TIDMADVT

RNS Number : 8169S

Advancedadvt Limited

14 March 2023

AdvancedAdvT Limited

("AdvancedAdvT" or the "Company")

Unaudited Interim Results for the period ended 31 December

2022

The Company provides an update on the Company's cash and net

asset position as at 28 February 2023 and announces its unaudited

interim results for the six months ended 31 December 2022.

Overview and Chairperson's statement

Cash and Net Asset update as at 28 February 2023

-- Unaudited Net Asset Value (NAV) of 95.6 pence per share[1]

(91.4p at 31 December 2022[2])

-- Net assets of GBP127.3m(1) (GBP121.7m at 31 December 2022)

-- Interest-bearing cash of GBP103.4m (GBP103m at 31 December

2022)

Highlights

-- Strong position to execute on strategy given the opportunities

in current economic climate.

-- Net assets of GBP121.7m as at 31 December 2022 (GBP121.7m

at 30 June 2022)

-- Cash of GBP103m at 31 December 2022 (GBP104.2m at 30 June

2022)

-- Interest income from cash deposits largely offset operating

losses, most of which related to changes in fair value

of financial assets during the period

Chairperson's statement

The Company has remained focused on its objective of completing

a business combination with one or more businesses, by seeking and

actively evaluating high-quality targets.

The global economy has faced significant challenges, with

inflation, interest rate increases and heightened geopolitical

tensions creating headwinds in various markets. However, we also

recognise that such challenges also present opportunities for

businesses to adapt and become more resilient. By identifying and

capitalising on these opportunities, businesses can weather the

storm and come out stronger on the other side.

The Board believes the trend of increased data creation and

digitalisation of business processes and operations will continue

to present investment opportunities for high-quality businesses

with the potential to generate long-term value.

This continued acceleration of digital technologies has provided

an opportunity for businesses to deliver increased productivity,

address labour imbalances and gain a competitive advantage.

Furthermore, the convergence of technologies across fragmented

markets has the potential to bring about significant advancements

for customers.

With a strong cash position which exceeds GBP100m, we have a

clear advantage in against a backdrop of market uncertainty. Whilst

the cost of servicing debt and its availability have become major

challenges for other investment vehicles, our cash reserves offer a

unique, attractive alternative and positions us well to execute on

our strategy. This financial strength provides flexibility and the

resources to capitalise on opportunities, navigate the challenges

that may arise, as well as being an attractive proposition to

potential target businesses.

M&C Saatchi plc ("M&C")

We identified an opportunity to invest in an area of the market

which had the potential to deliver significant digital related

growth and opportunity. An initial investment, purchasing 9.82% of

the issued share capital of M&C, was followed up with an offer

to acquire the remainder of M&C. Despite some shareholder

support, we did not receive sufficient acceptances and the offer

lapsed on 30 September 2022.

This was a disappointing outcome given the 42.5% support from

M&C shareholders in our announcement on 17 May 2022. We

believed our offer was beneficial to all the Company's and M&C

stakeholders, introducing new cash to fuel accelerated growth and

investment.

As a significant shareholder in M&C, we will continue to

assess all potential value creation opportunities for M&C.

We would like to take this opportunity to thank our shareholders

for their continued support. We remain committed to acting with a

disciplined approach to deliver our objectives and create value for

our shareholders.

We remain optimistic about the future, and we look forward to

continuing to work together to navigate the opportunities

ahead.

Vin Murria OBE

Chairperson

13 March 2023

Enquiries:

Company Secretary 020 7004 2700

Antoinette Vanderpuije

Singer Capital Markets (Broker) 020 7496 3000

Phil Davies

George Tzimas

KK Advisory (Investor Relations) 07779 229508

Kam Bansil

Meare Consulting 07990 858548

Adrian Duffield

The Interim Report is also available on the 'Shareholder

Documents' page of the Company's website at www.advancedadvt.com

and the National Storage Mechanism at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

Management Report

I present to shareholders the unaudited interim condensed

consolidated financial statements of AdvancedAdvT Limited

("AdvancedAdvT" or the "Company") for the six months ended 31

December 2022 (the "Consolidated Interim Financial Statements"),

consolidating the results of AdvancedAdvT and MAC I (BVI) Limited

(collectively, the "Group" or "MAC") .

