TIDM1SN

RNS Number : 0567A

First Tin PLC

18 January 2024

18 January 2024

First Tin Plc

("First Tin" or "the Company")

Taronga Power Supply Options Update

Preliminary Results of Behind the Grid Connection Provides

Positive Results

First Tin PLC, a tin development company with advanced, low

capex projects in Germany and Australia, is pleased to provide an

update on the power options for its Definitive Feasibility Study

("DFS") at the Taronga Tin Project in Australia. The project is

owned by First Tin's 100% owned Australian subsidiary, Taronga

Mines Pty Ltd ("TMPL").

It is First Tin's preference to use renewable power as far as

possible and as TMPL owns approximately 25km(2) of freehold land

over the project area, it has ample room for renewables

infrastructure.

TMPL's DFS lead consultants, Mincore, have looked at various

power options including:

-- Grid connection (approximately 7.7km to nearest 66kV power line)

-- Diesel engine generators (purchase and hire)

-- Gas engine generators (purchase and hire)

-- Solar panels

-- Wind turbines

-- Various combinations of the above

The study has confirmed that a combination of gas engines for

the base load and night-time usage, supplemented by solar panels

for daytime augmentation, is the most cost-effective and

carbon-friendly option for Taronga's power solution.

To reduce carbon emissions as much as possible, within economic

constraints, TMPL's preference is to operate the main three stage

crusher only during daylight hours. This has four main

benefits:

1. It will reduce noise levels during evening hours.

2. It will enable solar power to be used for much of the

crushing, hence making the crushed ore stockpile a "battery".

3. It will reduce total carbon emissions, as grid or gas

generated power requirements will be considerably lower.

4. It will mean that most ore can be mined during daylight hours

with mainly waste rock being mined during the evening.

By only crushing during daylight hours, the power demand during

these times will be higher than during night-time hours, with peak

demand estimated at 5.5MW during the daytime and 2.8MW during the

evening.

Based on the preliminary scoping study completed by Mincore, 5 x

2MW gas engines will be required plus solar panels generating a

total of 10MW power during times of peak solar radiation.

Given the solar efficiency estimates of 65% during peak daylight

hours, an estimated overall solar efficiency of between 16.7% and

20.1% is expected. However, due to the much higher demand during

daylight hours, the overall amount of site power generated by solar

is estimated to be 53% of total demand.

The current estimate of operating cost for solar is A$0.01/kWh

and for gas is A$0.24/kWh. This equates to a total estimated

operating cost of A$0.12/kWh, considerably lower than the estimate

of A$0.29/kWh for grid power. This represents a saving of

A$0.17/kWh (58%) or around A$5.6M per year on site power costs,

plus carbon abatement of around 14,780t per annum.

Capital cost estimates are around A$28.6M compared with A$14.0M

for a grid connection, plus some added capital cost for oversizing

the crushing facilities (current estimate approximately A$4.7M).

The additional capital cost would be recouped within 3.5 years of

operation.

It should be noted that these estimates are to Level 3 (scoping

study) accuracy only at this time and that Level 5 (feasibility

study) accuracy estimates are currently in progress.

First Tin CEO, Bill Scotting commented : "These positive results

represent significant energy cost savings and support our

commitment to minimising First Tin's environmental and CO(2)

footprints, as we assist the current global clean energy and

technological revolution."

Enquiries:

First Tin Via SEC Newgate below

Bill Scotting - Chief Executive

Officer

Arlington Group Asset Management

Limited (Financial Advisor

and Joint Broker)

Simon Catt 020 7389 5016

WH Ireland Limited (Joint

Broker)

Harry Ansell 020 7220 1670

SEC Newgate (Financial Communications)

Elisabeth Cowell / Molly FirstTin@secnewgate.co.uk

Gretton

Notes to Editors

First Tin is an ethical, reliable, and sustainable tin

production company led by a team of renowned tin specialists. The

Company is focused on becoming a tin supplier in conflict-free, low

political risk jurisdictions through the rapid development of high

value, low capex tin assets in Germany and Australia.

Tin is a critical metal, vital in any plan to decarbonise and

electrify the world, yet Europe has very little supply. Rising

demand, together with shortages, is expected to lead tin to

experience sustained deficit markets for the foreseeable future.

Its assets have been de-risked significantly, with extensive work

undertaken to date.

First Tin's goal is to use best-in-class environmental standards

to bring two tin mines into production in three years, providing

provenance of supply to support the current global clean energy and

technological revolutions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAKFXFSELEFA

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

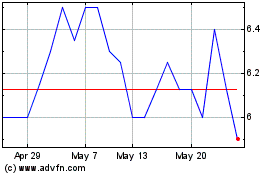

First Tin (LSE:1SN)

Historical Stock Chart

From Jan 2025 to Feb 2025

First Tin (LSE:1SN)

Historical Stock Chart

From Feb 2024 to Feb 2025