TIDMCOM

RNS Number : 2858N

Comptoir Group PLC

22 September 2023

22 September 2023

Comptoir Group plc

("Comptoir", the "Company" or the "Group")

Interim Results

Comptoir Group Plc (AIM: COM), the owner and/or operator of

Lebanese and Middle Eastern restaurants, is pleased to announce its

interim results for the six-month period ended 2 July 2023.

Financial Highlights

-- Group revenue of GBP14.8m, an increase of 2.1% (H1 2022: GBP14.5m)

-- Like for Like sales growth of 6.0% (Vat Adjusted)

-- Gross Profit of GBP11.5m (H1 2022: GBP11.5m)

-- Adjusted EBITDA* before highlighted items of GBP1m, a

decrease of 73.7% (H1 2022 Restated: GBP3.8m)

-- IFRS loss after tax of GBP0.8m (H1 2022: GBP0.9m Profit)

-- Net cash and cash equivalents at the period end of GBP5.7m

((H1 2022: GBP8.2m; 1 January 2023: GBP7.7m)

-- The basic loss per share for the period was 0.64 pence (H1

2022: basic earnings per share 0.77p)

-- Currently own and operate 20 restaurants, with a further 6 franchise restaurants

-- Terms agreed for 2 new sites including a London flagship restaurant, opening in early 2024

*Adjusted EBITDA was calculated from the profit/(loss) before

taxation adding back interest, depreciation, share-based payments,

and non-recurring costs (note 11).

Beatrice Lafon, Non-executive Chair, said: "We are pleased with

our first half results, delivering growth in total like-for-like

sales (VAT adjusted) of 6.0% as we continue the transformation

programme we started at the end of 2022. Total dine-in

like-for-like sales (VAT adjusted) were up 8.1%.

Against this backdrop, t he Group is navigating a challenging

trading environment, with the macroeconomic pressures of the

continuing cost of living crisis, high inflation and the removal of

government support with business rates and VAT resulting in a

decrease in profit. Utilities costs will significantly decline from

Q4 and other inflationary sensitive costs like ingredients and

labour have now started to plateau. The net effect will bring

improved performance towards the end of this year.

Trading continues to be impacted by significant events outside

of our direct control such as the ongoing public transport

industrial action which now enters a second year. We have also had

a relatively poor summer in terms of terrace weather. Both of these

issues have adversely impacted our sites, despite the welcome

relief that a warm start to September and the completion of our

terraces' refurbishment has so far brought to footfall.

Significant progress has been made in the first six months of

the year for those aspects that we can control: new menus have been

implemented across all our brands, particularly in Comptoir

Libanais; the changes are the most expansive seen in several years

and have been well received by customers. We have rebuilt our

restaurants' teams and a new Hospitality Training Programme is

underway in all locations.

Having announced the opening of our first new owned site in over

four years in Ealing later this year, we will continue our growth

plans into 2024 as we are close to securing a new flagship Comptoir

Libanais. We also continue to grow our franchise business first

with our existing partner HMS Host and the opening of the first

franchised Shawa in Abu Dhabi but also with a new additional

partner which will see us open in Milan airport in 2024.

Furthermore, a new digital experience will be offered to our guests

in early 2024, our first web revamp in eight years.

Comptoir Group remains in a strong financial position to take

advantage of future opportunities and to continue to innovate.

Whilst we remain cautious about the immediate future as macro

challenges continue to prevail, we are optimistic about the

longer-term prospects for the business."

Change of Name of Nominated Adviser and Broker

The Company also announces that its Nominated Adviser and Broker

has changed its name to Cavendish Capital Markets Limited following

completion of its own corporate merger.

Enquiries

Comptoir Group plc via Camarco

Beatrice Lafon, Non-Executive Chair

Nick Ayerst, CEO

Michael Toon, FD

Cavendish Capital Market Limited (Nominated Adviser and

Broker)

Simon Hicks 0207 220 0500

Camarco (press enquiries)

Jennifer Renwick comptoir@camarco.co.uk

Letaba Rimell

Notes to Editors

Comptoir Group PLC owns and operates 26 Lebanese restaurants,

six of which are franchised, based predominately in the UK. The

flagship brand of the group, Comptoir Libanais, is a collection of

20 restaurants located across London and nationwide, including

cities such as Manchester, Bath, Birmingham, Oxford and Exeter.

