TIDMATM

RNS Number : 5423L

Andrada Mining Limited

06 September 2023

6 September 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR) as in force in

the United Kingdom pursuant to the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service (RIS), this inside information will be in the

public domain.

Andrada Mining Limited

("Andrada" or the "Company")

Initial Drill Results on ML133 ("Lithium Ridge")

Notable lithium intersections up to 2.13% Li O.

Andrada Mining Limited (AIM: ATM, OTCQB: ATMTF), an African

technology metals mining company with a portfolio of mining and

exploration assets in Namibia, is pleased to provide assay results

for the first batch of Reverse Circulation ("RC") exploration

drilling results of an initial scouting programme undertaken within

the ML133 mining license area ("Lithium Ridge").

Building on the channel sampling programme, whose results

highlighted the potential of the mineralised pegmatites, an

exploration drilling programme ("the Programme") was implemented to

investigate the continuation of selected lithium enriched

pegmatites at depth. This announcement contains initial results

received for 14 of the 24 holes drilled. The Programme indicates

that the targeted pegmatites continue at depth and, these

analytical results confirm the presence of significant lithium

mineralisation within multiple pegmatites.

HIGHLIGHTS

-- All drill holes intersected mineralised pegmatites.

-- Significant pegmatite intersections include:

o D rill hole ATNN 08: 14m at 1.80% Li(2) O, 0.08% Sn and 70 ppm

Ta from a depth of 8m to 22m.

- Including a notable lithium intersection of 11 m at 2.13% Li(2) O from 9m to 20m.

o Drill hole ATNN 14 :17m at 1.29% Li(2) O, 0.09% Sn and 77 ppm

Ta from a depth of 23m to 40m.

- Including a notable lithium intersection of 11 m at 1.78% Li(2) O from 23m to 34m.

o Drill hole ATNN 01: 63m at 0.80% Li(2) O, 0.12% Sn and 66 ppm

Ta from a depth of 17m to 80m.

- Including a notable lithium intersection of 35 m at 1.05% Li(2) O from 44m to 79m.

o Drill hole ATNN 02: 27m at 1.24% Li(2) O, 0.14% Sn and 116 ppm

Ta from a depth of 31m to 58m.

- Including a notable lithium intersection of 19 m at 1.50% Li(2) O from 33m to 52m.

-- This initial batch of drill results covers a strike distance

of over 4 km.

Anth ony Viljoen, Chief Executive Officer, commented:

"These initial results further highlight the mineral potential

of our mining licenses and the Erongo region in general. We have

found high-grade mineralisation within all our license areas over

the last 12 months with indications that there is more to be found

at depth.

This first batch of results confirms lithium mineralisation

along a 4 km strike, and we anticipate that the second batch will

show similar results as per the results from the channel samples

over the remaining 2 km. These results indicate intersections at

higher lithium grades than those recorded at Uis and are

commensurate to similar hard-rock resources globally.

Andrada has already produced a saleable petalite concentrate on

a pilot scale from Lithium Ridge suitable for the industrial and

technical markets. With the commissioning of the lithium pilot

plant at Uis Mine being finalised, we are evaluating various

options to expedite lithium production."

PROJECT LOCATION

The Lithium Ridge project is within the ML133 mining license

area situated approximately 35km southeast of the Uis Mine along

the D1903 road linking to the B2 highway. This license area is

situated within the NaiNais - Kohero pegmatite belt and is the

location of the former tin and tantalum concentrate producing

TinTan mine.

Overview of results

This Programme comprised 24 RC drill holes at a total of 1900 m

drilled, yielding approximately 800 samples for chemical analysis.

The results of the first 14 holes comprising approximately 400

samples are reported in this announcement.

The Programme was undertaken to investigate the subsurface

morphology and metal endowment of selected pegmatite bodies which

contain elevated lithium values at surface. Since this Programme

has been undertaken over an area the Company considers to be

greenfield, the approach has been that of caution in evaluating the

potential of each pegmatite. Due to the favourable results of the

Programme, the Company is likely to implement additional drilling

programmes with a view to defining a JORC compliant resource within

this area in the future.

