TIDMCRV

RNS Number : 1061V

Craven House Capital PLC

29 November 2023

Craven House Capital

Annual Results For Year Ended 31 May 2023

Craven House Capital PLC

29 November 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION (EU) 596/2014 AS IT FORMS PART OF DOMESTIC LAW IN THE

UNITED KINGDOM BY VIRTUE OF THE EU (WITHDRAWAL) ACT 2018.

Craven House Capital plc

("Craven House" or the "Company")

Annual Results for year ended 31 May 2023

CRAVEN HOUSE CAPITAL PLC

CHAIRMAN'S STATEMENT

FOR THE YEARED 31 MAY 2023

Dear Shareholder

I am pleased to provide an introduction to the annual report and financial

statements for Craven House Capital Plc for the year ending 31 May 2023.

Updated valuations of Craven's portfolio companies are provided below. Positive

progress was demonstrated by each entity during the year as is detailed further

in the Investment Manager's report, however the Investment Manager has chosen

to impair the fair value of a number of the investments until such time as a

clear arms-length or market-based valuation can be determined, as has been the

case with BioVitos Medical Ltd during the year. The total valuation of the portfolio

was reduced from $6.4m to $1.14m during the period.

Mark Pajak

Acting Chairman

CRAVEN HOUSE CAPITAL PLC

INVESTMENT MANAGER'S REPORT

FOR THE YEARED 31 MAY 2023

Statement by the Investment Manager

The Company's investment portfolio comprises minority

shareholdings in five Swedish-managed businesses operating in the

eCommerce and pharmaceutical sector.

The Company's investments are held at fair value in accordance

with the IPEVC guidelines. We have used the prior-year valuations

as a starting point for estimation of fair value and have applied

adequate consideration to current facts and circumstances in

reviewing the respective valuations. A summary of the Company's

investments is as follows with further information provided in

notes 7 and 13 below;

Investment Value at 31 Value at 31

May 2023 May 2022

Comprising:

Shares in Garimon Limited - $1,600,000

Shares in Stormfjord Limited - -

Shares in BioVitos Medical Limited $1,136,256 $1,600,000

Shares in Rosedog Limited - $1,600,000

Shares in Honeydog Limited - $1,600,000

Each investee companies demonstrated positive progress during

the financial year, however remain at 'pre-revenue' stage of

business development. Updated information on each entity is

below.

Garimon Limited - 29.9% shareholding

As at end May 2023 Garimon's assets comprised ownership of the

domain www.magazinos.com, a platform for digital magazine

distribution, with over 10,000 magazines freely available for

readers. Limited progress was demonstrated in relation to

development and growth of this domain during the year. Despite the

potential future value of this investment, the fair value has been

impaired to zero due to the current absence of tangible arm's

length or market-based valuation metrics.

CRAVEN HOUSE CAPITAL PLC

INVESTMENT MANAGER'S REPORT - continued

FOR THE YEARED 31 MAY 2023

Stormfjord Limited - 25.5% shareholding

As previously announced the www.onebas.com domain was

transferred out of Garimon during the period and into a new entity,

Stormfjord Limited. Stormfjord subsequently raised $520,000 of

arms-length financing, which valued the domain at $5,000,000. The

proceeds of the financing were used to upgrade the functionality

and capacity of the websites as well as launch a PR / advertising

campaign across key target markets.

A subsequent round of fundraising was completed in March 2023,

raising $100,000 (announced on March 3, 2023) at a valuation of

$28,000,000. Craven did not participate in either fundraising.

Despite the potential future value of this investment, the fair

value has been impaired to zero due to the current absence of

tangible arm's length or market-based valuation metrics.

Bio Vitos Medical Limited - 24.5% shareholding

Bio Vitos has two principal assets;

In the prior year Bio Vitos acquired the licence to market a

patented heart drug 'Succifer' (also marketed as 'Inofer'), from

Double Bond Pharmaceutical AB. The drug has been demonstrated to

improve iron uptake in patients with chronic heart conditions.

