 | | |

| 1,296 | | |

| 854 | |

| EBITDA1 | |

| 1,577 | | |

| 1,275 | | |

| 3,179 | | |

| 3,584 | |

| | |

| | | |

| | | |

| | | |

| | |

| Add (deduct): | |

| | | |

| | | |

| | | |

| | |

| QB variable consideration to IMSA and ENAMI | |

| 49 | | |

| 114 | | |

| 69 | | |

| 116 | |

| Environmental costs | |

| 6 | | |

| 4 | | |

| (23 | ) | |

| 21 | |

| Inventory write-downs | |

| — | | |

| — | | |

| 41 | | |

| — | |

| Share-based compensation | |

| 28 | | |

| 56 | | |

| 63 | | |

| 78 | |

| Commodity derivatives | |

| (39 | ) | |

| 30 | | |

| (37 | ) | |

| 24 | |

| Loss (gain) on disposal or contribution of assets | |

| 14 | | |

| 1 | | |

| 6 | | |

| (257 | ) |

| Elkview business interruption claim | |

| — | | |

| (117 | ) | |

| — | | |

| (219 | ) |

| Other | |

| 35 | | |

| 116 | | |

| 65 | | |

| 104 | |

| Adjusted EBITDA1 | |

$ | 1,670 | | |

$ | 1,479 | | |

$ | 3,363 | | |

$ | 3,451 | |

| 1. | EBITDA and adjusted EBITDA for each period reported includes results from

our steelmaking coal business because final regulatory approval of the sale of EVR was not received until July 4, 2024, and EVR was not

classified as a discontinued operation as at June 30, 2024. |

| 9 | Teck Resources Limited 2024 Second Quarter News Release |

Reconciliation of Gross

Profit Before Depreciation and Amortization

| | |

Three months ended

June 30, | |

Six months ended

June 30, |

| (CAD$ in millions) | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

| |

| |

| |

|

| Gross profit | |

$ | 1,162 | | |

$ | 1,410 | | |

$ | 2,451 | | |

$ | 3,076 | |

| Depreciation and amortization | |

| 666 | | |

| 431 | | |

| 1,296 | | |

| 854 | |

| Gross profit before depreciation and amortization | |

$ | 1,828 | | |

$ | 1,841 | | |

$ | 3,747 | | |

$ | 3,930 | |

| | |

| | | |

| | | |

| | | |

| | |

| Reported as: | |

| | | |

| | | |

| | | |

| | |

| Copper | |

| | | |

| | | |

| | | |

| | |

| Quebrada Blanca | |

$ | 218 | | |

$ | — | | |

$ | 284 | | |

$ | (1 | ) |

| Highland Valley Copper | |

| 170 | | |

| 97 | | |

| 282 | | |

| 233 | |

| Antamina | |

| 279 | | |

| 226 | | |

| 476 | | |

| 456 | |

| Carmen de Andacollo | |

| 25 | | |

| (3 | ) | |

| 21 | | |

| 9 | |

| Other | |

| 2 | | |

| (2 | ) | |

| 2 | | |

| (6 | ) |

| | |

| 694 | | |

| 318 | | |

| 1,065 | | |

| 691 | |

| | |

| | | |

| | | |

| | | |

| | |

| Zinc | |

| | | |

| | | |

| | | |

| | |

| Trail Operations | |

| (54 | ) | |

| 33 | | |

| (29 | ) | |

| 69 | |

| Red Dog | |

| 107 | | |

| 123 | | |

| 215 | | |

| 250 | |

| Other | |

| 14 | | |

| (12 | ) | |

| 7 | | |

| (2 | ) |

| | |

| 67 | | |

| 144 | | |

| 193 | | |

| 317 | |

| | |

| | | |

| | | |

| | | |

| | |

| Steelmaking coal | |

| 1,067 | | |

| 1,379 | | |

| 2,489 | | |

| 2,922 | |

| Gross profit before depreciation and amortization | |

$ | 1,828 | | |

$ | 1,841 | | |

$ | 3,747 | | |

$ | 3,930 | |

| 10 | Teck Resources Limited 2024 Second Quarter News Release |

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking information and forward-looking

statements as defined in applicable securities laws (collectively referred to as forward-looking statements). These statements relate

to future events or our future performance. All statements other than statements of historical fact are forward-looking statements. The

use of any of the words “anticipate”, “plan”, “continue”, “estimate”, “expect”,

“may”, “will”, “project”, “predict”, “potential”, “should”, “believe”

and similar expressions is intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties

and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.

These statements speak only as of the date of this news release.

These forward-looking statements include, but are not limited to, statements

concerning: our focus and strategy; anticipated global and regional supply, demand and market outlook for our commodities; our business,

assets, and strategy going forward, including with respect to future and ongoing project development; the expected use of proceeds from

the sale of our steelmaking coal business, including the timing and format of any cash returns to shareholders; the anticipated benefits

of the sale of our steelmaking coal business; our expectations regarding the ramp-up of the QB2 project, including our ability to increase

production each quarter in 2024; QB2 capital and operating cost guidance; expectations regarding inflationary pressures and our ability

to manage controllable operating expenditures; expectations regarding future remediation costs at our operations and closed operations;

timing of and our ability to implement a solution related to water restrictions at Carmen de Andacollo operations; expectations with respect

to execution of our copper growth strategy, including the timing and occurrence of any sanction decisions and prioritization of growth

capital; expectations regarding advancement of copper growth portfolio, including advancement of study, permitting, execution planning,

and engineering work, community and Indigenous engagement, completion of updated cost estimates, and timing for receipt of permits at

our QB debottlenecking, HVC Mine Life Extension, San Nicolás, Zafranal, and Galore Creek projects, as applicable; expectations

regarding timing and amount of income tax payments and our effective tax rate; liquidity and availability of borrowings under our credit

facilities; requirements to post and our ability to obtain additional credit for posting security for reclamation at our sites; all guidance

appearing in this document including but not limited to the production, sales, cost, unit cost, capital expenditure, capitalized stripping,

and other guidance under the headings “Guidance” and "Outlook" and as discussed elsewhere in the various business

unit sections; our expectations regarding inflationary pressures and increased key input costs; and expectations regarding the adoption

of new accounting standards and the impact of new accounting developments.

