TIDMCOM

RNS Number : 9811B

Comptoir Group PLC

14 October 2020

14 October 2020

Comptoir Group Plc

("Comptoir", the "Group" or the "Company")

Interim Results

Comptoir Group Plc (AIM: COM), the owner and/or operator of

Lebanese and Eastern Mediterranean restaurants, announce its

results for the six months ended 30 June 2020.

Highlights:

-- Group revenue of GBP6.1m down by 61.4% (H1 2019: GBP 15.8m)

-- Gross profit of GBP4.5m down by 60.9% (H1 2019: GBP 11.5 m).

-- Adjusted EBITDA* before highlighted items of GBP0.45m down by 78.3% (H1 2019: GBP2.08m).

-- IFRS loss after tax of GBP4.97m (H1 2019: GBP0.6m loss).

-- Net cash and cash equivalents** at the period end of GBP5.0m

(H1 2019: GBP3.4m; 31 December 2019: GBP5.1m).

-- The basic loss per share for the period was 4.05 pence (H1

2019: basic loss per share 0.49 pence).

-- Currently own and operate 24 restaurants, with a further 4 franchise restaurants.

Note that these results are impacted by COVID-19 related

closures affecting all restaurants in the Group from 19th March

2020.

*Adjusted EBITDA was calculated from the profit/(loss) before

taxation adding back interest, depreciation, share-based payments

and non-recurring costs (note 12). The Group has applied IFRS 16

Leases that results in the restatement of the previous financial

statements (note 2).

**Net cash after deferral of COVID-19 direct related payments

and provisions amounting to GBP3.8m, the 'normalised' cash position

would be GBP1.2m.

Richard Kleiner, Non-Executive Chairman, said: "There is no

hiding from the fact that we are facing unprecedented times across

UK hospitality, and with that, market conditions will inevitably

continue to be challenging for our business. However, I am greatly

encouraged by the strength of the Comptoir brand with its excellent

quality, healthy food served in the safest possible environment,

whilst retaining the genuine feel of family and friendly

hospitality that forms the very heart and soul of our offering. Of

course, none of this would be remotely possible without the truly

immense dedication from every one of our team members who work

tirelessly, day in day out, to make all this happen. I am confident

that we will emerge all the stronger out of this crisis, working in

collaboration with all of our partners, as consumer confidence

lifts and normality once again resumes."

For further information:

Comptoir Group plc Tel: +44 (0)20 7486 1111

Chaker Hanna, Chief Executive

Officer

Canaccord Genuity Limited (NOMAD Tel: +44 (0)20 7523 8000

and Broker)

Bobbie Hilliam

Georgina McCooke

Chief executive's review

COVID-19 Update

Trading in the early weeks of 2020 had been in line with

management expectations and then the impact from COVID-19 dealt its

devastating blow with initial Government guidance for people to

avoid visiting bars and restaurants in early March, followed by the

enforced complete national lockdown including the closure of all UK

hospitality.

As a direct result of these lock down measures all the

restaurants within the Group were fully closed for trading on 19

March 2020. The Company had no choice but to enter an immediate

self-protection and cash preservation mode to try to minimise the

unprecedented detrimental impact that this would inevitably have on

the business.

Whilst the number one priority for the Group has always been,

and will certainly always continue to be, ensuring the safety of

all of our employees and guests, t he Board's focus was also to

take all appropriate measures to reduce the financial impact on the

Group, controlling our two most significant costs; labour and rent.

This was to help ensure the Company would do all it could to

survive the impact of the pandemic.

Labour costs

In the immediate aftermath of the closures, and following

announcement of the Government's furlough scheme to support

employees, the Group immediately placed all its employees, barring

a very small number of the central support team, into furlough. At

the same time a significant reduction in directors' remuneration

packages, including three directors receiving no remuneration at

all for a period of six months, ensured that operating costs were

reduced to the minimum to extend our survival for as long as

possible.

It is with deep regret and heavy heart that I report a number of

unavoidable casualties as a direct result of this pandemic, with a

reduction in the overall team by approximately 50% across our

restaurants and Head Office. I sincerely thank them all for being

an integral part of the Comptoir family and wish them all the very

best for their future journeys.

Landlords

The Group immediately entered into negotiations with all

landlords to agree on a sensible way forward which would help

ensure our survival and protect their investments in the long term.

I am pleased to report many of our landlords have been fully

engaging with us in understanding the difficulties that we are all

facing and we have come to mutually agreed positions involving rent

waivers, deferments and deductions from rent deposits and more

importantly turnover rents instead of base rents going forward. I

would like to sincerely thank all the landlords who have engaged

and worked with us so far.

Unfortunately, there are a number of landlords who have not been

as cooperative and we are still in discussions with them as this is

vital for our survival. The rent level post COVID-19 should reflect

the current trading conditions and take into consideration the

uncertainty of trading given future localised, and the potential

for national, Government imposed restrictions, as we need more

certainty on our outgoings at least until the end of 2021.

