TIDMAEWU

RNS Number : 8246T

AEW UK REIT PLC

27 July 2022

27 July 2022

AEW UK REIT Plc

NAV Update and Dividend Declaration

AEW UK REIT plc (LSE: AEWU) (the "Company"), which directly owns

a value-focused portfolio of 37 regional UK commercial property

assets, announces its unaudited Net Asset Value ("NAV") and interim

dividend for the three-month period ended 30 June 2022.

Highlights

-- NAV of GBP200.40 million or 126.50 pence per share as at 30

June 2022 (31 March 2022: GBP191.10 million or 120.63 pence per

share).

-- NAV total return of 6.53% for the quarter ( 31 March 2022 quarter: 7.37%).

-- 4.49% like-for-like valuation increase for the quarter (31

March 2022 quarter: 4.74%), driven by a 17.62% like-for-like

increase from the office sector associated with the anticipated

sale of Eastpoint Business Park in Oxford.

-- EPRA earnings per share ("EPRA EPS") for the quarter of 1.50

pence (31 March 2022 quarter: 1.55 pence). This is expected to

return to the Company's target level of 2.00 pence per quarter once

the sales of both Eastpoint Business Park, Oxford and Bath Street,

Glasgow, complete during August and sales proceeds have been

reinvested.

-- Interim dividend of 2.00 pence per share for the three months

ended 30 June 2022, in line with the targeted annual dividend of

8.00 pence per share.

-- New GBP60 million debt facility with AgFe priced at a fixed

total interest cost of 2.959% for five years. Following this

refinancing, the existing RBSi loan facility has been repaid in

full.

-- Loan to NAV ratio at the quarter end was 29.94% ( 31 March

2022 : 28.26%). The Company had a cash balance of GBP4.51 million

and its loan facility was fully drawn.

-- Acquisition of Railway Station Retail Park in Dewsbury for a

purchase price of GBP4.70 million, a capital value of GBP82 per sq.

ft. The price reflects a net initial yield of circa 9.4%.

-- Attractive investment pipeline of value-orientated assets

showing net initial yields between 6.75% and 10% is under

exclusivity.

-- Post quarter end, contractually committed disposal of

Eastpoint Business Park, Oxford for GBP29.0 million, a 16% premium

to the asset's value within the published NAV. Completion of the

sale will take place on 8(th) August 2022. As a result of the

transaction having exchanged post quarter end, a further 2.5p is

expected to be realised in the Company's Net Asset Value per

share.

-- Post quarter end, exchanged contracts for disposal of

Moorside Road, Swinton for GBP1.71 million, at a 58% premium to the

acquisition price, reflecting a net initial yield of circa 6.6% and

a capital value of GBP75 psf. Completion is due to take place prior

to the end of July.

Laura Elkin, Portfolio Manager, AEW UK REIT, commented:

"The portfolio's strong capital performance continues this

quarter, with the majority of the assets demonstrating continued

resilience. The office sector value gains seen in the portfolio of

late, following a period of strong performance by our industrial

assets in previous quarters, demonstrate the benefits of the

strategy's ability to invest across market sectors to maximise

value at different times. It is also an indicator of the positive

NAV impact our proactive approach to portfolio management can have.

In a value portfolio such as this, active asset management can

continue to drive defensive capital performance at times when

values in general may be experiencing increased volatility. Asset

management activity this quarter demonstrates this point, with

value accretive transactions seen in all major market sectors."

Portfolio Manager's Review

Capital growth in the Company's office assets was driven in the

most part this quarter by the Eastpoint Business Park in Oxford

which has now been formally revalued for the first time since being

placed under offer for sale in April. The value of the asset rose

43% during the quarter although, due to the sale having exchanged

post quarter end, further NAV uplift equating to 16% of the 30 June

2022 valuation is expected to follow. This is expected to add a

further 2.5p to the Company's Net Asset Value per share.