These statements are based on a number of assumptions, including, but

not limited to, assumptions disclosed elsewhere in this document and assumptions regarding general business and economic conditions,

interest rates, commodity and power prices; acts of foreign or domestic governments and the outcome of legal proceedings; the

possibility that the anticipated benefits from the sale of our steelmaking coal business are not realized in the time frame

anticipated or at all as a result of changes in general economic and market conditions, including credit, market, currency,

operational, commodity, liquidity and funding risks generally and relating specifically to the transaction; the possibility that our

business may not perform as expected or in a manner consistent with historical performance; the supply and demand for, deliveries

of, and the level and volatility of prices of copper and zinc and our other metals and minerals, as well as steel, crude oil,

natural gas and other petroleum products; the timing of the receipt of permits and other regulatory and governmental approvals for

our development projects and other operations, including mine extensions; positive results from the studies on our expansion and

development projects; our ability to secure adequate transportation, including rail and port services, for our products; our costs

of production and our production and productivity levels, as well as those of our competitors; continuing availability of water and

power resources for our operations; changes in credit market conditions and conditions in financial markets generally; the

availability of funding to refinance our borrowings as they become due or to finance our development projects on reasonable terms;

availability of letters of credit and other forms of financial assurance acceptable to regulators for reclamation and other bonding

requirements; our ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; the

availability of qualified employees and contractors for our operations, including our new developments and our ability to attract

and retain skilled employees; the satisfactory negotiation of collective agreements with unionized employees; the impact of changes

in Canadian-U.S. dollar, Canadian dollar-Chilean Peso and other foreign exchange rates on our costs and results; engineering and

construction timetables and capital costs for our development and expansion projects; our ability to develop technology and obtain

the benefits of technology for our operations and development projects; closure costs; environmental compliance costs; market

competition; the accuracy of our mineral reserve and resource estimates (including with respect to size, grade and recoverability)

and the geological, operational and price assumptions on which these are based; tax benefits and tax rates; the outcome of our

copper, zinc and lead concentrate treatment and refining charge negotiations with customers; the resolution of environmental and

other proceedings or disputes; our ability to obtain, comply with and renew permits, licenses and leases in a timely manner; and our

ongoing relations with our employees and with our business and joint venture partners.

| 11 | Teck Resources Limited 2024 Second Quarter News Release |

Assumptions regarding QB2 include current project assumptions and assumptions

regarding the final feasibility study, estimates of the final capital cost at QB2 are based on a CLP/USD rate range of 800 — 850,

as well as there being no further unexpected material and negative impact to the various contractors, suppliers and subcontractors that

would impair their ability to provide goods and services as anticipated during ramp-up activities or delay demobilization in accordance

with current expectations. Statements regarding the availability of our credit facilities are based on assumptions that we will be able

to satisfy the conditions for borrowing at the time of a borrowing request and that the facilities are not otherwise terminated or accelerated

due to an event of default. Assumptions regarding the costs and benefits of our projects include assumptions that the relevant project

is constructed, commissioned and operated in accordance with current expectations. Expectations regarding our operations are based on

numerous assumptions regarding the operations. Our Guidance tables include disclosure and footnotes with further assumptions relating

to our guidance, and assumptions for certain other forward-looking statements accompany those statements within the document. Statements

concerning future production costs or volumes are based on numerous assumptions regarding operating matters and on assumptions that demand

for products develops as anticipated, that customers and other counterparties perform their contractual obligations, that operating and

capital plans will not be disrupted by issues such as mechanical failure, unavailability of parts and supplies, labour disturbances, interruption

in transportation or utilities, or adverse weather conditions, and that there are no material unanticipated variations in the cost of

energy or supplies. The foregoing list of assumptions is not exhaustive. Events or circumstances could cause actual results to vary materially.

Factors that may cause actual results to vary materially include, but are

not limited to, changes in commodity and power prices; changes in market demand for our products; changes in interest and currency exchange

rates; acts of governments and the outcome of legal proceedings; inaccurate geological and metallurgical assumptions (including with respect

to the size, grade and recoverability of mineral reserves and resources); operational difficulties (including failure of plant, equipment

or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of labour, materials and equipment,

government action or delays in the receipt of government approvals, changes in royalty or tax rates, industrial disturbances or other

job action, adverse weather conditions and unanticipated events related to health, safety and environmental matters); union labour disputes;

any resurgence of COVID-19 and related mitigation protocols; political risk; social unrest; failure of customers or counterparties (including

logistics suppliers) to perform their contractual obligations; changes in our credit ratings; unanticipated increases in costs to construct

our development projects; difficulty in obtaining permits; inability to address concerns regarding permits or environmental impact assessments;

and changes or further deterioration in general economic conditions. The amount and timing of capital expenditures is depending upon,

among other matters, being able to secure permits, equipment, supplies, materials and labour on a timely basis and at expected costs.