We took the decision to suspend all but essential capital

expenditure (unless health and safety or other legal obligations

required this) and this includes the postponement of the planned

new site opening. We are now extending this prudent approach to the

postponement of new site openings originally planned for 2021 as a

further precaution to help preserve the financial position of the

Company.

We do appreciate the Government support provided during this

pandemic; namely the business rates relief, the more recent

reduction in VAT to 5% and the August 'Eat Out To Help Out Scheme'.

Although the impact from the latter scheme was limited in the

majority of our restaurants, as they are London based and the

footfall was not present to drive material benefit.

The Board also took the decision to apply for the G

overnment-backed Coronavirus Business Interruption Loan Scheme

("CBILS") and has drawn down on this loan. This additional

borrowing will help protect the cash position particularly with the

requirement to pay the additional liabilities due to landlords,

HMRC and other creditors as a result of deferred payment plans put

in place during this pandemic period and also to give us headroom

for survival during the anticipated low revenue expected for the

second half of 2020 and continuing at least until the end of 2021.

Bank net cash position at the half year of GBP5.0m, however, this

presents a healthier position than usual with the deferral of

COVID-19 direct related payments and provisions amounting to

GBP3.8m, the 'normalised' cash position would be GBP1.2m.

I would like to take this opportunity to thank all of our

stakeholders who in these extraordinary times have worked

collaboratively with us to ensure the ongoing viability of our

business. None more so than our truly fantastic teams, both in the

restaurants and in central supporting roles. I thank you personally

from the very bottom of my heart for your continued patience and

exceptional commitment to our business. The underlying Comptoir

family ethos has never been so important than in times of

unprecedented crisis.

Revenue and Operating Profit

The business traded with all restaurants fully open up until 19

March when, f ollowing guidance by the UK Government, the Board

took the decision to close all restaurants within the Group. This

was closely followed by the Government implementation of complete

lockdown measures, including enforced closure of all restaurants

and leisure sites across the UK.

As a result, revenue for the period was down 61.4% on last year

to GBP6.1m (H1 2019: GBP15.8m). In the period leading up to

closure, revenue had been in line with management expectations.

The Board carried out a full impairment review at the half year

and as a result, impairment of GBP2.6m has been charged, based on

judgement of future cash flow generation from each restaurant. The

Board will revisit these assumptions at the year end and adjust the

impairment provision according to the forecast at that time.

This impairment charge contributed towards the reported IFRS

loss after tax of GBP4.97m (H1 2019: GBP0.6m loss).

The Group has also taken account of the amendment to IFRS16

COVID-19 related rent concessions. Where the rent concession is a

direct consequence of COVID-19 and the reduction does not involve

substantive changes to the lease then the concessions are able to

be credited to the profit and loss. This has resulted in a one-off

credit of GBP302k in the period.

We envisage exiting a small number of leases over the next 12

months, as we continue to discuss with our landlords and assess

trading conditions, we will make these final decisions at the

appropriate time and only if in the best interest of the Group.

The Board does not recommend the payment of any dividend at this

time as it is anticipated that all available funds will be required

to ensure working capital requirements are met over the foreseeable

future.

Current trading and outlook

The Group began a phased re-opening of its restaurants for full

dining, take away and delivery services from 4th July 2020. As at 1

October we have re-opened 19 of our own operated restaurants

leaving 5 still closed, pending the outcome of ongoing negotiations

with the landlords. Our franchise partners HMS Host have re-opened

three out of the four sites they operate leaving just Dubai Airport

still currently closed. The two franchise restaurants operated by

The Restaurant Group ("TRG") in Heathrow and Gatwick will not

re-open under the TRG franchise agreement, however, we are in early

discussions with airport authorities for the possibility of

reopening them as company owned, or with another franchise partner,

if and when the passenger numbers return to normality in the

future.

Trading in the early stages of re-opening has inevitably been

very challenging with the focus on the health and safety of our

restaurant teams and guests being of ever more increasing paramount

importance. Focus has continued on protecting the cash position,

particularly bearing in mind the large majority of our restaurants

are London based which are still very quiet in terms of footfall,

driven by very low number of tourists, offices still unoccupied and

theatres still closed. Also the need to service the increased

deferred liabilities of the business has placed even more pressure

on the available cash position. With the huge reduction in revenue,

the focus on the control of operational costs and the tightest

possible management of our cash is now absolutely key and continues

to be at the forefront of minds as we navigate through these

unprecedented times for us and the entire UK hospitality.

Cost saving measures introduced include redeployment of field

based Operational Support Managers into the restaurants and reduced

salaries across the central support and executive teams plus all of

our salaried site management teams.

The focus on the health and safety of our team members and

guests has been further enhanced by the implementation of a new

Comptoir app providing our guests with the option to order and pay

safely at the table. Alongside revised rota management protocols

and the introduction of safeguarding equipment and other related

measures, we have sought to optimise protection from the COVID-19

virus.

