TIDMATM

RNS Number : 3523J

Andrada Mining Limited

15 August 2023

15 August 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR) as in force in

the United Kingdom pursuant to the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service (RIS), this inside information will be in the

public domain.

Andrada Mining Limited

("Andrada" or "the Company")

Orion US$25 Million Funding Package Update

Andrada Mining Limited (AIM: ATM, OTCQB: ATMTF), the African

technology metals mining company with a portfolio of mining and

exploration assets in Namibia, is pleased to provide an update on

the previously proposed Funding Package with funds managed by Orion

Resource Partners ("Orion") announced on 15 September 2022. On 11

August 2023, Andrada signed binding documentation for an updated,

conditional US$25 million funding package with Orion.

HIGHLIGHTS

-- US$25 million financing agreements signed ("Orion Financing") detailed below:

o US$2.5 million (cGBP2.0 million) equity at 6.39p and US$10

million (cGBP7.9 million) Convertible Loan Note ("the Note") being

for the general purposes of accelerating Andrada's overall strategy

of achieving commercial production of its lithium, tin, and

tantalum revenue streams.

o US$12.5 million unsecured tin royalty for the sole purpose of

increasing Andrada's tin production as it ramps up its capital

programmes over the next 2 years.

-- The Company will issue Orion with warrants equivalent to

double the GBP value of the US$10 million Convertible Loan Note

based on the USD/GBP closing rate at market close on the Orion

Issuance Date. Each warrant will enable Orion to subscribe for one

ordinary share in the Company (the "Warrants").

-- Financing conditional on satisfaction of requirements

customary with transactions of this nature and shareholder approval

of certain resolutions at the Company's Annual General Meeting

(before 29 September 2023).

-- Funding expected to be completed around the end of September 2023.

-- The financing facility from the Development Bank of Namibia

also remains on track with drawdown of funds expected in due course

pending satisfaction of final conditions.

Anthony Viljoen, Chief Executive Officer, commented:

"The signing of the Orion financing agreement will provide

sufficient capital to complete our expansion programmes at our

flagship Uis operation. Finalising this funding will expedite our

lithium implementation programme, expand our tin production, and

concurrently bring a highly respected new investor onto our

register. This will be another major step towards our goal of

becoming a multi-technology metals producer. Additionally, the

conclusion of the Development Bank of Namibia c.US$5.8 million debt

facility will further provide considerable strength to the

Company's balance sheet.

"Orion is a renowned mining investment fund with a long track

record of enhancing shareholder value, and we believe the proposed

investment terms strongly endorse Andrada's corporate and broader

multi-commodity development strategy. Orion also has the depth to

provide debt financing for Phase 2 of the business growth. We look

forward to building a successful partnership with Orion in

conjunction with all our funding partners going forward."

Philip Clegg, Managing Partner of Orion, commented:

"We are very pleased to have executed definitive documents with

Andrada. We regard Andrada as a high-quality investment opportunity

presenting extensive optionality, with a series of value-creative

projects across multiple future-facing commodities. We are excited

to begin our partnership with Anthony and his team."

DETAILS OF THE ORION FINANCING

The financing is subject to the fulfilment of the following

outstanding conditions precedent:

-- shareholder approval at the upcoming Annual General Meeting;

-- the Company's lender banks' consent;

-- exchange control approval to remit funds into Namibia; and

-- Admission of the Subscription Shares (as defined below) to trading on AIM.

The final agreed deal terms of the US$25 million funding package

are as follows;

Equity Subscription

-- Andrada, Orion Mine Finance Fund III LP ("Orion LP") and OMF

Fund III (F) Limited ("OMF Limited") have today entered into a

subscription agreement (the "Subscription Agreement"), pursuant to

which Orion LP has agreed, subject to the conditions set out above,

to subscribe for 30,821,596 ordinary shares in the Company, at a

price of 6.39p (the "Subscription Shares") (the "Subscription

Price"), being a total investment of cGBP2.0 million (US$2.5

million ). The price is 90% of the Company's 10 - day Volume

Weighted Average Price ("VWAP") of 7.1p, calculated as at 11 August

2023, being the last practicable date prior to the date of this

announcement.

-- Application for Admission of the Subscription Shares will be

made and, subject to the satisfaction of the conditions above,

trading in the Subscription Shares is anticipated to occur shortly

after the Company's Annual General Meeting. A further update will

be provided at that time.

-- Following the issue of the Subscription Shares, Orion LP's

interest in the Company will be 30,821,596 Ordinary Shares

representing 1.96% of the then enlarged share capital of the

Company.

Convertible Loan Note

-- As also set out in the Subscription Agreement, OMF Limited

has conditionally agreed to make available to Andrada up to US$10

million (cGBP7.9 million) by way of an unsecured Loan Note (the

"Note"). The Loan can only be drawn down in full, and not in part.

Interest accrues on the Note at a rate of 12% per annum.

-- The Note has a four-year term from the date that the

Subscription Shares commence trading on AIM, anticipated to be end

of September 2023 (the "Redemption Date").

-- The Note is convertible at any time prior to the Redemption

Date in tranches of US$100k. The conversion price for the Note at

the election of the holder is fixed at 9.45p, being the conversion

price of the Loan Notes issued by the Company on 18 July 2023 (see

announcement of the same date) ("Conversion Price").