Certain operations and projects are not controlled by us; schedules and costs may be adjusted by our partners, and timing of spending

and operation of the operation or project is not in our control. Certain of our other operations and projects are operated through joint

arrangements where we may not have control over all decisions, which may cause outcomes to differ from current expectations. Ongoing monitoring

may reveal unexpected environmental conditions at our operations and projects that could require additional remedial measures. QB2 costs,

commissioning and commercial production are dependent on, among other matters, our continued ability to advance commissioning and ramp-up

as currently anticipated. QB2 costs may also be affected by claims and other proceedings that might be brought against us relating to

costs and impacts of the COVID-19 pandemic or otherwise. Production at our Red Dog Operations may also be impacted by water levels at

site. Sales to China may be impacted by general and specific port restrictions, Chinese regulation and policies, and normal production

and operating risks. The forward-looking statements in this news release and actual results will also be impacted by the continuing effects

of COVID-19 and related matters, particularly if there is a further resurgence of the virus.

| 12 | Teck Resources Limited 2024 Second Quarter News Release |

We assume no obligation to update forward-looking statements except as required

under securities laws. Further information concerning risks, assumptions and uncertainties associated with these forward-looking statements

and our business can be found in our Annual Information Form for the year ended December 31, 2023 filed under our profile on SEDAR+ (www.sedarplus.ca)

and on EDGAR (www.sec.gov) under cover of Form 40-F, as well as subsequent filings that can also be found under our profile.

Scientific and technical information in this quarterly report regarding

our material properties was reviewed, approved and verified by Rodrigo Alves Marinho, P.Geo., an employee of Teck and a Qualified Person

as defined under National Instrument 43-101.

| 13 | Teck Resources Limited 2024 Second Quarter News Release |

EXHIBIT 99.2

News Release

| For Immediate Release |

Date: July 23, 2024 |

| 24-26-TR |

|

Teck Reports Unaudited Second Quarter Results for

2024

Record quarterly copper production and transformation

to pure-play energy transition metals company

Vancouver, B.C. – Teck Resources Limited (TSX: TECK.A and TECK.B,

NYSE: TECK) (Teck) today announced its unaudited second quarter results for 2024.

"We generated $1.7 billion of Adjusted EBITDA1 in the second

quarter driven by record copper production with QB ramp-up continuing, as well as strong copper market fundamentals with copper prices

reaching all-time highs," said Jonathan Price, President and CEO. "In early July, we completed the sale of our steelmaking coal

business, and we now move forward as a pure-play energy transition metals company with leading copper growth. With cash proceeds of US$7.3

billion we will reduce debt, retain cash to fund our near-term copper growth, and return significant cash to our shareholders."

Highlights

| • | Adjusted EBITDA1 of $1.7 billion in Q2 2024 was

driven by record copper production as Quebrada Blanca (QB) continues to ramp-up operations, as well as strong copper prices and steelmaking

coal sales volumes. Profit from continuing operations before taxes was $658 million in Q2 2024. |

| • | Adjusted profit from continuing operations attributable to

shareholders1 was $413 million, or $0.80 per share, in Q2 2024. Profit from continuing operations attributable to shareholders

was $363 million, $0.70 per share, in Q2 2024. |

| • | On July 11, 2024, we completed the sale of the remaining

77% interest in our steelmaking coal business, Elk Valley Resources (EVR) and received cash proceeds of US$7.3 billion, subject to customary

closing adjustments. We will deploy the cash proceeds to reduce debt, fund our near-term copper growth, and return significant cash to

our shareholders. |

| • | With the proceeds from the sale of the steelmaking coal business,

the Board authorized up to a $2.75 billion share buyback and approved payment of an eligible dividend of $0.625 per share, including a

$0.50 per share supplemental dividend, payable on September 27, 2024 to shareholders of record on September 13, 2024. Combined with the

$500 million share buyback announced in February, total cash returns to shareholders of $3.5 billion from the sale of the steelmaking

coal business have been authorized. |

| • | On July 15, 2024, we purchased US$1.4 billion of our public

notes through a bond tender offer. |

| • | Our liquidity as at July 23, 2024 is $14.3 billion,

including $8.7 billion of cash. We generated cash flows from operations of $1.3 billion in Q2. |

| • | We returned a total of $346 million to shareholders in the

second quarter through the purchase of $282 million of Class B subordinate voting shares pursuant to our normal course issuer bid, and

$64 million paid to shareholders as dividends. |

| • | Record quarterly copper production of 110,400 tonnes in the

second quarter, with QB producing 51,300 tonnes. QB production continues to ramp-up to full production rates with first molybdenum produced

in the quarter. |

| • | Copper prices (LME) averaged US$4.42 per pound in the second

quarter with spot copper prices reaching all-time highs of US$4.92 per pound in the quarter. |

| • | Red Dog had a strong second quarter with zinc production

increasing by 4% from a year ago to 139,400 tonnes and lead production increasing by 23% to 28,900 tonnes. |

Note:

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further

information. |

All

dollar amounts expressed in this news release are in Canadian dollars unless otherwise noted.

| Reference: |

Fraser

Phillips, Senior Vice President, Investor Relations and Strategic Analysis |

604.699.4621 |

| |

|

|

| |

Dale Steeves, Director, Stakeholder Relations |

236.987.7405 |

Additional

corporate information is available at www.teck.com.

