TIDMAEWU

RNS Number : 4375D

AEW UK REIT PLC

20 October 2022

20 October 2022

AEW UK REIT plc

NAV Update and Dividend Declaration

AEW UK REIT plc (LSE: AEWU) ("AEWU" or the "Company"), which

directly owns a value-focused portfolio of 35 regional UK

commercial property assets, announces its unaudited Net Asset Value

("NAV") and interim dividend for the three-month period ended 30

September 2022.

Highlights

-- NAV of GBP193.08 million or 121.88 pence per share as at 30

September 2022 (30 June 2022: GBP200.40 million or 126.50pence per

share).

-- NAV total return of -2.07% for the quarter (30 June 2022 quarter: 6.53%).

-- 3.71% like-for-like valuation decrease for the quarter (30

June 2022 quarter increase: 4.49%).

-- EPRA earnings per share ("EPRA EPS") for the quarter of 1.08

pence (30 June 2022 quarter: 1.50 pence).

-- Interim dividend of 2.00 pence per share for the three months

ended 30 September 2022, paid for 28 consecutive quarters and in

line with the targeted annual dividend of 8.00 pence per share.

-- Loan to NAV ratio at the quarter end was 31.07% ( 30 June

2022 : 29.94%). The Company had capital available for deployment of

GBP38.28 million and its loan facility was fully drawn.

-- Cost of debt fixed at 2.959% in May 2022 for the next five years.

-- Share price total return of -16.89% for the quarter (30 June 2022 quarter: -2.86%).

-- Acquisition of JD Gyms, Glasgow, for a purchase price of

GBP2.60 million, representing a capital value of GBP99 per sq. ft.

The price reflects a net initial yield of circa 7.4%.

-- Completed sale of Moorside Road, Swinton, for GBP1.71

million, resulting in a circa 13% IRR over the hold period. The

sales price reflects a net initial yield of circa 6.6% and a

capital value of GBP75 per sq. ft.

-- Completed sale of Bath Street, Glasgow, for GBP9.30 million,

following completion of a long running business plan.

-- Completed sale of Eastpoint Business Park, Oxford, for

GBP29.0 million, producing an IRR in excess of 22%.

-- New ten-year lease to Senior Architectural Systems Ltd at

Mangham Road, Rotherham, providing a rent of GBP410,000 per annum

representing a significant uplift in income against the previous

passing rent of GBP275,000 per annum.

Laura Elkin, Portfolio Manager, AEW UK REIT, commented:

"With its low fixed cost of debt and value investment style, we

believe that the Company's portfolio is robustly positioned to

withstand the challenges presented by current market conditions. We

expect the number and extent of value investment opportunities in

the direct property market to increase against this economic

backdrop. The Company's current high weighting of cash and the fact

that its strategy is unconstrained by sector leave it well placed

to benefit from upcoming investment opportunities. In addition, we

are seeing resilience in occupational demand from the Company's

tenants. Following full investment of capital available for

deployment, the Company's earnings are expected to return to full

cover of its dividend, which has now been paid for 28 consecutive

quarters."

Portfolio Manager's Review

Having taken the opportunity to complete a number of key sales

during the summer, including realising significant profit from the

disposal of Eastpoint Business Park in Oxford, the Company

currently benefits from a high cash weighting, leaving it

advantageously positioned to select assets from the increased

number of investment opportunities that are expected to present in

the near term. We are currently analysing a pipeline of potential

acquisitions, including those assets that the Company had placed

under exclusivity over the summer, albeit these are being

re-evaluated against today's pricing. The focus of the Company's

investment strategy remains to return to full investment and to

full cover of its dividend. We believe that balancing the Company's

upcoming investment rate against current and prospective pipeline

opportunities will be beneficial to shareholder total returns.

The Company's current weighting to cash is reflected in low

earnings for the quarter, which are depressed by lost rental income

from disposals as well as one-off costs associated with improvement

works being undertaken at a number of the portfolio's holdings.

These works include those detailed below in Bristol and Rotherham

which are both associated with new lettings that will be accretive

to the Company's earnings going forward. The Company's prudent

accounting provision for doubtful debtors has also been increased

this quarter, given the deteriorating economic outlook. The Company

will continue to pursue all outstanding arrears. Our prudent

projections indicate a return to full dividend cover during the

third quarter of 2023, following the Company's intended return to

full investment during the first half of the year.