The name Comptoir Libanais means Lebanese Counter and is a place

where guests can eat casually and enjoy Middle Eastern food, served

with warm and friendly hospitality, just like back home.

The Group also operates Shawa, serving traditional shawarmas

through a counter service model in Westfield and Bluewater shopping

centres, Yalla-Yalla with branches near Oxford Circus and in Soho,

and entertainment venue Kenza, located in Devonshire Square,

London.

The group has expanded internationally with its franchise

partners HMSHOST, with restaurants in the Netherlands, Qatar and

Dubai.

Chief Executive's review

I am pleased to report the results for the six-month period

ending 3 July 2023. The performance of the Group's various brands

and restaurants during these first six months has been in line with

management's expectations, with strong top-line trading being

offset by increased costs, stemming in the main from food

inflation, the increase in the national minimum wage and

significant increases in our utility costs.

The underlying trading performance has remained resilient and is

a testament to the hard work of our teams, who have had another

interrupted period of trade due to regular train strikes which have

an impact on a significant number of our sites. To support our

teams, we have continued to invest in our people and our

infrastructure, implementing several strategies to simplify the

business and improve efficiency. These include investment in our

tech stack such as tablets for integrated ordering at tables,

pay-at-table QR codes and improved labour productivity tools. This

has also been allied with substantial investment in team training

following significant brand work for Comptoir Libanais.

During the six-month period, once again, some exceptional

challenges were presented to the business. In comparison to 2022,

there was no government support in respect of business rates and

VAT, whereas in 2022 these were still significantly lower than

where we find ourselves now. At the same time, the National Living

Wage (NLW) increased by 9.7% from GBP9.50 to GBP10.42. As the war

in Ukraine continues into a second year, we are still seeing a

significant impact on utility and food prices, though as noted in

the 2022 results announcement this was anticipated and the pressure

is starting to plateau. Food inflation in the business has reduced

the profit conversion but the overall impact is significantly less

than the headline rate across the industry, thanks mainly to the

excellent work done on our supply chain and logistics, including

the consolidation of a previously fragmented supply chain.

Utilities in these 6 months were the highest in the Group's history

as, like many of our peers, we entered into a short-term contract

in September 2022 for 12 months at a significantly higher rate than

the previous two-year agreement. Even with the government cap

benefit in the first three months of 2023, this cost was hugely

increased compared to the same period in 2022. However, I can

confirm that we have hedged on a three-year flexible contract from

September 2023 at a rate significantly lower than that seen in the

first half of 2023. As ever the business will work to mitigate all

costs as look to deliver excellence to our guests in the most

cost-efficient manner.

Thanks to our strong relationships with our current landlords

and a proactive approach to finding suitable new sites, there is an

opportunity for the Group to add to its site pipeline. We have

exchanged on a new site in Ealing where we will begin trading in

October and have two other sites in advanced discussions. As well

as managed site growth, we continue to expand our footprint with

our franchise partners and expect to open two sites by the end of

2023, one with our existing partner where we will open our

shawarma-based QSR brand Shawa in Abu Dhabi, and a Comptoir

Libanais in Milan airport with our new partner AREAS, one of the

largest operators of food and beverage in global airports. In terms

of the existing estate, we had a significant number of lease

renewals to negotiate, and these have been successfully concluded,

ahead of expectations, which is a testament to our strong

relationship with our current landlords and the power of the brands

within the Group's portfolio.

Financial Performance Half-Year

The total revenue for the Group for the half-year was GBP14.8m

(H1 2022 GBP14.5m) and the adjusted EBITDA profit was GBP1.0m (H1

2022 GBP3.8m). Like-for-like sales were pleasing at 6.0% (VAT

adjusted) with LFL Dine in sales growing by 8.1% (VAT adjusted) but

conversely, in line with the rest of the industry, we have seen

delivery sales decline post the growth seen during the years

disrupted by Covid. Franchise system sales grew 150.5% (+14.9% Like

for Like) in the six-month period with the new sites opening in

2022 performing extremely well. Stansted in particular is

benefiting from the growth in Travel.

The Group controls remained strong, but profit declined due to

the aforementioned impact of VAT and Business Rates returning to

previous levels, as well as the utility, food and wage inflation.

The impact of the VAT movement back to 20% was GBP388k in

comparison to 2022. The IFRS loss after tax was GBP0.78m (H1 2019:

GBP0.9m profit).

During the period we closed one site (Comptoir Leeds). We do not

envisage any further closures across the Group this year.

