TIDMATM

RNS Number : 3805M

Andrada Mining Limited

14 September 2023

14 September 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR) as in force in

the United Kingdom pursuant to the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service (RIS), this inside information will be in the

public domain.

Andrada Mining Limited

("Andrada" or the "Company")

Q2 Operational Update for the period ended 31 August 2023

Completion of the bulk sampling (lithium) pilot plant and

tantalum circuit commissioning.

Andrada Mining Limited (AIM: ATM, OTCQB: ATMTF), the African

technology metals mining company with a portfolio of mining and

exploration assets in Namibia hereby provides an unaudited

operational update for the second quarter ending 31 August 2023

("Q2 2024").

HIGHLIGHTS

OPERATIONS

-- 86% year-on-year ("YoY") increase in tin concentrate to 398

tonnes (Q2 2023: 214 tonnes).

-- 79% YoY increase in contained tin metal to 238 tonnes (Q2

2023: 133 tonnes).

-- Completion of the tantalum circuit ("Circuit") commissioning

with 225kg produced.

-- Improved safety performance to 0.86 LTIFR at the end of the

quarter compared to 0.95 at the end of Q1 2024 and 8.02 at the end

of Q2 2023.

LITHIUM DEVELOPMENT

-- Commissioning of the lithium pilot plant ("Pilot Plant")

completed.

-- Initial test campaigns have commenced to produce a consistent

saleable grade of lithium concentrate.

EXPLORATION PROGRAMME

-- Spodumene Hill inaugural drill results over the B1 and C1

pegmatites intersected high grade spodumene mineralisation with up

to 2.32% Li O.

o All drill holes intercepted lithium rich pegmatites.

o High grade tantalum mineralisation was also recorded

highlighting upside potential.

-- Lithium Ridge Reverse Circulation ("RC") drilling programme

provided initial batch of results with notable lithium

intersections with up to 2.13% Li O.

o Second batch of results are expected shortly.

-- Lithium Ridge infill channel sampling confirmed the existence

of continuous mineralisation at surface over a 6 km strike

length.

o When combined, the weighted average of the 27 highest lithium

grade channel sample lines amounted to 179 m at 1.20% Li O.

o The primary lithium minerals identified were spodumene and

petalite.

FINANCIAL

-- Average C1(1) operating cash costs for Q2 2024 and H1 2024

are within management guidance for the year, of between USD17 000

and USD20 000 per tonne of contained tin, at USD19 560 and USD18

161 respectively.

-- Average C2(2) operating costs for Q2 2024 and H1 2024 are

within management guidance for the year of between USD20 000 and

USD25 000 per tonne of contained tin, at USD22 252 and USD20 796

respectively.

-- All-in sustaining cost ("AISC") (3) for Q2 2024 within and H1

2024 below management guidance for the year of between USD25 000

and USD30 000 per tonne of contained tin, at USD26 671 and USD24

662 respectively. The stripping ratios have begun to decrease as

the new ore is reached through the push-back.

-- Approximately USD10 million (GBP7.7 million) raised through

issuance of unsecured convertible loan notes. Proceeds mainly

targeted at the expansion of the tin, tantalum, and lithium

exploration and production circuits. (see announcement dated 18

July 2023).

-- USD25 million financing with Orion Resource Partners

("Orion") was updated and will potentially be completed in the

quarter ending November 2023. (See announcement dated 15 August

2023).

-- Conclusion of NAD100 million (cUSD5.8 million) Development

Bank of Namibia ("DBN") financing occurred after the period end, on

5 September 2023.

o Initial drawdown of the facility on 12 September 2023.

-- Cash balance on 31 August 2023 was USD7 million (GBP6

million).

CORPORATE

-- Strategic partner process discussions ongoing with parties

that have met the strategic criteria.

Anth ony Viljoen, Chief Executive Officer, commented:

" Our main activity over the quarter involved the completion of

commissioning of the lithium pilot plant. The completion of

commissioning is key to expediting the metallurgical testwork that

is essential to incorporating the lithium circuit into the Run of

Mine production. The main objective of the testwork programme is to

determine the optimal processing facility for extracting

consistent, homogenous, saleable concentrate for both the chemical

and industrial lithium markets.