We believe that the Company and its portfolio are defensively

positioned to weather higher interest rates for a number of

reasons. The Company took the prudent decision to complete a full

refinancing of its loan in May 2022, fixing its cost of debt below

3% for the next five years. This will protect the Company from the

impact of rising interest rates on its cost of borrowing. We also

believe that high yielding assets, such as those in the Company's

portfolio, will be more resilient to the valuation impact of rising

interest rates. As yields re-adjust to the current market

conditions, it is those assets at the most prime end of the

spectrum that have suffered more acutely to date. With higher

"starting" yields, the portfolio's current book values are closer

to long term value fundamentals, such as vacant possession values,

alternative use values and replacement cost.

Although the outlook from a capital market perspective is one of

increased volatility, we are not seeing this reflected in the

uptake by tenants of the portfolio's occupational space. Active

asset management is a key driver of value and income resilience

within AEWU and, during the quarter, we agreed terms with three key

tenants to take space, all of which were in line with the rental

estimates of our independent valuer, Knight Frank.

Several of these lettings have been in the portfolio's

industrial assets, including the letting in Rotherham to Senior

Architectural Systems Ltd. This letting will deliver a rental

income to the Company that is 49.09% higher than the previous

tenant had been paying and growth within the lease term is also

ensured by inflation-linked reviews. The letting secured a capital

uplift for the asset of 14.58% during the quarter. This activity

highlights the ongoing demand from industrial occupiers at a time

when the sector's capital values have generally declined. AEWU's

industrial holdings show an average passing rent of GBP3.37 per sq.

ft. and, despite the expectation of some medium-term volatility in

capital values, are expected to continue to deliver growth over the

long term from this low starting point.

Valuation movement

As at 30 September 2022, the Company owned investment properties

with a fair value of GBP214.25 million. The like-for-like valuation

decrease for the quarter of GBP8.15 million (3.71%) is broken down

as follows by sector:

Valuation Like-for-like

30 September valuation movement

Sector 2022 for the quarter

GBP % GBP million %

million

Industrial 113.32 52.89 (7.65) (6.32)

Retail Warehouses 39.70 18.53 (0.35) (0.87)

High Street

Retail 24.70 11.53 - -

Other 19.78 9.23 - -

Office 16.75 7.82 (0.15) (0.96)

Total 214.25 100.00 (8.15) (3.71)*

* This is the overall weighted average like-for-like valuation

decrease of the portfolio.

Net Asset Value

The Company's unaudited NAV at 30 September 2022 was GBP193.08

million, or 121.88 pence per share. This reflects a decrease of

3.65% compared with the NAV per share at 30 June 2022. The

Company's NAV total return, which includes the interim dividend of

2.00 pence per share for the period from 1 April 2022 to 30 June

2022, was -2.07% for the three-month period ended 30 September

2022.

Pence per GBP million

share

NAV at 1 July 2022 126.50 200.40

Gain on sale of investments 6.83 10.83

Portfolio acquisition costs (0.56) (0.89)

Capital expenditure (0.62) (0.99)

Valuation change in property portfolio (9.35) (14.81)

Income earned for the period 2.21 3.50

Expenses and net finance costs for the

period (1.13) (1.79)

Interim dividend paid (2.00) (3.17)

NAV at 30 September 2022 121.88 193.08

The NAV attributable to the ordinary shares has been calculated

under International Financial Reporting Standards. It incorporates

the independent portfolio valuation at 30 September 2022 and income

for the period, but does not include a provision for the interim

dividend for the three-month period to 30 September 2022.

Share price and Discount

The closing share price reflects a decrease of 18.3% compared

with the share price at 30 June 2022. The Company's share price

total return, which includes the interim dividend of 2.00 pence per

share for the period from 1 April 2022 to 30 June 2022, was -16.89%

for the three-month period ended 30 September 2022.

The closing ordinary share price at 30 September represented a

discount to the NAV per share of 23.2%. In line with other

companies in the sector, the Company's discount widened

significantly during volatile market conditions at the end of

September.

Rent Collection

The Company has achieved very high rent collection levels, which

stand at over 98% (1) for each quarter since March 2020 (excluding

the current quarter as rent continues to be collected).

For the rental quarter commencing on 29 September 2022,

approximately 94% of rent demanded has been collected, with 98%

expected to be received prior to quarter end. The remainder of

rents owed will continue to be pursued.