Financial Summary Q2 2024

Financial Metrics1 (CAD$ in millions, except per share data) | |

Q2 2024 | |

Q2 2023 |

| Revenue | |

$ | 3,873 | | |

$ | 3,519 | |

| Gross profit | |

$ | 1,162 | | |

$ | 1,410 | |

| Gross profit before depreciation and amortization2 | |

$ | 1,828 | | |

$ | 1,841 | |

| Profit from continuing operations before taxes | |

$ | 658 | | |

$ | 805 | |

| Adjusted EBITDA2 | |

$ | 1,670 | | |

$ | 1,479 | |

| Profit from continuing operations attributable to shareholders | |

$ | 363 | | |

$ | 510 | |

| Adjusted profit from continuing operations attributable to shareholders2 | |

$ | 413 | | |

$ | 643 | |

| Basic earnings per share from continuing operations | |

$ | 0.70 | | |

$ | 0.98 | |

| Diluted earnings per share from continuing operations | |

$ | 0.69 | | |

$ | 0.97 | |

| Adjusted basic earnings per share from continuing operations2 | |

$ | 0.80 | | |

$ | 1.24 | |

| Adjusted diluted earnings per share from continuing operations2 | |

$ | 0.79 | | |

$ | 1.22 | |

Notes:

| 1. | The financial metrics presented for each period includes results from our steelmaking coal business because final regulatory approval

of the sale of EVR was not received until July 4, 2024, and EVR was not classified as a discontinued operation as at June 30, 2024. |

| 2. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further

information. |

Key Updates

Executing on Our Copper Growth Strategy

| • | QB copper production of 51,300 tonnes in the second quarter

increased compared to 43,300 tonnes in the first quarter of 2024, as quarter over quarter production ramp-up continues. |

| • | First molybdenum production and sales at QB in the quarter,

as planned, with ramp-up progressing. |

| • | Robust plant design and construction supports debottlenecking,

and we remain focused on recovery and throughput. We continue to expect to be operating at full rates by the end of 2024. |

| • | Throughput has improved and is close to design rates. Recoveries

have improved as we adjust to the clays in the transition ores and improve plant stability. We have confidence in achieving target recoveries

by the end of 2024. We are forecasting slightly lower grades in the second half of 2024 compared to plan due to short term access issues

related to pit de-watering and a localized geotechnical issue. As a result, we have updated our previously disclosed annual 2024 QB production

guidance for copper to 200,000 to 235,000 tonnes and molybdenum to 1.8 to 2.4 thousand tonnes. |

| • | We continued to advance our industry-leading copper growth

portfolio in the second quarter, with the focus on progressing feasibility studies and permitting, advancing detailed engineering work,

and planning for project execution. At QB, we progressed work to define the near term debottlenecking opportunities. We achieved milestones

in the permitting processes for HVC MLE and San Nicolás projects, and advanced the preparation of construction permits and feasibility

study updates to support the next stages of Zafranal project development. |

| 2 | Teck Resources Limited 2024 Second Quarter News Release |

Sale of the Steelmaking Coal Business

| • | On July 11, 2024, we completed the sale of our remaining

77% interest in our steelmaking coal business, EVR, to Glencore and received transaction proceeds of US$7.3 billion, subject to customary

closing adjustments. |

| • | On July 4, 2024, we announced our intention to allocate the

transaction proceeds consistent with Teck's Capital Allocation Framework. This includes the repurchase of up to $2.75 billion of Class

B subordinate voting shares, a one-time supplemental dividend of approximately $250 million, a debt reduction program of up to $2.75 billion,

funding retained for our value-accretive copper growth projects, and approximately $1.0 billion for final taxes and transaction costs. |

| • | In our second quarter 2024 News Release, Management's Discussion

and Analysis, and Condensed Interim Consolidated Financial Statements, EVR continues to be reported in continuing operations because final

regulatory approval of the sale of EVR was not received until July 4, 2024. Beginning in the third quarter of 2024, EVR results will be

presented as discontinued operations. |

Safety and Sustainability Leadership

| • | Our High-Potential Incident (HPI) Frequency rate was 0.11

for the first half of 2024, a 46% reduction in HPI's compared to the same period last year. |

| • | Teck was named one of the Best 50 Corporate Citizens in Canada

by Corporate Knights for the 18th consecutive year. |

Guidance

| • | Our previously disclosed guidance has been updated for changes

to our 2024 annual copper and molybdenum production, and copper net cash unit costs1 as a result of changes to our 2024 annual

production and net cash unit cost1 guidance for QB. |

| • | Our 2024 annual copper production guidance has been revised

to 435,000 to 500,000 tonnes. Our 2024 annual molybdenum production guidance has been revised to 4.3 to 5.5 thousand tonnes. Copper net

cash units costs1 (including QB) guidance has been revised to US$1.90 to $2.30 per pound. |

| • | Given the completion of the sale of EVR on July 11, 2024,

we have removed all steelmaking coal business unit information from our Outlook and Guidance disclosures. Our guidance is outlined in

summary below and our usual guidance tables, including three-year production guidance, can be found on pages 29–33. |

| 2024 Guidance – Summary |

Current |

| Production Guidance |

|

| Copper (000’s tonnes) |

435 - 500 |

| Zinc (000’s tonnes) |

565 - 630 |

| Refined zinc (000’s tonnes) |

275 - 290 |

| Sales Guidance – Q3 2024 |

|

| Red Dog zinc in concentrate sales (000’s tonnes) |

250 - 290 |

| Unit Cost Guidance |

|

| Copper net cash unit costs (US$/lb.)1 |

1.90 - 2.30 |

| Zinc net cash unit costs (US$/lb.)1 |

0.55 - 0.65 |

Note:

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further

information. |

| 3 | Teck Resources Limited 2024 Second Quarter News Release |

Management's Discussion and Analysis

This management's discussion and analysis (MD&A) is dated as at

July 23, 2024 and should be read in conjunction with the unaudited condensed interim consolidated financial statements of Teck Resources

Limited (Teck) and the notes thereto for the three months and six months ended June 30, 2024 and with the audited consolidated financial

statements of Teck and the notes thereto for the year ended December 31, 2023. In this news release, unless the context otherwise dictates,

a reference to “the company” or “us,” “we” or “our” refers to Teck and its subsidiaries.

Additional information, including our Annual Information Form and Management’s Discussion and Analysis for the year ended December

31, 2023, is available on SEDAR+ at www.sedarplus.ca.