The operational team has been performing extremely well on the

existing plant annually. Therefore, the potential additional

lithium revenue credits from the integration of the lithium plant

to the main production circuit, could substantially enhance total

revenue. The conclusion of several work streams as well as the

completion of key financing partnerships this quarter, has notably

strengthened the Company's balance sheet for a transformational

period of growth and development."

OPERATIONAL SUMMARY

Table 1: Unaudited Uis Mine quarterly production and cost

performance

Description Unit Q1 Q2 Q2 H1 H1 YoY YoY QoQ

FY 2024 FY 2023 FY 2024 FY 2024 FY 2023 % <DELTA> % <DELTA> % <DELTA>

Quarterly Interim

Feed

grade % Sn 0.151 0.145 0.161 0.156 0.147 11% 6% 7%

----------- --------- --------- --------- --------- --------- ---------- ---------- ----------

Plant

processing

rate tph 135 100 138 136 99 39% 0% 3%

----------- --------- --------- --------- --------- --------- ---------- ---------- ----------

214 134 232 446 286

Ore processed t 467 315 154 621 558 73% 56% 8%

----------- --------- --------- --------- --------- --------- ---------- ---------- ----------

Tin

concentrate t 359 214 398 758 455 86% 67% 11%

----------- --------- --------- --------- --------- --------- ---------- ---------- ----------

Contained

tin t 216 133 238 454 287 79% 58% 10%

----------- --------- --------- --------- --------- --------- ---------- ---------- ----------

Tin recovery % 67 69 64 65 68 -7% -2% -5%

----------- --------- --------- --------- --------- --------- ---------- ---------- ----------

Plant

availability % 91 89 92 92 89 3% 3% 1%

----------- --------- --------- --------- --------- --------- ---------- ---------- ----------

Plant

utilisation % 79 69 83 81 74 20% 10% 5%

----------- --------- --------- --------- --------- --------- ---------- ---------- ----------

Uis mine USD/t

C1 operating contained 19 18

cost(1) tin 15 741 22 903 560 161 20 094 -16% -10% 24%

----------- --------- --------- --------- --------- --------- ---------- ---------- ----------

Uis mine USD/t

C2 operating contained 22 20

cost(2) tin 18 235 25 245 252 796 22 668 -12% -8% 14%

----------- --------- --------- --------- --------- --------- ---------- ---------- ----------

USD/t

Uis mine contained 26 24

AISC(3) tin 21 377 29 282 671 662 25 812 -9% -5% 25%

----------- --------- --------- --------- --------- --------- ---------- ---------- ----------

USD/t

Tin price contained 25 25

achieved tin 25 149 22 975 183 912 25 525 10% 2% 0%

----------- --------- --------- --------- --------- --------- ---------- ---------- ----------

(1)C1 refers to operating cash costs per unit of production

excluding selling expenses and sustaining capital expenditure

associated with Uis Mine.

(2) C2 operating cash cost is the C1 amount including selling

expenses (logistics, smelting and royalties).

(3)All-in sustaining cost (AISC) incorporates all costs related

to sustaining production, capital expenditure associated with

developing and maintaining the Uis operation as well as

pre-stripping waste mining costs.

Safety performance

There was a single LTI incident during the quarter. However, the

operation's safety record continued to improve over the quarter

from a LTIFR of 0.95 at the end of Q1 FY 2024 to 0.86 at the end of

the quarter under review. The continued improvement in safety is

the result of the implementation of safety culture programmes

supported by independent external safety audits.

Increased volumes

Tin concentrate production increased by 86% to 398 tonnes

resulting in a 79% increase in contained tin to 238 tonnes YoY. The

plant processing rate increased by 39% YoY and 3% QoQ to 138 tph

due to the positive impact of the modular expansion implemented in

Q3 FY 2023. All costs in the quarter decreased YoY due to the

economies of scale from higher volumes and improved efficiencies.