The introduction of the recent 10pm curfew across hospitality

has placed further pressure on our restaurants. The Company are

mindful of the increasing imposition of Government enforced

localised lock downs and the potential for future wider

restrictions and even national lock downs.

In August this year we announced that Mark Carrick had notified

the Board of his intention to resign from his role as Chief

Financial Officer and will be leaving the business on 10(th)

November 2020. I would like to take the opportunity to thank Mark

for all his commitment and contribution to driving change and

proactive challenge to the business. I am now pleased to advise

that we have sourced a replacement for Mark; Michael Toon joined

the Group as Finance Director on 1 October 2020. Michael brings

with him a wealth of hospitality experience from senior finance

roles with the Casual Dining Group and most recently as Finance

Director of Chopstix.

Chaker Hanna

Chief Executive

13 October 2020

Consolidated statement of comprehensive income

For the half-year ended 30 June 2020

Notes Half-year Half-year Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

(Restated)

GBP GBP GBP

Revenue 6,090,758 15,773,983 33,403,402

Cost of sales (1,597,547) (4,257,068) (8,547,180)

Gross profit 4,493,211 11,516,915 24,856,222

Distribution expenses (1,785,442) (4,211,604) (8,605,186)

Administrative expenses (4,604,293) (7,511,374) (16,566,053)

Other income - 264,680 1,020,090

Rent concessions 302,413 - -

Impairment costs 8 (2,572,443) (54,163) (129,001)

Payroll provision 3 (353,012) - -

Operating (loss)/profit 3 (4,519,566) 4,454 576,072

Finance costs (482,589) (552,139) (1,096,462)

Loss before tax (5,002,155) (547,685) (520,390)

Taxation charge 30,695 (55,038) (146,573)

Loss for the year (4,971,460) (602,723) (666,963)

Other comprehensive income - - -

Total comprehensive loss for

the year (4,971,460) (602,723) (666,963)

---------------------------------- ------ ----------------------- ----------------------- -----------------------

Basic loss per share (pence) 6 (4.05) (0.49) (0.54)

Diluted loss per share (pence) 6 (4.05) (0.49) (0.54)

---------------------------------- ------ ----------------------- ----------------------- -----------------------

Adjusted EBITDA:

Loss before tax - as above (5,002,155) (547,685) (520,390)

Add back:

Depreciation 8 2,011,000 1,993,768 4,036,956

Finance costs 482,589 552,139 1,096,462

Impairment of assets 8 2,572,443 54,163 129,001

EBITDA 63,877 2,052,385 4,742,029

Share-based payments expense 3 26,394 19,441 53,963

Restaurant opening costs 3 7,032 8,370 18,075

Payroll provision 3 353,012 - -

Loss on disposal of fixed assets - - 298,022

Abandoned project costs - - 156,849

Adjusted EBITDA 450,315 2,080,196 5,268,938

---------------------------------- ------ ----------------------- -----------------------

All the above results are derived from continuing

operations.

Consolidated balance sheet

At 30 June 2020

Notes 30 June 2020 30 June 2019 31 December

2019

(Restated)

GBP GBP GBP

Assets

Non-current assets

Intangible assets 7 55,267 87,675 87,675

Property, plant and equipment 8 9,688,797 11,674,631 11,287,115

Right-of-use assets 8 19,558,261 25,378,583 23,951,079

Deferred tax asset 262,137 130,254 139,588

----------------------------------------------------------- ----------------------------------- ------------------------------------ ----------------------------------- -------------------------------------

29,564,462 37,271,143 35,465,457

Current asset

Inventories 494,878 633,335 594,409

Trade and other receivables 1,388,244 2,855,194 2,202,974

Cash and cash equivalents 5,009,864 3,369,783 5,076,610

----------------------------------------------------------- ----------------------------------- ------------------------------------ ----------------------------------- -------------------------------------

6,892,986 6,858,312 7,873,993

Total assets 36,457,448 44,129,455 43,339,450

----------------------------------------------------------- ----------------------------------- ------------------------------------ ----------------------------------- -------------------------------------

Liabilities

Current liabilities

Borrowings (181,490) (374,820) (261,611)

Trade and other payables (5,439,441) (4,703,111) (5,015,604)

Lease liabilities (2,113,151) (2,415,531) (2,481,471)

Current tax liabilities (183,518) (158,023) (184,125)

----------------------------------------------------------- ----------------------------------- ------------------------------------ ----------------------------------- -------------------------------------

(7,917,600) (7,651,485) (7,942,811)

Non-current liabilities

Borrowings (15,817) (140,727) (55,735)

Provisions for liabilities (808,452) (162,221) (438,570)

Lease liabilities (21,837,360) (25,394,660) (24,170,903)

Deferred tax liability (262,137) (189,496) (170,283)

----------------------------------------------------------- ----------------------------------- ------------------------------------ ----------------------------------- -------------------------------------

(22,923,766) (25,887,104) (24,835,491)