The results reported as "whole intersection" in Table 1 below,

indicate a pegmatite intersection from the top to the bottom

contact. Samples with RC chips indicating the presence of xenolith

material have been included within the reported intersection. The

intersections reported as "including" represent continuous

higher-grade intervals within the total intersection of the

selected pegmatites. Although all the drill holes were drilled at

an angle of 60deg (sixty degrees) from the horizontal as

illustrated in Figure 2, the reported pegmatite intersections

should still be considered to represent apparent width.

Table 1 : Analytical results of the maiden RC drill programme

executed on the Lithium Ridge project. The 'whole intersection'

values comprise the weighted average for of the entire pegmatite

intersection including xenoliths. The remaining intersections

represent selected intervals within the pegmatites highlighting

increased metal content.

Hole Intersection From/To Width Grades

ID (m) (Metres)

Li O Sn Ta (ppm)

(%) (%)

----- ----- ---------

ATNN

01 Whole Intersection 17-80 63 0.80 0.12 66

-------------------- -------- ---------- ----- ----- ---------

Including 44-79 35 1.05 0.12 79

--------------------------- -------- ---------- ----- ----- ---------

ATNN

02 Whole Intersection 31-58 27 1.24 0.14 116

-------------------- -------- ---------- ----- ----- ---------

Including 33-52 19 1.50 0.16 113

--------------------------- -------- ---------- ----- ----- ---------

Whole Intersection 62-74 12 0.50 0.10 91

--------------------------- -------- ---------- ----- ----- ---------

ATNN

03 Whole Intersection 10-16 6 0.92 0.07 164

-------------------- -------- ---------- ----- ----- ---------

Including 11-15 4 1.28 0.09 176

--------------------------- -------- ---------- ----- ----- ---------

Whole Intersection 27-30 3 1.02 0.13 42

--------------------------- -------- ---------- ----- ----- ---------

ATNN

04 Whole Intersection 21-32 11 0.75 0.16 63

-------------------- -------- ---------- ----- ----- ---------

Including 24-29 5 1.34 0.19 66

--------------------------- -------- ---------- ----- ----- ---------

ATNN

05 Whole Intersection 10-26 16 1.18 0.16 54

-------------------- -------- ---------- ----- ----- ---------

Including 13-24 11 1.42 0.17 54

--------------------------- -------- ---------- ----- ----- ---------

Whole Intersection 76-83 7 0.37 0.13 46

--------------------------- -------- ---------- ----- ----- ---------

ATNN

06 Whole Intersection 30-40 10 0.36 0.19 81

-------------------- -------- ---------- ----- ----- ---------

ATNN

07 Whole Intersection 26-32 6 0.33 0.07 85

-------------------- -------- ---------- ----- ----- ---------

ATNN

08 Whole Intersection 08-22 14 1.80 0.08 70

-------------------- -------- ---------- ----- ----- ---------

Including 09-20 11 2.13 0.08 70

--------------------------- -------- ---------- ----- ----- ---------

ATNN

10 Whole Intersection 18-28 10 0.59 0.14 67

-------------------- -------- ---------- ----- ----- ---------

ATNN

11 Whole Intersection 26-36 10 1.03 0.06 43

-------------------- -------- ---------- ----- ----- ---------

Including 27-30 3 1.86 0.02 36

--------------------------- -------- ---------- ----- ----- ---------

ATNN

12 Whole Intersection 43-53 10 0.11 0.17 48

-------------------- -------- ---------- ----- ----- ---------

ATNN

13 Whole Intersection 30-37 7 0.85 0.19 121

-------------------- -------- ---------- ----- ----- ---------

ATNN

14 Whole Intersection 23-40 17 1.29 0.09 77

-------------------- -------- ---------- ----- ----- ---------

Including 23-34 11 1.78 0.11 76

--------------------------- -------- ---------- ----- ----- ---------

All reported holes were drilled by RC methodology at an

inclination of 60deg from the horizontal. Downhole surveys through

magnetic deviation probe at 2 m intervals, were completed for each

hole immediately after drilling and collar locations were surveyed

using a differential GPS. Due to the undulating dip angle of the

pegmatites, the intersections are assumed to be an indication of

apparent thickness, which is greater than true thickness.

