Brazil's Usiminas: No Decision On Usimec, Automotiva Sales

March 14 2012 - 12:47PM

Dow Jones News

Brazilian steelmaker Usinas Siderurgicas de Minas Gerais SA

(USIM5.BR), or Usiminas, said Wednesday it has considered options

for development of its capital-goods and automotive-parts units but

no decision has been made on possible sales.

No decision is expected soon on new strategies regarding

Usiminas Mecanica, or Usimec--the steelmaker's engineering,

construction and capital goods arm--and Automotiva Usiminas--a

subsidiary that produces parts for the vehicle industry, according

to a Usiminas press spokesman.

In February 2011, Usiminas's former chief executive officer,

Wilson Brumer, told analysts the company may place Usimec in an

initial public offering or seek a strategic partner to provide

technological support. The idea was that Usimec could be used to

add value to Usiminas's assets, the former executive said.

O Estado de S.Paulo newspaper said Wednesday that, with Latin

American steelmaker Ternium SA's (TX) recent purchase of a voting

stake in Usiminas and assumption of some management duties, sales

of the two subsidiaries may now occur.

The units together are worth around 2.5 billion Brazilian reais

($1.37 billion), the newspaper said, citing sources close to

Usiminas. The cash raised from a sale may be essential for Usiminas

to finance its planned expansion of its iron ore mining operations

to a capacity of 29 million tons a year by 2015, from the current 8

million tons, according to Estado.

Estado's estimated price tags of around BRL2 billion for

Usiminas Mecanica and BRL500 million for Automotiva Usiminas are

too high, Barclays Capital said in a note to clients Wednesday. The

figure is "a bit stretched," according to Barclays analyst Leonardo

Correa, who considers BRL1.4 billion a more suitable asking price

for Usimec.

Barclays, however, doesn't expect news on this in the near term

as Ternium's recent entry into Usiminas management may lead to a

new search for growth potential and synergies in these areas, it

says.

A Sao Paulo-based analyst, who declined to be named, said that

"Ternium will make changes at Usiminas, but it won't have any

impact in the short term. However, Usiminas could divest from its

noncore businesses, such as Usiminas Mecanica and the [steel]

distribution business."

Usimec had net sales of BRL1.4 billion in 2011, 11.8% of

Usiminas's total sales. It's active in the basic infrastructure

area, which is an investment focus for the Brazilian government as

the country prepares to host the World Cup in 2014 and Olympic

Games in 2016.

Automotiva Usiminas had sales of BRL343.9 million in 2011, 2.9%

of Usiminas's total sales.

Ternium's parent, Techint Group, finalized acquisition of a 29%

stake in Usiminas's voting stock in January for $2.8 billion.

Ex-Ternium executive Julian Eguren replaced Brumer as Usiminas's

CEO, and is one of three Ternium executives to sit on the

management board of the company, based in Minas Gerais state.

Usiminas is now undertaking "a new analysis of investment plans

and capital expenditure" to seek synergies, improve its operations

and cut costs, Eguren told analysts last week.

Usiminas's preferred shares surged 3.38% to BRL13.15 in early

afternoon trading in Sao Paulo, compared with an overall 0.35%

decline on the Bovespa exchange.

-By Diana Kinch, Dow Jones Newswires, Tel: +55 21 2586 6086,

diana.kinch@dowjones.com

-0-

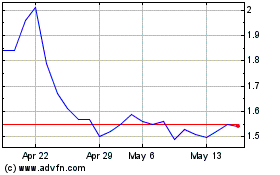

Usinas Siderurgicas De M... (PK) (USOTC:USNZY)

Historical Stock Chart

From May 2024 to Jun 2024

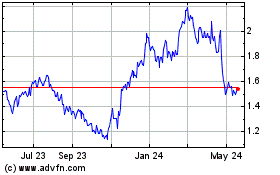

Usinas Siderurgicas De M... (PK) (USOTC:USNZY)

Historical Stock Chart

From Jun 2023 to Jun 2024