Current Report Filing (8-k)

December 20 2016 - 2:49PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported)

December 16, 2016

XFIT

BRANDS, INC

.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-55372

|

|

47-1858485

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

25731

Commercentre Drive, Lake Forest, CA

|

|

92630

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code:

(949) 916-9680

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2.below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM

1.01 ENTRY INTO MATERIAL DEFINITIVE AGREEMENTS

AMENDED AND RESTATED NOTE PURCHASE AGREEMENT WITH PIMCO FUNDS: PRIVATE ACCOUNT PORTFOLIO SERIES: PIMCO HIGH YIELD PORTFOLIO

On

December 16, 2016 we entered into an Amended and Restated Note Purchase Agreement (the “Agreement”) with PIMCO Funds:

Private Account Portfolio Series: PIMCO High Yield Portfolio (“PIMCO”) pursuant to which we issued a $3.5 million

9% Senior Secured Fixed Rate Note due July 12, 2020 (the “Note”). The Note refinanced our prior 14% Senior Secured

Note in the principal amount of $2.5 million (the “Prior Note”), providing us with an additional $1 million in working

capital. As with the Prior Note, the Note is secured by a lien on substantially all of our assets (other than those sold pursuant

to our factoring agreement with Crown Financial).

In

connection with the Agreement, (i) PIMCO converted $ 278,689 in accrued and unpaid interest into 1,990,639 shares of our common

stock. In addition we had previously issued PIMCO a warrant to purchase ten percent of our equity at an exercise price of $1.5

million. We amended the terms of the common stock purchase warrant previously issued to PIMCO to reduce the exercise price thereof

to $350,000.

The

foregoing descriptions of the Agreement, Note and the amended common stock purchase warrant are qualified in its entirety by reference

to the provisions of such agreements filed as exhibits to this Current Report on the Form 8-K which are incorporated herein by

reference.

ITEM

2.03 CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT

Reference

is made to the disclosure set forth under Item 1.01 of this Report, which disclosure is incorporated herein by reference.

The

Note provides for monthly payments of interest at the rate of 9% per annum, with the principal due at maturity on July 12, 2020.

The principal and interest on the Note will be accelerated upon an event of default as provided in the Note. The Agreement and

the Note provide for standard representations and warranties. The Agreement prohibits us from paying cash dividends on our shares

or our repurchasing shares of common stock.

ITEM

3.02 UNREGISTERED SALES OF EQUITY SECURITIES

Reference

is made to the disclosure set forth under Item 1.01 of this Report, which disclosure is incorporated herein by reference.

The

issuances of the Note, the shares of common stock issued upon conversion of accrued interest and the amended common stock purchase

warrant were exempt from the registration requirements of the Securities Act pursuant to the exemption for transactions by an

issuer not involving any public offering under Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D promulgated

under the Securities Act (“Regulation D”). The Company made this determination based on the representations of PIMCO

that PIMCO is an “accredited investor” within the meaning of Rule 501 of Regulation D and has access to information

about the Company and its investment.

The

Company did not pay any brokerage commissions or finders’ fees in connection with the transactions with PIMCO.

This

Report is neither an offer to sell nor the solicitation of an offer to buy any securities. The securities have not been registered

under the Securities Act and may not be offered or sold in the United States of America absent registration or an exemption from

registration under the Securities Act.

ITEM

9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d)

Exhibits

|

10.1

|

|

Amended

and Restated Note Purchase Agreement dated as of December 16, 2016

|

|

|

|

|

|

10.2

|

|

9%

Senior Secured Fixed-Rate Note due July 12, 2020

|

|

|

|

|

|

10.3

|

|

Amended

and Restated Common Stock Purchase Warrant

|

|

|

|

|

|

10.4

|

|

Amended

and Restated Pledge And Security Agreement

|

|

|

|

|

|

10.5

|

|

Patent

Security Agreement

|

|

|

|

|

|

10.6

|

|

Trademark

Security Agreement

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

XFIT BRANDS, INC.

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

Date:

December 20, 2016

|

By:

|

/s/

David E. Vautrin

|

|

|

|

David

E. Vautrin

|

|

|

|

Chief

Executive Officer

|

XFIT Brands (CE) (USOTC:XFTB)

Historical Stock Chart

From Oct 2024 to Nov 2024

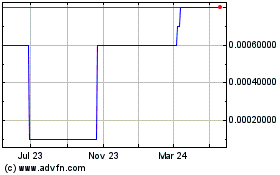

XFIT Brands (CE) (USOTC:XFTB)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about XFIT Brands Inc (CE) (OTCMarkets): 0 recent articles

More Xfit Brands, Inc. News Articles