A summary of the financial performance for the half year is

shown in the table below:

Post IFRS Pre IFRS Post IFRS Pre IFRS Post IFRS Pre IFRS

16 16 16 16 16 16

2 July 2 July Restated Restated Restated Restated

2023 2023 3 July 3 July 1 January 1 January

2022 2022 2023 2023

GBP GBP GBP GBP GBP GBP

Revenue 14,801,949 14,801,949 14,501,725 14,501,725 31,046,546 31,046,546

Adjusted EBITDA:

Profit after

tax (780,460) (545,243) 945,825 737,267 588,304 264,463

Add back:

Finance costs 497,567 67,731 409,860 41,319 1,042,697 94,078

Taxation (496,100) (496,100) 361,081 361,081 314,146 314,146

Depreciation 1,655,805 561,532 1,628,502 540,612 3,252,841 1,124,243

Impairment of

assets - - 336,356 - 78,266 -

EBITDA 876,812 (412,080) 3,681,624 1,680,279 5,276,254 1,796,930

Share-based

payments expense 10,006 10,006 14,050 14,450 15,377 15,377

Loss on disposal

of fixed assets - - - - 8,188 8,188

Exceptional

legal and professional

fees 23,045 23,045 - - 1,002,054 1,002,054

Restaurant opening

costs - - 38,245 38,245 36,745 36,745

Restaurant closing

costs 75,657 75,657 - - 28,628 28,628

Dilapidations 16,493 16,493 17,334 17,334 5,956 5,956

Adjusted EBITDA 1,002,013 (286,879) 3,751,253 1,750,308 6,373,203 2,893,879

We continue to prioritise our team's well-being and the Group

has looked to improve the benefits available to the staff

increasing pay rates, bonus potential as well as mental and

physical health care schemes.

Nicole Goodwin joined as Director of Marketing. Nicole is an

award-winning Marketing Director with over 25 years of experience

across diverse market-leading FMCG & drinks brands and has

already made a substantial contribution as we add to the Group's

expertise and plan for future opportunities.

Current and future outlook

Despite the challenging macro environment, trading and the

overall outperformance of our peers is encouraging. The Group has a

strong base to continue to operate from, and we will look to grow

in H2 and into 2024 and beyond. The Board has every confidence in

the prospects for the remainder of the year and into 2024.

Nick Ayerst

Chief Executive Officer

22 September 2023

Consolidated statement of comprehensive income

For the half-year ended 2 July 2023

Notes Half-year Half-year Period

ended 2 ended 3 ended 1

July 2023 July 2022 January

2023

GBP GBP GBP

Revenue 14,801,949 14,501,725 31,046,546

Cost of sales (3,264,510) (2,994,130) (6,605,074)

Gross profit 11,537,439 11,507,595 24,441,472

Distribution expenses (6,077,722) (5,308,893) (11,431,633)

Administrative expenses (6,246,967) (4,741,711) (11,357,436)

Other income 8,257 259,775 292,744

Operating (loss)/profit 3 (778,993) 1,716,766 1,945,147

Finance costs (497,567) (409,860) (1,042,697)

Profit/(loss) before tax (1,276,560) 1,306,906 902,450

Taxation charge 496,100 (361,081) (314,146)

Loss/(profit) for the year (780,460) 945,825 588,304

Other comprehensive income - - -

------------ ------------ -------------

Total comprehensive (loss)/profit

for the year (780,460) 945,825 588,304

----------------------------------- ------ ------------ ------------ -------------

Basic (loss)/earnings per share

(pence) 6 (0.64) 0.77 0.48

Diluted (loss)/earnings per

share (pence) 6 (0.64) 0.77 0.48

----------------------------------- ------ ------------ ------------ -------------

All the above results are derived from continuing

operations.