Despite the QoQ increases, the cash costs and AISC were mostly

within the management guidance except for the H1 2024 AISC figures

that were below guidance .

As previously disclosed, the Company decided to expedite the

waste stripping of the mining pit, which resulted in an accelerated

pushback to access ore and inadvertently a spike in the quarter

stripping ratio to 4.9 (Q1 2024: 2.3). Stripping ratios have begun

to decrease as the ore is reached, and management expects the ratio

for H2 FY 2024 to be 3.9 resulting in an annual ratio of 3.8. The

lower recovery rates in the quarter were mainly due to the

increased throughput and significantly finer ore processed. The

costs of this however, remain within previous management

guidance.

LITHIUM, TANTALUM development & METALLURGY UPDATE

Completion of the Lithium Pilot Plant commissioning

Andrada completed the commissioning of the Pilot Plant with the

testing of samples to determine the optimal process for lithium

extraction from all three mining licences commencing in October

2023. The feed from Uis will constitute both run of mine ("ROM")

material and the discard from the tin processing plant, whilst that

from Lithium Ridge and Spodumene Hill will be ROM material.

The Pilot Plant is also targeted to produce a minimum of 2 400

tpa of saleable concentrate for glass-ceramics off-takers. To date,

the Company has sent high purity petalite concentrate produced

off-site to several potential customers and discussions to conclude

an initial sale of lithium product are advanced. The Company

believes that the concentrate is also potentially suitable as

feedstock for lithium refineries producing lithium carbonate or

lithium hydroxide for the battery manufacturing industry.

Completion of the Tantalum Circuit commissioning.

Similarly, the commissioning of the Tantalum Circuit was

successfully completed, and it is currently being optimised. During

commissioning, approximately 225 Kg of tantalum was produced.

Tantalum concentrate is used to produce a range of tantalum

chemicals or refined into metal for use in niche metal products or

alloys. Tantalum is essential for high-performance applications

such as capacitors, superalloys, and electronics for aerospace,

military, and consumer use. Current tantalum prices for 25% Ta O

are as high as USD170 000 per tonne .

EXPLORATION PROGRESS UPDATE

Mining licence 129: Spodumene Hill

An initial drill programme of 17 holes over the B1 and C1

pegmatite bodies was completed during the quarter All the drill

holes returned positive results with spodumene being identified in

all holes drilled (see announcement dated 6 July for full details

of these results). The programme returned weighted average grades

of up to 1.38% Li O and 285 ppm tantalum. The results of this

programme highlight the mineral potential of Spodumene Hill. The

Company has initiated a metallurgical programme to investigate the

optimal beneficiation process for the recovery of both lithium and

tantalum, whilst also producing tin as a by-product.

Argus Non-Ferrous Markets , Issue 23 - 174.Monday 11 September

2023

Mining licence 133: Lithium Ridge

Lithium Ridge infill channel sampling results confirmed the

existence of continuous mineralisation at surface over a 6 km

strike length. The primary lithium minerals identified were

spodumene and petalite and the weighted average of the 27 highest

lithium grade channel sample lines amounted to 179 m at 1.20% Li O.

(See announcement dated 29 August 2023).

Post-period, initial results for 14 out of 24 holes from the

Lithium Ridge RC drilling programme reported notable lithium

intersections with up to 2.13% Li O. (See announcement dated 6

September 2023).

Off-site testing update

Metallurgical test work to date has focused on the concentration

of petalite due to its prevalence in all the mining areas. Lithium

recovery has therefore been focussed on petalite recovery, whilst

the feasibility of concentrating other lithium bearing minerals

from the deposit is also being investigated. Testing for spodumene

is planned to commence in Q4 FY2024. Three technologies are being

explored to determine the optimal solution to extract petalite.

Test work has indicated that it may be possible to upgrade ore to a

saleable concentrate solely through DMS technology. Transfer of

off-site DMS and XRT testing to the Pilot Plant is currently

on-going.

