Braveheart Investment Group plc Acquisition of further interest in Autins Group

June 26 2024 - 8:03AM

RNS Regulatory News

RNS Number : 0105U

Braveheart Investment Group plc

26 June 2024

26 June 2024

Braveheart Investment Group Plc

("Braveheart", the "Company" or the "Group")

Acquisition of further interest in Autins

Group plc

Braveheart Investment

Group (AIM: BRH), announces an update on recent purchases

of shares by Braveheart in one of its portfolio companies, Autins

Group plc ("Autins").

Between 15 March 2024 and 25 June 2024, the Company has purchased a

further 1,930,000 ordinary shares in Autins at an average price of

10.24 pence per share for a total cash consideration of £197,600,

details of which are set out below. Following these purchases,

Braveheart now holds 26.95% per cent. of the issued share capital

of Autins.

|

Date Of

Purchase

|

No. of Autins Shares

Purchased

|

Price (£)

|

Consideration

(£)

|

|

15 March

2024

|

300,000

|

£ 0.080

|

£24,000

|

|

5 April

2024

|

420,000

|

£ 0.089

|

£37,380

|

|

19 April

2024

|

85,000

|

£ 0.100

|

£8,500

|

|

23 April

2024

|

165,000

|

£ 0.110

|

£18,150

|

|

8 May

2024

|

250,000

|

£ 0.100

|

£25,000

|

|

31 May

2024

|

100,000

|

£ 0.117

|

£11,700

|

|

28 May

2024

|

110,000

|

£ 0.117

|

£12,870

|

|

25 June

2024

|

500,000

|

£ 0.120

|

£60,000

|

Autins' shares are admitted to

trading on AIM (AIM: AUTG) and the company specialises in solving

acoustic and thermal problems in the automotive industry and other

specialist applications. The growth of electric vehicle production

has created new opportunities for Autins who now supply vehicle

producers including: JLR, Nissan, BMW, Aston Martin, Lotus,

Lamborghini and Bentley; as well as Tier 1 automotive suppliers:

Draxlmaier, Kasai, Treves, Novares, Mergon and Yangfeng. In the

year ended 30 September 2023, Autins made a loss before tax of

£1.04 million on revenue of approximately £22.7 million with net

assets of approximately £10.8 million.

The Board continues to seek

investment opportunities, both within its existing portfolio and

from outside. The Braveheart Board considers this investment to be

a strategic investment and thus an important addition to the

Group's portfolio.

For further information:

|

Braveheart Investment Group plc

|

Tel: 01738 587555

|

|

Trevor Brown, Chief Executive

Officer

Viv Hallam, Executive

Director

|

|

|

|

|

|

Allenby Capital Limited (Nominated Adviser and Joint

Broker)

|

Tel: 020 3328 5656

|

|

James Reeve / George

Payne

|

|

|

|

|

|

Peterhouse Capital Limited (Joint

Broker)

|

Tel: 020 7469 0936

|

|

Duncan Vasey / Lucy

Williams

|

|

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

PFUGZGZVFVMGDZM

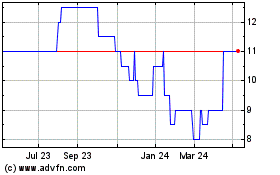

Autins (LSE:AUTG)

Historical Stock Chart

From Dec 2024 to Jan 2025

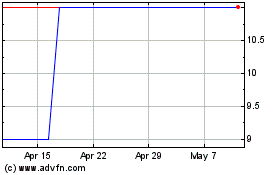

Autins (LSE:AUTG)

Historical Stock Chart

From Jan 2024 to Jan 2025