Other minor pegmatites identified in drill holes have not been

reported, because they are not currently considered to be of

economic significance. Each drill hole was geologically logged and

sampled at 1 m intervals with the entire RC sample being dispatched

to the laboratory for preparation. The sample analysis was

undertaken by UIS Analytical Services, a certified independent

laboratory in Namibia, using a peroxide fusion. ICP-OES analysis

was utilised for major and minor elements whilst ICP-MS was

utilised for the trace elements. No top cut was applied in

calculating the weighted average grades for anomalously rich

intersections.

Figure 1 : Map displaying the localities of the reported holes,

and the mapped surface exposure or pegmatites. Line A-A' indicates

the area represented by the cross section in Figure 2 below .

Figure 2 : Section line A-A' displaying a projection of the

drill holes results in this announcement. Since there are no second

intersections of each intrusive body, the morphology of the unit

was extrapolated using mapped surface expressions. All holes were

drilled at an inclination of 60deg from the horizontal.

Competent Person Statement

The technical data in this announcement has been reviewed by

Professor Laurence Robb ("Prof. Robb"), who is a non-executive

director of Andrada Mining. Prof. Robb has over 30 years of

industry related exploration and mineral experience and is a

Competent Person for the reporting of exploration results. He has

reviewed both the technical disclosures in this release as well as

the quality assurance protocols and results for this programme.

Glossary of abbreviations

GPS Global Positioning System

ICP-MS Inductively Coupled Plasma-Mass Spectrometry

---------------------------------------------------------

ICP-OES Inductively Coupled Plasma-Optical Emission Spectrometry

---------------------------------------------------------

Li Symbol for Lithium

---------------------------------------------------------

Li -> Metal to metal-oxide conversion factor of 2.153

Li(2)

O

---------------------------------------------------------

Li(2) Lithium oxide

O

---------------------------------------------------------

PPM Parts Per Million

---------------------------------------------------------

RC Reverse Circulation

---------------------------------------------------------

Sn Symbol for Tin

---------------------------------------------------------

Ta Symbol for Tantalum

---------------------------------------------------------

Contact

Andrada Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO investorrelations@andradamining.com

Sakhile Ndlovu, Investor Relations

Nominated Adviser

WH Ireland Limited

Katy Mitchell +44 (0) 207 220 1666

Corporate Adviser and Joint

Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield

Matt Hasson +44 (0) 20 7907 8500

Stifel Nicolaus Europe Limited

Ashton Clanfield

Calum Stewart

Varun Talwar +44 (0) 20 7710 7600

Tavistock Financial PR (United +44 (0) 207 920 3150

Kingdom) andrada@tavistock.co.uk

Jos Simson

Catherine Drummond

Adam Baynes

About Andrada Mining Limited

Andrada Mining Limited, formerly Afritin Mining Limited, is a

London-listed technology metals mining company with a vision to

create a portfolio of globally significant, conflict-free,

production and exploration assets. The Company's flagship asset is

the Uis Mine in Namibia, formerly the world's largest hard-rock

open cast tin mine.

An exploration drilling programme is currently underway with the

aim of expanding the tin resource over the fourteen additional,

historically mined pegmatites, all of which occur within a 5 km

radius of the current processing plant. The Company has set a

mineral resource target of 200 Mt to be delineated within the next

5 years. The existing mine, together with substantial mineral

resource potential, allows the Company to consider economies of

scale.

Andrada is managed by a board of directors with extensive

industry knowledge and a management team with extensive commercial

and technical skills. Furthermore, the Company is committed to the

sustainable development of its operations and the growth of its

business. This is demonstrated by the manner in which the

leadership team places significant emphasis on creating value for

the wider community, investors, and other key stakeholders. Andrada

has established an environmental, social and governance system

which has been implemented at all levels of the Company and aligns

with international standards.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLMZGGLKVNGFZG

(END) Dow Jones Newswires

September 06, 2023 02:00 ET (06:00 GMT)

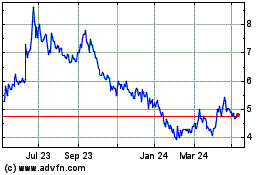

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Jan 2025 to Feb 2025

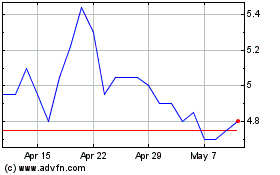

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Feb 2024 to Feb 2025