Following a refinancing in May, the Company now benefits from a

fixed cost of debt for the next five years, putting it at a

significant advantage to those competitors still paying floating

rates. The Company has been able to lock in a cost of debt below 3%

due to its tactical decision to refinance at this time. Debt

finance is also deployed at a modest level of circa 30%, limiting

risk in future cycles.

The high yielding nature of the AEWU portfolio provides

significant headroom against rising interest rates that have

started to impact prime yields in some sectors. The portfolio's low

capital values also provide a defensive starting point due to their

correlation with replacement costs and optionality for alternative

uses.

Earnings for the quarter of 1.50 pence per share are below

target, predominantly due to the continued impact of vacancy at

Bath Street, Glasgow. Following the completed sales of Glasgow and

Oxford, which are both due during August, earnings are expected to

return to the Company's target level of 2.00 pence per share per

quarter once sales proceeds have been reinvested. The Company's

12-month backward looking dividend cover currently sits at 77% and

total historic dividend cover at 97%.

We have placed a significant pipeline of attractive assets under

exclusivity and endeavour to complete acquisitions promptly in

order to return the portfolio to a fully invested and maximum

income producing position. These pipeline assets have been sourced

based upon the same value investment principles as the existing

portfolio, with net initial yields ranging between 6.75% and 10%.

Further announcements regarding investment transactions are

expected in the coming weeks. Following both of these planned

sales, the Company's office exposure is projected to reduce to 8%

of the portfolio.

As mentioned above, the Manager has completed several value

accretive asset management transactions this quarter. These have

been undertaken across all major property sectors, highlighting

that tenant activity continues where market appropriate levels of

ERV have been applied. This has been particularly reassuring in the

high street retail and leisure sectors where tenants on the whole

remain keen to secure suitable premises to ensure the future of

their businesses, despite the backdrop of a gloomier economic

outlook. From our experience, this applies to both large national

multiples, with whom we are currently engaging in respect of vacant

accommodation, and smaller emerging chains, as demonstrated by the

letting discussed below in Portsmouth to Kokoro which has been

achieved 15% ahead of our independent valuer's estimated rental

value.

Occupational demand also continues to be strong in the

industrial and warehousing sectors, contrary to the turbulence seen

in the share prices of some of the major listed REITs in these

sectors. The portfolio is well placed to benefit from this demand

with an average passing rent psf in the Company's warehousing

portfolio of GBP3.40 psf. The Company has also continued to

crystallise profit in the sector having exchanged contracts for the

sale of Moorside Road in Swinton, the portfolio's smallest

industrial asset, for GBP1.71m, 58% ahead of its purchase price in

2015, post quarter end.

Another excellent outcome for the portfolio this quarter has

been the completion of Konica Minolta's agreement for lease at

Queens Square, Bristol. The letting will secure a new high rent of

GBP40 psf in this building which has already seen significant

rental growth of 29% since its purchase.

In retail warehousing, a lease renewal with Charlie's Stores at

Arrow Point, Shrewsbury has been completed at a level 50% ahead of

estimated rental value. The portfolio's holdings within this sector

are expected to provide an ongoing source of value and income

creation as various key business plans make headway.

Valuation movement

As at 30 June 2022, the Company owned investment properties with

a fair value of GBP255.65 million. The like-for-like valuation

increase for the quarter of GBP10.78 million (4.49%) is broken down

as follows by sector:

Like-for-like

Valuation valuation movement

Sector 30 June 2022 for the quarter

GBP % GBP million %

million

Industrial 122.82 48.04 2.08 1.72

Office 50.90 19.91 7.63 17.62

High Street

Retail 24.70 9.66 (0.28) (1.10)

Retail Warehouses 40.05 15.67 1.10 3.21

Other 17.18 6.72 0.25 1.48

Total 255.65 100.00 10.78 4.49*

* This is the overall weighted average like-for-like valuation

increase of the portfolio.