Consolidated balance sheet

At 2 July 2023

Notes 2 July 3 July 1 January

2023 2022 2023

GBP GBP GBP

Non-current assets

Intangible assets 7 29,134 55,267 29,134

Property, plant and equipment 8 6,536,519 6,970,576 6,708,383

Right-of-use assets 8 12,607,187 14,872,490 13,704,427

Deferred tax asset 224,133 - -

------------------------------- ------ ------------- ------------- -------------

19,396,973 21,898,333 20,441,944

Current asset

Inventories 526,071 517,775 474,655

Trade and other receivables 1,379,568 1,627,408 1,220,053

Cash and cash equivalents 7,640,868 10,738,261 9,930,323

------------------------------- ------ ------------- ------------- -------------

9,546,507 12,883,444 11,625,031

Total assets 28,943,480 34,781,777 32,066,975

------------------------------- ------ ------------- ------------- -------------

Current liabilities

Borrowings (600,000) (600,000) (600,000)

Trade and other payables (5,793,557) (6,924,257) (6,399,675)

Lease liabilities (1,165,194) (2,380,659) (2,351,410)

Current tax liabilities - (104,839) -

------------------------------- ------ ------------- ------------- -------------

(7,558,751) (10,009,755) (9,351,085)

Non-current liabilities

Borrowings (1,300,000) (1,900,000) (1,600,000)

Provisions for liabilities (373,347) (735,686) (362,088)

Lease liabilities (15,728,067) (16,811,910) (15,728,066)

Deferred tax liability - (214,063) (271,967)

------------------------------- ------ ------------- ------------- -------------

(17,401,414) (19,661,659) (17,962,121)

Total liabilities (24,960,165) (29,671,414) (27,313,206)

------------------------------- ------ ------------- ------------- -------------

Net assets 3,983,315 5,110,363 4,753,769

------------------------------- ------ ------------- ------------- -------------

Equity

Share capital 9 1,226,667 1,226,667 1,226,667

Share premium 10,050,313 10,050,313 10,050,313

Other reserves 155,105 144,172 145,099

Retained losses (7,448,770) (6,310,789) (6,668,310)

------------------------------- ------ ------------- ------------- -------------

Total equity 3,983,315 5,110,363 4,753,769

------------------------------- ------ ------------- ------------- -------------

Consolidated statement of changes in equity

For the half-year ended 2 July 2023

Notes Share capital Share premium Other reserves Retained losses Total equity

GBP GBP GBP GBP GBP

At 2 January 2022 1,226,667 10,050,313 145,099 (6,668,310) 4,753,769

Total comprehensive income

Loss for the period 3 - - - (780,460) (780,460)

Transactions with owners

Share-based payments 5 - - 10,006 - 10,006

At 3 July 2023 1,226,667 10,050,313 155,105 (7,448,770) 3,983,315

---------------------------- ------ -------------- -------------- --------------- ---------------- -------------

At 3 January 2022 1,226,667 10,050,313 129,722 (7,256,614) 4,150,088

Total comprehensive loss

Loss for the period 3 - - - 945,825 945,825

Transactions with owners

Share-based payments 5 - - 14,450 - 14,450

At 3 July 2022 1,226,667 10,050,313 144,172 (6,310,789) 5,110,363

---------------------------- ------ -------------- -------------- --------------- ---------------- -------------

At 3 January 2022 1,226,667 10,050,313 129,722 (7,256,614) 4,150,088

Total comprehensive income

Profit for the period 3 - - - 588,304 588,304

Transactions with owners

Share-based payments 5 - - 15,377 - 15,377

At 1 January 2023 1,226,667 10,050,313 145,099 (6,668,310) 4,753,769

---------------------------- ------ -------------- -------------- --------------- ---------------- -------------

Consolidated statement of cash flows

For the half-year ended 2 July 2023

Notes Half-year Half-year Period

ended 2 ended 3 ended 1

July 2023 July 2022 January

2023

GBP GBP GBP

Operating activities

Cash inflow from operations 10 81,028 2,897,522 4,368,949

Interest paid (67,731) (41,319.00) (94,078)

Tax paid - - -

Net cash from operating activities 13,297 2,856,203 4,274,871

--------------------------------------- ------ ------------ ------------- ------------

Investing activities

Purchase of property, plant

& equipment 8 (386,701) (278,319) (581,250)

Net cash used in investing

activities (386,701) (278,319) (581,250)

--------------------------------------- ------ ------------ ------------- ------------

Financing activities

Payment of lease liabilities (1,616,051) (1,407,422) (3,031,097)

Bank loan proceeds - - -

Bank loan repayments (300,000) (300,000.00) (600,000)

Net cash used from financing

activities (1,916,051) (1,707,422) (3,631,097)

--------------------------------------- ------ ------------ ------------- ------------

Increase in cash and cash equivalents (2,289,455) 870,462 62,524

Cash and cash equivalents at

beginning of period 9,930,323 9,867,799 9,867,799

Cash and cash equivalents at

end of period 7,640,868 10,738,261 9,930,323

--------------------------------------- ------ ------------ ------------- ------------