Activity, Strategy & Outlook

The Company was formed with the goal of identifying

opportunities where a merger of management expertise, improved

operating performance, and a focused investment and M&A

strategy can unlock growth potential in core markets and

potentially expand into new territories and adjacent sectors. Our

objective is to generate attractive long-term returns for

shareholders by supporting sustainable growth, strategic

acquisitions and performance improvements within acquired

companies.

The management team has significant experience in the technology

sector, having invested in and/or operated a range of

high-performing software and digital services businesses. The

management team has a track record of successfully driving

operational excellence within these businesses to deliver organic

growth and has a history of executing targeted and accretive

M&A in the software sector, having completed more than 85

acquisitions collectively.

Over the last 25 years companies across all sectors have

increasingly adopted new digital technologies to optimise business

processes and operations. Implementing these new technologies has

become central to driving cost efficiencies and gaining a

competitive advantage in a digital world, where sectors and

businesses with the highest level of digitalisation display the

largest productivity growth.

Despite the opportunities presented by digitalisation,

pre-Covid-19 adoption of new technologies by businesses and

consumers was in part restricted by the reticence of companies to

invest in digital strategies and adopt new systems and

technologies. The global restrictions caused by Covid-19 have

helped to break down these barriers and forced businesses to become

more agile which has considerably accelerated digitalisation. The

resulting increase in demand and appetite to adopt new digital

technologies, alongside the continued momentum to move to the

cloud, has given rise to a squeeze on the labour market and digital

skills.

We therefore believe there is significant opportunity to invest

in companies that are positioned to take advantage of the

structural change arising from an unprecedented acceleration of

digitalisation brought about by the current macroeconomic

environment, affecting the way people live, work, and consume, and

the way businesses operate, engage, and sell to customers.

The Company may either consider acquiring total voting control

of any target company or business or acquiring a non-controlling

interest constituting less than total voting control or less than

the entire equity interest of that target company or business if

such opportunity is considered attractive or where the Company

expects to acquire sufficient influence to implement its strategy.

In such circumstances, the remaining ownership interest will be

held by third parties and the Company's decision-making authority

may be limited. Any third party's interests may be contrary to the

Company's interests.

Results

The Group's loss after taxation for the six months to 31

December 2022 was GBP113,010 (31 December 2021: loss after taxation

GBP218,548). The Group held cash and cash equivalents at 31

December 2022 of GBP 103,016,497 (31 December 2021:

GBP104,169,997).

Dividend Policy

The Company has not yet acquired a trading operation and it is

therefore inappropriate to make a statement on the likelihood of

any future dividends. The Directors intend to determine the

Company's dividend policy following completion of a platform

acquisition and, in any event, will only commence the payment of

dividends when it becomes commercially prudent to do so.

Corporate Governance

As a company with a Standard Listing, the Company is not

required to comply with the provisions of the UK Corporate

Governance Code. Nevertheless, the Board is committed to

maintaining high standards of corporate governance and will

consider whether to voluntarily adopt and comply with the UK

Corporate Governance Code as part of any acquisition, taking into

account the Company's size and status at that time.

The Company currently complies with the following principles of

the UK Corporate Governance Code:

-- The Company is led by an effective and entrepreneurial Board,

whose role is to promote the long-term sustainable success of the

Company, generating value for shareholders and contributing to

wider society.

-- The Board ensures that it has the policies, processes,

information, time and resources it needs in order to function

effectively and efficiently.

-- The Board ensures that the necessary resources are in place

for the company to meet its objectives and measure performance

against them.

Given the size and nature of the Company, the Board has not

established any committees and intends the Board as a whole would

make decisions. If the need should arise in the future, for example

following any acquisition, the Board may set up committees as

appropriate.

Risks

The Directors have carried out a robust assessment of the

principal risks facing the Company including those that would

threaten its business model, future performance, solvency, or

liquidity. The Company has published its principal risks in the

Company's prospectuses dated 4 December 2020, 18 March 2021 and 31

March 2022. The Directors are of the opinion that the risks

detailed in the Company's prospectus dated 31 March 2022 remain

applicable for the current financial year. The prospectus and

detailed risks can also be found on the Company's website

www.advancedadvt.com .

