TIDMBANK

RNS Number : 7677R

Immediate Acquisition PLC

08 July 2022

8 July 2022

Immediate Acquisition Plc (to be renamed Fiinu Plc)

(or the "Company")

Admission to Trading on AIM and First Day of Dealings

Immediate Acquisition plc (AIM: BANK) (to be renamed Fiinu plc),

is pleased to announce the readmission of its shares to trading on

AIM ("Admission") following completion of the reverse takeover of

Fiinu Holdings Limited ("Fiinu" and the enlarged group following

Admission being the "Group"), a fintech company and creator of the

Plugin Overdraft(R).

About Fiinu

Fiinu, founded in 2017, is a technology platform and provider of

consumer banking products.

Fiinu comprises two innovative businesses: Fiinu 2 Ltd (to be

renamed Fiinu Bank Ltd) ("Fiinu 2"), which has been granted Part 4A

Permission from the UK regulators and will offer the Group's

flagship product, the Plugin Overdraft(R), and Fiinu Ltd, a

provider of financial technology and alternative data

solutions.

Fiinu's Plugin Overdraft(R) is an unbundled overdraft solution,

whereby Fiinu can provide its customers with an overdraft facility

without them having to switch their current account with their

present bank, giving customers access to affordable credit.

Importantly, an overdraft does not negatively impact a consumer's

credit score and helps avoid expensive "payday lenders", giving

consumers the opportunity to build their credit rating.

Fiinu Ltd is the Group's technology arm which will manage and

develop the Group's platform utilising data insights and

analytics.

Following the receipt of the deposit taking licence from the UK

regulators on 7 July 2022, Fiinu 2 has entered a mobilisation

period which is expected to last for up to 12 months. Mobilisation

is an optional stage in which new banks, once authorised, operate

with deposit restrictions while they complete their set up before

starting to trade fully. During mobilisation, the Group will update

investors as and when it completes various mobilisation actions,

for example:

-- advancing its operational capabilities (for example, securing

further investment for when it exits mobilisation);

-- recruiting senior managers and other staff;

-- building out control functions such as risk, internal audit and compliance;

-- investing in and testing IT systems;

-- committing to third-party suppliers etc.; and

-- finalising the firm's recovery plan and solvent wind-down

plan, while the PRA/FCA will continue their assessments of whether

the Group is ready to exit mobilisation and become fully

operational.

During mobilisation, the amount of total deposits that a new

bank can accept is limited to a total of GBP50,000. A new bank can

exit the mobilisation phase by submitting a Variation of Permission

to the PRA and the FCA, having submitted evidence that all actions

set out in its authorisation letter, and any other actions

requested from the firm during mobilisation, have been

completed.

Chris Sweeney, CEO of Fiinu and incoming CEO of the Company,

commented: "We are very proud to be joining AIM today. This move to

the public markets completes the next step in Fiinu's growth plan.

We are confident that we have both an innovative new product in our

Plugin Overdraft and a market that desperately needs a responsible,

easy to access credit. We have an exciting opportunity ahead of us

and being a quoted business will allow us to capitalise on this and

accelerate our growth plans."

Placing Highlights

The Company has successfully raised GBP8.01 million (before

expenses) via a placing of 40,050,000 new ordinary shares at an

issue price of 20 pence per share (the "Placing"). The net proceeds

of the Placing will be used in combination with the Company's

existing capital resources for regulatory capital, investment in

technology and general operating expenses.

SPARK Advisory Partners Limited is acting as Nominated Adviser

and SP Angel Corporate Finance LLP is acting as broker in relation

to Admission.

The ISIN of the Ordinary Shares is GB0033881904 , the SEDOL of

the Ordinary Shares is 3388190 and the Company's LEI number is

213800XSRH9SNN1EXX92.

Total Voting Rights

The number of shares in issue immediately after Admission is

265,131,861 giving the Company a market capitalisation of

approximately GBP53 million at the issue price of 20 pence per

share. Admission took place at 8.00 a.m. today, 8 July 2022.

The Company holds no shares in treasury and therefore the figure

above may be used by shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

share capital of the Company under the Disclosure Guidance and

Transparency Rules of the Financial Conduct Authority.

Change of Name and TIDM

The Company's TIDM has changed to "BANK" with effect from

Admission. The Company has today resolved to change its name to

Fiinu plc ("Change of Name"), the Change of Name is being processed

by Companies House and will take effect on the London Stock

Exchange once this has occurred.

Directorate Changes

As set out in the Company's Admission Document dated 15 June

2022, Tim Hipperson (Non-Executive Chairman) and Mark Horrocks

(Non-Executive Director) have today stepped down from the Board of

Directors. Simon Leathers (Non-Executive Director) will remain in

his position.

In addition to Simon Leathers, the following have been appointed

to the Board of Directors with effect from Admission:

David Hopton - Non-Executive Chairman

Chris Sweeney - Chief Executive Officer

Marko Sjoblom - Founder and Executive Director

Philip Tansey - Chief Financial Officer

Jerry Loy - Independent Non-Executive Director

Huw Evans - Independent Non-Executive Director

Full details of the Directors are given in the Company's

Admission Document dated 15 June 2022. There are no further

disclosures to be made pursuant to Schedule Two paragraph (g) of

the AIM Rules for Companies.

Tim Hipperson, departing Non-Executive Chairman, commented: "I,

along with my colleague Mark Horrocks, as departing directors,

would like to wish Simon Leathers and the Fiinu team the very best

on their future endeavours. We are proud of what the Company has

achieved in completing the reverse takeover of Fiinu and have every

confidence the executive team will deliver significant long-term

value for the Company's shareholders"

Change of Registered Office

With effect from Admission, the Company's registered office has

changed to Abbey House, Wellington Way, Weybridge KT13 0TT.

For further information please contact:

Immediate Acquisition Plc (to be renamed via Brazil London

Fiinu plc)

David Hopton, Non-Executive Chairman

Chris Sweeney, Chief Executive Officer

SPARK Advisory Partners Limited (Nomad) Tel: +44 (0) 203 368 3550

Mark Brady

Adam Dawes

SP Angel Corporate Finance LLP (Broker) Tel: +44 (0) 207 470 0470

Abigail Wayne

Matthew Johnson

Buchanan Communications (Financial Tel: +44 (0) 207 466 5000

PR adviser) Email: Fiinu@buchanan.uk.com

Chris Lane / Kim van Beeck / Jack Devoy

Brazil London (Press office for Fiinu) Tel: +44 (0) 207 785 7383

Joshua Van Raalte / Christine Webb Email: fiinu@agencybrazil.com

/ Jamie Lester

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSSDESWEESEEW

(END) Dow Jones Newswires

July 08, 2022 03:14 ET (07:14 GMT)

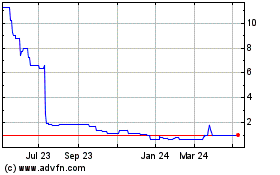

Fiinu (LSE:BANK)

Historical Stock Chart

From Nov 2024 to Dec 2024

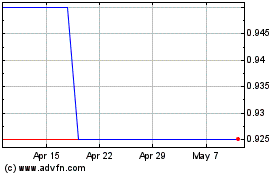

Fiinu (LSE:BANK)

Historical Stock Chart

From Dec 2023 to Dec 2024