Net Asset Value

The Company's unaudited NAV at 30 June 2022 was GBP200.40

million, or 126.50 pence per share. This reflects an increase of

4.87% compared with the NAV per share at 31 March 2022. The

Company's NAV total return, which includes the interim dividend of

2.00 pence per share for the period from 1 January 2022 to 31 March

2022, was 6.53% for the three-month period ended 30 June 2022.

Pence per GBP million

share

NAV at 1 April 2022 120.63 191.10

Loss on sale of investments and derivatives (0.06) (0.09)

Portfolio acquisition costs (0.20) (0.33)

Capital expenditure (0.13) (0.20)

Valuation change in property portfolio 6.76 10.71

Income earned for the period 3.15 5.00

Expenses and net finance costs for the

period (1.65) (2.62)

Interim dividend paid (2.00) (3.17)

NAV at 30 June 2022 126.50 200.40

The NAV attributable to the ordinary shares has been calculated

under International Financial Reporting Standards. It incorporates

the independent portfolio valuation at 30 June 2022 and income for

the period, but does not include a provision for the interim

dividend for the three-month period to 30 June 2022.

Rent Collection

The Company has achieved very high rent collection levels, which

stand at over 98% (1) for each quarter since March 2020 (excluding

current quarter where rent continues to be collected).

For the rental quarter commencing on 24 June 2022, approximately

89% of rent has been collected, with 98% expected to be received

prior to quarter end. The remainder of rents owed will continue to

be pursued.

(1) Excluding rent arrears from Outfit Retail Properties

Limited, Central Six Retail Park, Coventry, who are in

administration, with the unit having been vacant since acquisition

(November 2021).

Dividend

Dividend declaration

The Company today announces an interim dividend of 2.00 pence

per share for the period from 1 April 2022 to 30 June 2022. The

dividend payment will be made on 31 August 2022 to shareholders on

the register as at 5 August 2022. The ex-dividend date will be 4

August 2022. The Company operates a Dividend Reinvestment Plan

("DRIP"), which is managed by its registrar, Link Group. For

shareholders who wish to receive their dividend in the form of

shares, the deadline to elect for the DRIP is 9 August 2022.

The dividend of 2.00 pence per share will be designated 1.50

pence per share as an interim property income distribution ("PID")

and 0.50 pence per share as an interim ordinary dividend

("non-PID").

The Company has now paid a 2.00 pence quarterly dividend for 27

consecutive quarters(1) , providing income consistency to our

shareholders.

(1) For the period 1 November 2017 to 31 December 2017, a pro

rata dividend of 1.33 pence per share was paid for this two-month

period, following a change in the accounting period end.

Dividend outlook

It remains the Company's intention to continue to pay dividends

in line with its dividend policy and this will be kept under

review. In determining future dividend payments, regard will be

given to the circumstances prevailing at the relevant time, as well

as the Company's requirement, as a UK REIT, to distribute at least

90% of its distributable income annually.

Financing

Equity

The Company's share capital consists of 158,774,746 Ordinary

Shares, of which 350,000 are currently held by the Company as

treasury shares.

Debt

The Company completed a refinancing of its debt facility in May

2022. The Company has secured a new GBP60.00 million, five-year

term loan facility with AgFe, a leading independent asset manager

specialising in debt-based investments. The loan is priced as a

fixed rate loan with a total interest cost of 2.959%. The existing

RBSi loan facility, which was priced at a floating rate according

to SONIA, was due to mature in October 2023 and has been repaid in

full by the new loan facility. Simultaneous to the funding, the

Company's interest rate cap was sold for proceeds of GBP743,000. In

the current inflationary environment, the Company considers it

prudent to fix the loan now, rather than run the risk of further

rising rates. The Company intends to utilise borrowings to enhance

returns over the next five years.

The Company had borrowings of GBP60.0 million at 30 June 2022,

producing a Loan to NAV ratio of 29.94%. The loan is now fully

drawn.