Responsibility Statement

Each of the Directors confirms that, to the best of their

knowledge:

(a) these Consolidated Interim Financial Statements, which have

been prepared in accordance with IAS 34 "Interim Financial

Reporting" as adopted by the European Union, give a true and fair

view of the assets, liabilities, financial position and profit or

loss of the Company; and

(b) these Consolidated Interim Financial Statements comply with

the requirements of DTR 4.2

Neither the Company nor the Directors accept any liability to

any person in relation to the interim financial report except to

the extent that such liability could arise under applicable

law.

Details on the Company's Board of Directors can be found on the

Company website at www.advancedadvt.com.

Vin Murria OBE

Chairperson

13 March 2023

Condensed Consolidated Statement of Comprehensive Income

Six months Six months

ended ended

31 December 31 December

2022 2021

Note Unaudited Unaudited

GBP GBP

Administrative expenses 2 (167,005) (237,894)

Fair Value on Financial Assets 5 (1,080,000) -

------------ ------------

Operating loss (1,247,005) (237,894)

Finance Income 1,133,995 19,346

------------ ------------

Loss before taxation (113,010) (218,548)

Taxation 3 - -

------------ ------------

Loss for the period (113,010) (218,548)

Total comprehensive loss for the period

attributable to owners of the parent (113,010) (218,548)

============ ============

Loss per ordinary share (GBP)

Basic 4 (0.00) (0.00)

Diluted 4 (0.00) (0.00)

The Group's activities derive from continuing operations.

Condensed Consolidated Statement of Financial Position

As at As at

31 December 30 June

2022 2022

Note Unaudited Audited

GBP GBP

Non-current assets

Financial asset at fair value through

profit or loss 5 18,120,000 19,200,000

------------ ------------

18,120,000 19,200,000

Current assets

Trade and other receivables 6 662,568 101,485

Cash and cash equivalents 7 103,016,497 104,169,997

Total current assets 103,679,065 104,271,482

Total assets 121,799,065 123,471,482

============ ============

Equity and liabilities

Equity

Sponsor share 2 2

Ordinary shares 131,166,131 131,166,131

Warrant reserve 98,000 98,000

Warrant cancellation reserve 350,000 350,000

Share-based payment reserve 353,135 305,104

Accumulated losses (10,374,418) (10,261,408)

------------ ------------

Total equity 121,592,850 121,657,829

Current liabilities

Trade and other payables 8 206,215 1,813,653

------------ ------------

Total liabilities 206,215 1,813,653

Total equity and liabilities 121,799,065 123,471,482

============ ============

Consolidated Statement of Changes in Equity

Notes Sponsor Ordinary Class Warrant Warrant Share Accumulated Total

share shares A shares reserves Cancellation based losses equity

GBP GBP GBP GBP Reserve payment GBP GBP

GBP reserve

GBP

Balance - - - - - - - -

as at 31

July 2020

Issuance

of 1 ordinary

share - 1 - - - - - 1

Redesignation

of 1 ordinary

share 1 (1) - - - - - -

Issuance

of 700,000

ordinary

shares and

warrants - 602,000 - 98,000 - - - 700,000

Share issue

costs - (275,300) - - - - - (275,300)

Issuance

of 2,500,000

Class A

shares and

warrants - - 2,150,000 350,000 - - - 2,500,000

Conversion

of 2,500,000

Class A

shares - 2,150,000 (2,150,000) (350,000) 350,000 - - -

Issuance

of 130,000,000

ordinary

shares - 130,000,000 - - - - - 130,000,000

Share issue

costs - (1,310,569) - - - - - (1,310,569)

Issuance

of 1 sponsor

share 1 - - - - - - 1

Total comprehensive

loss for

the period - - - - - - (2,546,025) (2,546,025)

Share-based

payment

expense - - - - - 209,250 - 209,250

Balance

as at 30

June 2021

(Audited) 2 131,166,131 - 98,000 350,000 209,250 (2,546,025) 129,277,358

Total comprehensive

loss for

the period - - - - - - (218,548) (218,548)