Total liabilities (30,841,366) (33,538,589) (32,778,302)

----------------------------------------------------------- ----------------------------------- ------------------------------------ ----------------------------------- -------------------------------------

Net assets 5,616,082 10,590,866 10,561,148

----------------------------------------------------------- ----------------------------------- ------------------------------------ ----------------------------------- -------------------------------------

Equity

Share capital 10 1,226,667 1,226,667 1,226,667

Share premium 10,050,313 10,050,313 10,050,313

Other reserves 109,102 48,186 82,708

Retained losses (5,770,000) (734,300) (798,540)

----------------------------------------------------------- ----------------------------------- ------------------------------------ ----------------------------------- -------------------------------------

Total equity - attributable

to equity shareholders

of the company 5,616,082 10,590,866 10,561,148

----------------------------------------------------------- ----------------------------------- ------------------------------------ ----------------------------------- -------------------------------------

Consolidated statement of changes in equity

For the half-year ended 30 June 2020

Notes Share Share Other Retained Total

capital premium reserves losses equity

GBP GBP GBP GBP GBP

At 1 January 2020 1,226,667 10,050,313 82,708 (798,540) 10,561,148

Total

comprehensive

loss

Loss for the period - - - (4,971,460) (4,971,460)

Transactions with

owners

Share-based payments - - 26,394 - 26,394

At 30 June 2020 1,226,667 10,050,313 109,102 (5,770,000) 5,616,082

---------------------------- ------------------ -------------------- ---------- -------------------- ------------

At 1 January 2019 1,226,667 10,050,313 28,745 635,252 11,940,977

Impact of restatement

of prior period error - - - (766,829) (766,829)

---------------------------- ------------------ -------------------- ---------- -------------------- ------------

At 1 January 2019

(Restated) 1,226,667 10,050,313 28,745 (131,577) 11,174,148

Total

comprehensive

loss

Loss for the period - - - (602,723) (602,723)

Transactions with

owners

Share-based payments - - 19,441 - 19,441

At 30 June 2019 1,226,667 10,050,313 48,186 (734,300) 10,590,866

---------------------------- ------------------ -------------------- ---------- -------------------- ------------

At 1 January 2019 1,226,667 10,050,313 28,745 (131,577) 11,174,148

Total

comprehensive

loss

Loss for the year - - - (666,963) (666,963)

Transactions with

owners

Share-based payments - - 53,963 - 53,963

At 31 December 2019 1,226,667 10,050,313 82,708 (798,540) 10,561,148

---------------------------- ------------------ -------------------- ---------- -------------------- ------------

Consolidated statement of cash flows

For the half-year ended 30 June 2020

Notes Half-year Half-year Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

(Restated)

GBP GBP GBP

Operating activities

Cash inflow from

operations 11 1,613,637 1,351,549 5,654,971

Interest paid (4,723) (13,048) (21,730)

Tax paid (606) - (93,981)

Net cash from

operating

activities 1,608,308 1,338,501 5,539,260

--------------------- --------------- ----------------------------- ------------------------------- --------------------------

Investing activities

Purchase of

property, plant

& equipment 8 (97,494) (685,470) (1,287,749)

Net cash used in

investing

activities (97,494) (685,470) (1,287,749)

--------------------- --------------- ----------------------------- ------------------------------- --------------------------

Financing activities

Payment of lease

liabilities (1,457,522) (1,680,332) (3,373,788)

Bank loan repayments (120,038) (227,585) (425,786)

Net cash used in

financing

activities (1,577,560) (1,907,917) (3,799,574)

--------------------- --------------- ----------------------------- ------------------------------- --------------------------

(Decrease)/Increase

in cash

and cash

equivalents (66,746) (1,254,886) 451,937

Cash and cash

equivalents

at beginning of

year 5,076,610 4,624,673 4,624,673

Cash and cash

equivalents

at end of year 5,009,864 3,369,785 5,076,610

--------------------- --------------- ----------------------------- ------------------------------- --------------------------

Notes to the financial information

For the half-year ended 30 June 2020

1. Basis of preparation

The consolidated financial information for the half-year ended

30 June 2020, has been prepared in accordance with the accounting

policies the Group applied in the Company's latest annual audited

financial statements and are expected to be applied in the annual

financial statements for the year ending 31 December 2020. These

accounting policies are based on the EU-adopted International

Financial Reporting Standards ("IFRS") and International Financial

Reporting Interpretation Committee ("IFRIC") interpretations. The

consolidated financial information for the half-year ended 30 June

2020 has been prepared in accordance with IAS 34: 'Interim

Financial Reporting', as adopted by the EU, and under the

historical cost convention.

