Associated British Foods PLC Trading Update (1857C)

January 15 2015 - 1:00AM

UK Regulatory

TIDMABF

RNS Number : 1857C

Associated British Foods PLC

15 January 2015

15 January 2015

Associated British Foods plc

Trading update

Associated British Foods plc today issues a trading update for

the 16 weeks to 3 January 2015. The Financial Conduct Authority has

removed the requirement for listed companies to publish interim

management statements. This trading update summarises the

significant trading developments since the last market update. The

timetable for further market updates for the 2015 financial year is

detailed on the Investors section of the Company's website.

Group revenue

Group revenue for the 16 weeks ended 3 January 2015 was 3% ahead

of the same period last year at constant currency, and was 1% ahead

at actual exchange rates.

Retail

Sales at Primark were 15% ahead of last year at constant

currency driven by increased retail selling space and very high

sales densities in stores opened during the last year, with

exceptional trading from the stores opened in France. As indicated

at the Company's annual results presentation on 4 November 2014,

like-for-like sales in the autumn were affected by the unseasonably

warm weather but trading over the last five weeks, including

Christmas, was strong. In the year to date, the UK, Ireland and

Iberia have each achieved like-for-like sales growth. Total

like-for-like sales growth for the group was held back by the

impact on existing stores of the new store openings in the

Netherlands and Germany, although total sales in northern

continental Europe were well ahead of last year. As a result of the

weakening of the euro against sterling, total Primark sales were

12% ahead of the same period last year at actual exchange rates.

Operating profit margin in the period was in line with

expectations, that is, lower than last year as a result of a higher

level of mark-down.

Retail selling space increased by 0.5 million sq ft since the

financial year end and at 3 January 2015, 287 stores were trading

from 10.7 million sq ft of retail selling space. We opened ten new

stores in the period including the relocation of the Northampton

store to much larger premises. We opened four stores in the

Netherlands, bringing our total there to 12, and three stores in

Germany including 80,000 sq ft in Dresden. We have a very strong

pipeline of new stores in Europe extending over a number of years.

We continue to expect the increase in selling space for the current

year to be less than 1.0 million sq ft including further stores or

extensions in Germany, Belgium and the UK. The extension of our

Mönchengladbach warehouse in Germany, which increased capacity by

60%, is now fully operational.

Good progress has been made in building the management team in

the US in anticipation of our launch in late 2015. We have signed

eight leases in the north east of the country, including seven from

Sears, and a lease has been signed for warehouse space located in

the Lehigh Valley area of Pennsylvania.

Sugar

EU sugar prices, as previously indicated, have been lower in the

period leading to lower revenues and margins for both the UK and

Spain, although we are now seeing some stabilisation. The European

campaigns are progressing extremely well with record factory

performances achieved. Sugar content in the beet is lower than last

year but we are benefiting from good extraction rates. UK sugar

production in the current year is now estimated to be 1.40 million

tonnes, compared with last year's 1.32 million tonnes. The Vivergo

bioethanol plant in Hull is now achieving rated output although

ethanol prices remain very weak.

Illovo has performed consistently throughout the period but cane

availability has been restricted in South Africa. Sugar prices in

Africa have remained relatively stable with the exception of

Tanzania where low-cost imports continue to hold back domestic

prices.

We have made substantial progress in developing a beet sugar

business in north China since our first investment in 2007,

particularly in the advancement of both agricultural and factory

operations. However, Heilongjiang province in the north east of the

country has proven to be the most challenging in terms of achieving

beet yields that are sufficient to provide our factories at Yi'an

and BoCheng with an adequate supply of raw material at a

competitive cost. When combined with continuing poor market prices

we have now concluded that these factories will remain uneconomic

for the foreseeable future and have therefore announced our

intention to cease sugar operations in Heilongjiang. Action will

also be taken to reduce associated overheads. The group's interim

results will include a loss on closure of businesses of some

GBP128m, reflecting the write down of assets and including one-off

cash costs of GBP18m, all of which will be excluded from adjusted

operating profit. Importantly, following this action, we expect all

of our remaining sugar factories in China to be cash generative,

even at the current low sugar prices.

Grocery

Twinings Ovaltine continues to make good progress and record

market shares have been achieved in a number of key markets

including the UK. The business is on track to deliver further good

profit growth this year. Performance in the first half at George

Weston Foods in Australia is being held back by higher meat

prices.

Ingredients and Agriculture

The recovery in Ingredients is continuing and our Agriculture

businesses have maintained the strong momentum of last year.

Currency

Sterling continues to be stronger than last year against most of

our major trading currencies, especially those in emerging markets.

A notable exception is the US dollar which has strengthened

significantly against sterling. Our estimate of the translation

impact on adjusted operating profit for the full year is a

reduction of some GBP15m.

Trading outlook

This year we expect Primark's expansion to continue and Grocery,

Ingredients and Agriculture to make further progress in operating

profit on the back of their very positive performance last year.

With the fall in EU sugar prices and weakness in the world sugar

price, we expect a further large reduction in profit from AB Sugar,

but this will put much of the effect of the structural changes in

EU prices, seen over the last three years, behind us. We expect a

decline in adjusted operating profit for the group but the impact

on earnings will be mitigated by much lower tax and interest

charges. Sterling's strength against most of our major trading

currencies will also have a negative effect and we now expect a

marginal decline in adjusted earnings per share for the group for

the full year.

For further enquiries please

contact:

Associated British Foods

John Bason, Finance Director Tel: 020 7399

Flic Howard-Allen, Head of External 6500

Affairs

Citigate Dewe Rogerson

Chris Barrie, Shabnam Bashir Tel: 020 7638

9571

Jonathan Clare

Tel: 07770 321881

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTSFMFILFISEIF

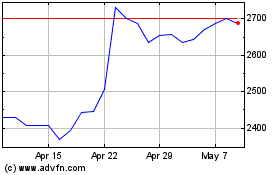

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Jan 2025 to Feb 2025

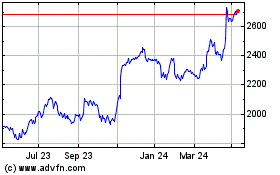

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Feb 2024 to Feb 2025