NetworkNewsWire Editorial

Coverage: Zinc supplies are

dwindling, and spot prices are soaring. Futures look

robust, as well, and, despite a minor pullback toward the end of

the week of October 23, there appears to be a stable forward price

trajectory for the foreseeable future. As fundamental drivers such

as China’s reduced

production of mined and refined zinc loom large, the upside for

smaller sector participants such as Vancouver-based Zinc

One Resources, Inc. (OTC: ZZZOF) (TSX.V: Z) (Zinc One

Profile) is now coming sharply into

focus, and there is still plenty of upside for other sector players

like Vedanta (NYSE: VEDL), Hecla Mining

(NYSE: HL), Southern Copper (NYSE: SCCO)

and Teck Resources (NYSE: TECK).

According to a recent Technavio

report, zinc demand is projected to continue providing upward

of 2 to 3 percent CAGR, as it has in preceding years. The report

predicts that the global zinc market will bear a hearty 4 percent

CAGR through 2021 on the continued strength of vectors such as

China’s trillion dollar-plus “One Belt, One Road” infrastructure

development initiative, given that more than half of the demand for

zinc comes from galvanizing (steel) applications. Zinc on the

London Metal Exchange hit a 10-year high of $3,308 per metric ton

($1.50 per pound) in October and hit a nine-and-a-half-year high on

the Shanghai Futures Exchange of $4,048 per metric ton. Meanwhile,

stockpiles of zinc on both the LME and SHFE are at some

of their lowest levels since 2008 and 2009. As of the end of the

week of October 23, the cash/three-month LME spread is in

significant backwardation,

adding further weight to the supply shortage in the spot market.

According to the International Lead and Zinc Study Group, the zinc

supply shortfall was up 30 percent year-on-year for the first eight

months of 2017 alone.

Such factors are what makes a smaller zinc-focused developer

like Zinc One

Resources (OTC: ZZZOF) (CVE: Z) so interesting,

particularly given the company’s direct access to historically

proven high-grade zinc-oxide mineralization via its Bongara zinc-oxide

mine project in mining-friendly northern Peru’s mineral-rich

Amazonas Region, obtained via the acquisition of Forrester Metals

in June. In

concert with the acquisition, Zinc One Resources closed a fully

subscribed $10 million private placement that will fund

exploration and development costs at Bongara, and it tapped

industry veteran Dr. William “Bill” Williams (PhD, Economic

Geology) as its COO.

Williams brings a considerable amount of raw experience to the

table, having previously served as president and CEO of

gold/copper-focused Orvana (OTC: ORVMF), as well as vice president

of the copper/molybdenum-focused private company Phelps Dodge

Exploration. And quite the table it is, with a proven management

team of exploration geologists and engineers whose top three

members have over a century of combined mining experience focused

on advancing projects into production. Williams will no doubt be

instrumental when it comes to ensuring the short-term and long-term

success of the roughly 20,000-acre Bongara mine project and

adjacent Charlotte Bongara site, which represents nearly 7,700

additional acres of drill-tested high-grade zinc oxide mineralized

land.

Williams is joined by a management team with a track record of

raising capital, leveraging an extensive network to identify new

projects and negotiate potential acquisitions. Backed by this

management team, Zinc One is in a favorable position to execute its

business plan to successfully bring its Bongara Mine Project back

into production and achieve near-term cash flow. A look at the

project’s history emphasizes this potential.

The Bongara Zinc project was discovered in 1974 and was mined in

2007 and 2008 via open-pit operations covering just 37 acres of the

massive site. The mine yielded 358 metric tons per day resulting in

a 60 to 65 percent zinc end product using a very simple Waelz kiln

process before the mine was shuttered in late 2008 due to the

slumping market price for zinc. In addition to more recent

sampling, this historic record offers a solid indicator that the

project’s output can be readily extracted and processed using

simple and straightforward techniques. The project has good road

access and exceptional community relations with the locals.

Extant sampling and analysis indicates a sizeable zinc-oxide

mineralization trend that runs all the way along the Bongara Zinc

Mine site for nearly three-quarters of a mile, extending

northwest into an additional exploration area (Campo Cielo) where

trenching and pit mining have shown similarly high-grade zinc-oxide

mineralization. The companion Charlotte Bongara mine site is

adjacent to the northwest of Bongara. This is the first time these

two projects have been controlled by a single operator, and,

post-acquisition, they comprise an exceptional opportunity for Zinc

One Resources to delineate a substantial trend of high-grade

zinc-oxide that stretches for nearly two-and-a-half miles. The

historical resource estimate (PDF) from

Forrester on the Bongara project contains additional data and

technical work stretching back to the 1990s.