Share-based

payment

expense - - - - - 48,031 - 48,031

Balance

as at 31

December

2021 (Unaudited) 2 131,166,131 - 98,000 350,000 257,281 (2,764,573) 129,106,841

Total comprehensive

loss for

the period - - - - - - (7,496,835) (7,496,835)

Share-based

payment

expense - - - - - 47,823 - 47,823

Balance

as at 30

June 2022

(Audited) 2 131,166,131 - 98,000 350,000 305,104 (10,261,408) 121,657,829

Total comprehensive

loss for

the period - - - - - - (113,010) (113,010)

Share-based

payment

expense - - - - - 48,031 - 48,031

-------- ------------ ------------ ---------- ------------- --------- ----------------- ------------

Balance

as at 31

December

2022 (Unaudited) 2 131,166,131 - 98,000 350,000 353,135 (10,374,418) 121,592,850

-------- ------------ ------------ ---------- ------------- --------- ----------------- ------------

Consolidated Statement of Cash Flows

Six months Six months

ended ended

31 December 31 December

2022 2021

Note Unaudited Unaudited

----- ------------- -------------

GBP GBP

Operating activities

Loss for the period (113,010) (218,548)

Adjustments to reconcile total operating

loss to net cash flows:

Interest income (1,133,995) (19,346)

Fair Value adjustment on Investment 5 1,080,000 -

Add back share-based payment expense 2 48,031 48,031

Working capital adjustments:

(Increase)/decrease in trade and other

receivables and

Prepayments (288,426) 210,188

Decrease in trade and other payables (1,607,438) (32,728)

-------------

Net cash flows used in operating activities (2,014,838) (12,403)

------------- -------------

Financing activities

Interest income 861,339 19,346

------------- -------------

Net cash flows from financing activities 861,339 19,346

------------- -------------

Net (decrease)/increase in cash and

cash equivalents (1,153,499) 6,943

Cash and cash equivalents at the beginning

of the period 104,169,996 129,224,447

------------- -------------

Cash and cash equivalents at the end

of the period 7 103,016,497 129,231,390

============= =============

Notes to the Condensed Consolidated Financial Statements

1. SEGMENT INFORMATION

The Board of Directors is the Group's chief operating

decision-maker. As the Group has not yet acquired a trading

business, the Board of Directors considers the Group as a whole for

the purposes of assessing performance and allocating resources, and

therefore the Group has one reportable operating segment.

2. ADMINISTRATIVE EXPENSES BY NATURE

Six months Six months

ended 31 ended 31

December December

2022 2021

Unaudited Unaudited

GBP GBP

Group administrative expenses by nature

Directors' fees 112,021 111,340

Professional fees 74,056 32,396

Non-recurring project costs (103,982) (3,039)

Listing fees 24,140 44,288

Share based payment expense 48,031 48,031

Branding and website cost 11,262 3,637

Travel and entertainment 690 611

Bank charges 787 630

-----------

167,005 237,894

=========== ===========

3. TAXATION

Six months Six months

ended 31 ended 31

December December

2022 2021

Unaudited Unaudited

GBP GBP

Analysis of tax in period

Current tax for the period - -

----------- -----------

Total current tax - -

=========== ===========

The central management and control of the Group is exercised in

the UK and accordingly the Group is treated as tax resident in the

UK.

Reconciliation of effective rate and tax charge:

Six months Six months

ended 31 ended 31

December December

2022 2021

Unaudited Unaudited

GBP GBP

Loss on ordinary activities before tax (113,010) (218,548)

Expenses not deductible for tax purposes 1,128,102 48,031

-----------

Profit/(Loss) on ordinary activities subject

to corporation tax 1,015,092 (170,517)

Profit/(Loss) on ordinary activities multiplied

by the rate of corporation tax in the UK

of 19% 192,867 (32,398)

Tax Losses utilised (192,867) -

Effects of:

Losses carried forward for which no deferred

tax recognised - 32,398

-----------

Total taxation charge - -

=========== ===========

At 31 December 2022, cumulative tax losses available to carry

forward against future trading profits were GBP3,902,418 subject to

agreement with HM Revenue & Customs. Prior to an acquisition,

there is no certainty as to future profits and no deferred tax

asset is recognised in relation to these carried forward

losses.

