Latin American Steelmakers Downgraded As Profits Set To Deteriorate

February 15 2012 - 2:14PM

Dow Jones News

RIO DE JANEIRO (Dow Jones) -- Merchant bank analysts downgraded

various Latin American steelmakers Wednesday on prospects of

falling steel prices in Brazil and deteriorating profitability amid

weak first-half demand.

Now is the time for profit-taking in the Latin American steel

sector after a recent stocks rally which is set to peter out, said

analysts from Morgan Stanley and Citigroup, which both downgraded

Brazil's Gerdau SA (GGBR4.BR), Usinas Siderurgicas de Minas Gerais

SA (USIM5.BR, USZNY), or Usiminas, Companhia Siderurgica Nacional

SA (CSNA3.BR, SID) or CSN, and Latin American steelmaker Ternium

(TX).

Morgan Stanley's researcher Carlos de Alba said in a report he

downgraded the four steelmakers because "steel prices are poised to

fall" and there's little room for any further improvement in steel

stocks prices, which have risen as much as 42% from recent lows.

The analyst cut Gerdau and Ternium to equalweight from overweight

and CSN and Usiminas to underweight from equalweight.

"Risk-reward profiles have deteriorated as the shares appear

already to price in the improving Latam steel fundamentals we see

in the coming years: higher volumes driven by demand growth and

reduced raw material costs that will boost operating margins," de

Alba said. "We think (steel) prices have peaked and will decline in

coming weeks."

It's unclear how Ternium will generate an attractive return on

its expensive acquisition of a controlling stake in Usiminas, where

any turnaround by its new management will take at least two years,

according to de Alba. In addition, Gerdau's stock is currently

pricey and CSN continues to face problems expanding its iron ore

shipments which has generated concerns over capital allocations, he

said.

Citigroup analyst Alex Hacking cut Gerdau and Ternium to neutral

from buy and Usiminas and CSN to sell from neutral. Target share

prices were cut for all the steelmakers.

Hacking highlighted several near-term concerns for Latin

American steelmakers in a report. Steel share prices have rallied

without fundamental improvements, he said. First-half 2012 demand

for steel in Brazil, the biggest Latin American producer and

consumer, is looking weak and is overhung by high inventories,

meaning there's little near-term prospect of higher prices for the

region's steel mills.

"Global over-capacity has limited any sustainable pricing since

2008, and we do not anticipate any improvement in 2012," Hacking

said.

While steelmakers' margins may rise in second-quarter 2012 due

to lower raw materials costs, any advantages gained will fizzle out

later in the year due to cost inflation, according to Citigroup's

calculation.

In a report earlier this week, Morgan Stanley analyst Marcelo

Aguiar said that a combination of lower risk aversion among equity

investors and recent steel price hikes in the U.S. has brought

investor attention back to the steel sector.

However, "we do not see earnings expanding for Brazilian

companies, given a low probability of local steel price increases

near term," Aguiar said.

The Morgan Stanley analyst notes there is "skepticism" on CSN's

investment case and says that the stronger outlook for the U.S.

economy seems to be already priced into the stock at Gerdau, which

still needs to reap in any benefit from its current iron ore mining

investments.

Appointment of a new CEO at Usiminas meanwhile "reduces the

near-term visibility on Usiminas' strategy, which could act as an

overhang," said Aguiar, who expects Usiminas to report weak

earnings in fourth quarter 2011 and first-quarter 2012.

-By Diana Kinch, Dow Jones Newswires, Tel +55 21 2586 6086.

diana.kinch@dowjones.com

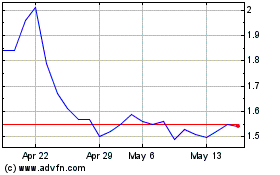

Usinas Siderurgicas De M... (PK) (USOTC:USNZY)

Historical Stock Chart

From May 2024 to Jun 2024

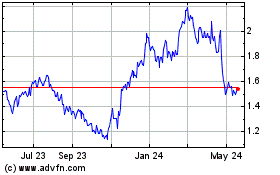

Usinas Siderurgicas De M... (PK) (USOTC:USNZY)

Historical Stock Chart

From Jun 2023 to Jun 2024