The historical measured and indicated resource for the Bongara

project is a hefty 1,007,796 metric tons at a grade of 21.61

percent zinc (plus 209,018 metric tons at 21.18 percent zinc

inferred). With over 26,247 feet of drilling having already been

completed on the project — including gorgeous intercepts such as

29.5 percent zinc across 50.9 feet, 26.1 percent zinc across 41.0

feet and 29.7 percent zinc across 37.7 feet. It is rare for zinc

mineralization grades to be as exceptionally high as they are at

Bongara, and the fact that the mineralization is on the surface

only enhances the project’s expected economics. Ongoing surface

sampling at Bongara recently showed (http://nnw.fm/o3ghQ) even more promising results,

including two surface channel samples reading 47.73 percent zinc

over 26.6 feet and 25.65 percent zinc over 64.6 feet, as well as an

exploration pit sample of 32.50 percent zinc over 12.5 feet.

Such highly prospective and drill-tested geology at a

past-producing, low-risk project, based on past production records,

makes Zinc One Resources very attractive to investors, particularly

because the simple metallurgy and 90-percent-plus prior recovery

rates mean that the company could have very little trouble

generating cash flow from the project. As one of the only new zinc

companies with near-term production potential and a projected mine

life estimate at Bongara of a decade or more, the exceptionally

high-grade on-surface mineralization at this project will likely be

coming online just as the zinc market supply gap peaks. The company

expects a three-year production timeline moving forward, with an

increased resource estimate by Q2 next year and a PEA by Q3

2018.

Zinc One is one of the few new zinc companies with near-term

production potential, placing it among the ranks of mature

companies with a deeper history in metals.

Vedanta’s (NYSE: VEDL) share price has been

feeling the momentum from rising zinc prices, climbing to just shy

of a yearly high at around $21 (October 30 close). Goldman Sachs

(NYSE: GS) recently upped its stake in the company by 3.9 percent

(to $3.99 million) after JPMorgan Chase (NYSE: JPM) went whole-hog

earlier in October, upping its stake by a whopping 5,527.9 percent

(to $1.164 million). With around a 72 percent share of the India

zinc market under its thumb and occupying the number two slot for

global production behind Glencore, Vedanta, which owns a 64.9

percent stake in subsidiary Hindustan Zinc, is well positioned to

capitalize on higher zinc prices moving forward.

With four operating mines in North America and a bevy of

exploration projects, Hecla Mining (NYSE: HL) is

the biggest primary silver producer in the entire region. However,

the company’s zinc component is starting to shine as the price

rises. The company had around 111,000 tons of zinc in the proven

reserves category at the close of 2016, with the lion’s share

located at the company’s deep underground Lucky Friday

mine in northern Idaho’s Coeur d’Alene Mining District, from

which the company ships lead and zinc concentrates up to British

Columbia for processing by Teck’s massive smelting and refining

complex in Trail.

Teck Resources (NYSE: TECK), a diversified

mining, smelting and refining group, is one of the world’s top

metallurgical producers of coal and zinc and has been looking more

toward zinc as the price of coal continues to sag. The company

recently

reported record zinc production for the second quarter in a row

(102,300 metric tons) at its massive Peruvian copper-zinc mine,

Antamina. It

also upped the 2017 zinc production guidance for the Red Dog site

to as much as 550,000 metric tons, with plans to have shipped one

million tons of zinc concentrate as the season ends during the

first week of November.

Southern Copper (NYSE: SCCO) has a substantial

zinc production footprint in Mexico and continues to see big

profits on the strength of rising copper prices, with better-than-expected Q3 earnings and a doubling of net

profits compared to the same quarter last year. Zinc sales

increased for Southern Copper nearly in proportion to the rise in

copper sales for the company during the quarter, with zinc sales

31.4 percent higher than in Q3 2016. That’s an astonishing figure

for a company that is better known for copper, and, with a supply

deficit in the cards for copper similar to the one in the zinc

market, SCCO may just be getting warmed up.

Mounting demand for zinc from markets like China and a supply

deficit the likes of which we haven’t seen in a decade spell big

things for companies with skin in the zinc game. Zinc One is in an

especially unique position as one of the few younger zinc companies

with near-term production potential. If successfully placed back

into production, the company’s Bongara Mine Project stands to be

one of the continent’s highest-grade zinc mines.

For more information on Zinc One Resources

please visit: Zinc One

Resources Inc. (TSX-V: Z) (OTC: ZZZOF) (FSE: RH33)

About NetworkNewsWire

NetworkNewsWire (NNW) is an information service that provides

(1) access to our news aggregation and syndication servers, (2)

NetworkNewsBreaks that summarize corporate news and

information, (3) enhanced press release services, (4) social media

distribution and optimization services, and (5) a full array of

corporate communication solutions. As a multifaceted financial news

and content distribution company with an extensive team of

contributing journalists and writers, NNW is uniquely positioned to

best serve private and public companies that desire to reach a wide

audience of investors, consumers, journalists and the general

public. NNW has an ever-growing distribution network of more than

5,000 key syndication outlets across the country. By cutting

through the overload of information in today’s market, NNW brings

its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW are a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertake no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

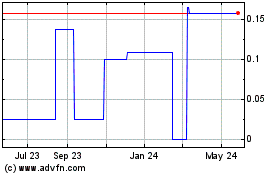

Zinc One Resources (CE) (USOTC:ZZZOF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Zinc One Resources (CE) (USOTC:ZZZOF)

Historical Stock Chart

From Dec 2023 to Dec 2024