The financial information relating to the half-year ended 30

June 2020 is unaudited and does not constitute statutory financial

statements as defined in section 434 of the Companies Act 2006. It

has, however, been reviewed by the Company's auditors and their

report is set out at the end of this document. The comparative

figures for the year ended 31 December 2019 have been extracted

from the consolidated financial statements, on which the auditors

gave an unqualified audit opinion and did not include a statement

under section 498 (2) or (3) of the Companies Act 2006. The annual

report and accounts for the year ended 31 December 2019 has been

filed with the Registrar of Companies.

The Group's financial risk management objectives and policies

are consistent with those disclosed in the 2019 annual report and

accounts.

The half-yearly report was approved by the board of directors on

13 October 2020. The half-yearly report is available on the

Comptoir Libanais website, www.comptoirlibanais.com , and at

Comptoir Group's registered office, Unit 2, Plantain Place, Crosby

Row, London Bridge, SE1 1YN.

Going concern

Uncertainty due to the recent COVID-19 outbreak has been

considered as part of the Group's adoption of the going concern

basis.

All appropriate measures have been put in place to reduce the

impact on the Group, including cost reduction and postponement of

all new site openings and other non-essential capital expenditure

projects. The Board's latest forecasts take into consideration the

three months closure up to 4 July 2020 followed by the subsequent

phased re-opening of 19 sites as at 1 October 2020. Revenue

forecasts have been significantly reduced for the following 18

months. The Board has factored in the agreements which have been

reached with landlords, however, there are still several ongoing

negotiations in this area.

The Board has also considered the severe but possible downside

scenario of another complete closure or further delays in

re-opening the remaining restaurants. This continues to be under

review given current market conditions associated with COVID-19.

The Group currently has sufficient cash reserves and the Board

believes that the business has the ability to remain trading for a

period of at least 12 months from the date of signing of this

half-yearly report.

The events arising as a result of the COVID-19 outbreak has

meant that there are various inherent material uncertainties. Based

on these indications the directors believe that it remains

appropriate to prepare the half-yearly report on a going concern

basis. However, these circumstances represent a material

uncertainty that may cast significant doubt on the Group and

Company's ability to continue as a going concern and, therefore, to

continue realising their assets and discharging their liabilities

in the normal course of business for the foreseeable future, a

period of not less than 12 months from the date of approving this

half-yearly report.

2. Changes in accounting policies

The accounting policies adopted in the preparation of the

consolidated financial information for the half-year ended 30 June

2020 are consistent with those followed in the preparation of the

Group's annual consolidated financial statements for the year ended

31 December 2019, except for the amendments disclosed below:

-- Amendments to References to the Conceptual Framework in IFRS Standards.

-- Amendments to IAS 1 and IAS 8: Definition of Material

-- Amendments to IFRS 16 COVID-19 Related Rent Concessions

Their adoption did not have a material effect on the accounts

except for the Amendments to IFRS 16 COVID-19 Related Rent

Concessions.

Amendments to IFRS 16 COVID-19 Related Rent Concessions

The practical expedient was applied whereby the lessee will

account for any changes to their lease payments as if the change

were not a lease modification.

In order to apply the practical expedient all of the following

criteria was met:

-- The revised consideration for the lease is substantially the

same as, or less than the original consideration immediately

preceding the change. Rent concessions which increase the total

consideration, but only for the time value of money, will be able

to apply the practical expedient;

-- Any reduction in payments only affects payments originally

due on or before 30 June 2021. This would include a situation where

there are reduced payments before 30 June 2021 followed by

increased payments that extend beyond 30 June 2021; and

-- There are no substantive changes to other terms and

conditions of the lease. This assessment would consider both

qualitative and quantitative factors. It has been specifically

noted by the IASB that a three-month rent holiday before 30 June

2021 followed by three additional months of substantially

equivalent payments at the end of the lease would not constitute a

substantive change to the lease.

The practical expedient was applied consistently to all lease

contracts with similar characteristics and in similar

circumstances. This resulted in GBP302,413 being recognised as a

credit to income in the profit and loss for the reporting period

reflecting the changes in lease payments arising from the

application of this exemption.

Critical estimates, judgements and errors

Restatement of prior period error

It was identified in the half-yearly report for 30 June 2019

that two leases had been omitted in error during the application of

the IFRS 16 transition adjustments. The error resulted in a

material understatement of the right of use assets and lease

liabilities presented in the half-yearly report. These two leases

were subsequently included in 31 December 2019 financial statements

and therefore did not require a restatement for that period.

