Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

May 07 2024 - 4:23PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D/A

Under

the Securities Exchange Act of 1934

(Amendment

No.2)

TELEFÓNICA,

S.A.

(Name

of Issuer)

Ordinary

Shares, nominal value 1.00 euro per share

(Title

of Class of Securities)

879382208*

(CUSIP

Number)

Sociedad

Estatal de Participaciones Industriales

C/Velázquez,

134

28006,

Madrid, Spain

Attn:

Javier Morales Abad

Secretary

of the Board of Directors and Chief Legal Officer

Tel:

0034 91 396 11 06

(Name,

Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

May 7, 2024

(Date

of Event Which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of Sections 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐

*

The CUSIP number is for the American Depositary Shares, each representing one Ordinary Share. No CUSIP number exists for the underlying

Shares.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but

shall be subject to all other provisions of the Act.

| 1 |

NAME

OF REPORTING PERSON:

Sociedad

Estatal de Participaciones Industriales |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS):

(a)

☐

(b)

☐ |

| 3 |

SEC

USE ONLY:

|

| 4 |

SOURCE

OF FUNDS (SEE INSTRUCTIONS):

OO |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e):

☐ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION:

Spain |

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7 |

SOLE

VOTING POWER:

407,050,664 Shares |

| 8 |

SHARED

VOTING POWER:

0 |

| 9 |

SOLE

DISPOSITIVE POWER:

407,050,664

Shares |

| 10 |

SHARED

DISPOSITIVE POWER:

0 |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON:

407,050,664

Shares |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS):

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11):

7.079% |

| 14 |

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS):

OO |

Explanatory

Note

This

Amendment No. 2 (“Amendment No.2”) amends and supplements the Schedule 13D filed on April 22, 2024 as amended

by Amendment No.1 filed on April 26, 2024 (as amended to date, “Schedule 13D”). Except as specifically provided herein,

this Amendment No. 2 does not modify any of the information previously reported in the Schedule 13D.

Item

3. Source and Amount of Funds or Other Consideration

Item

3 is hereby amended and restated in its entirety as follows:

On

May 3, 2024, SEPI acquired Shares in an amount that would cause its holdings to exceed 7% of the Issuer’s outstanding

Shares as of such date. The settlement of this acquisition of Shares was completed on May 7, 2024. SEPI acquired the Shares reported

in this Schedule 13D in order to carry out the order of the Spanish government dated December 19, 2023 to purchase up to 10% of Shares

of the Issuer, subject to compliance with applicable Spanish reporting obligations and Spanish regulations requiring that such purchases

be implemented while minimizing the impact on the trading price of the Shares, with a view to promoting stability in the Issuer’s

shareholder base and safeguarding its strategic capabilities. Telefónica is a leading telecommunications company in Spain and

internationally whose activities the Spanish government considers to be of crucial importance to the economy, productivity, research

activities, security, defense and public interest of Spain.

SEPI

purchased the Shares reported in this Schedule 13D in the open market at an average price of €3.973 per Share. These

purchases were funded from capital contributions made to SEPI by the Spanish public treasury.

Item

4. Purpose of Transaction

The

third paragraph of Item 4 is hereby amended and restated in its entirety as follows:

As

a result of SEPI’s significant holdings of the Issuer’s total Shares, SEPI has the right under applicable Spanish law to

designate a representative to the Issuer’s board of directors. Therefore, on May 7, SEPI requested the Issuer to consider appointing

Mr. Carlos Ocaña Orbis as a new director to represent SEPI’s ownership interest on the Issuer’s board of directors.

Item

5. Interest in Securities of the Issuer

The

first paragraph of Item 5(a) is hereby amended and restated in its entirety as follows:

(a)

As of May 7, 2024, Telefónica had 5,750,458,145 Shares outstanding as disclosed in its Form 20-F for the fiscal year ended

December 31, 2023. SEPI beneficially owned 407,050,664 Shares, representing approximately 7% (rounded off to the nearest

tenth from 7.079%) of the total outstanding Shares, as of such date.

Item

5(b) is hereby amended and restated in its entirety as follows:

(b)

SEPI may be deemed to have sole voting and dispositive power with respect to an aggregate of 407,050,664 Shares that it directly

owns. The responses of SEPI to Rows (7) through (10) of the cover page of this Schedule 13D are incorporated herein by reference. To

the knowledge of SEPI, none of the persons set forth in Schedule A may be deemed to have sole voting and dispositive power with respect

to any Shares.

SIGNATURES

After

reasonable inquiry and to the best of his knowledge and belief, the undersigned hereby certifies that the information set forth in this

statement is true, complete and correct.

Dated:

May 7, 2024

| |

Sociedad

Estatal de Participaciones Industriales

|

| |

|

| |

/s/

Javier Morales Abad

|

| |

Name: |

Javier Morales Abad |

| |

Title: |

Secretary of the Board of Directors and Chief Legal Officer |

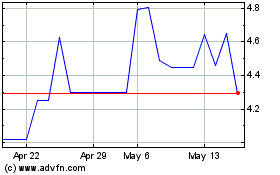

Telefonica (PK) (USOTC:TEFOF)

Historical Stock Chart

From Jan 2025 to Feb 2025

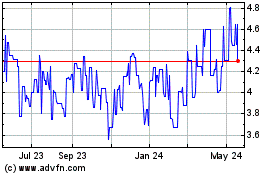

Telefonica (PK) (USOTC:TEFOF)

Historical Stock Chart

From Feb 2024 to Feb 2025