Turkey's Sovereign Wealth Fund Seeks International Investors

February 17 2017 - 9:44AM

Dow Jones News

By Margaret Coker and Yeliz Candemir

ISTANBUL--Turkey's newly created sovereign-wealth fund is

conducting a valuation process of its blue-chip state enterprises

as part of a planned drive to attract more overseas investment, the

fund's director Mehmet Bostan said Friday.

Turkey Wealth Fund has hired international accounting firms for

the audit of the varied group of companies that were transferred to

its control by the government earlier this month. These include

stakes in Turkish Airlines, Turk Telekomunikasyon AS, the country's

largest landline operator and internet-service provider, the

nation's energy pipeline company BOTAS and state-owned oil company

TPAO.

Mr. Bostan told The Wall Street Journal that the investment and

management goals of the fund are based on conservative, long-term

investment principles aimed at increasing the value of the state

enterprises via foreign investment, domestic job creation and

maximizing the government's macroeconomic growth strategy.

He said the fund isn't seeking to privatize the state

enterprises under its control, but rather help them attract foreign

investment as a way to expand operations. Although the fund has the

authority to invest in both domestic and international markets, he

doesn't expect to be going on an asset buying spree in the near

future.

"Our main playing field is the portfolio we have been given,"

said Mr. Bostan. "From the cash that these companies generate...we

will use it in markets and use it smartly. We want to be a platform

for foreign investors in both capital markets and other

investments."

Turkey formally established the fund in late 2016 at a time of

escalating instability in which Turkey posted its first negative

growth rate in eight years. The Turkish lira had depreciated by

more than 20% in annual terms against the U.S. dollar and the

country was becoming polarized over the radical political reform

program of President Recep Tayyip Erdogan that aims to change the

structure of Turkey's democracy.

At the same time, investors have grown wary of the extraordinary

powers the government has used since it declared a state of

emergency after the failed July 15 coup.

Investors are particularly concerned over the seizure of

hundreds of businesses without judicial review due to their alleged

links to a U.S. based cleric Fethullah Gülen. The Turkish

government blamed Mr. Gülen for masterminding the failed coup and

jailed tens of thousands of people on accusations of supporting

terrorism or the coup plotters. Mr. Gülen denies any role in the

summer's military insurrection.

All three international ratings firms classify Turkey at junk

status, citing in part the continuing political instability.

In this turbulent atmosphere, Mr. Bostan, who left Turkey's

privatization administration to take on his job in early November,

is completing the hiring of a four-person team who would be in

charge of the fund's investments based on a strategy that he

described as focused on low-risk, long-term returns.

The top candidates for the management jobs--who are all Turkish

nationals--have extensive experience in international banking and

multinational corporations, he said.

Meanwhile, a full audit and valuation process for the

enterprises under the fund's control is expected to be completed in

a few months, he said. At that stage, the fund will seek government

approval for a five-year strategy that he expects to be financed by

raising cash on international money markets.

Mr. Bostan said it was too early to talk about the size of any

bond offerings, as the fund still has no idea the size of the

assets it has under management. "I can't even tell you an

approximate figure," he said in an interview in his Spartan offices

located in the headquarters of Borsa Istanbul, Turkey's main stock

exchange.

Critics and analysts of Turkey's economic strategy have raised

questions about the creation of the fund at a time when political

pressure has weakened the independence of financial regulators as

well as the checks and balances of government bodies. They fear

that the fund will become an alternative revenue pool for

controversial infrastructure projects favored by the ruling party,

to the detriment of the state enterprises themselves.

Mr. Bostan said that the fund would abide by international

standards of transparency and it will have strong internal audit

mechanisms as well as face independent auditors on a regular

basis.

"It should be easy for international investors to look to us for

opportunities. We have a strong background with the government. We

are adopting best practices. We have a very diverse asset set," Mr.

Bostan said.

The fund's operations may also be adversely affected by the

country's political uncertainty. The nation will be voting in

mid-April on a referendum to approve a constitutional reform

package that envisages a strong executive presidency and abolishing

the office of the prime minister. Current legislation has the fund

reporting directly to the prime minister and the cabinet.

Mr. Bostan didn't have any answer as to what changes in his

statutory reporting obligations there could be if the referendum

passed.

Write to Margaret Coker at margaret.coker@wsj.com and Yeliz

Candemir at yeliz.candemir@wsj.com

(END) Dow Jones Newswires

February 17, 2017 10:29 ET (15:29 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

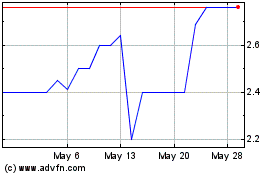

Turk Telekomunikasyon (PK) (USOTC:TRKNY)

Historical Stock Chart

From Jan 2025 to Feb 2025

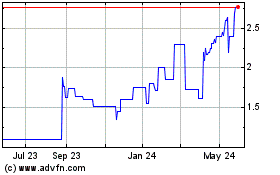

Turk Telekomunikasyon (PK) (USOTC:TRKNY)

Historical Stock Chart

From Feb 2024 to Feb 2025