TIDMCMCL

RNS Number : 9314J

Caledonia Mining Corporation

14 August 2012

Caledonia Mining Reports Second Quarter 2012 Operating and

Financial Results and Notification of Management Conference

Call

Toronto, Ontario - August 14, 2012: Caledonia Mining Corporation

(the "Company") (TSX: CAL, OTCQX: CALVF, AIM: CMCL) is pleased to

announce its operating and financial results for the second quarter

2012 ("Q2" or the "Quarter"), which are reported below in Canadian

dollars unless otherwise indicated.

Operational Highlights

-- Gold produced at the Blanket Mine in Zimbabwe in Q2 was

11,560 ounces, 26% higher than the 9,164 ounces produced in the

quarter ended March 31, 2012 (the "preceding quarter") and 41%

higher than the 8,226 ounces produced in Q2 of 2011 (the

"comparable quarter").

-- The increase in gold production in Q2 was due to the

completion of scheduled maintenance on the winding portion of both

compartments of No. 4 Shaft which was completed in early May and

progressively allowed an increase in the daily available hoisting

time.

-- Average gold recovery during the Quarter increased to 93.9%,

compared to 93.2% in the preceding quarter.

-- Blanket's cash operating costs in the Quarter decreased to

US$547 per ounce of gold produced from US$648 in the preceding

quarter and US$585 in the comparable quarter. The decrease in cash

costs was due to the higher gold production during the Quarter and

the non-recurrence of certain costs which temporarily increased the

average cost per ounce in the preceding quarter.

-- Gold production in July 2012 was 4,708 ounces.

Financial Highlights

-- Gold Sales during the Quarter were 11,560 ounces at an

average sales price of US$1,599 per ounce compared to 10,368 ounces

at an average sales price of US$1,688 in the preceding quarter and

8,226 ounces at an average sales price of US$1,512 in the

comparable quarter.

-- Gross Profit for the Quarter (i.e. after depreciation and

amortization but before administrative expenses) was $10,067,000

compared to $8,996,000 in the preceding quarter and $5,593,000 in

the comparable quarter.

-- Net profit after tax for the Quarter was $5,497,000 compared

to $7,111,000 in the preceding quarter and $2,874,000 in the

comparable quarter. Net profit in the Quarter was reduced by the

payment of a US$1 million donation to the Gwanda Community Share

Ownership Trust in terms of the Indigenisation Agreements signed by

Blanket Mine, and by the increase in second quarter tax payments to

the Zimbabwean Revenue Authority.

-- Basic earnings per share for the Quarter were 1.1 cents per

share, compared to 1.4 cents in the preceding quarter and 0.6 cents

in the comparable quarter. Basic earnings per share for the first

half of the year were 2.5 cents compared to 0.9 cents in the six

months to June 30, 2011.

-- At June 30, 2012 the Corporation had cash and cash

equivalents of $18,323,000 compared to $16,288,000 at March 31,

2012 and $2,612,000 at June 30, 2011.

-- Cash flow from operations in the six months to June 30, 2012

before capital investment was $11,195,000 compared to $7,346,000 in

the six months to June 30, 2011.

-- During the Quarter Blanket made payments in respect of direct

and indirect taxes, royalties, licence fees, levies and other

payments to the Government of Zimbabwe totalling US$7,893,000

compared to US$3,282,000 in the preceding quarter and US$3,307,000

in the comparable quarter. Payments in the Quarter include a

donation of US$1 million to the Gwanda Community Share Ownership

Trust and a payment of US$1.8 million which was made to the

National Indigenisation Economic Empowerment Fund ("NIEEF") in

anticipation of an advance dividend arrangement against their right

to receive dividends declared by Blanket on their proposed

shareholding in Blanket. Both the Community donation and the

payment to NIEEF were made in terms of the implementation of

indigenisation at Blanket Mine.

Nama Base Metals Project, Zambia

A News Release issued on August 9, 2012 sets out a summary of

the drilling programme that has been completed which confirms the

existence of the mineralised zone that was identified in 2011 and

describes the further drilling work which has already

commenced.