FINANCE

Orion Resource Partners USD25 million financing

In August 2023, Andrada signed binding documentation for an

updated, conditional USD25 million funding package with Orion. The

financing is conditional on the satisfaction of requirements

customary with transactions of this nature and shareholder approval

of certain resolutions at the Company's Annual General Meeting

which is to be held on 29 September 2023. (see announcement dated

15 August 2023). Funding is expected to be completed around the end

of September 2023.

Development Bank of Namibia ("DBN") funding

Post-period end on 5 September 2023, DBN confirmed that all

conditions had been fulfilled or waived for the finalisation of a

N$100 million (USD5.8 million) financing. The proceeds are

ring-fenced for implementation of the Uis Mine Stage II Continuous

Improvement Project. (See announcement dated 5 September 2023). The

Company has drawn N$50 million from this facility to date.

Cash balance

The combined cash and cash equivalent balance on 31 August 2023

was USD7 million (GBP6 million). During the quarter the available

funds were mainly utilised for the commissioning of the Lithium

Pilot Plant and the Tantalum Circuit.

CORPORATE

Strategic process update

The strategic process to identify an appropriate partner to

participate in the lithium development is progressing well.

Discussions are ongoing with parties that have met the strategic

criteria and they are expected to continue beyond 30 September

2023. Meanwhile, the Company is focused on completing the

workstreams required to finalise the process. Further updates on

the strategic process will be communicated in due course as

appropriate.

Glossary of abbreviations

FY Financial year for the period March to April

GBP British pound sterling

---------------------------------------------

LTI Lost time injury

---------------------------------------------

LTIFR Lost time injury frequency rate

---------------------------------------------

ppm Parts per million

---------------------------------------------

Sn Symbol for tin

---------------------------------------------

t Tonnes

---------------------------------------------

tph/a Tonnes per hour/annum

---------------------------------------------

USD United States Dollar

---------------------------------------------

Contact

Andrada Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO investorrelations@andradamining.com

Sakhile Ndlovu, Investor Relations

Nominated Adviser

WH Ireland Limited

Katy Mitchell +44 (0) 207 220 1666

Corporate Adviser and Joint

Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield

Matt Hasson +44 (0) 20 7907 8500

Stifel Nicolaus Europe Limited

Ashton Clanfield

Calum Stewart

Varun Talwar +44 (0) 20 7710 7600

Tavistock Financial PR (United +44 (0) 207 920 3150

Kingdom) andrada@tavistock.co.uk

Jos Simson

Catherine Drummond

Adam Baynes

About Andrada Mining Limited

Andrada Mining Limited, formerly Afritin Mining Limited, is a

London-listed technology metals mining company with a vision to

create a portfolio of globally significant, conflict-free,

production and exploration assets. The Company's flagship asset is

the Uis Mine in Namibia, formerly the world's largest hard-rock

open cast tin mine.

An exploration drilling programme is currently underway with the

aim of expanding the tin resource over the fourteen additional,

historically mined pegmatites, all of which occur within a 5 km

radius of the current processing plant. The Company has set a

mineral resource target of 200 Mt to be delineated within the next

5 years. The existing mine, together with substantial mineral

resource potential, allows the Company to consider economies of

scale.

Andrada is managed by a board of directors with extensive

industry knowledge and a management team with extensive commercial

and technical skills. Furthermore, the Company is committed to the

sustainable development of its operations and the growth of its

business. This is demonstrated by the manner in which the

leadership team places significant emphasis on creating value for

the wider community, investors, and other key stakeholders. Andrada

has established an environmental, social and governance system that

has been implemented at all levels of the Company and aligns with

international standards.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGZGMLMFNGFZZ

(END) Dow Jones Newswires

September 14, 2023 02:00 ET (06:00 GMT)

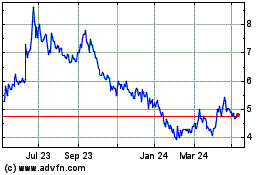

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Jan 2025 to Feb 2025

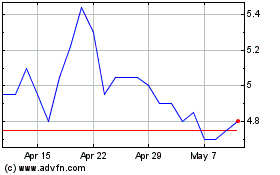

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Feb 2024 to Feb 2025