Notes to the financial information

For the half-year ended 2 July 2023

1. Basis of preparation

The consolidated financial information for the half-year ended 2

July 2023, has been prepared in accordance with the accounting

policies the Group applied in the Company's latest annual audited

financial statements and are expected to be applied in the annual

financial statements for the period ending 1 January 2023. These

accounting policies are based on the UK-adopted International

Financial Reporting Standards ("IFRS") and International Financial

Reporting Interpretation Committee ("IFRIC") interpretations. The

consolidated financial information for the half-year ended 2 July

2023 has been prepared in accordance with IAS 34: 'Interim

Financial Reporting', as adopted by the UK, and under the

historical cost convention.

The financial information relating to the half-year ended 2 July

2023 is unaudited and does not constitute statutory financial

statements as defined in section 434 of the Companies Act 2006. The

comparative figures for the period ended 1 January 2023 have been

extracted from the consolidated financial statements, on which the

auditors gave an unqualified audit opinion and did not include a

statement under section 498 (2) or (3) of the Companies Act 2006.

The annual report and accounts for the period ended 1 January 2023

has been filed with the Registrar of Companies.

The Group's financial risk management objectives and policies

are consistent with those disclosed in the period ended 1 January

2023 annual report and accounts.

The half-yearly report was approved by the board of directors on

22 September 2023. The half-yearly report is available on the

Comptoir Libanais website, www.comptoirgroup.com , and at Comptoir

Group's registered office, Unit 2, Plantain Place, Crosby Row,

London Bridge, SE1 1YN.

2. Changes in accounting policies

The accounting policies adopted in the preparation of the

consolidated financial information for the half-year ended 2 July

2023 are consistent with those followed in the preparation of the

Group's annual consolidated financial statements for the year ended

1 January 2023.

At the date of authorisation of the half-yearly report, the

following amendments to Standards and Interpretations issued by the

IASB that are effective for an annual period that begins on or

after 1 January 2023. These amendments have not had any material

impact on the amounts reported for the current and prior years.

Standard or Interpretation Effective Date

IFRS 17 - Insurance Contracts 1 January 2023

IAS 8 - Definition of Accounting Estimates 1 January 2023

IAS 1 - Disclosure of Accounting Policies 1 January 2023

IAS 12 - Deferred Tax Arising from a Single Transaction 1

January 2023

Initial Application of IFRS 17 and IFRS 9 - Comparative

Information 1 January 2023

New and revised Standards and Interpretations in issue but not

yet effective

At the date of authorisation of these financial statements, the

Group has not early adopted the following amendments to Standards

and Interpretations that have been issued but are not yet

effective:

Standard or Interpretation Effective Date

IAS 1 Classification of liabilities as current or

non-current

1 January 2024

IAS 1 - Non-current liabilities with covenants 1 January

2024

IFRS 7 - Supplier finance arrangements 1 January 2024

IFRS 16 - Lease liability in a Sale and Leaseback 1 January

2024

As yet, none of these have been endorsed for use in the UK and

will not be adopted until such time as endorsement is confirmed.

The directors do not expect any material impact as a result of

adopting standards and amendments listed above in the financial

year they become effective.

Critical accounting judgements and key sources of estimation

uncertainty

The preparation of financial statements in conformity with IFRS

requires management to make judgments, estimates and assumptions

that affect the application of policies and reported amounts of

assets and liabilities, income and expenses. The estimates and

associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making the

judgements about carrying values of assets and liabilities that are

not readily apparent from other sources. The resulting accounting

estimates may differ from the related actual results.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision affects

only that period, or in the period of the revision and future

periods if the revision affects both current and future

periods.

In the process of applying the Group's accounting policies,

management has made a number of judgments and estimations of which

the following are the most significant. The estimates and

assumptions that have a risk of causing material adjustment to the

carrying amounts of assets and liabilities within the future

financial years are as follows:

Depreciation, useful lives and residual values of property,

plant & equipment

The Directors estimate the useful lives and residual values of

property, plant & equipment in order to calculate the

depreciation charges. Changes in these estimates could result in

changes being required to the annual depreciation charges in the

statement of comprehensive incomes and the carrying values of the

property, plant & equipment in the balance sheet.

