Clariant AG: Record 2022 sales growth, EBITDA and cash conversion

driven by strong operating performance; dividend increase proposed

AD HOC ANNOUNCEMENT PURSUANT TO ART. 53 LR

- Q4

2022:

Sales grew by

12 %

in local currency to

CHF 1.323 billion,

underpinned by strong pricing

in a softening demand

environment, EBITDA

margin was

11.6 %

(14.7 %

excluding CHF 40 million

restructuring charges related to the

implementation of the new operating

model)

- FY

2022:

Sales increased by

24 %

in local currency to

CHF 5.198 billion,

EBITDA margin was

15.6 %

(16.4 %

excluding CHF 40 million

restructuring charges in

Q4 2022 related to

the implementation of the new operating

model)

- FY 2022: Net result for total

Group at

CHF 116 million

- FY 2022: Net

operating cash flow increased

by

38 %

to

CHF 502 million,CHF 293 million

free cash flow resulting in a

36 % free cash flow

conversion

- FY 2022:

Increased distribution of

CHF 0.42

per share proposed to AGM on 4

April 2023

- Outlook

2023:

Full year sales

around

CHF 5 billion

with the aim to

slightly improve

the year-on-year

reported Group EBITDA margin

level in a challenging

macro

environment, which is

expected to improve in

H2 2023

“In the fourth quarter of 2022, pricing

continued to have a significant positive impact on sales growth and

EBITDA margin, despite softer end markets in some businesses. The

hard work of all our colleagues enabled us to successfully increase

year-on-year sales in all regions, including China,” said Conrad

Keijzer, Chief Executive Officer of Clariant. “I am particularly

proud of our continued strong operating performance and that our

full year 16.4 % EBITDA margin (excluding restructuring

charges of CHF 40 million related to the implementation

of the new operating model) slightly exceeded the full year 2022

guidance we previously communicated. Our shareholders will

participate in our strong operational performance with an increased

distribution of CHF 0.42 per share. From a sustainability

perspective, the magnitude of Clariant’s Scope 1 and 2 total

greenhouse gas emission improvement in 2022 is positive proof that

we have managed to decouple emissions from our 7 % volume

growth.”

“In the full year 2022, we achieved above-market

sales growth and a margin improvement in a challenging inflationary

environment. We have set the company up for growth in the years

ahead with the measures undertaken during the implementation of our

new operating model. The benefits of our new model include better

customer orientation, better and faster decision making, greater

empowerment, more accountability, and improved transparency which

will enable Clariant to achieve its 2025 targets,” Conrad Keijzer

added.

Key Financial Group

Figures

| Continuing

operations |

Fourth Quarter |

|

Full Year |

| in CHF

million |

2022 |

2021 |

% CHF |

% LC |

|

2022 |

2021 |

% CHF |

% LC |

| Sales |

1 323 |

1 242 |

7 |

12 |

|

5 198 |

4 372 |

19 |

24 |

| EBITDA |

154 |

203 |

-24 |

|

|

810 |

708 |

14 |

|

| - margin |

11.6 % |

16.3 % |

|

|

|

15.6 % |

16.2 % |

|

|

| EBITDA before

exceptional items |

203 |

230 |

-12 |

|

|

893 |

760 |

18 |

|

| - margin |

15.3 % |

18.5 % |

|

|

|

17.2 % |

17.4 % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBIT |

|

|

|

|

|

72 |

440 |

|

|

| Return on

invested capital (ROIC) |

|

|

|

|

|

1.5 %(2) |

9.9 % |

|

|

| Net result from

continuing operations |

|

|

|

|

|

-101 |

292 |

|

|

| Net result total

(1) |

|

|

|

|

|

116 |

373 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net operating

cash flow (1) |

|

|

|

|

|

502 |

363 |

|

|

| Number of

employees (1) |

|

|

|

|

|

11 148(4) |

13 374(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Discontinued

operations (3) |

|

|

|

|

|

|

|

|

|

| Sales |

0 |

240 |

n.m. |

n.m. |

|

0 |

912 |

n.m. |

n.m. |

| Net result from

discontinued operations |

|

|

|

|

|

217 |

81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Total Group, including discontinued operations(2) Excl.

