Immediate Acquisition PLC Result of AGM (3769R)

July 05 2022 - 4:48AM

UK Regulatory

TIDMIME

RNS Number : 3769R

Immediate Acquisition PLC

05 July 2022

5 July 2022

Immediate Acquisition Plc

("IME", the "Group" or the "Company")

Result of Annual General Meeting

Immediate Acquisition Plc (AIM: IME) announces that at its

Annual General Meeting ("AGM") held earlier today, all resolutions

were passed with the requisite majorities. Resolutions 1-8

(inclusive) were passed as ordinary resolutions. Resolutions 9, 10

and 11 were all in relation to the Directors' authority to allot

shares, this matter was covered in the resolutions put to the

general meeting held on 1 July and therefore the Directors decided

to withdraw resolutions 9, 10 and 11 from the AGM.

Voting was conducted by way of a poll and the results are set

out below:

Resolution Votes for % of votes Votes Against % of votes Withheld Total Votes

1. To receive and adopt the Company's

annual accounts for the year ended 31

December 2021

together with the Directors' report

and auditor's report. 7,678,780 100.00% Nil 0.00% Nil 7,678,780

---------- ----------- -------------- ----------- --------- ------------

2. To receive and approve the

Directors' remuneration report for

the year ended 31 December

2021. 7,678,780 100.00% Nil 0.00% Nil 7,678,780

---------- ----------- -------------- ----------- --------- ------------

3. To re-elect Tim Hipperson as a

director of the Company. 7,678,780 100.00% Nil 0.00% Nil 7,678,780

---------- ----------- -------------- ----------- --------- ------------

4. To re-elect Mark Horrocks as a

director of the Company. 3,078,780 100.00% Nil 0.00% Nil 3,078,780

---------- ----------- -------------- ----------- --------- ------------

5. To re-elect Simon Leathers as a

director of the Company. 7,678,780 100.00% Nil 0.00% Nil 7,678,780

---------- ----------- -------------- ----------- --------- ------------

6. To re-appoint the auditors, Nexia

Smith & Williamson. 7,678,780 100.00% Nil 0.00% Nil 7,678,780

---------- ----------- -------------- ----------- --------- ------------

7. To authorise the Directors to fix

the remuneration of the auditors. 7,678,780 100.00% Nil 0.00% Nil 7,678,780

---------- ----------- -------------- ----------- --------- ------------

8. To affirm the sale of the Company's

loan to Sprift Technologies Limited,

at face value,

for a total cash consideration of

GBP1.05 million to Mark Horrocks,

Non-Executive Director

of the Company, for the purposes of

section 190 of the Companies Act

2006. 3,078,780 100.00% Nil 0.00% Nil 3,078,780

---------- ----------- -------------- ----------- --------- ------------

9. Withdrawn N/A N/A N/A N/A N/A N/A

---------- ----------- -------------- ----------- --------- ------------

10. Withdrawn N/A N/A N/A N/A N/A N/A

---------- ----------- -------------- ----------- --------- ------------

11. Withdrawn N/A N/A N/A N/A N/A N/A

---------- ----------- -------------- ----------- --------- ------------

For further information please contact:

Immediate Acquisition Plc Tel: +44 (0) 203 515 0233

Tim Hipperson, Non-executive Chairman

Simon Leathers, Non-executive Director

SPARK Advisory Partners Limited (Nomad) Tel: +44 (0) 203 368 3550

Mark Brady

Neil Baldwin

SP Angel Corporate Finance LLP (Broker) Tel: +44 (0) 207 470 0470

Abigail Wayne

Matthew Johnson

Buchanan Communications Tel: +44 (0) 207 466 5000

Chris Lane / Kim van Beeck / Jack Devoy

Information on Immediate Acquisition plc

Immediate Acquisition plc is currently an AIM Rule 15 cash

shell. At a general meeting on 1 July 2022, shareholders approved

the acquisition of Fiinu Holdings Limited ("Fiinu Holdings") (the

"Acquisition"), a fintech company and creator of the Plugin

Overdraft(R), which is classified as a reverse takeover under AIM

Rule 14. The Acquisition remains conditional, inter alia, upon

Fiinu's subsidiary, Fiinu 2 Ltd ("Fiinu 2"), receiving confirmation

of its Part 4A deposit taking licence from the UK regulators.

Information on Fiinu

Fiinu Holdings, founded in 2017, is a technology platform and

provider of consumer banking products.

Fiinu is comprised of two innovative businesses: Fiinu 2, which

is in the final stages of obtaining Part 4A Permission from the UK

regulators and will offer the group's flagship product, the Plugin

Overdraft(R), and Fiinu Ltd, a provider of financial technology and

alternative data solutions.

Fiinu's Plugin Overdraft(R) is an unbundled overdraft solution,

whereby Fiinu can provide its customers with an overdraft facility

without them having to switch their current account with their

present bank, giving customers access to affordable credit.

Importantly, an overdraft does not negatively impact a consumer's

credit score and helps avoid expensive "payday lenders", giving

consumers the opportunity to build their credit rating.

Fiinu Ltd is the group's technology arm which will manage and

develop the group's platform utilising data insights and

analytics.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGRAMLTMTIMMRT

(END) Dow Jones Newswires

July 05, 2022 05:48 ET (09:48 GMT)

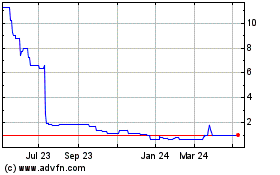

Fiinu (LSE:BANK)

Historical Stock Chart

From Dec 2024 to Jan 2025

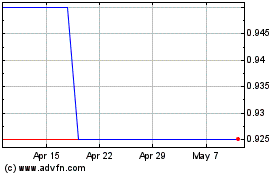

Fiinu (LSE:BANK)

Historical Stock Chart

From Jan 2024 to Jan 2025