Impairment of assets

The Group assesses at each reporting date whether there is an

indication that an asset may be impaired. If any such indication

exists, or when annual impairment testing for an asset is required,

the Group makes an estimate of the asset's recoverable amount. An

asset's recoverable amount is the higher of an asset's or

cash-generating unit's fair value less costs to sell and its value

in use and is determined for an individual asset, unless the asset

does not generate cash inflows that are largely independent of

those from other assets or groups of assets.

Critical accounting judgements and key sources of estimation

uncertainty (continued)

Where the carrying amount of an asset exceeds its recoverable

amount, the asset is considered impaired and is written down to its

recoverable amount. In assessing value in use, the estimated future

cash flows are discounted to their present value of money and the

risks specific to the asset. Impairment losses of continuing

operations are recognised in the profit or loss in those expense

categories consistent with the function of the impaired asset.

Please refer to note 8 for further details on impairments.

Leases

The Group has estimated the lease term of certain lease

contracts in which they are a lessee, including whether they are

reasonably certain to exercise lessee options. The incremental

borrowing rate used to discount lease liabilities has also been

estimated in the range of 2.6% to 4%. This is assessed as the rate

of interest that would be payable to borrow a similar about of

money for a similar length of time for a similar right-of-use

asset.

Deferred tax assets

Historically, deferred tax assets had been recognised in respect

of the total unutilised tax losses within the Group. A condition of

recognising this amount depended on the extent that it was probable

that future taxable profits will be available.

3. Group operating profit/(loss)

Half-year Half-year Period ended

ended 2 July ended 3 July 1 January

2023 2022 2023

This is stated after (crediting)/charging: GBP GBP GBP

Variable lease charges 347,069 385,208 444,327

Rent concessions - (150,887) (171,856)

Share-based payments expense

(note 5) 10,006 14,450 15,377

Depreciation of property, plant

and equipment (note 8) 1,655,805 1,628,502 3,252,841

Impairment of assets (note

7 & 8) - - 78,266

Loss on disposal of fixed assets - - 8,188

Auditors' remuneration - - 75,000

Exceptional legal and professional

fees 23,045 - 1,002,054

-------------------------------------------- -------------- -------------- --------------

Half-year Restated Restated

ended 3 July Half-year Period ended

2023 ended 3 July 1 January

2022 2023

GBP GBP GBP

Restaurant opening costs - 38,245 36,745

Restaurant closing costs 75,657 - 28,628

Dilapidations 16,493 17,334 5,956

92,150 55,579 71,330

-------------------------------------------- -------------- -------------- --------------

For the initial trading period following opening of a new

restaurant, the performance of that restaurant will be lower than

that achieved by other, similar, mature restaurants. The difference

in this performance, which is calculated by reference to gross

profit margins amongst other key metrics, is quantified and

included within opening costs. The breakdown of opening costs,

between pre-opening costs and post-opening costs is shown

above.

4. Operating segments

The Group has only one operating segment: the operation of

restaurants with Lebanese and Middle Eastern offering and one

geographical segment (the United Kingdom). The Group's brands meet

the aggregation criteria set out in paragraph 22 of IFRS 8

"Operating Segments" and as such the Group reports the business as

one reportable segment. None of the Group's customers individually

contribute over 10% of the total revenue.

5. Share options and share-based payment charge

On 4 July 2018, the Group established a Company Share Option

Plan ("CSOP") under which 4,890,000 share options were granted to

key employees. The CSOP scheme includes all subsidiary companies

headed by Comptoir Group PLC. The exercise price of all of the

options is GBP0.1025, which all carry a three year vesting period

and the term to expiration is ten years from the date of grant (4

July 2018).

On 21 May 2021, the Group established another Company Share

Option Plan ("CSOP") under which 3,245,000 share options were

granted to key employees. The CSOP scheme includes all subsidiary

companies headed by Comptoir Group PLC. The exercise price of all

of the options is GBP0.0723, which all carry a three year vesting

period and the term to expiration is ten years from the date of

grant (21 May 2021).

The total share-based payment charge for the period was

GBP10,006 (H1 2021: GBP14,450, 1 January 2023: GBP15,377).

6. Earnings/(loss) per share

The Company had 122,666,667 ordinary shares of GBP0.01 each in

issue at 2 July 2023. The basic and diluted earnings/(loss) per

share figures, is based on the weighted average number of shares in

issue during the periods. The basic and diluted earnings/(loss) per

share figures are set out below.