4. LOSS PER ORDINARY SHARE

Basic EPS is calculated by dividing the profit/(loss)

attributable to equity holders of a company by the weighted average

number of ordinary shares in issue during the year. Diluted EPS is

calculated by adjusting the weighted average number of ordinary

shares outstanding to assume conversion of all dilutive potential

ordinary shares.

The Company has issued 700,000 warrants, each of which is

convertible into one ordinary share. The Group made a loss in the

current period, which would result in the warrants being

anti-dilutive. Therefore, the warrants have not been included in

the calculation of diluted earnings per share.

The Company has issued two sponsor shares, the sponsor shares

have no right to receive distributions and so have been ignored for

the purposes of IAS 33.

Six months Six months

ended 31 ended 31

December December

2022 2021

Unaudited Unaudited

Loss attributable to owners of the parent (113,010) (218,548)

Weighted average number of ordinary shares

in issue 133,200,000 133,200,000

Weighted average number of ordinary shares

for diluted EPS 133,200,000 133,200,000

Basic and diluted loss per ordinary share

(GBP's) 0.00 0.00

5. INVESTMENTS

Principal subsidiary undertakings of the Group

The Company owns directly the whole of the issued ordinary share

capital of its subsidiary undertaking. Details of the Company's

subsidiary are presented below:

Proportion Proportion

of ordinary of ordinary

Nature of Country shares held shares held

Subsidiary business of incorporation by parent by the Group

--------------------- ------------ ------------------- ------------- --------------

Incentive

MAC I (BVI) Limited vehicle BVI 100% 100%

The registered office of MAC I (BVI) Limited Commerce House,

Wickhams Cay 1, P.O. Box 3140, Road Town, Tortola, British Virgin

Islands VG1110.

Financial assets of the Company

The Company directly owns equity investments for which the

Company has not elected to recognise fair value gains and losses

through Other Comprehensive Income.

As at 31 As at 30

December June 2022

2022 Audited

Unaudited

GBP GBP

Level 1 Financial assets at fair value through

profit or loss (FVTPL) 18,120,000 19,200,000

18,120,000 19,200,000

=========== ===========

There were no transfers between levels for fair value

measurements during the year. The Company's policy is to recognise

transfers into and out of fair value hierarchy levels as at the end

of the reporting period.

a) Level 1: The fair value of financial instruments traded in

active markets (such as publicly traded derivatives, and equity

securities) is based on quoted market prices at the end of the

reporting period. The quoted market price used for financial assets

held by the Company is the current bid price. These instruments are

included in level 1.

b) Level 2: The fair value of financial instruments that are not

traded in an active market (e.g. over-the counter derivatives) is

determined using valuation techniques that maximise the use of

observable market data and rely as little as possible on

entity-specific estimates. If all significant inputs required to

fair value an instrument are observable, the instrument is included

in level 2.

c) Level 3: If one or more of the significant inputs is not

based on observable market data, the instrument is included in

level 3. This is the case for unlisted equity securities. During

the year, the following gains/(losses) were recognised in profit or

loss:

Six months Six months

ended 31 ended 31

December December

2022 2021

Unaudited Unaudited

GBP GBP

Fair value (losses) on equity investments

at FVTPL recognised in the profit or loss (1,080,000) -

(1,080,000) -

============ ===========

6. TRADE AND OTHER RECEIVABLES

As at 31 As at 30

December June 2022

2022 Audited

Unaudited

GBP GBP

Amounts receivable in one year:

Prepayments 20,553 11,271

Other receivables 272,660 65,488

VAT receivable 369,355 24,726

----------- -----------

662,568 101,485

=========== ===========

There is no material difference between the book value and the

fair value of the receivables. Receivables are considered to be

past due once they have passed their contracted due date.