The error has been corrected by restating each of the affected

financial statement line items for the period as follows:

Statement of Comprehensive Income

(Extract)

30 June (Increase)/ 30 June

2019 Decrease 2019

(Restated)

GBP GBP GBP

Administrative expenses (7,596,184) 30,647 (7,565,537)

Operating profit (26,193) 30,647 4,454

Finance costs (501,566) (50,573) (552,139)

Loss before tax (527,759) (19,926) (547,685)

Statement of Financial Position (Extract)

30 June Increase/ 30 June

2019 (Decrease) 2019

(Restated)

GBP GBP GBP

Right-of-use assets 22,889,144 2,489,439 25,378,583

Trade and other receivables 3,546,975 (691,781) 2,855,194

Lease liabilities (25,225,778) (2,584,413) (27,810,191)

Net assets 11,377,621 (786,755) 10,590,866

Equity

Retained losses 52,455 (786,755) (734,300)

------------------------------------------- -------------------- ------------------ ---------------------

Statement of Changes in Equity (Extract)

30 June Increase/ 30 June

2019 (Decrease) 2019

(Restated)

GBP GBP GBP

Retained earnings at 1 January 2019 635,252 (766,829) (131,577)

Loss for the year (582,797) (19,926) (602,723)

Retained earnings at 30 June 2019 52,455 (786,755) (734,300)

Statement of Cashflow (Extract)

30 June Increase/ 30 June

2019 (Decrease) 2019

(Restated)

GBP GBP GBP

Operating activities

Cash inflow from operations 1,740,065 (388,518) 1,351,547

Interest paid (501,566) 488,518 (13,048)

Net cash from operating activities 1,238,499 100,000 1,338,499

------------------------------------------- -------------------- ------------------ ---------------------

Financing activities

Payment of lease liabilities (1,580,332) (100,000) (1,680,332)

Net cash used in financing activities (1,580,332) (100,000) (1,680,332)

------------------------------------------- -------------------- ------------------ ---------------------

Basic and diluted earnings per share for the prior year have

also been restated. The amount of the correction for basic and

diluted earnings per share was a decrease of GBP0.01 and GBP0.02

per share respectively.

Deferred tax assets

Historically, deferred tax assets had been recognised in respect

of the total unutilised tax losses within the Group. A condition of

recognising this amount depended on the extent that it was probable

that future taxable profits will be available.

Given the uncertainty of the current trading outlook, management

have decided to only recognise a deferred tax asset amount of

GBP262,137, being equal to the deferred tax liability amount and

therefore have an unprovided deferred tax asset amount of

GBP354,792.

3. Group operating loss

Half-year Half-year Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

(Restated)

GBP GBP GBP

This is stated after

(crediting)/charging:

Operating lease

charges 101,634 441,674 787,222

Rent concessions (302,413) - -

Lease term

modifications 117,800 - -

Share-based payments

expense

(see note 5) 26,394 19,441 53,963

Restaurant opening

costs 7,032 8,370 18,075

Depreciation of

property,

plant and equipment

(see note

8) 2,011,000 1,993,768 4,036,957

Impairment of assets

(see

note 7 & 8) 2,572,443 54,163 129,001

Payroll provision 353,012 - -

Loss on disposal of

fixed

assets - - 298,022

Development of the

Grab &

Go concept

subsequently

cancelled - - 74,551

Costs in relation to

unopened

new sites - - 67,211

Reclassification of

legal

fees - - 15,087

Auditors' remuneration - - 51,750

----------------------- ------------------------------- ------------------------------- -------------------------------

Half-year Half-year Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

GBP GBP GBP

Pre-opening costs 7,032 3,982 3,982

Post-opening costs - 4,388 14,093

7,032 8,370 18,075

----------------------- ------------------------------- ------------------------------- -------------------------------

The payroll provision relates to a one-off provision as a result

of a review of the current pension scheme in place as part of a

planned transition to Payroll Bureau services.

For the initial trading period following opening of a new restaurant,

the performance of that restaurant will be lower than that achieved

by other, similar, mature restaurants. The difference in this performance,

which is calculated by reference to gross profit margins amongst

other key metrics, is quantified and included within opening costs.

The breakdown of opening costs, between pre-opening costs and post-opening

costs for 3 months is shown above.

4. Operating segments

The Group has only one operating segment: the operation of

restaurants with Lebanese and Middle Eastern offering and one

geographical segment (the United Kingdom). The Group's brands meet

the aggregation criteria set out in paragraph 22 of IFRS 8

"Operating Segments" and as such the Group reports the business as

one reportable segment. None of the Group's customers individually

contribute over 10% of the total revenue.

5. Share options and share-based payment charge

On 4 July 2018, the Group established a Company Share Option

Plan ("CSOP") under which 4,890,000 share options were granted to

key employees. The CSOP scheme includes all subsidiary companies

headed by Comptoir Group PLC. The exercise price of all of the

options is GBP0.1025 and the term to expiration is 3 years from the

date of grant, being 4 July 2018. All of the options have the same

vesting conditions attached to them.

The total share-based payment charge for the period was

GBP26,394 (half-year ended 30 June 2019: GBP19,441 and year ended

31 December 2019: GBP53,963).

6. Loss per share

The Company had 122,666,667 ordinary shares of GBP0.01 each in

issue at 30 June 2020. The basic and diluted loss per share

figures, is based on the weighted average number of shares in issue

during the periods. The basic and diluted loss per share figures

are set out below.