Half-year Half-year Period

ended 2 ended 3 ended 1

July 2023 July 2022 January

2023

GBP GBP GBP

Profit/(loss) attributable to shareholders (780,460) 945,825 588,304

Weighted average number of shares Number Number Number

For basic earnings/(loss) per share 122,666,667 122,666,667 122,666,667

Adjustment for options outstanding - 558,126 -

------------

For diluted earnings/(loss) per share 122,666,667 123,224,793 122,666,667

-------------------------------------------- ------------ ------------ ------------

Earning/(loss) per share: Pence per Pence per Pence per

share share share

Basic (pence)

From profit/(loss) for the year (0.64) 0.77 0.48

Diluted (pence)

From profit/(loss) for the year (0.64) 0.77 0.48

6. Earnings/(loss) per share (continued)

The basic and diluted earnings/(loss) per share is calculated by

dividing the profit or loss attributable to ordinary shareholders

by the weighted average number of shares and 'in the money' share

options in issue. Share options are classified as 'in the money' if

their exercise price is lower than the average share price for the

period.

As required by 'IAS 33: Earnings per share', this calculation

assumes that the proceeds receivable from the exercise of 'in the

money' options would be used to purchase shares in the open market

in order to reduce the number of new shares that would need to be

issued. The shares were not 'in the money' as at the half-year

ended 2 July 2023 or period ended 1 January 2023 and consequently

would be antidilutive. Therefore, no adjustment was made in respect

of the share options outstanding to determine the diluted number of

options for these periods.

7. Intangible assets

Goodwill Total

Cost GBP GBP

At 2 January 2023 89,961 89,961

Additions - -

--------- ---------

At 2 July 2023 89,961 89,961

----------------------------------------- --------- ---------

Accumulated amortisation and impairment

At 2 January 2023 (60,827) (60,827)

Amortised during the year - -

Impairment during the year - -

--------- ---------

At 2 July 2023 (60,827) (60,827)

----------------------------------------- --------- ---------

Net Book Value as at 2 July 2023 29,134 29,134

----------------------------------------- --------- ---------

Net Book Value as at 3 July 2022 55,267 55,267

----------------------------------------- --------- ---------

Net Book Value as at 1 January 2023 29,134 29,134

----------------------------------------- --------- ---------

Intangible fixed assets consist of goodwill from the acquisition

of Agushia Limited, which included the Yalla Yalla brand. Goodwill

arising on business combinations is not amortised but is subject to

an impairment test annually which compares the goodwill's 'value in

use' to its carrying value. No impairment of goodwill was

considered necessary in the current period.

8. Property, plant and equipment

Right-of Leasehold Plant Fixture, Motor Total

use assets land and and machinery fittings vehicles

buildings & equipment

Cost GBP GBP GBP GBP GBP GBP

At 2 January 2023 28,596,410 10,371,174 5,093,306 2,991,247 38,310 47,090,447

Additions - - 164,113 222,588 - 386,701

Disposals - (11,290) - - - (11,290)

At 2 July 2023 28,596,410 10,359,884 5,257,419 3,213,835 38,310 47,465,858

-------------------------- ------------- ------------ --------------- ------------- ---------- -------------

Accumulated depreciation

and impairment

At 2 January 2023 (14,891,983) (6,820,336) (3,236,904) (1,717,177) (11,237) (26,677,637)

Depreciation during

the year (1,097,240) (310,621) (160,218) (84,866) (2,860) (1,655,805)

Disposals during the

year - 11,290 - - - 11,290

At 2 July 2023 (15,989,223) (7,119,667) (3,397,122) (1,802,043) (14,097) (28,322,152)

-------------------------- ------------- ------------ --------------- ------------- ---------- -------------

Net book value

At 2 July 2023 12,607,187 3,240,217 1,860,297 1,411,792 24,213 19,143,706

At 3 July 2022 14,872,490 3,906,950 1,737,645 1,292,779 33,202 21,843,066

At 1 January 2023 13,704,427 3,550,838 1,856,402 1,274,070 27,073 20,412,810

-------------------------- ------------- ------------ --------------- ------------- ---------- -------------

At each reporting date the Group considers any indication of

impairment to the carrying value of its property, plant and

equipment. The assessment is based on expected future cash flows

and Value-in-Use calculations are performed annually and at each

reporting date and is carried out on each restaurant as these are

separate 'cash generating units' (CGU). Value-in-Use was calculated

as the net present value of the projected risk-adjusted post-tax

cash flows plus a terminal value of the CGU. A pre-tax discount

rate was applied to calculate the net present value of pre-tax cash

flows. The discount rate was calculated using a market participant

weighted average cost of capital. A single rate has been used for

all sites as management believe the risks to be the same for all

sites.

