TIDMALBA

RNS Number : 6994U

Alba Mineral Resources PLC

16 July 2018

Click on or paste the following link into your website browser

to view the associated PDF document (including maps and

images):

http://www.rns-pdf.londonstockexchange.com/rns/6994U_1-2018-7-15.pdf

Alba Mineral Resources plc

("Alba" or the "Company")

Alba Signs Conditional Agreement to Increase Stake

in Clogau Gold Project to 90%

Alba Mineral Resources plc (AIM: ALBA), the diversified mineral

exploration and development company, is pleased to announce that it

has conditionally agreed to acquire a further 41 per cent interest

in Gold Mines of Wales Limited ("GMOW"). Subject to Completion,

Alba will thereby move to 90 per cent ownership of the Clogau Gold

Project situated within the Dolgellau Gold Belt in Wales, United

Kingdom (the "Project"). As previously announced, the Project

comprises the Clogau Gold Mine and includes a large number of

highly prospective gold targets and former gold workings within a

total option area of 106.94 km(2).

HIGHLIGHTS

-- Alba to acquire 41% of the Clogau Gold Project, taking its

total ownership of the Project to 90%.

-- The remaining 10% of the Project will be free carried to

commercial production, but will be subject to a put and call option

effective from the grant of planning permission enabling Alba to

move to 100% ownership in the future if so desired.

-- As part of the transaction, the vendor has agreed to assign

to Alba in full the approximately GBP1 million in loans owed to it

by GMOW.

-- The consideration payable for the acquisition is 185,714,285

Alba consideration shares (valuing the total consideration at

approximately GBP650,000 based on a 30 trading day VWAP of Alba

shares of GBP0.0035 up to and including 12 July 2018), plus a one

for three Alba share warrant (ie 61,904,761 share warrants at an

exercise price of GBP0.0042 and an expiry date of 27 March 2021).

The Alba consideration shares will be subject to a seven month lock

up/orderly marketing agreement.

-- Alba has agreed to grant a 4 per cent net smelter return

royalty to the vendor, subject to a buy-back right in respect of

any proposed future sale of the royalty.

-- Alba's objective remains to bring the Clogau Gold Mine back

into production and also to make a push into the regional

exploration of the wider Project area.

George Frangeskides, Alba's Executive Chairman, commented:

"For the first time in many years, the Clogau Gold Project is

moving to the majority ownership of one company. This will allow us

more readily to progress the plan for re-opening the Clogau Mine,

as well as making a push into regional exploration of the extensive

and under-explored Dolgellau Gold Belt."

"We will not be depleting the Company's cash reserves with this

proposed acquisition, and the shares that will be issued on

Completion will be subject to lock up and orderly marketing

restrictions for a seven-month period."

Acquisition Terms

Alba has conditionally agreed to issue 185,714,285 Alba fully

paid ordinary shares ("Consideration Shares") to Victorian Gold

Limited ("VGL") for a 41 per cent shareholding in Gold Mines of

Wales Limited, which is the ultimate parent company of GMOW

(Operations) Limited, the owner of the Project. The consideration

is valued at GBP650,000 (based on a 30 trading day VWAP of Alba

shares of GBP0.0035 up to and including 12 July 2018). All

Consideration Shares issued to the vendor shall be subject to

lock-up and/or orderly marketing restrictions for a period of seven

months, as follows:

- For a 30 day period following Completion, no Consideration

Shares may be sold or transferred without the prior written

approval of Alba.

- For a further 6 month period thereafter:

o 50% of the Consideration Shares shall remain under a formal

lock up agreement, such that they may not be disposed of without

the prior written approval of Alba; and

o 50% of the Consideration Shares shall be subject to orderly

marketing restrictions, such that they may not be sold without

first seeking the prior written approval of Alba (or Alba's broker

acting as Alba's agent) and complying with such requirements as

Alba or Alba's broker shall reasonably require in order to ensure

the maintenance of an orderly market in Alba's shares.

The consideration shall include a one for three Alba share

warrant, that is 61,904,761 share warrants at an exercise price of

GBP0.0042 and an expiry date of 27 March 2021.

The remaining 10% of the Project will be free carried to

commercial production, but will be subject to a put and call option

agreement effective from the grant of planning permission ("Put and

Call Option") enabling Alba to move to 100% ownership in the future

if so desired. The option may be exercised by either party

following the grant of planning permission to recommence mining

operations at the Project, or earlier if so agreed by the parties,

for an agreed price or, failing agreement, a price determined by

independent valuation.