Half-year Half-year Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

(Restated)

GBP GBP GBP

Loss attributable

to shareholders (4,971,460) (602,723) (666,963)

Number Number Number

Weighted average

number of shares

For basic

earnings per

share 122,666,667 122,666,667 122,666,667

Adjustment for

options

outstanding - 597,713 180,385

For diluted

earnings per

share 122,666,667 123,264,380 122,847,052

------------------ -------------------------------- ------------------------------- -------------------------------

Pence per Pence per Pence per

share share share

Loss per share:

Basic (pence)

From loss for the

year (4.05) (0.49) (0.54)

Diluted (pence)

From loss for the

year (4.05) (0.49) (0.54)

The loss per share and diluted loss per share is calculated by

dividing the profit or loss attributable to ordinary shareholders

by the weighted average number of shares and 'in the money' share

options in issue. Share options are classified as 'in the money' if

their exercise price is lower than the average share price for the

period. As required by 'IAS 33: Earnings per share', this

calculation assumes that the proceeds receivable from the exercise

of 'in the money' options would be used to purchase shares in the

open market in order to reduce the number of new shares that would

need to be issued. As the shares were not 'in the money' as at 30

June 2020 and consequently would be antidilutive, no adjustment was

made in respect of the share options outstanding to determine the

diluted number of options.

7. Intangible assets

Intangible fixed assets consist of goodwill from the acquisition

of Agushia Limited. During the period, the Group spent GBPnil on

intangible assets (half-year ended 30 June 2018: GBPnil and year

ended 31 December 2019: GBPnil).

Group Goodwill Total

GBP GBP

Cost

At 1 January 2020 89,961 89,961

Additions - -

-------------------------------- --------------------------------

At 30 June 2020 89,961 89,961

----------------------------------------- -------------------------------- --------------------------------

Accumulated amortisation and impairment

At 1 January 2020 (2,286) (2,286)

Amortised during the year - -

Impairment during the year (32,408) (32,408)

-------------------------------- --------------------------------

At 30 June 2020 (34,694) (34,694)

----------------------------------------- -------------------------------- --------------------------------

Net Book Value as at 30 June 2020 55,267 55,267

----------------------------------------- -------------------------------- --------------------------------

Net Book Value as at 30 June 2019 87,675 87,675

----------------------------------------- -------------------------------- --------------------------------

Net Book Value as at 31 December 2019 87,675 87,675

----------------------------------------- -------------------------------- --------------------------------

Goodwill arising on business combinations is not amortised but

is subject to an impairment test annually which compares the

goodwill's 'value in use' to its carrying value. During the year,

100% of the goodwill allocated to Yalla Yalla Winsley, being

GBP32,408 was impaired based on the impairment test. The remaining

goodwill related to Yalla Yalla Soho. No impairment of goodwill was

considered necessary in relation to this site.

8. Property, plant and equipment

Right-of Leasehold Plant Fixture, Motor Total

use Assets Land and and machinery fittings Vehicles

buildings & equipment

GBP GBP GBP GBP GBP GBP

Cost

At 1 January

2020 29,095,737 11,514,602 5,151,883 3,116,519 53,430 48,932,171

Additions - 28,307 58,034 11,153 - 97,494

Disposals (1,537,594) - - - - (1,537,594)

At 30 June

2020 27,558,143 11,542,909 5,209,917 3,127,672 53,430 47,492,071

-------------- ------------------------- ------------------------- ------------------------- ------------------------- ------------------------- -------------------

Accumulated

depreciation

and

impairment

At 1 January

2020 (5,144,658) (4,647,857) (2,613,387) (1,280,703) (7,373) (13,693,978)

Depreciation

during

the year (1,336,027) (385,259) (194,613) (94,333) (768) (2,011,000)

Impairment

during

the year (1,519,197) (473,340) (365,161) (182,337) - (2,540,035)

At 30 June

2020 (7,999,882) (5,506,456) (3,173,161) (1,557,373) (8,141) (18,245,013)

-------------- ------------------------- ------------------------- ------------------------- ------------------------- ------------------------- -------------------

Net book

value

As at 30 June

2020 19,558,261 6,036,453 2,036,756 1,570,299 45,289 29,247,058

As at 30 June

2019 25,378,583 7,051,181 2,722,387 1,892,340 8,723 37,053,214

As at 31

December

2019 23,951,079 6,866,745 2,538,496 1,835,817 46,057 35,238,194

-------------- ------------------------- ------------------------- ------------------------- ------------------------- ------------------------- -------------------

At each reporting date the Group considers any indication of

impairment to the carrying value of its property, plant and

equipment. The assessment is based on expected future cash flows

and Value-in-Use calculations are performed annually and at each

reporting date and is carried out on each restaurant as these are

separate 'cash generating units' (CGU). Value-in-Use was calculated

as the net present value of the projected risk-adjusted post-tax

cash flows plus a terminal value of the CGU. A pre-tax discount

rate was applied to calculate the net present value of pre-tax cash

flows. The discount rate was calculated using a market participant

weighted average cost of capital. A single rate has been used for

all sites as management believe the risks to be the same for all

sites.

