TIDMCLON

RNS Number : 4959R

Clontarf Energy PLC

20 November 2012

20 November 2012

Clontarf Energy plc

("Clontarf" or "the Company")

Update on Peruvian exploration progress

STRATEGIC PARTNERSHIP NEGOTIATIONS ADVANCING

IN BOTH BLOCKS 183 AND 188

Clontarf Energy plc (AIM: CLON) ("Clontarf" or "the Company")

today announces an update on progress on its 100 per cent owned

Blocks 183 and 188 in Peru. Block 183 in central Peru covers

396,826 hectares. Block 188 in southern Peru covers 595,809

hectares and is located only 100 kilometres north east of the

Camisea gas field.

Clontarf Energy plc is advancing towards securing strategic

partnerships in both Blocks 183 and 188 in Peru.

Block 183:

The Company's negotiations to date have focused on the Pacaya

structure and the possible implementation of an integrated

gas-condensate project, with estimated prospective reserves of 870

billion cubic feet of natural gas and 45 million barrels of

condensate according to our latest most probable scenario.

Negotiations are complicated by the need to verify gas off-take

levels in order to justify upstream investment in required

exploration wells to confirm these resources. Clontarf is in

advanced discussions with a European power generation group, over a

projected 160 MW first phase power generation project, as well as

with a leading natural gas distribution group.

Clontarf's technical team foresees natural gas off-take in the

first phase of Pacaya production of 75 million cubic feet daily, of

which approximately 45 million cubic feet will go to power

production and 30 million cubic feet daily to other natural gas

distribution markets.

The Board of Clontarf expects that there will be a specific

agreement on the Pacaya structure. This would leave Clontarf Energy

free to explore the remainder of the 396,826 hectare Block 183.

Clontarf's geoscientists have already identified four additional

prospects: two with gas-condensate potential and two with oil

potential.

In the meantime, technical work progresses, with upcoming AVO

(Amplitude vs. Offset) analysis to be contracted with international

geophysical company ZEP-TECH. This work (which we expect would be

funded by a future partner) is intended to confirm and evaluate

amplitude anomalies found in three gas-condensate prospects,

including Pacaya.

These amplitude anomalies have already been proven in the

Shanushi 1X well (located 15 kilometers away from Pacaya), drilled

in 1975 by Germany's Deminex. High gas pressure was encountered in

the pre-Cretaceous Sarayaquillo and top Pucara formations.

Clontarf's experts believe that the Shanushi structure is directly

connected to the Pacaya prospect. Clontarf is also conducting a

further reprocessing of the seismic lines which connect Shanushi

with Pacaya in order to prove the extension of the natural gas

anomalies. A specialised technical study carried out by Fugro

Geophysical on behalf of Amerada Hess of the Shanushi well showed

potential recoverable gas reserves of over 1.3 trillion cubic feet

(TCF) and 69 million barrels of gas condensate, with a net pay of

almost 30 metres, which would considerably enhance the already

important Pacaya potential reserves.

Block 188:

In Block 188 the Company is mainly concentrating on working up

oil-prone targets. So far the negotiations have followed a more

standard farm-out format: the proposed carried work programme would

include an Environmental Impact Study and the acquisition of 200

kilometers of new 2D seismic. Clontarf has requested additional

dense-grid seismic lines, in order to confirm closure of large

structures on top of geological horsts related to rift depocentres

with main maturing zones during the Late Paleozoic era.

The Company also requires the drilling of one exploration well.

This technical work would be funded by the partner. In negotiations

to date, Clontarf Energy has proposed remaining as Operator,

retaining a 50 per cent operating interest.

Clontarf hopes that detailed, high-resolution seismic will

de-risk the 13 prospects and leads identified to date. The

Company's objective is to work up short-term drillable structures,

as well as to acquire more regional lines that will help establish

the prospectivity of Clontarf's eastern zone close to the Brazilian

shield outcrop, where giant stratigraphic trap accumulations could

exist.

Clontarf would reserve the right to re-enter the Panguana

structure, itself on top of a geological horst. This is an existing

oil discovery, drilled by Phillips Petroleum in 1999. The Company

estimates a potential reserve of 30-45 million barrels of 37 degree

API oil.

David Horgan, Managing Director of Clontarf Energy,

commented:

"Clontarf's Blocks have the right address. Our Block 188 is

surrounded by recent discoveries by Petrominerales last October in

Block 126, by Repsol last September in Block 57 and earlier by

Petrobras in Block 58. In addition Peru's growing power

consumption, high Latin American gas prices, and the Peruvian

Government's continuation of investment incentives, are all making

the territory extremely attractive.

"We are looking to cut industry deals that capture as much of

our Blocks' potential as possible."

________________________________________________________________________

This statement has been approved by senior oil industry

consultant Jorge Flores, a University of Oklahoma qualified

petroleum engineer.

________________________________________________________________________

For further information please visit http://clontarfenergy.com

or contact:

Clontarf Energyplc

John Teeling, Chairman +353 (0) 1 833 2833

David Horgan, Managing Director

James Finn, Finance Director

Nominated Adviser and Joint Broker

Shore Capital

Pascal Keane/Toby Gibbs, Corporate Finance +44 (0)20 7408 4090

Jerry Keen, Corporate Broking

Joint Broker

Optiva Securities Limited

Jeremy King +44(0)20 3137 1904

Jason Robertson +44(0)20 3137 1906

Public Relations

Blythe Weigh Communications +44 (0)20 7138 3204

Tim Blythe +44 (0) 7816 924626

Robert Kellner +44 (0) 7800 554377

Pembroke Communications

David O'Siochain +353 (0) 1 649 6486

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGGGQAGUPPGQB

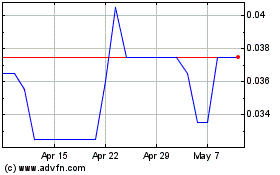

Clontarf Energy (LSE:CLON)

Historical Stock Chart

From Jan 2025 to Feb 2025

Clontarf Energy (LSE:CLON)

Historical Stock Chart

From Feb 2024 to Feb 2025