Indigenisation

Caledonia and Blanket have made considerable progress in

implementing the Memorandum of Understanding ("MoU") which was

signed with the Government of Zimbabwe in February 2012 pursuant to

which Indigenous Zimbabweans will acquire an effective 51%

ownership of the Blanket Mine for a paid transactional value of

US$30.09 million. The various transaction documents have been

signed and Blanket has now received its Certificate of Compliance

from the Government of Zimbabwe. Completion of the agreements is

subject to a pending condition precedent being the approval of the

Reserve Bank of Zimbabwe for the transactions contemplated in the

MoU, underlying agreements and related transactions to give effect

to the Indigenisation programme.

Commenting on Caledonia's performance, Stefan Hayden, President

and CEO, said: "The second quarter of 2012 showed a substantial

improvement in gold production at the Blanket Mine in Zimbabwe.

Gold production in the quarter was 11,560 ounces - 26% higher than

the preceding quarter and 41% higher than the second quarter of

2011. Increased gold production, further improvements in gold

recoveries and continued close attention to costs contributed to a

reduction in average operating costs from US$648 per ounce of gold

produced in the preceding quarter to US$547 per ounce of gold

produced. Higher production and lower costs contributed to the

increase in gross profits. Gross profit for the Quarter was

$10,067,000 compared to $8,996,000 in the preceding quarter,

notwithstanding a 5% fall in the average realised price per ounce

of gold sold.

The strong operating performance is a testament to the hard work

of the management and employees at Blanket and shows the benefits

of Caledonia's recent investments in the Blanket Mine.

Caledonia and Blanket have made good progress on implementing

indigenisation at Blanket Mine. All of the transaction documents

have been signed; we await only the final approval from the Reserve

Bank of Zimbabwe so that all of the transactions can become

unconditional. Once indigenisation has been fully implemented,

Blanket, as a profitable and cash-generative gold producer, will be

well-positioned to take advantage of opportunities that exist for

further growth.

Work at the Nama base metals project in Zambia has continued and

our ongoing drilling programme has identified a substantial new

copper-bearing mineralised zone. Further work has already commenced

to identify the scale of this body. Caledonia has sufficient cash

resources on hand to continue this work as quickly as

possible."

Caution Regarding Forward Looking Statements:

Information included in this release constitutes forward-looking

statements. There can be no assurance that future exploration will

identify mineralisation that will prove to be economic, that

anticipated metallurgical recoveries will be achieved, that future

evaluation work will confirm the viability of deposits that may be

identified or that required regulatory approvals will be

obtained.

Caledonia management will host a conference call starting at

10.00 (EDT), 15.00 (GMT+1) on August 15, 2012. Please dial-in 10

minutes beforehand and quote Caledonia as the conference call

password.

Canadian Toll-free Number*: + 1 800 608 0547

USA Toll-free Number*:+ 1 866 966 5335

UK Toll-free Number*:+44 (0)808 109 0700

International Access Number: +44 (0)20 3003 2666

*If you are calling from a mobile phone your provider may charge

you when connected to the toll-free numbers.

Further information regarding Caledonia's exploration activities

and operations along with its latest financials and Management

Discussion and Analysis may be found at www.caledoniamining.com

Caledonia Mining Corporation Canaccord Genuity Limited

Mark Learmonth John Prior / Sebastian Jones

Tel: + 27 11 447 2499 Tel: + 44 20 7523 8350

marklearmonth@caledoniamining.com

Newgate Threadneedle CHF Investor Relations

Beth Harris / Josh Royston Stephanie Fitzgerald

Tel: +44 20 7653 9850 Tel : +1 416 868 1079 x 222

stephanie@chfir.com

Condensed Consolidated Statement of Comprehensive Income (unaudited)

(In thousands of Canadian dollars except per share amounts)

For the 3 months For the 6 months

ended June 30 ended June 30

2012 2011 2012 2011

$ $ $ $

Restated Restated(1)