The outbreak of COVID-19 and related global responses have

caused material disruptions to businesses around the world, leading

to an economic slowdown. Global equity markets have experienced

significant volatility and weakness. As at the date of this

half-yearly report, the fair value of the Group's assets and

investments has declined as a result of the virus outbreak and the

resulting temporary closure of the Group's restaurants. These

factors have been incorporated into our review.

The recoverable amount of each CGU has been calculated with

reference to its Value-in-Use. The key assumptions of this

calculation are shown below:

Sales and costs growth 3%

Discount rate 4.3%

Number of years projected over life of lease

The projected sales growth was based on the Group's latest

forecasts at the time of review. The key assumptions in the

cashflow pertain to revenue growth. Management have determined that

growth based on industry average growth rates and actuals achieved

historically are the best indication of growth going forward. The

Directors are confident that the Group is largely immune from the

effects of Brexit and forecasts have considered the impact of

COVID-19. Management has also performed sensitivity analysis on all

inputs to the model and noted no material sensitivities in the

model.

Based on the review, an impairment charge of GBP2,572,443

(half-year ended 30 June 2019: GBP54,163 and year ended 31 December

2019: GBP129,001) was recorded for the period.

9. Dividends

No dividends were distributable to equity holders during the

half-year ending 30 June 2020 (half-year ended 30 June 2019: GBPnil

and year ended 31 December 2019: GBPnil).

10. Share capital

Authorised, issued Number of 1p shares

and fully paid

Half-year Half-year Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

Brought forward 122,666,667 122,666,667 122,666,667

Issued in the period - - -

At 31 December 122,666,667 122,666,667 122,666,667

---------------------- ------------------------------ ------------------------------ ------------------------------

Nominal value

Half-year Half-year Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

GBP GBP GBP

Brought forward 1,226,667 1,226,667 1,226,667

Issues in the period - - -

At 31 December 1,226,667 1,226,667 1,226,667

---------------------- ------------------------------ ------------------------------ ------------------------------

11. Cash flow from operations

Reconcilliation of (loss)/profit to cash generated from

operations

Half-year Half-year Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

(Restated)

GBP GBP GBP

Operating

(loss)/profit for

the year (4,519,566) 4,454 576,072

Depreciation 2,011,000 1,993,768 4,036,957

Loss on disposal of

fixed

assets - - 299,272

Impairment of assets 2,572,443 54,163 129,001

Share-based payment

charge 26,394 19,441 53,963

Rent concessions (302,413) - -

Lease term 117,800 - -

adjustments

Payroll provision 353,012 - -

Movements in working

capital

Decrease in

inventories 99,532 73,406 112,332

Decrease/(Increase

)in trade

and other

receivables 814,731 (996,746) (344,532)

Increase in payables

and

provisions 440,704 203,063 791,906

Cash from operations 1,613,637 1,351,549 5,654,971

--------------------- -------------------------------- -------------------------------- ---------------------------

12. Adjusted EBITDA

Adjusted EBITDA was calculated from the profit/loss before

taxation adding back interest, depreciation, share-based payments

and non-recurring costs incurred in opening new sites, as

follows:

Half-year Half-year Year ended

ended 30 ended 30 31 December

June 2020 June 2019 2019

(Restated)

GBP GBP GBP

Operating

(loss)/profit (4,519,566) 4,454 576,072

Add back:

Depreciation 2,011,000 1,993,768 4,036,957

Impairment of

assets 2,572,443 54,163 129,001

Share-based

payments 26,394 19,441 53,963

Payroll

provision 353,012 - -

Loss on

disposal of

fixed assets - - 298,022

Abandoned

project costs - - 156,849

EBITDA 443,283 2,071,826 5,250,864

Non-recurring

costs incurred

in opening new

sites 7,032 8,370 18,075

Adjusted EBITDA 450,315 2,080,196 5,268,939

-------------------------------- -------------------------------- --------------------------------

13. Subsequent events

In August the Group drew down on an additional bank loan under

the Government's Coronavirus Business Interruption Loan Scheme

('CBILS'). As at 1 October, 19 of the owner operated restaurants

were open leaving 5 still closed, pending the outcome of ongoing

negotiations with the landlords. HMS Host have reopened three out

of the four sites they operate leaving just Dubai Airport still

currently closed. The two franchise restaurants operated by The

Restaurant Group ("TRG") in Heathrow and Gatwick will not

re-open.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFSFWDESSELS

(END) Dow Jones Newswires

October 14, 2020 02:00 ET (06:00 GMT)

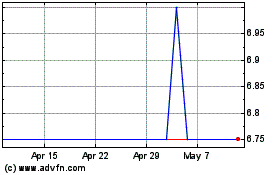

Comptoir (LSE:COM)

Historical Stock Chart

From Mar 2025 to Apr 2025

Comptoir (LSE:COM)

Historical Stock Chart

From Apr 2024 to Apr 2025