impairment charges of CHF 453 million for the North American Land

Oil divestment and the Podari plant; the ROIC was 10.6 %(3)

Pigments divested on 3 January 2022(4) As of 31 December

2022(5) As of 31 December 2021

Fourth Quarter

2022 –

Continued sales

growth with profitability

impacted by restructuring

charges

MUTTENZ, MARCH

2, 2023

Clariant, a focused, sustainable, and innovative

specialty chemical company, today announced its fourth quarter and

full year 2022 results. In the fourth quarter of 2022, continuing

operations sales were CHF 1.323 billion, compared to

CHF 1.242 billion in the fourth quarter of 2021. This

corresponds to an increase of 12 % in local currency and

7 % in Swiss francs. Pricing positively impacted the Group

sales result by 13 % while volumes declined by 1 %, with

a currency impact of - 5 %. The strong sales growth in

Catalysis and Natural Resources outpaced the anticipated muted

development in Care Chemicals.

In the fourth quarter of 2022, sales grew

solidly in all geographic regions. European sales grew by 6 %

in local currency, as prices increased while volume growth slowed.

Sales in Asia-Pacific also grew by 15 %, primarily propelled

by China with 14 % sales growth. North American sales were

16 % higher, and Latin American sales grew 18 %. The

robust advances in both regions were supported by volume growth in

Catalysis and strong pricing in Natural Resources. The Middle East

& Africa increased sales by 9 %.

In the fourth quarter of 2022, Care Chemicals

increased sales by 4 % in local currency by maintaining

pricing while volumes declined as expected. This progress was

driven by double-digit growth in Consumer Care – Crop Solutions and

Personal Care in particular – while Industrial Applications sales

slowed slightly. Catalysis sales rose by 18 % in local

currency, mainly driven by volume growth and primarily due to

growth in Petrochemicals and Syngas. Natural Resources sales

increased by 16 % in local currency due to increased pricing

with growth attributable to all three Business Units, especially

Oil and Mining Services.

The absolute continuing operations EBITDA

decreased by 24 % to CHF 154 million, and the

corresponding 11.6 % margin was negatively impacted by

restructuring expenses of CHF 40 million for the

implementation of the new operating model. Excluding this one-time

charge, the 14.7 % EBITDA margin was below the 16.3 %

reported in the fourth quarter of the previous year, driven by a

negative CHF 20 million EBITDA impact from project cost

and higher operational cost for the sunliquid® production plant in

Romania and the expected lower volumes in Care Chemicals and

Additives.

Full

Year 2022 – ESG Update

– Leading in sustainability

In the full year 2022, the Group’s Scope 1 and 2

total greenhouse gas emissions for continuing operations improved

to 0.62 metric tons from 0.71 metric tons in 2021, a decline of

13 % compared to prior year. The total indirect greenhouse gas

emissions for purchased goods and services (Scope 3) also

decreased by 4 % to 2.58 metric tons from 2.70 metric tons in

2021.

These improvements were the result of increased

energy efficiency measures at operating sites, an accelerated

transition to renewables in our operations, as well as a higher

share of green electricity purchased. For example, in Bonthapally,

India, the replacement of coal with biomass derived from

agricultural waste enables annual savings of 10 000 tons of CO2

emissions. At Clariant’s sites in Indonesia, a ten-year purchase

power agreement (PPA) has been in place since 2021, covering most

of the electricity demand across all business units with a

reduction of 21 000 tons of greenhouse gas emissions in 2022. These

results and initiatives are positive proof that Clariant has been

able to decouple its emissions from its increasing volume sales

(+ 7 %) and demonstrate significant progress towards the

Group’s emissions reduction targets.

The Group also marked a milestone in its

continuous efforts to increase transparency for customers into

greenhouse gas emissions associated with a product throughout its

lifecycle. With the launch of its product carbon footprint (PCF)

tool, ‘CliMate,’ Clariant offers selected product carbon footprint

calculations across its portfolio, in line with the ISO 14067

standard.

Another highlight in 2022 was Clariant’s

low-carbon, high-performing solutions that create value for

customers. Clariant’s solution contributes to the catalytic

abatement of nitrous oxide (N2O) emitted during the production of

nitric acid, which is a valuable base chemical primarily used in

fertilizers. Through its global climate campaign, the Group enables

ten nitric acid producers to reduce more than 4 million metric tons

of CO2 emissions annually. Clariant received the 2022

Sustainability Leadership Award from the American Chemistry Council

for this achievement.