The recoverable amount of each CGU has been calculated with

reference to its Value-in-Use. The key assumptions of this

calculation are shown below:

Growth rate 3%

Discount rate 4.4%

Number of years projected over life of lease

The value-in-use figure has been calculated using the expected

annual cashflows of the Group from the latest forecasts at the time

of review. In producing the forecasts, the Directors have

considered the impact of current inflation levels, rising wage

costs as well as the potential risk of recession.

The growth rate is based on a combination of industry average

growth rates, actual results achieved historically and the current

economic conditions. Sensitivity analysis was performed on the

forecasted cashflows as well as the growth rate and only a

significant reduction in cashflows would result in a material

impairment charge. Therefore, based on the impairment review and

sensitivity analysis carried out, an impairment charge of GBPnil

(H1 2022: GBPnil, 1 January 2023: GBP78,266) was recorded for the

period.

9. Share capital

Authorised, issued and fully paid Number of shares

2 July 3 July 1 January

2023 2022 2023

Brought forward 122,666,667 122,666,667 122,666,667

Issued in the period - - -

------------ ------------ ------------

122,666,667 122,666,667 122,666,667

----------------------------------- ------------ ------------ ------------

Nominal value

2 July 3 July 1 January

2023 2022 2023

GBP GBP GBP

Brought forward 1,226,667 1,226,667 1,226,667

Issues in the period - - -

------------ ------------ ------------

1,226,667 1,226,667 1,226,667

----------------------------------- ------------ ------------ ------------

10. Cash flow from operations

Reconciliation of profit/(loss) to cash generated from

operations:

Half-year Half-year Period

ended 2 ended 3 ended 1

July 2023 July 2022 January

2023

GBP GBP GBP

Operating (loss)/profit for the

period (778,993) 1,716,766 1,945,147

Depreciation 1,655,805 1,628,502 3,252,841

Loss on disposal of fixed assets - - 8,188

Impairment of assets - - 78,266

Share-based payment charge 10,006 14,450 15,377

Rent concessions - (150,887) (171,856)

Movements in working capital

Increase in inventories (51,416) (51,885) (8,765)

Increase in trade and other receivables (159,506) (928,416) (521,065)

(Increase)/decrease in payables

and provisions (594,868) 668,992 (229,184)

Cash generated from operations 81,028 2,897,522 4,368,949

----------------------------------------- ----------- ----------- ----------

11. Adjusted EBITDA

Adjusted EBITDA was calculated from the profit/loss before

taxation adding back interest, depreciation, share-based payments

and non-recurring/non-cash costs incurred in relation to restaurant

sites, as follows:

Half-year Restated Restated

ended 2 Half-year Period

July 2023 ended 3 July ended 1

2022 January

2023

GBP GBP GBP

Profit after tax (780,460) 945,825 588,304

Add back:

Finance costs 497,567 409,860 1,042,697

Taxation (credit)/charge (496,100) 361,081 314,146

Depreciation 1,655,805 1,628,502 3,252,841

Impairment of assets - 336,356 78,266

EBITDA 876,812 3,681,624 5,276,254

Share-based payments 10,006 14,050 15,377

Loss on disposal of fixed assets - - 8,188

Exceptional legal and professional

fees 23,045 - 1,002,054

Restaurant opening costs - 38,245 36,745

Restaurant closing costs 75,657 - 28,628

Dilapidations 16,493 17,334 5,956

Adjusted EBITDA 1,002,013 3,751,253 6,373,203

----------- -------------- ----------

12. Subsequent events

The Group exchanged an agreement to open and operate a new

Comptoir Libanais in Ealing, London, and is at the final stage of

securing a new London flagship site. The group also signed a new

Franchise agreement with AREAS.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFLTALILFIV

(END) Dow Jones Newswires

September 22, 2023 02:00 ET (06:00 GMT)

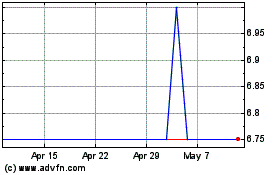

Comptoir (LSE:COM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Comptoir (LSE:COM)

Historical Stock Chart

From Dec 2023 to Dec 2024