7. CASH AND CASH EQUIVALENTS

As at 31 As at 30

December June

2022 2022

Unaudited Audited

GBP GBP

Cash and cash equivalents

Cash at bank 20,114,984 64,169,997

Deposits on call 82,901,513 40,000,000

------------ ------------

103,016,497 104,169,997

============ ============

Credit risk is managed on a Group basis. Credit risk arises from

cash and cash equivalents and deposits with banks and financial

institutions. For banks and financial institutions, only

independently rated parties with a minimum short-term credit rating

of P-1, as issued by Moody's, are accepted.

8. TRADE AND OTHER PAYABLES

As at 31 As at 30

December June

2022 2022

Unaudited Audited

GBP GBP

Amounts falling due within one year:

Trade payables 1,725 125,768

Accruals 88,646 1,572,041

A ordinary share liability 115,844 115,844

-----------

206,215 1,813,653

=========== ==========

There is no material difference between the book value and the

fair value of the trade and other payables.

9. FINANCIAL INSTRUMENTS AND ASSOCIATED RISKS

The Group has the following categories of financial instruments

at the period end:

As at 31 As at 30

December June

2022 2022

Unaudited Audited

GBP GBP

Financial assets measured at amortised

cost

Cash and cash equivalents 103,016,497 104,169,997

Other receivables 272,660 65,488

Financial assets at fair value through

profit or loss (FVTPL) 18,120,000 19,200,000

------------ ------------

121,409,157 123,435,485

------------ ------------

Financial liabilities measured at amortised

cost

Trade and other payables 206,215 1,813,653

------------ ------------

206,215 1,813,653

============ ============

The fair value and book value of the financial assets and

liabilities are materially equivalent.

As the Group's assets are predominantly cash and cash

equivalents, market risk and liquidity risk are not currently

considered to be material risks to the Group. There have been no

changes to the Group's risk management policies or treasury

management since 30 June 2022

10. RELATED PARTY TRANSACTIONS

Antoinette Vanderpuije, the Company Secretary is a partner of

Marwyn Investment Management LLP ("MIMLLP"). MIMLLP manages MVI II

Holdings I LP which is beneficially owned by Marwyn Value Investors

II LP. MVI II Holdings I LP holds 15.41 per cent of the Company's

ordinary shares and 1 Sponsor Share.

Antoinette Vanderpuije has a beneficial interest in the

Incentive Shares her indirect interest in MLTI which owns 2,000 A2

ordinary shares in the capital of MAC I (BVI) Limited.

Antoinette Vanderpuije is also a partner of Marwyn Capital LLP

("MCLLP"). MCLLP provides corporate finance, company secretarial

and managed service support to the Company. The Company has

incurred fees of GBP8,788 in respect of company secretarial and

managed service support and GBP125,000 for services to the Company

in regard to Project Maltesers. MCLLP incurred costs of GBP5,648,

which it recharged the Company during the period.

11. COMMITMENTS AND CONTINGENT LIABILITIES

There were no commitments or contingent liabilities outstanding

at 31 December 2022 that requires disclosure or adjustment in these

financial statements.

12. POST BALANCE SHEET EVENTS

No other matter or circumstance has arisen since 31 December

2022 that has significantly affected, or may significantly affect

the consolidated entity's operations, the results of those

operations, or the consolidated entity's state of affairs in future

financial years.

[1] NAV per share estimated using 10 day VWAP price of 194p for

the M&C Saatchi shares held as a Financial asset at fair value

through profit or loss

[2] NAV per share estimated using 10 day VWAP price of 152p for

the M&C Saatchi shares held as a Financial asset at fair value

through profit or loss

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VXLFFXXLEBBE

(END) Dow Jones Newswires

March 14, 2023 03:00 ET (07:00 GMT)

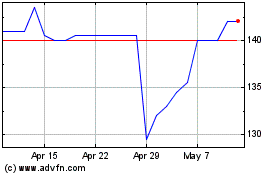

Advancedadvt (LSE:ADVT)

Historical Stock Chart

From Apr 2024 to May 2024

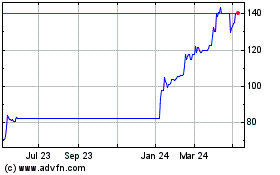

Advancedadvt (LSE:ADVT)

Historical Stock Chart

From May 2023 to May 2024