Full

Year 2022

– Teamwork, pricing, and

cost discipline

underpinned

higher sales,

while restructuring

charges impacted EBITDA

In the full year 2022, sales from continuing

operations were CHF 5.198 billion, compared to

CHF 4.372 billion in the full year 2021. This corresponds

to an increase of 24 % in local currency and 19 % in

Swiss francs. Both pricing and volume growth had a positive impact

on the Group of 17 % and 7 %, respectively, while the

currency impact was – 5 %.

In the full year 2022, sales growth exceeded

20 % in local currency in all geographic regions. Clariant’s

performance was especially strong in North America, Latin America,

and the Middle East & Africa.

Care Chemicals grew sales by 28 % in local

currency in full year 2022 with double-digit sales growth in all

key businesses. In Catalysis, the top line was up by 14 % in

local currency, propelled by the Petrochemicals and Specialty

Catalysts businesses. Oil and Mining Services, Functional

Minerals, and Additives in particular, all contributed to the

25 % local currency sales growth reported at Natural

Resources.

The continuing operations EBITDA increased by

14 % to CHF 810 million as the Group improved

profitability on the back of sales growth. The EBITDA margin was

15.6 %, versus 16.2 % in the previous year. Adjusting for

restructuring expenses of CHF 40 million related to the

implementation of the new operating model booked in the fourth

quarter of 2022, the 16.4 % EBITDA margin exceeded the

previous year’s level. The adjusted profitability improvement was

propelled by pricing measures that more than fully offset the high

raw material cost increase (25 % year-on-year) and higher

energy (+ 35 %) and logistics cost (+ 6 %). The

Group’s ongoing cost discipline and the profitability improvement

in Care Chemicals and Natural Resources more than offset the

relative weakness in Catalysis, which includes a

CHF 43 million negative impact from sunliquid®.

The EBIT decreased to CHF 72 million

in the full year 2022 from CHF 440 million in the

previous year, mainly due to three impairments totaling

CHF 462 million. A non-cash impairment in the amount of

CHF 233 million was related to the sale of Clariant’s

North American Land Oil business to Dorf Ketal, which is expected

to close in the first quarter of 2023. A further impairment of

CHF 220 million was booked for the sunliquid® bioethanol

plant in Romania based on the delayed ramp up and the plant’s

current financial performance. A CHF 5 million impairment

was also made on Clariant’s assets in Ukraine. Excluding these

charges, the EBIT increased to CHF 534 million, 21 %

above the full year 2021.

In the full year 2022, the total Group net

result was CHF 116 million, versus

CHF 373 million in the previous year. The net result was

lifted by the net result from discontinued operations of

CHF 217 million, mainly related to the gain on the

Pigments disposal; the strong business performance of the

continuing operations; and the corresponding margin improvement,

while impairments had a negative impact of

CHF 462 million.

Net operating cash flow for the total Group

increased to CHF 502 million from

CHF 363 million in the full year 2021. This development

was mainly attributable to strong underlying earnings and net

working capital management. The increased free cash flow of CHF 293

million compared to CHF 6 million in 2021 resulted in a

conversion rate in 2022 of 36 %, versus 1 % a year ago

and is attributable to the strong operating cash flow and

disciplined capital expenditures.

Net debt for the total Group decreased to

CHF 750 million, versus CHF 1.535 billion

recorded at the end of 2021. This development is largely

attributable to a significant reduction in current financial debt

and an increase in short-term deposits due to proceeds received

from the divestment of the Pigments business and the Scientific

Design Company stake.

The Board of Directors recommends

an increased regular distribution

of CHF 0.42

per share to the Annual General Meeting

(AGM) on 4 April 2023 based on the strong performance in 2022. This

distribution is proposed to be

made through a capital reduction

by way of a par value

reduction.

Outlook – Full

Year 2023

Clariant aims to grow above the market to

achieve higher profitability through sustainability and innovation.