-- If, after 12 months from the date of drawdown, the 20-day

VWAP of the Company's shares is trading at 200% or more of the

Conversion Price the Company may request the immediate conversion

of the outstanding Note.

Warrants

-- On drawdown of the Note, the Company will issue OMF Limited

with warrants to subscribe for up to US$20m of ordinary shares in

Andrada at a price of 9.45p ("Orion Warrants"). The exact GBP

(sterling) value of the warrant package will be determined by

reference to the USD/GBP closing exchange rate at market close on

the date that the Subscription Shares commence trading on AIM.

-- Each warrant will enable OMF Limited to subscribe for one

Ordinary Share at a subscription price of 9.45p.

-- The Orion Warrants are exercisable at any time from the date

of issue for a period of two years.

Assuming full conversion of the Note at 9.45p, the issue of the

Subscription Shares at 6.39p, and exercise of all the Orion

Warrants (using estimated warrant numbers, based on the prevailing

exchange rate) Orion's interest in Andrada would be c.7.8% of the

then enlarged issued share capital.

Royalty

-- The Company has today entered into a Royalty Agreement with

Uis Tin Mining Proprietary Limited ("Uis"); OMF Limited; Greenhills

Resources Limited and Andrada Mining (Namibia) (Proprietary)

Limited pursuant to which Uis, the subsidiary of the Company,

grants to OMF Limited up to US$12.5 million unsecured gross royalty

over tin production, which is drawn down at staggered rates based

on increasing contained tin gross revenue produced at the Uis

Mine.

-- A base rate of 5.13% at the current production run rate with

a 15-month fixed commitment from drawdown to allow the proceeds to

be converted into additional production. If the increased

production has not been achieved within 15 months, then the rate

temporarily increases to 9.63% until the increased production is

achieved, with a linear decrease from this rate to 5.13% from 1000

tpa to 1599 tpa.

-- At an annualised contained tin production between 1,600 tpa

to 2,000 tpa the rate will further reduce from 4.50% to 3.61%,

ultimately reducing to 0.86% with the Phase 2 expansion.

-- Once the royalty has been paid against 95,500 tonnes, the

rate then further reduces by 75% in respect of the first 9,800

tonnes, or 87.5% in respect of the production in excess of 9,800

tonnes for the remainder of that year. The 75% rate reduction for

the first 9,800 tonnes in a year and by 87.5% for amounts in excess

of 9.800 tonnes in that year then applies separately for each

subsequent year.

Update of Financing with Development Bank of Namibia ("DBN")

Further to the announcement on 26 June 2023, the inter-creditor

agreements between DBN and Standard Bank have been concluded and

the completion of the DBN financing is now only subject to the

finalisation of the associated security package. The Directors

currently expect the completion and associated drawdown to occur

during August 2023. Further updates will be provided in due

course.

General Meeting

As set out above, the key outstanding condition is the approval

by Andrada's shareholders at the upcoming Annual General Meeting of

the Company. A further announcement will be made when the circular

convening that meeting is dispatched.

Andrada Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO investorrelations@andradamining.com

Sakhile Ndlovu, Investor Relations

Nominated Adviser

WH Ireland Limited

Katy Mitchell +44 (0) 207 220 1666

Corporate Adviser and Joint

Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield

Matt Hasson +44 (0) 20 7907 8500

Stifel Nicolaus Europe Limited

Ashton Clanfield

Calum Stewart

Varun Talwar +44 (0) 20 7710 7600

Tavistock Financial PR (United +44 (0) 207 920 3150

Kingdom) andrada@tavistock.co.uk

Catherine Drummond

Adam Baynes

About Andrada Mining Limited

Andrada Mining Limited has a vision to create a portfolio of

globally significant, conflict-free, production and exploration

assets. The Company's flagship asset is the Uis Mine in Namibia,

formerly the world's largest hard-rock open cast tin mine.

Andrada has three mining licences namely:

ML 134 on which Uis Mine is located.

ML133 (Lithium Ridge)

ML129 (Spodumene Hill)

The main minerals in these mining licences are tin, lithium and

tantalum. Additionally, the Company has an exploration licence

EL5445 (Brandberg West) on which the main minerals are tin, copper

and tungsten. The Company has set a mineral resource target of 200

Mt to be delineated within the next 5 years. The substantial

mineral resource potential allows the Company to consider economies

of scale.

Andrada is managed by a board of directors with extensive

industry knowledge and a management team with deep commercial and

technical skills. Furthermore, the Company is committed to the

sustainable development of its operations and the growth of its

business. This is demonstrated by how the leadership team places

significant emphasis on creating value for the wider community,

investors, and other key stakeholders. Andrada has established an

environmental, social and governance system which has been

implemented at all levels of the Company and aligns with

international standards.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDPAMATMTIBMIJ

(END) Dow Jones Newswires

August 15, 2023 02:00 ET (06:00 GMT)

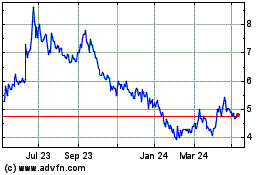

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Jan 2025 to Feb 2025

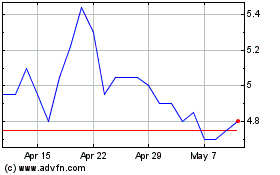

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Feb 2024 to Feb 2025