Orsted Loses a Quarter of its Market Value After Warning on US Offshore Wind

August 30 2023 - 8:32AM

Dow Jones News

By Dominic Chopping

Danish renewable energy company Orsted lost a quarter of its

market value Wednesday after warning of hefty impairments related

to three wind projects off the east coast of the U.S., adding

further pressure to an industry hit by surging costs and supply

delays.

Offshore wind developers are facing strong headwinds at the same

time as demand for renewable energy is greater than ever, with

governments moving to hit climate targets and boost electricity

supplies. The Biden administration is targeting 30 gigawatts of

offshore wind power to be installed by 2030, enough to power

roughly 10 million homes, up from essentially zero now, and the

country has opened up areas mainly along the east coast for

development whilst offering tax credits to encourage development

and cut costs.

But soaring inflation has seen materials and services costs rise

while higher interest rates mean financing costs have surged,

sending project costs spiraling out of control and forcing

developers to renegotiate or exit contracts as projects are no

longer profitable.

Norway's Equinor and Britain's BP are developing three wind

farms off the coast of New York and said in June that they will

need to renegotiate power prices or the projects won't get

financing, while a subsidiary of Spanish multinational Iberdrola

last month agreed to pay $48 million to back out of an offshore

wind-power deal in Massachusetts that it bid in September 2021,

when project economics were more favorable.

A first-ever auction of offshore wind development rights in the

Gulf of Mexico resulted in a single $5.6 million winning bid on

Tuesday, while two areas offshore Texas that were offered received

no bids at all.

Orsted's chief problems relate to three U.S offshore projects;

the company said late Tuesday it could book up to 16 billion Danish

kroner ($2.34 billion) in impairments in its third quarter earnings

next month after reviewing the projects.

Those projects haven't yet reached a final investment decision,

which is the final stage before a project gets fully sanctioned,

and Orsted said that although it hopes to move ahead, it will

continue to explore alternative options.

"As we mature towards final investment decision, if the

walk-away scenario is the economical, rational decision for us,

then this remains a real scenario for us as an alternative to

actually taking the final investment decision," Chief Executive

Mads Nipper said on a media call after the announcement.

Orsted has eight U.S. offshore projects off the coast of

Connecticut, Maryland, New Jersey, New York and Rhode Island.

The company is facing delays from suppliers, mainly from

companies that build the offshore foundations as well as from a

specialist installation vessel, which could create knock-on effects

for final installation as well as potentially delaying revenue and

increasing costs, but assuming no further supply chain issues the

company will book impairments of up to DKK5 billion from this

issue.

As part of U.S. efforts to encourage offshore development it

offers tax incentives to wind developers which comprise a series of

tax credits based on certain criteria such as using domestically

produced materials and various jobs and location criteria, among

others.

Orsted said it is in discussions with federal stakeholders to

qualify for additional tax credits beyond 30%, aiming to qualify

for at least 40% of credits on all of its projects, however, due to

the lack of capacity in U.S. industry it's currently impossible for

any developers to qualify for the extra 10%. The company is

"pushing really hard" to change the situation, Nipper said.

If its efforts prove unsuccessful, it could lead to impairments

of up to DKK6 billion. In addition, if U.S. long-dated interest

rates remain at the current level by the end of the third quarter,

the company said it will cause impairments of around DKK5

billion.

"We still believe in the long term potential of the U.S. market

but something needs to happen short-term in order for this industry

to be scalable...it's extremely important that the federal

government takes this as seriously as they possibly can if they

still intend to have scalable offshore wind," Nipper said.

Orsted regularly evaluates all of its projects and Nipper said

that at the moment its projects in the rest of the world are not in

impairment territory.

However, other companies are facing similar problems in Europe.

Swedish state-owned utility group Vattenfall last month decided to

stop development of an offshore wind farm off the U.K. coast as

higher inflation and interest rates meant the guaranteed price for

electricity produced at the project was no longer enough to ensure

project profitability.

Helene Bistrom, head of Vattenfall's wind business, said at the

time that a decent mechanism that reflected the current market

situation was needed and that talks within the industry with

suppliers, the U.K. government and developers were continuing.

Suppliers, too, have felt the pinch. Turbine maker Vestas Wind

Systems has seen its shares fall 20% this year amid slowing orders

as higher project costs and slow European permitting weigh on

orders. Hopes have been high that the U.S. push into offshore wind

would provide a boost to orders in the second half of this year,

but shares slipped as much as 5.2% following news of Orsted's U.S.

woes.

At 1258 GMT, Orsted shares were trading 25% lower at DKK422.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

August 30, 2023 09:17 ET (13:17 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

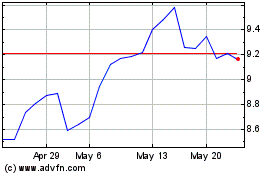

Vestas Wind Systems AS (PK) (USOTC:VWDRY)

Historical Stock Chart

From Oct 2024 to Nov 2024

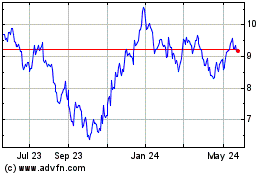

Vestas Wind Systems AS (PK) (USOTC:VWDRY)

Historical Stock Chart

From Nov 2023 to Nov 2024