Investment Update

During the quarter the Company completed the following

investment transaction:

Railway Station Retail Park, Dewsbury (retail warehouse) - In

June, the Company completed the acquisition of a 6.04-acre Railway

Station Retail Park in Dewsbury for a price of GBP4,700,000. The

purchase price reflects a low capital value of GBP82 psf and

provides an attractive net initial yield of 9.4%. The park occupies

a prominent location on the edge of the town centre within an

established retail and leisure area. Neighbouring occupiers include

Sainsburys, Aldi, Matalan, Pets at Home and Iceland, as well as a

council operated library and sports facility. Dewsbury has a tight

supply of retail warehousing stock, with no current vacancies

within the town.

The park is fully let with a low average passing rent of GBP8.28

psf, which the Manager believes provides strong potential for

rental growth. Tenants include Sports Direct, Mecca Bingo,

Fieldrose Ltd, trading as KFC, and the Danish furniture retailer,

Jysk.

Post quarter end, the Company undertook the following investment

transaction:

Eastpoint Business Park, Oxford (office) - During July, the

Company exchanged contracts to sell the Eastpoint Business Park in

Oxford for the price of GBP29 million. The asset was acquired in

May 2015 for GBP8.2 million reflecting a net initial yield of over

9%. The sale price crystallises significant profit, exceeding both

the valuation level immediately prior to the sale by 16% and the

acquisition price by 254%. The asset has delivered an IRR to the

Company in excess of 22% during its hold period.

In 2018, the Company signed a new 25-year lease with specialist

healthcare provider Genesis Care. The lease provided for 5 yearly

rental uplifts in line with RPI which increased the asset's value

by GBP2.0m. As a condition of this letting, the Manager sought

planning consent for change of use away from the asset's existing

office use setting a precedent for healthcare and life science use

in the location.

Since this time, investor demand in the healthcare and life

science sectors has increased and this is reflected in the sale

pricing now achieved. Since announcing an agreed sale price of

GBP37 million on the 25 April, the rising cost of debt combined

with a more uncertain economic outlook impacted the potential

purchasers' assessment of the development risk and required returns

associated with the project, resulting in them withdrawing from the

transaction altogether. The Company received a number of offers for

the asset and accordingly the property went under offer to another

party and ultimately will complete at a reduced price of GBP29

million, with contracts having now been exchanged.

The sale is due to complete on 8 August 2022 and the Company

will receive income from the asset until this date. Subsequent to

this, the Manager intends to reinvest the sale proceeds in assets

producing net initial yields between 6.75% and 10% and has

exclusively secured a pipeline of attractive assets with further

announcements in this regard expected imminently. Due to recent

valuation increases, Oxford is currently producing an income yield

of circa 1.0% and therefore, reinvested proceeds from the sale will

be significantly more accretive to the Company's earnings.

Due to the exchange of the sale post quarter end, a further 2.5p

is expected to be realised in the Company's Net Asset Value per

share.

349 Moorside Road, Swinton (industrial) - Post quarter end, the

Company has exchanged on the sale of the property for GBP1.71

million. A sale at this price reflects a net initial yield of circa

6.6% and a capital value of GBP75 psf. The freehold property

comprises 22,831 sq ft of modern industrial accommodation on a 1.4

acre site. The property was acquired in September 2015 for

GBP1,071,577 reflecting a 9.0% initial yield. A sale at GBP1.7

million represents a 58% premium to the acquisition price.

Completion of the sale is due to take place prior to the end of

July.

Asset Management Update

During the quarter the Company completed the following asset

management transactions:

Arrow Point, Shrewsbury (retail warehouse) - During May, the

Company completed the renewal of Charlie's Stores' lease on

straight 10-year term at a rent of GBP385,000 per annum reflecting

GBP11 psf, versus an ERV of GBP7.50 psf. Charlie's Stores is the

scheme's anchor tenant, so this is an important letting for the

property. Only 9 months' rent-free incentive was given. The

valuation consequently rose by GBP300,000 to GBP10 million, having

already increased by GBP1.35 million on the 2021 purchase price of

GBP8.35 million.

