Current Report Filing (8-k)

August 17 2016 - 10:26AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported)

August 12, 2016

XFIT

BRANDS, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-55372

|

|

47-1858485

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

25731

Commercentre Drive, Lake Forest, CA

|

|

92630

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code:

(949) 916-9680

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2.below):

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM

1.01 ENTRY INTO MATERIAL DEFINITIVE AGREEMENTS

INVESTMENT

AGREEMENT WITH GHS INVESTMENTS, LLC

On

August 12, 2016 we entered into an “at the market” Investment Agreement (the “Investment Agreement”) with

GHS Investments, LLC (“GHS”). To sell shares under the Investment Agreement, the Investment Agreement gives us the

option to sell to GHS up to $5,000,000 worth of our common stock (“Shares”) over the period following effectiveness

of a registration statement under the Securities Act of 1933 (the “Effective Date”) and ending thirty-six (36) months

after the Effective Date. Under the terms of the Investment Agreement, we have the right to deliver from time to time a Put Notice

to GHS stating the dollar amount of Put Shares (up to $500,000 under any individual Put Notice)(the “Put Amount”)

that we intend to sell to GHS with the price per share based on the following formula: the lesser of (a) the lowest sale price

for the Common Stock on the date of the Put Notice (the “Put Notice Date”); or (b) the arithmetic average of the three

(3) lowest trading prices for the Company’s Common Stock during the five trading days following the Put Notice Date. The

maximum number of shares that can be put to GHS is two times the average daily trading volume during the ten trading days prior

to the closing of a put (the “Closing Date”). If the amount of the tranche exceeds the volume limitation, additional

tranches will be delivered until the entire Put Amount is delivered. Each tranche, including the initial tranche, will trigger

a new purchase price, and will be priced according to the purchase price definition.

On

any Closing Date, we shall deliver to GHS the number of shares of the Common Stock registered in the name of GHS as specified

in the Put Notice. In addition, we must deliver the other required documents, instruments and writings required. GHS is not required

to purchase the shares unless:

|

|

●

|

Our

Registration Statement with respect to the resale of the shares of Common Stock delivered in connection with the applicable

Put shall have been declared effective.

|

|

|

|

|

|

|

●

|

at

all times during the period beginning on the date of the Put Notice and ending on the date of the related closing, our Common

Stock has been listed on the Principal Market as defined in the Investment Agreement (which includes, among others, the OTC

Market: QB Tier) and shall not have been suspended from trading thereon.

|

|

|

|

|

|

|

●

|

we

have complied with our obligations and we are not otherwise not in breach of or in default under the Investment Agreement,

the Registration Rights Agreement or any other agreement executed in connection therewith;

|

|

|

|

|

|

|

●

|

no

injunction has been issued and remains in force, and no action has been commenced by a governmental authority which has not

been stayed or abandoned, prohibiting the purchase or the issuance of the Put Shares; and

|

|

|

|

|

|

|

●

|

the

issuance of the Shares will not violate any shareholder approval requirements of the market or exchange on which our Common

Stock is principally listed.

|

In

addition, there is an ownership limit for GHS of 9.99% of the total outstanding shares.

GHS

will not engage in any “short-sale” (as defined in Rule 200 of Regulation SHO) of our Common Stock at any time during

this Agreement. Pursuant to the Investment Agreement with GHS, we agreed to pay a fee equaling $250,000 or 5% of the Commitment

Amount (the “Commitment Fee”) which shall be paid in installments of Fifty Thousand ($50,000) beginning on the earlier

of (i) the Effective Date and (ii) January 1, 2017 and, the first Trading Day of each January, April, July and October thereafter

until fully paid. Each installment of the Commitment Fee shall be paid either in cash or, at the election of the Company, in shares

of Common Stock, which shall be deemed a put under the Investment Agreement. On August 12, 2016, we entered into a Registration

Rights Agreement with GHS requiring, among other things that we prepare and file with the SEC a Registration Statement on Form

S-1 covering the resale of the shares issuable to GHS under the Investment Agreement. As per the Investment Agreement, GHS’

obligations are not assignable.

We

currently have an Equity Purchase Agreement with Kodiak Capital Group, LLC (“Kodiak”) pursuant to which we can put

shares to Kodiak. The pricing to us under the IA is better than the Kodiak agreement and we intend to terminate the Kodiak agreement

immediately prior to the Effective Date.

The

foregoing descriptions of the IA and the Registration Rights Agreement are qualified in its entirety by reference to the provisions

of the IA filed as exhibit 10.1 and the Registration Rights Agreement filed as exhibit 10.2 to this Current Report on the Form

8-K which are incorporated herein by reference.

TEM

3.02 UNREGISTERED SALES OF EQUITY SECURITIES

Reference

is made to the disclosure set forth under Item 1.01 of this Report, which disclosure is incorporated herein by reference.

The

issuance of the Commitment Shares and the sale of the Shares to GHS under the IA are exempt from the registration requirements

of the Securities Act pursuant to the exemption for transactions by an issuer not involving any public offering under Section

4(a)(2) of the Securities Act and Rule 506 of Regulation D promulgated under the Securities Act (“Regulation D”).

The Company made this determination based on the representations of GHS that GHS is an “accredited investor” within

the meaning of Rule 501 of Regulation D and has access to information about the Company and its investment.

The

Company did not pay any brokerage commissions or finders’ fees in connection with the IA.

This

Report is neither an offer to sell nor the solicitation of an offer to buy any securities. The securities have not been registered

under the Securities Act and may not be offered or sold in the United States of America absent registration or an exemption from

registration under the Securities Act.

ITEM

8.01 OTHER EVENTS.

ACCOUNT

PURCHASE AGREEMENT WITH CROWN FINANCIAL LLC

On

August 3, 2017 we entered into an account purchase agreement (the “Purchase Agreement”) with Crown Financial LLC (“Crown”)

pursuant to which we can sell our accounts receivable to Crown, subject to consent by PIMCO, which has a security interest in

substantially all of our assets. On August 10, 2016, PIMCO granted its consent to the Purchase Agreement. Under the Purchase Agreement,

Crown will advance 80% of purchased receivables and will pay to us a rebate based upon the time it takes Crown to collect the

receivable. Crown can require us to repurchase sold accounts receivable which are not collected by them within 120 days of purchase.

ITEM

9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d)

Exhibits

10.1

Investment

Agreement dated as of August 12, 2016 by and between GHS Investments, LLC and XFit Brands, Inc.

10.2

Registration

Rights Agreement dated as of August 12, 2016 by and between GHS Investments, LLC and XFit Brands, Inc.

99.1

Press Release announcing GHS Investment Agreement.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

XFIT

BRANDS, INC.

|

|

|

(Registrant)

|

|

|

|

|

Date:

August 17, 2016

|

By:

|

/s/

David E. Vautrin

|

|

|

|

David

E. Vautrin

|

|

|

|

Chief

Executive Officer

|

XFIT Brands (CE) (USOTC:XFTB)

Historical Stock Chart

From Oct 2024 to Nov 2024

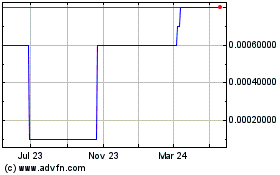

XFIT Brands (CE) (USOTC:XFTB)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about XFIT Brands Inc (CE) (OTCMarkets): 0 recent articles

More Xfit Brands, Inc. News Articles