(1) Excluding rent arrears from Outfit Retail Properties

Limited, Central Six Retail Park, Coventry, which is in

administration, with the unit having been vacant since acquisition

(November 2021).

Dividend

Dividend declaration

The Company today announces an interim dividend of 2.00 pence

per share for the period from 1 July 2022 to 30 September 2022. The

dividend payment will be made on 28 November 2022 to shareholders

on the register as at 28 October 2022. The ex-dividend date will be

27 October 2022. The Company operates a Dividend Reinvestment Plan

("DRIP"), which is managed by its registrar, Link Group. For

shareholders who wish to receive their dividend in the form of

shares, the deadline to elect for the DRIP is 7 November 2022.

The dividend of 2.00 pence per share will be designated 1.00

pence per share as an interim property income distribution ("PID")

and 1.00 pence per share as an interim ordinary dividend

("non-PID").

The Company has now paid a 2.00 pence quarterly dividend for 28

consecutive quarters(1) , providing income consistency to our

shareholders.

(1) For the period 1 November 2017 to 31 December 2017, a pro

rata dividend of 1.33 pence per share was paid for this two-month

period, following a change in the accounting period end.

Dividend outlook

It remains the Company's intention to continue to pay dividends

in line with its dividend policy and this will be kept under

review. In determining future dividend payments, regard will be

given to the circumstances prevailing at the relevant time, as well

as the Company's requirement, as a UK REIT, to distribute at least

90% of its distributable income annually.

Financing

Equity

The Company's share capital consists of 158,774,746 Ordinary

Shares, of which 350,000 are currently held by the Company as

treasury shares.

Debt

The Company completed a refinancing of its debt facility in May

2022. The Company has a GBP60.00 million, five-year term loan

facility with AgFe, a leading independent asset manager

specialising in debt-based investments. The loan is priced as a

fixed rate loan with a total interest cost of 2.959%. The Company

intends to utilise borrowings to enhance returns over the next five

years.

The Company had borrowings of GBP60.0 million at 30 September

2022, producing a Loan to NAV ratio of 31.07%. The loan is now

fully drawn.

Investment Update

During the quarter the Company completed the following

investment transactions:

Disposals:

Bath Street, Glasgow (office) - Following the expiry of the

three-month planning judicial review period, the Company completed

on the sale of the property for GBP9.30 million (GBP109 per sq.

ft.). The sale realises a long-term change of use strategy for the

asset, with contracts for the sale having been exchanged with a

subsidiary company of IQ Student Accommodation in October 2020. The

sale agreement required AEW to negotiate with tenants to bring the

asset to vacancy and, as a result, following its sale, the

occupancy rate for AEWU's portfolio increased to 92.3% from 87.0%,

as at 30 September 2022. At the time of purchase in 2016, the

Company intended to keep the asset producing income as a multi-let

office however, due to weakening in the occupier market conditions

in this location, an alternative use strategy was then pursued.

Eastpoint Business Park, Oxford (office) - The Company completed

on the sale of the property for GBP29.0 million (GBP388 per sq.

ft.). The property was acquired in May 2015 for GBP8.20 million

reflecting a net initial yield of over 9%. The sale price

crystallises significant profit, exceeding both the valuation level

immediately prior to the sale by 16% and the acquisition price by

254%. The asset has delivered an IRR to the Company in excess of

22% during its hold period. Due to prior valuation increases, the

asset was producing an income yield of circa 1.0% and therefore

reinvested proceeds from the sale, in assets producing net initial

yields between 6.75% and 10%, will be significantly accretive to

the Company's earnings.

349 Moorside Road, Swinton (industrial) - The Company completed

the sale of the property for GBP1.71 million. A sale at this price

reflects a net initial yield of circa 6.6% and a capital value of

GBP75 per sq. ft. The freehold property comprises 22,831 sq. ft. of

modern industrial accommodation on a 1.4-acre site. The property

was acquired in September 2015 for GBP1,071,577 reflecting a 9.0%

net initial yield. A sale at GBP1.70 million represents a 58%

premium to the acquisition price.

Purchases:

JD Gyms, Glasgow (leisure) - The Company completed the purchase

of a high yielding leisure asset in Glasgow for GBP2.60 million

reflecting a low capital value of GBP99 per sq. ft. and a net

initial yield of 7.4%. The property comprises a standalone leisure

and retail warehousing unit let to JD Sports Gym Ltd, which

operates 74 gyms in the UK and is a subsidiary of JD Sports Fashion

Plc. The lease provides an unexpired lease term of 10.4 years,

benefitting from five-yearly upward-only reviews. The site also

contains a vacant plot of land which may be suitable for

redevelopment over the medium term, subject to planning.