(1)

Revenue 18,612 11,990 36,115 23,216

Royalty (1,303) (593) (2,530) (1,048)

Production costs (6,318) (5,171) (12,762) (10,121)

Amortization (924) (633) (1,760) (1,206)

-------- --------- --------- ------------

Gross profit 10,067 5,593 19,063 10,841

Administrative expenses (1,174) (723) (1,974) (1,457)

Share-based payment - - (1,102)

Donation to indigenous community (1,006) - (1,006) -

-------- --------- --------- ------------

Foreign exchange (loss)/gain. 379 - 361 -

-------- --------- --------- ------------

Results from operating activities 8,266 4,870 16,444 8,282

Finance expense (35) (24) (81) (179)

-------- --------- --------- ------------

Profit before income tax 8,231 4,846 16,363 8,103

Income tax expense (2,734) (1,972) (3,755) (3,334)

-------- --------- --------- ------------

Profit for the period 5,497 2,874 12,608 4,769

Profit/(loss) on foreign currency

translation 619 (361) (196) (1,075)

-------- --------- --------- ------------

Total comprehensive income

for the period 6,116 2,513 12,412 3,694

-------- --------- --------- ------------

Earnings per share (cents)

Basic 1.1 0.57 2.5 0.95

Diluted 1.1 0.56 2.5 0.93

Weighted average number of

common shares outstanding (thousand)

Basic 505,774 500,313 503,147 500,241

Diluted 509,427 513,696 506,800 511,712

--------------------------------------- -------- --------- --------- ------------

Note 1: The 2011 comparatives have been re-stated by

re-allocating withholding taxes from Administrative Expenses to

Income Tax expense.

Condensed Consolidated Statement of Cash Flows (unaudited)

(In thousands of Canadian dollars)

For the 6 months ended

June 30

2012 2011

$ $

Cash flows from operating activities

Profit for the period 12,608 4,769

Adjustments for:

Adjustments to reconcile net cash

from operations 6,196 5,802

Changes in non-cash working capital (955) (512)

Indigenisation donation (1,006) -

Advance paid (1,845) -

Tax paid (3,722) (2,534)

Interest paid (81) (179)

------------ -----------

Net cash from operating activities 11,195 7,346

Cash flows from investing activities

Property, plant and equipment additions (2,779) (5,171)

Cash flows from financing activities

Bank overdraft increase/(decrease) (293) 1,675

Proceeds from shares issued 514 38

------------ -----------

Net cash from (used in) financing

activities (221) 1,713

Net increase in cash and cash equivalents 8,637 3,888

Cash and cash equivalents at beginning

of period 9,686 1,145

Cash and cash equivalents at end

of period 18,323 5,033

-------------------------------------------- ------------ -----------

Condensed Consolidated statements of Financial Position (unaudited)

(In thousands of Canadian As at June 30, December 31,

dollars)

2012 2011

$ $

Total non-current assets 35,483 34,248

Inventories 4,670 4,482

Prepayments 276 334

Trade and other receivables 4,586 3,652

Advance paid 1,845 -

--------------- --------------

Cash and cash equivalents 18,323 9,686

--------------- --------------

Total current assets 29,700 18,154

--------------- --------------

Total assets 65,183 52,402

--------------- --------------

Total non-current liabilities 7,863 7,822

Trade and other payables 4,242 3,841

Income taxes payable - 295

Bank overdraft 138 430

--------------- --------------

Total liabilities 12,243 12,388

Capital and reserves 52,940 40,014

--------------- --------------

Total equity and liabilities 65,183 52,402

------------------------------------------- --------------- --------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UOSWRUNAWAAR

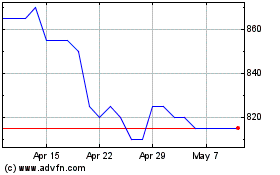

Caledonia Mining (LSE:CMCL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Caledonia Mining (LSE:CMCL)

Historical Stock Chart

From Mar 2024 to Mar 2025