Clariant has become a true specialty chemical company and confirms

its 2025 ambition to deliver profitable sales growth (4 – 6 %

CAGR), a Group EBITDA margin between 19 – 21 %, and a free

cash flow conversion of around 40 %.

As of 1 January 2023, Clariant will report in

the Business Unit structure aligned with its new operating model.

The Business Unit Care Chemicals includes the former Business Area

Care Chemicals and the Business Unit Oil & Mining Services

(previously part of the former Business Area Natural Resources).

The Business Unit Catalysts is unchanged from the former Business

Area Catalysis. The Business Unit Adsorbents & Additives is a

combination of the former Business Units Functional Minerals and

Additives (both previously part of the former Business Area Natural

Resources).

From a macroeconomic perspective, Clariant

anticipates a soft recessionary environment in the first half of

2023, compared to a very strong first half of 2022, and expects to

see an economic recovery in the second half of 2023 while

uncertainties and risks related to the economic environment remain.

For the full year 2023, Clariant expects to achieve sales of around

CHF 5 billion, including a net negative top line impact

of around CHF 130 million from divestments and the bolt-on

acquisition. Clariant aims to slightly improve its year-on-year

reported EBITDA margin due to a continued recovery in Catalysts,

which is expected to offset lower sales volumes in the other

Business Units. Clariant expects an increasing negative annualized

sunliquid® impact and a continued inflationary environment given

the current economic outlook, counterbalanced by savings benefits

from the restructuring programs.

Q4/FY 2022 Media ReleaseFY 2022 Financial

Review

| CORPORATE

MEDIA RELATIONS Jochen DubielPhone

+41 61 469 63 63jochen.dubiel@clariant.com Anne

MaierPhone +41 61 469 63 63anne.maier@clariant.com

Ellese CaruanaPhone +41 61 469 63

63ellese.caruana@clariant.com |

INVESTOR

RELATIONS Andreas Schwarzwälder

Phone +41 61 469 63 73andreas.schwarzwaelder@clariant.com

Maria IvekPhone +41 61 469 63

73maria.ivek@clariant.com Thijs

BouwensPhone +41 61 469 63

73thijs.bouwens@clariant.com |

Follow us on Twitter, Facebook, LinkedIn,

Instagram.

This media release contains certain statements

that are neither reported financial results nor other historical

information. This document also includes forward-looking

statements. Because these forward-looking statements are subject to

risks and uncertainties, actual future results may differ

materially from those expressed in or implied by the statements.

Many of these risks and uncertainties relate to factors that are

beyond Clariant’s ability to control or estimate precisely, such as

future market conditions, currency fluctuations, the behavior of

other market participants, the actions of governmental regulators

and other risk factors such as: the timing and strength of new

product offerings; pricing strategies of competitors; the Company’s

ability to continue to receive adequate products from its vendors

on acceptable terms, or at all, and to continue to obtain

sufficient financing to meet its liquidity needs; and changes in

the political, social and regulatory framework in which the Company

operates or in economic or technological trends or conditions,

including currency fluctuations, inflation and consumer confidence,

on a global, regional or national basis. Readers are cautioned not

to place undue reliance on these forward-looking statements, which

speak only as of the date of this document. Clariant does not

undertake any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these materials.

www.clariant.com

Clariant is a focused, sustainable, and

innovative specialty chemical company based in Muttenz, near

Basel/Switzerland. On 31 December 2022, Clariant totaled a staff

number of 11 148 and recorded sales of

CHF 5.198 billion in the fiscal year for its continuing

businesses. The company reports in three Business Areas: Care

Chemicals, Catalysis, and Natural Resources. As of January 2023,

the Group conducts its business through the three newly formed

Business Units Care Chemicals, Catalysts, and Adsorbents &

Additives and will report accordingly as of the first quarter of

2023. Clariant’s corporate strategy is led by the overarching

purpose of ‘Greater chemistry – between people and planet,’ and

reflects the importance of connecting customer focus, innovation,

sustainability, and people.

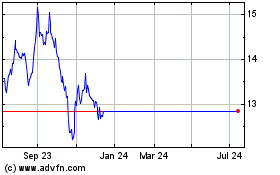

Clariant (LSE:0QJS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Clariant (LSE:0QJS)

Historical Stock Chart

From Feb 2024 to Feb 2025