Asset Management Update

During the quarter the Company completed the following asset

management transactions:

40 Queen Square, Bristol (office) - The Company completed an

agreement for lease with existing tenant Konica Minolta Marketing

Services Ltd on the third floor. The tenant will enter into a new

ten-year lease with a five-year tenant break option at a rent of

GBP218,840 per annum, reflecting a new high rental tone for the

building of GBP40 per sq. ft. The letting is subject to landlord

refurbishment works including roof, lift and reception upgrades at

a cost of GBP1.07 million plus eleven months' rent-free incentive.

Landlord works commenced during the quarter and are due to complete

before the end of the year.

Mangham Road, Rotherham (industrial) - The Company has completed

a new ten-year ex-Act lease to Senior Architectural Systems Ltd at

a rent of GBP410,000 per annum reflecting a rent of GBP5 per sq.

ft. This shows a significant uplift to the rent paid by previous

tenant, Hydro Components, at GBP275,000 per annum. The lease

provides for five-yearly rent reviews to the higher of open market

rent or RPI, with collar and cap at 2% & 4% per annum,

respectively. There was no rent-free incentive granted to the

tenant, however the landlord undertook works to upgrade the

building at a cost of GBP964,700. These works were completed during

the quarter and are expected to improve the asset's energy

efficiency. The tenant benefits from a break option at the end of

year five.

Bank Hay Street, Blackpool (retail / leisure) - Repair works at

the property which commenced in 2020 have now reached practical

completion. The total cost of these works amounted to circa GBP2.40

million, of which approximately GBP800,000 is expected to be

recovered from tenants. The recoverable elements of this

expenditure have been raised within the service charge budget and

all tenants are up to date with payments.

Enquiries

AEW UK

Laura Elkin laura.elkin@eu.aew.com

+44(0) 20 7016 4869

Henry Butt henry.butt@eu.aew.com

+44(0) 20 7016 4869

Nicki Gladstone nicki.gladstone-ext@eu.aew.com

+44(0) 7711 401 021

Company Secretary

Link Company Matters Limited aewu.cosec@linkgroup.co.uk

+44(0) 1392 477 500

TB Cardew AEW@tbcardew.com

Ed Orlebar +44 (0 ) 7738 724 630

Tania Wild +44 (0) 7425 536 903

Liberum Capital

Darren Vickers / Owen Matthews +44 (0) 20 3100 2000

Notes to Editors

About AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total

return to shareholders by investing predominantly in smaller

commercial properties (typically less than GBP15 million), on

shorter occupational leases in strong commercial locations across

the United Kingdom. The Company is currently invested in office,

retail, industrial and leisure assets, with a focus on active asset

management, repositioning the properties and improving the quality

of income streams. AEWU is currently paying an annualised dividend

of 8p per share.

The Company was listed on the Official List of the Financial

Conduct Authority and admitted to trading on the Main Market of the

London Stock Exchange on 12 May 2015. www.aewukreit.com

LEI: 21380073LDXHV2LP5K50

About AEW UK Investment Management LLP

AEW UK Investment Management LLP employs a well-resourced team

comprising 29 individuals covering investment, asset management,

operations and strategy. It is part of AEW Group, one of the

world's largest real estate managers, with EUR87.7bn of assets

under management as at 30 June 2022. AEW Group comprises AEW SA and

AEW Capital Management L.P., a U.S. registered investment manager

and their respective subsidiaries. In Europe, as at 30 June 2022,

AEW Group managed EUR39.7bn of real estate assets on behalf of a

number of funds and separate accounts with over 470 staff located

in 12 locations.

www.aewuk.co.uk

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVMLBBTMTBBBRT

(END) Dow Jones Newswires

October 20, 2022 02:00 ET (06:00 GMT)

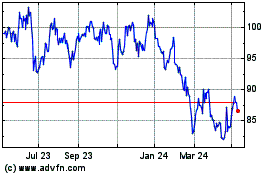

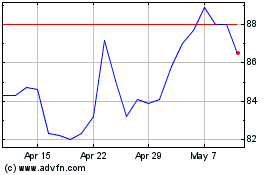

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jan 2025 to Feb 2025

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Feb 2024 to Feb 2025