This document contains forward-looking statements and forward-looking

information. Please refer to the cautionary language under the heading “CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS”

below.

Overview

| • | Our profit from continuing operations attributable to shareholders

decreased to $363 million in the second quarter from $510 million in the same period a year ago partly due to the reduced ownership of

Elk Valley Resources (EVR), our steelmaking coal business, as described below, and lower steelmaking coal prices. In addition, finance

expense and depreciation and amortization expense increased compared to the same period last year as we are depreciating QB assets and

no longer capitalizing interest on the project, starting in 2024, as anticipated. These items were partly offset by increased copper sales

from QB, higher copper prices and increased steelmaking coal sales volumes compared with a year ago. |

| • | Our profit from continuing operations attributable to shareholders

in the second quarter and for the six months ended June 30, 2024 included our 77% ownership interest of EVR because final regulatory approval

of the sale of EVR was not received until July 4, 2024, and EVR was not classified as a discontinued operation as at June 30, 2024. EVR

results include 23% that are attributable to non-controlling interests, which includes Nippon Steel Corporation's (NSC) 20% and POSCO’s

3% ownership in EVR. This is a result of the closing of transactions with NSC and POSCO on January 3, 2024. We continued to operate EVR

in the second quarter and retained all cash flows until completion of the sale of our remaining 77% interest in EVR to Glencore on July

11, 2024. |

| • | In the second quarter, London Metal Exchange (LME) copper

prices increased by 15% compared with a year ago and averaged US$4.42 per pound, and LME zinc prices increased by 12%, averaging US$1.29

per pound. During the second quarter, spot copper prices reached all-time highs of US$4.92 per pound in late May. |

| • | Realized steelmaking coal prices in the second quarter remained

above historical averages at US$238 per tonne but decreased compared with US$264 per tonne in the second quarter last year. Steelmaking

coal prices also decreased compared to the first quarter of 2024, resulting in negative provisional pricing adjustments of $50 million

in the second quarter. |

| Average Prices and Exchange Rates | |

Three months ended

June 30, | |

Change |

| | |

2024 | |

2023 | |

|

| Copper (LME cash – US$/pound) | |

$ | 4.42 | | |

$ | 3.84 | | |

| 15 | % |

| Zinc (LME cash – US$/pound) | |

$ | 1.29 | | |

$ | 1.15 | | |

| 12 | % |

| Steelmaking coal (realized US$/tonne) | |

$ | 238 | | |

$ | 264 | | |

| (10 | )% |

| Average exchange rate (CAD$ per US$1.00) | |

$ | 1.37 | | |

$ | 1.34 | | |

| 2 | % |

| 4 | Teck Resources Limited 2024 Second Quarter News Release |

| • | Copper production increased significantly to 110,400 tonnes

in the second quarter, approximately 46,000 tonnes, or 71%, higher than the same period a year ago as a result of QB production continuing

to ramp-up. Copper production from QB was 51,300 tonnes in the second quarter compared with 43,300 tonnes in the first quarter of 2024,

as quarter over quarter production ramp-up continues. |

| • | Zinc in concentrate production of 151,900 tonnes in the second

quarter decreased by 8% compared to a year ago due to expected lower zinc production from Antamina, partly offset by higher production

from Red Dog driven by higher grade and recovery. |

| • | Steelmaking coal production in the second quarter was 6.3

million tonnes, up from 5.8 million tonnes a year ago. Production from all the plants was strong in the second quarter driven by higher

plant reliability. Second quarter steelmaking coal sales were 6.4 million tonnes compared with 6.2 million tonnes in the same period last

year, and at the top end of our previously disclosed guidance of 6.0 – 6.4 million tonnes. |

| • | We remain highly focused on managing our controllable operating

expenditures. Our underlying key mining drivers such as strip ratios and haul distances remain relatively stable. Inflation on key input

costs, including the cost of certain key supplies and mining equipment, labour and contractors, and changing diesel prices, are included

in our 2024 annual capital expenditure, capitalized stripping and unit cost guidance. |

| • | On November 13, 2023, we announced the full sale of EVR for

an implied enterprise value of US$9.0 billion, with a 77% majority stake sold to Glencore and a minority stake sold to NSC. On January

3, 2024, NSC acquired a 20% interest in EVR in exchange for its 2.5% interest in Elkview Operations plus US$1.3 billion in cash paid at

closing to Teck and US$0.4 billion paid subsequently to Teck out of cash flows from EVR. Teck continued to operate the steelmaking coal

business and retained all cash flows from EVR until closing of the Glencore transaction on July 11, 2024. |

| • | On July 4, 2024, final regulatory approval was received for

the sale of our remaining 77% interest in EVR to Glencore. The transaction closed on July 11, 2024 and we received cash proceeds of US$7.3

billion, excluding customary closing adjustments. We have or intend to allocate the transaction proceeds consistent with Teck's Capital

Allocation Framework as follows: |

| 1. | Cash Return to Shareholders |

| • | Repurchase of up to US$2.0 billion (CAD$2.75 billion) of

Class B subordinate voting shares. |

| • | Distribution of approximately US$182 million (CAD$250 million)

through a supplemental eligible dividend of CAD$0.50 declared by the Board on July 11, 2024 on both Class A common and Class B subordinate

shares. The supplemental dividend will be paid on September 27, 2024, to shareholders of record at the close of business on September

13, 2024. This one-time supplemental dividend is in addition to the regular base quarterly dividend of $0.125 per share, for an expected

total eligible dividend payable of $0.625 per share. |

| • | Total announced cash return to shareholders from the 100%

sale of EVR of US$2.6 billion (CAD$3.5 billion). |

Execute a debt reduction program of up to US$2.0 billion (CAD$2.75

billion), including the cash tender offer to purchase US$1.25 billion aggregate principal amount of our outstanding public notes, which

was announced on July 4, 2024. On July 15, 2024, we completed the purchase of US$1.4 billion of our public notes through this bond tender.

| 5 | Teck Resources Limited 2024 Second Quarter News Release |

| 3. | Well-Funded, Value-Accretive Copper Growth |

Remaining proceeds, net of taxes and transaction costs, will be

retained to fund near-term copper growth. We will continue to advance our near-term copper projects, including the Highland Valley Copper

Mine Life Extension, Zafranal Project, San Nicolas Project and QB debottlenecking, with the first sanction decisions expected in 2025.