40 Queens Square, Bristol (office) - The Company has completed

an agreement for lease with Konica Minolta Marketing Services Ltd

on the third floor. The tenant will enter into a new 10-year lease

with a five-year tenant break option at a rent of GBP218,840 per

annum reflecting a new high rental tone for the building of GBP40

psf. The letting is subject to the Company undertaking landlord

works comprising a comprehensive Cat A refurbishment and roof, lift

and reception works at a cost of GBP1.07 million plus 11 months'

rent-free incentive. The headline rent demonstrates the strong

location and property fundamentals of the asset.

Commercial Road, Portsmouth (high street retail) - During May,

the Company completed a new 15-year lease to Kokoro UK Limited, a

Japanese-Korean restaurant. The agreed rent is GBP52,500 per annum

versus an ERV of GBP45,750 per annum. The tenant has the benefit of

a 12-month rent free period and a tenant only break option at the

end of the tenth year.

Diamond Business Park, Wakefield (industrial) - During June, the

Company completed a new letting of Units 8 and 9 to Wow Interiors,

an existing tenant on the estate already occupying Unit 7. Wow have

taken a new six-year lease with a tenant break option at the end of

the third year. The commencing rent of GBP3 psf will increase to

GBP3.50 psf in years 2 and 3, and subsequently GBP3.75 psf from

year 4 onwards. In doing so, the Company has also completed a lease

regear on Unit 7, removing Wow's 2022 tenant break option and

agreeing a 3-year reversionary lease with a tenant break option

mirroring Units 8 and 9.

Enquiries

AEW UK

Laura Elkin laura.elkin@eu.aew.com

+44(0) 20 7016 4869

Henry Butt henry.butt@eu.aew.com

+44(0) 20 7016 4869

Nicki Gladstone nicki.gladstone-ext@eu.aew.com

+44(0) 7711 401 021

Company Secretary

Link Company Matters Limited aewu.cosec@linkgroup.co.uk

+44(0) 1392 477 500

TB Cardew AEW@tbcardew.com

Ed Orlebar +44 (0 ) 7738 724 630

Tania Wild +44 (0) 7425 536 903

Liberum Capital

Darren Vickers / Owen Matthews +44 (0) 20 3100 2000

Notes to Editors

About AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total

return to shareholders by investing predominantly in smaller

commercial properties (typically less than GBP15 million), on

shorter occupational leases in strong commercial locations across

the United Kingdom. The Company is currently invested in office,

retail, industrial and leisure assets, with a focus on active asset

management, repositioning the properties and improving the quality

of income streams. AEWU is currently paying an annualised dividend

of 8p per share.

The Company was listed on the Official List of the Financial

Conduct Authority and admitted to trading on the Main Market of the

London Stock Exchange on 12 May 2015. www.aewukreit.com

LEI: 21380073LDXHV2LP5K50

About AEW UK Investment Management LLP

AEW UK Investment Management LLP employs a well-resourced team

comprising 26 individuals covering investment, asset management,

operations and strategy. It is part of AEW Group, one of the

world's largest real estate managers, with EUR85.2bn of assets

under management as at 31 March 2022. AEW Group comprises AEW SA

and AEW Capital Management L.P., a U.S. registered investment

manager and their respective subsidiaries. In Europe, as at 31

March 2022, AEW Group managed EUR39.5bn of real estate assets on

behalf of a number of funds and separate accounts with over 470

staff located in 12 locations.

www.aewuk.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCRFMFTMTTTBJT

(END) Dow Jones Newswires

July 27, 2022 02:00 ET (06:00 GMT)

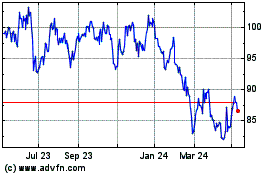

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jan 2025 to Feb 2025

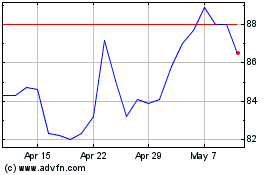

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Feb 2024 to Feb 2025