As part of the consideration for the acquisition, the existing

loans of approximately GBP1 million made by VGL to GMOW will be

assigned to Alba or its wholly-owned subsidiary on Completion,

thereby effectively extinguishing those loans in full. Alba has

agreed to grant to VGL a 4 per cent net smelter return ("NSR")

royalty over the Project ("Royalty"), subject to a pre-emptive

right for Alba to acquire the Royalty on the same or equivalent

terms as may be offered to the royalty holder by a bona fide arm's

length third party.

Completion of the acquisition is subject to certain conditions

precedent, notably the execution by the parties thereto of

definitive agreements in respect of the Royalty and Put and Call

Option described above.

Exploration Update

As announced in our mining update (see RNS on 2 May 2018), Alba

has been collating all historical data for the project and has

compiled a regional geological model that has been used to generate

regional exploration targets from across the licence. The regional

targets have been identified through a comparison of the known

geological framework of the existing Clogau-St David's Gold Mine.

Numerous targets have been identified with Alba initially planning

to focus efforts on the two targets in closest proximity to the

existing mine.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information please contact:

Alba Mineral Resources plc

George Frangeskides, Executive Chairman +44 20 7264 4366

Cairn Financial Advisers LLP (Nomad)

James Caithie / Liam Murray +44 20 7213 0880

First Equity Limited (Broker)

Jason Robertson +44 20 7374 2212

Yellow Jersey (PR/IR)

Tim Thompson/Harriet Jackson +44 7710 718649

Qualified Person's Statement:

Michael Nott, a Director of Alba, has over 45 years relevant

experience in the geological, mining, minerals, waste disposal,

industrial minerals, oil , drilling, mineral planning and quarrying

industries has approved the information in this announcement.

He holds a BSc. degree in Geology from Queen Mary, University of

London, a MSc. Degree in Mineral Production Management from the

Royal School of Mines, Imperial College, University of London, The

Diploma of Imperial College in Mineral Production Management and is

a Chartered Engineer.

He is a Fellow of the Institute of Materials, Minerals and

Mining, a Fellow of the Minerals Engineering Society, a Fellow of

the Institute of Quarrying and an Associate of the Royal School of

Mines Association.

Alba's Project Portfolio

Oil & Gas

Horse Hill (Oil & Gas, UK): Alba holds a 18.1 per cent

interest in Horse Hill Developments Limited, the company which has

a 65 per cent participating interest and operatorship of the Horse

Hill oil and gas project (licences PEDL 137 and PEDL 246) in the UK

Weald Basin.

Brockham (Oil & Gas, UK): Alba has a direct 5 per cent

interest in Production Licence 235, which comprises the previously

producing onshore Brockham Oil Field.

Mining

Amitsoq (Graphite, Greenland): Alba owns a 90 per cent interest

in the Amitsoq Graphite Project in Southern Greenland and has an

option over the remaining 10 per cent.

Black Sands (Ilmenite, Greenland): Alba owns 100 per cent of

mineral exploration licences 2017/29 and 2017/39 in the Thule

region, north-west Greenland.

Melville Bay (Iron Ore, Greenland): Alba is entitled to a 51 per

cent interest in mineral exploration licence 2017/41 in Melville

Bay, north-west Greenland. The licence area benefits from an

existing inferred JORC resource of 67 Mt @ 31.4% Fe.

Inglefield Land (Copper, Cobalt, Gold): Alba owns 100 per cent

of mineral exploration licence 2017/40 in north-west Greenland.

Limerick (Base Metals, Ireland): Alba has 100 per cent of the

Limerick base metal project in the Republic of Ireland.

El Mreiti (Uranium, Mauritania): Alba has applied for the

reissue of a uranium permit in northern Mauritania, centred on

known uranium-bearing showings.

Web: www.albamineralresources.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQBELLFVDFXBBK

(END) Dow Jones Newswires

July 16, 2018 02:00 ET (06:00 GMT)

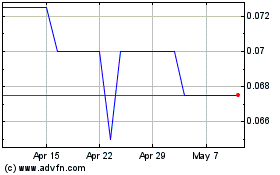

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Jan 2024 to Jan 2025