The current estimated capital cost attributable to Teck for these projects is US$3.3–$3.6 billion (CAD $4.5–$4.9 billion).

| 4. | Taxes and Transaction Costs |

Estimated US$750 million (CAD$1.0 billion) to pay taxes and transaction

costs.

| 6 | Teck Resources Limited 2024 Second Quarter News Release |

Profit from Continuing Operations Attributable to Shareholders

and Adjusted Profit from Continuing Operations Attributable to Shareholders

Our profit from continuing operations attributable to shareholders in the

second quarter of 2024 included our 77% ownership interest of the steelmaking coal business EVR because final regulatory approval of the

sale of EVR was not received until July 4, 2024, and EVR was not classified as a discontinued operation as at June 30, 2024, as outlined

above.

In the second quarter, profit from continuing operations attributable to

shareholders was $363 million, or $0.70 per share, compared to $510 million, or $0.98 per share, in the same period last year, as outlined

above.

Adjusted profit from continuing operations attributable to shareholders1

2 in the second quarter, taking into account the items identified in the table below, was $413 million, or $0.80 per share, compared

with $643 million, or $1.24 per share, in the second quarter of 2023. Significant second quarter adjustments to profit, reflected in the

table below, were after-tax expenses of $25 million relating to changes to the carrying value of the financial liability for the preferential

dividend stream to ENAMI and $22 million of share-based compensation, partly offset by $29 million of commodity derivative gains.

| | |

Three months ended

June 30, | |

Six months ended

June 30, |

| (CAD$ in millions) | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

| |

| |

| |

|

| Profit from continuing operations attributable to shareholders1 | |

$ | 363 | | |

$ | 510 | | |

$ | 706 | | |

$ | 1,676 | |

| Add (deduct) on an after-tax basis: | |

| | | |

| | | |

| | | |

| | |

| QB variable consideration to IMSA and ENAMI | |

| 32 | | |

| 69 | | |

| 42 | | |

| 71 | |

| Environmental costs | |

| 5 | | |

| 3 | | |

| (12 | ) | |

| 16 | |

| Inventory write-downs | |

| — | | |

| — | | |

| 19 | | |

| — | |

| Share-based compensation | |

| 22 | | |

| 42 | | |

| 49 | | |

| 60 | |

| Commodity derivatives | |

| (29 | ) | |

| 23 | | |

| (27 | ) | |

| 19 | |

| Loss (gain) on disposal or contribution of assets | |

| 9 | | |

| — | | |

| 3 | | |

| (186 | ) |

| Elkview business interruption claim | |

| — | | |

| (81 | ) | |

| — | | |

| (149 | ) |

| Other | |

| 11 | | |

| 77 | | |

| 25 | | |

| 66 | |

| Adjusted profit from continuing operations attributable to shareholders1 2 | |

$ | 413 | | |

$ | 643 | | |

$ | 805 | | |

$ | 1,573 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic earnings per share from continuing operations | |

$ | 0.70 | | |

$ | 0.98 | | |

$ | 1.36 | | |

$ | 3.25 | |

| Diluted earnings per share from continuing operations | |

$ | 0.69 | | |

$ | 0.97 | | |

$ | 1.35 | | |

$ | 3.20 | |

| Adjusted basic earnings per share from continuing operations2 | |

$ | 0.80 | | |

$ | 1.24 | | |

$ | 1.55 | | |

$ | 3.05 | |

| Adjusted diluted earnings per share from continuing operations2 | |

$ | 0.79 | | |

$ | 1.22 | | |

$ | 1.54 | | |

$ | 3.00 | |

In addition to the items identified in the table above, our results include

gains and losses due to changes in market prices in respect of pricing adjustments. Pricing adjustments resulted in $30 million of after-tax

gains ($45 million, before tax) in the second quarter, or $0.06 per share.

Notes:

| 1. | Profit from continuing operations attributable to shareholders and adjusted

profit from continuing operations attributable to shareholders for each period reported includes results from our steelmaking coal business

because final regulatory approval of the sale of EVR was not received until July 4, 2024, and EVR was not classified as a discontinued

