HSBC Posts Strong 1Q Earnings - Analyst Blog

May 07 2013 - 3:49AM

Zacks

HSBC Holdings plc’s (HBC) earnings per share

came in at 34 cents in the first quarter of 2013, substantially

surpassing the prior-quarter earnings of 16 cents and the year-ago

earnings of 13 cents. Net profit came in at $6.4 million, rising

massively from both the prior quarter and the year-ago quarter.

The robust results were driven by top-line improvement and growth

in total operating income. Moreover, the core results were

favorably impacted by reduced operating expenses. However, dismal

performance in some divisions acted as a headwind.

HSBC exhibited significant progress in strategically reshaping

itself and improving its returns. Since the beginning of 2011, the

company announced the divestiture or closure of 52 of its

non-core/unprofitable operations across the globe. Moreover, HSBC

generated cost savings of $0.4 billion in the reported quarter,

leading to annualized total savings of $4.0 billion.

Performance in Detail

Underlying profit before tax was $7.6 million in the quarter,

surging 34.2% year over year. The rise primarily reflected increase

in revenues and reduced loan impairment charges along with an

improvement in the US consumer and mortgage lending portfolio.

Total revenue (on an underlying basis) stood at $17.6 million,

climbing 4.5% from $16.8 million in the previous year quarter.

Improvement was largely driven by growth in revenues from

residential mortgages and commercial banking in Hong Kong and UK

and financing and equity capital markets.

Total operating income rose 7.5% from the year-ago period to $22

million. The rise was mainly due to increase in net trading income,

dividend income and other operating income, partially offset by

lower net interest and fee income.

Total operating expenses were $9.3 million, decreasing 9.7% from

$10.4 million in the prior year quarter. The decline was mainly due

to decrease in charges related to UK customer redress programmes

and a reduction in restructuring and related costs.

The underlying cost efficiency ratio decreased to 53.2% from 56.9%

in the previous year quarter. The fall in efficiency ratio

indicates higher profitability.

Performance by Business Line

Retail Banking and Wealth Management: The segment reported $1.6

million in pre-tax profit, down 28.2% from $2.2 million in the

prior year quarter. The fall was primarily due to decrease in

revenue growth, partially offset by lower loan impairment

charges.

Commercial Banking: The segment reported pre-tax profit of $2.18

million, down 0.8% from $2.20 million in the previous year quarter.

The fall was mainly due to decrease in revenues, partially offset

by decline in loan impairment charges.

Global Banking and Markets: Pre-tax profit for the segment was $3.6

million, increasing 16.5% year over year. Segment results improved

on the back of higher revenues, offset in part by rise in loan

impairment charges.

Global Private Banking: Pre-tax loss for the segment was $125

million compared with the pre-tax profit of $286 million in the

previous year quarter. The deterioration was due to increase in

operating expenses, fall in revenues and higher loan impairment

charges.

Other: The segment recorded a pre-tax profit of $1.2 million in the

reported quarter against pre-tax loss of $3.4 million in the prior

year quarter. This was primarily due to increase in revenues and

decrease in operating expenses, partially offset by higher loan

impairment charges.

Profitability and Capital Ratios

Profitability ratios improved in the quarter. Annualized return on

equity rose to 14.9% from 6.4% in the previous year quarter.

Moreover, pre-tax return on risk-weighted assets (annualized)

increased to 3.1% from 1.4% in the prior year quarter.

HSBC continued to generate capital from its retained profits. The

company’s core tier 1 ratio as of Mar 31, 2013 improved to 12.7%

compared with 12.3% as of Mar 31, 2012. Total capital ratio also

rose from 16.1% recorded as of Dec 31, 2012 to 16.7% as of Mar 31,

2013.

Our Viewpoint

HSBC is bearing the brunt of weak revenue growth in its mature

markets mainly due to the ongoing low interest rates and regulatory

restrictions. However, the company is poised to benefit from its

extensive global network, strong capital position, business

re-engineering and solid asset growth.

Further, HSBC’s cost containment measures are expected to

extensively help it counter the economic pressures. However, high

inflation in some key Asian markets, sluggish loan growth,

insufficient core operating performance and increased wage

inflation are apprehended to restrict the company’s growth in the

near future.

HSBC currently carries a Zacks Rank #3 (Hold). However, other

foreign banks that are worth considering include China

Merchants Bank Co., Ltd. (CIHKY) and United

Overseas Bank Limited (UOVEY) with a Zacks Rank #1 (Strong

Buy) and Agricultural Bank of China Limited

(ACGBY) with a Zacks Rank #2 (Buy).

AGRI BANK CHINA (ACGBY): Get Free Report

CHINA MERCH BK (CIHKY): Get Free Report

HSBC HOLDINGS (HBC): Free Stock Analysis Report

UTD OVERSEAS BK (UOVEY): Get Free Report

To read this article on Zacks.com click here.

Zacks Investment Research

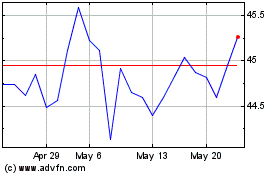

United Overseas Bk (PK) (USOTC:UOVEY)

Historical Stock Chart

From Oct 2024 to Nov 2024

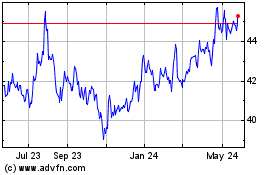

United Overseas Bk (PK) (USOTC:UOVEY)

Historical Stock Chart

From Nov 2023 to Nov 2024