operation as at June 30, 2024. |

| 2. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP

Financial Measures and Ratios” for further information. |

| 7 | Teck Resources Limited 2024 Second Quarter News Release |

| FINANCIAL OVERVIEW | |

Three months ended

June 30, | |

Six months ended

June 30, |

| (CAD$ in millions, except per share data) | |

2024 | |

2023 | |

2024 | |

2023 |

| Revenue and profit | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

$ | 3,873 | | |

$ | 3,519 | | |

$ | 7,861 | | |

$ | 7,304 | |

| Gross profit | |

$ | 1,162 | | |

$ | 1,410 | | |

$ | 2,451 | | |

$ | 3,076 | |

| Gross profit before depreciation and amortization1 | |

$ | 1,828 | | |

$ | 1,841 | | |

$ | 3,747 | | |

$ | 3,930 | |

| Profit from continuing operations before taxes | |

$ | 658 | | |

$ | 805 | | |

$ | 1,399 | | |

$ | 2,661 | |

| Adjusted EBITDA1 | |

$ | 1,670 | | |

$ | 1,479 | | |

$ | 3,363 | | |

$ | 3,451 | |

| Profit attributable to shareholders | |

$ | 363 | | |

$ | 510 | | |

$ | 706 | | |

$ | 1,650 | |

| Profit from continuing operations attributable to shareholders | |

$ | 363 | | |

$ | 510 | | |

$ | 706 | | |

$ | 1,676 | |

| Cash flow | |

| | | |

| | | |

| | | |

| | |

| Cash flow from operations | |

$ | 1,326 | | |

$ | 1,130 | | |

$ | 1,368 | | |

$ | 2,222 | |

| Expenditures on property, plant and equipment | |

$ | 958 | | |

$ | 1,264 | | |

$ | 1,741 | | |

$ | 2,535 | |

| Capitalized production stripping costs | |

$ | 259 | | |

$ | 235 | | |

$ | 577 | | |

$ | 545 | |

| Balance Sheet | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| | | |

| | | |

$ | 918 | | |

$ | 1,773 | |

| Total assets | |

| | | |

| | | |

$ | 58,787 | | |

$ | 53,090 | |

| Debt and lease liabilities, including current portion | |

| | | |

| | | |

$ | 7,724 | | |

$ | 7,258 | |

| Per share amounts | |

| | | |

| | | |

| | | |

| | |

| Basic earnings per share | |

$ | 0.70 | | |

$ | 0.98 | | |

$ | 1.36 | | |

$ | 3.20 | |

| Diluted earnings per share | |

$ | 0.69 | | |

$ | 0.97 | | |

$ | 1.35 | | |

$ | 3.15 | |

| Basic earnings per share from continuing operations | |

$ | 0.70 | | |

$ | 0.98 | | |

$ | 1.36 | | |

$ | 3.25 | |

| Diluted earnings per share from continuing operations | |

$ | 0.69 | | |

$ | 0.97 | | |

$ | 1.35 | | |

$ | 3.20 | |

| Dividends declared per share | |

$ | 0.125 | | |

$ | 0.125 | | |

$ | 0.25 | | |

$ | 0.75 | |

| PRODUCTION, SALES AND PRICES | |

| | | |

| | | |

| | | |

| | |

| Production (000’s tonnes, except steelmaking coal) | |

| | | |

| | | |

| | | |

| | |

| Copper2 | |

| 110 | | |

| 64 | | |

| 209 | | |

| 121 | |

| Zinc in concentrate | |

| 152 | | |

| 164 | | |

| 312 | | |

| 309 | |

| Zinc – refined | |

| 65 | | |

| 68 | | |

| 128 | | |

| 130 | |

| Steelmaking coal (million tonnes)2 | |

| 6.3 | | |

| 5.8 | | |

| 12.3 | | |

| 11.8 | |

| Sales (000’s tonnes, except steelmaking coal) | |

| | | |

| | | |

| | | |

| | |

| Copper2 | |

| 104 | | |

| 62 | | |

| 199 | | |

| 121 | |

| Zinc in concentrate | |

| 64 | | |

| 90 | | |

| 163 | | |

| 199 | |

| Zinc – refined | |

| 68 | | |

| 67 | | |

| 130 | | |

| 122 | |

| Steelmaking coal (million tonnes)2 | |

| 6.4 | | |

| 6.2 | | |

| 12.3 | | |

| 12.4 | |

| Average prices and exchange rates | |

| | | |

| | | |

| | | |

| | |

| Copper (LME cash – US$/pound) | |

$ | 4.42 | | |

$ | 3.84 | | |

$ | 4.12 | | |

$ | 3.95 | |

| Zinc (LME cash – US$/pound) | |

$ | 1.29 | | |

$ | 1.15 | | |

$ | 1.20 | | |

$ | 1.29 | |

| Steelmaking coal (realized US$/tonne) | |

$ | 238 | | |

$ | 264 | | |

$ | 266 | | |

$ | 273 | |

| Average exchange rate (CAD$ per US$1.00) | |

$ | 1.37 | | |

$ | 1.34 | | |

$ | 1.36 | | |

$ | 1.35 | |

Notes:

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP

Financial Measures and Ratios” for further information. |

| 2. | We include 100% of production and sales from our Quebrada Blanca and Carmen

de Andacollo mines in our production and sales volumes, even though we do not own 100% of these operations, because we fully consolidate

their results in our financial statements. We include 22.5% of production and sales from Antamina, representing our proportionate ownership

interest in this operation. We include 100% of production and sales from EVR operations in our production and sales volumes, even though

we own 77% of EVR effective from January 3, 2024, because we fully consolidate (100%) EVR results in our financial statements. |

| 8 | Teck Resources Limited 2024 Second Quarter News Release |

BUSINESS UNIT RESULTS

Our revenue, gross profit, and gross profit before depreciation and amortization1

by business unit are summarized in the table below.

| | |

Three months ended

June 30, | |

Six months ended

June 30, |

| (CAD$ in millions) | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

| |

| |

| |

|

| Revenue | |

| | | |

| | | |

| | | |

| | |

| Copper | |

$ | 1,369 | | |

$ | 733 | | |

$ | 2,447 | | |

$ | 1,496 | |

| Zinc | |

| 433 | | |

| 532 | | |

| 974 | | |

| 1,148 | |

| Steelmaking coal | |

| 2,071 | | |

| 2,254 | | |

| 4,440 | | |

| 4,660 | |

| Total | |

$ | 3,873 | | |

$ | 3,519 | | |

$ | 7,861 | | |

$ | 7,304 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| | | |

| | | |

| | | |

| | |

| Copper | |

$ | 397 | | |

$ | 205 | | |

$ | 503 | | |

$ | 466 | |

| Zinc | |

| 21 | | |

| 105 | | |

| 84 | | |

| 233 | |

| Steelmaking coal | |

| 744 | | |

| 1,100 | | |

| 1,864 | | |

| 2,377 | |

| Total | |

$ | 1,162 | | |

$ | 1,410 | | |

$ | 2,451 | | |

$ | 3,076 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit before depreciation and amortization1 | |

| | | |

| | | |

| | | |

| | |

| Copper | |

$ | 694 | | |

$ | 318 | | |

$ | 1,065 | | |

$ | 691 | |

| Zinc | |

| 67 | | |

| 144 | | |

| 193 | | |

| 317 | |

| Steelmaking coal | |

| 1,067 | | |

| 1,379 | | |

| 2,489 | | |

| 2,922 | |

| Total | |

$ | 1,828 | | |

$ | 1,841 | | |

$ | 3,747 | | |

$ | 3,930 | |

| Gross profit margins before depreciation and amortization1 | |

| |

| |

| |

|

| Copper | |

| 51 | % | |

| 43 | % | |

| 44 | % | |

| 46 | % |

| Zinc | |

| 15 | % | |

| 27 | % | |

| 20 | % | |

| 28 | % |

| Steelmaking coal | |

| 52 | % | |

| 61 | % | |

| 56 | % | |

| 63 | % |

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP

Financial Measures and Ratios” for further information. |

| 9 | Teck Resources Limited 2024 Second Quarter News Release |

COPPER BUSINESS UNIT

| | |

Three months ended

June 30, | |

Six months ended

June 30, |

| (CAD$ in millions) | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

| |

| |

| |

|

| Copper price (realized – US$/pound) | |

$ | 4.44 | | |

$ | 3.80 | | |

$ | 4.16 | | |

$ | 3.94 | |

| Production (000’s tonnes)1 | |

| 110 | | |

| 64 | | |

| 209 | | |

| 121 | |

| Sales (000’s tonnes)1 | |

| 104 | | |

| 62 | | |

| 199 | | |

| 121 | |

| Gross profit | |

$ | 397 | | |

$ | 205 | | |

$ | 503 | | |

$ | 466 | |

| Gross profit before depreciation and amortization2 | |

$ | 694 | | |

$ | 318 | | |

$ | 1,065 | | |

$ | 691 | |

| Property, plant and equipment expenditures | |

$ | 558 | | |

$ | 1,013 | | |

$ | 1,146 | | |

$ | 2,116 | |

| 1. | We include 22.5% of production and sales from Antamina, representing our proportionate

ownership interest in this operation. We include 100% of production and sales from our Quebrada Blanca and Carmen de Andacollo mines in

our production and sales volumes, even though we do not own 100% of these operations, because we fully consolidate their results in our

financial statements. |

| 2. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP

Financial Measures and Ratios” for further information. |

Gross profit from our copper business unit increased to $397 million in

the second quarter, compared with $205 million a year ago (see table below). The increase in gross profit was due to higher copper prices

and substantially higher sales volumes, partly offset by the depreciation of QB assets that commenced at the start of 2024.

Record quarterly copper production of 110,400 tonnes was achieved in the

second quarter, 71% higher than the same period last year. The increase was primarily driven by continued quarter over quarter improvement

in QB's production, with the operation contributing 51,300 tonnes of copper in concentrate in the second quarter. Slightly higher production

from Antamina and Highland Valley Copper was offset by lower production at Carmen de Andacollo due to water restrictions in the second

quarter as a result of continued extreme drought conditions. The water restrictions improved during the quarter and we expect that improvement

to continue in the second half of 2024.

The table below summarizes the change in gross profit in our copper business

unit for the quarter.

| Gross Profit (CAD$ in millions) | |

Three months ended

June 30, |

| | |

|

| As reported in the second quarter of 2023 | |

$ | 205 | |

| Increase (decrease): | |

| | |

| Copper price realized | |

| 194 | |

| Sales volumes | |

| 173 | |

| Unit operating costs | |

| (14 | ) |

| Co-product and by-product contribution | |

| 11 | |

| Foreign exchange (CAD$/US$) | |

| 12 | |

| Depreciation | |

| (184 | ) |

| Net increase | |

$ | 192 | |

| As reported in current quarter | |

$ | 397 | |

| 10 | Teck Resources Limited 2024 Second Quarter News Release |

Property, plant and equipment expenditures in the second quarter totalled

$558 million, including $202 million for sustaining capital, and $297 million for project development expenditures for QB2.

Capitalized production stripping costs were $88 million in the second quarter

compared with $95 million a year ago.

Markets

In the second quarter, copper prices rose 16% over the previous quarter

to an average US$4.42/lb. reaching a record high at the end of May with prices rising to US$4.92/lb. on the LME. Traditional markets continue

to perform well with new technology and new energy sectors growing at an accelerated pace. Demand in Europe and North America during the

quarter was quiet, with high copper prices keeping buyers operating prudently on a day to day basis. Demand in China remains strong despite

weakness in the property market. Copper stocks in China rose by 70,000 tonnes in the quarter on the SHFE exchange and in bonded warehouses,

and are up 375,000 tonnes year to date. In Asia, spot demand continues to be strong with India demand the standout, projected to rise

this year by over 8%. Overall, global demand in 2024 is expected to remain supportive through the remainder of the year with both CRU

and Wood Mackenzie expecting global demand growth to come in over 3.0% this year.

The tightness in the copper concentrate market continued through the second

quarter, with spot smelter terms falling further to new record lows. Mid-Year settlements by major miners and major smelters for contracts

into 2025 were settled below US$25/tonne and 2.5 cents/lb. Demand from smelters continued to outpace the rise in primary mine supply in

2024, and this tightness is projected to continue well into 2025. New smelter capacity being built to meet the growing demand from traditional