As publicly disclosed, after the end of the period BioVitos

completed its transaction with Hemcheck Sweden AB (a Swedish

medical technology company, listed on the Stockholm Stock Exchange)

whereby BioVitos has completed an RTO into Hemcheck in a

transaction which will value Succifer at $5,000,000. As a result,

BioVitos will be issued 259,654,000 shares in Hemcheck.

Craven House remains a 24.5% shareholder in BioVitos and will

receive a pro-rata distribution of Hemcheck shares shortly after

they are awarded to BioVitos (anticipated in December 2023). As a

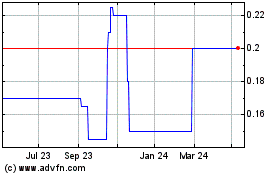

result, Craven received c.63,615,230 shares in Hemcheck which have

a current market value of c. 12 million Swedish Kroner / $1.136m US

Dollars, which the board believes accurately reflects the current

fair value for this investment.

The dietary / Omega-3 supplement products owned by BioVitos in

the prior period have now been transferred to a new entity,

Rosemonkey Ltd, in which Craven is a shareholder.

Rosedog Limited - 28.6% shareholder

Rosedog is the owner of TV Zinos (www.tvzinos.com), a website

which offers a number of free-to-view television channels.

As publicly announced on March 3, 2023, Rosedog raised $70,000

on 1st March 2023 at a valuation of $28,000,000. Following

completion of the fundraising, Craven House's holding of 29,900,000

shares represents 28.6% of Rosedog. Despite the potential future

value of this investment, the fair value has been impaired to zero

due to the current absence of tangible arm's length or market-based

valuation metrics.

Honeydog Ltd - 29.9% shareholder

Honeydog the 25% owner of the entity which owns the licence to

manufacture and distribute the chemotherapy drug, SI-053 /

'Temodex' which is used in the treatment of brain tumours, offering

significant increases in survival rates. Preparation for the

finalisation of clinical trials is ongoing. Despite the potential

future value of this investment, the fair value has been impaired

to zero due to the current absence of tangible arm's length or

market-based valuation metrics.

Desmond Holdings Ltd

Investment Manager to Craven House Capital Plc

CRAVEN HOUSE CAPITAL PLC

STRATEGIC REPORT

FOR THE YEARED 31 MAY 2023

The directors present the Strategic Report of Craven House

Capital plc for the year ended 31 May 2023.

Principal activity

The Investing Policy is primarily to invest in or acquire a

portfolio of companies, partnerships, joint ventures, businesses or

other assets participating in the e-Commerce sector. The

investments or acquisitions may be funded wholly by cash, the issue

of new shares or debt, or a mix thereof, as the Board deems

appropriate. The Company's equity interest in a proposed investment

may range from a minority position to 100% ownership; the proposed

investments may be either quoted or unquoted, although will likely

be unquoted in the majority of cases. The Company will specifically

target investments which the Board believes offer high growth

opportunities or steady cash flows and where the exit will be a

liquidity event, such as a trade sale or IPO.

Review of the Business in the year

A comprehensive review of the Company's performance and business

activities is included in the Investment Manager's Report above.

The Company's portfolio comprises minority stakes in five

e-commerce businesses which were originally acquired in March 2020.

The status of the underlying investments is disclosed in further

detail in notes 7 and 13 below. The only material movements in the

Company's balance sheet during the year were adjustments to the

valuation of the investment portfolio and an increase in amounts

owing to Craven Industrial Holdings Plc in order to satisfy working

capital requirements.

Position of the Company's business at the end of the year

Sufficient cash remains available to the Company from its

subsidiaries and via external loan facilities to ensure it is able

to meet its liabilities as they fall due. Other than directors, the

Company has no employees and the majority of overhead expenditure

continues to comprise regulatory, accounting and audit costs.

Principal risks and uncertainties facing the business

The principal risks to the business include the ability of the

Company to successfully execute its Investing Policy and the early

/ pre-revenue stage of the development of the current portfolio of

investments. Description of these risks are further detailed in

note 13 below.

Corporate governance

The directors place a high degree of importance on ensuring that

high standards of Corporate Governance are maintained and have

therefore chosen to apply the framework as provided by the Quoted

Companies Alliance Corporate Governance Code for small and medium

size companies (2018) (the 'QCA Code').

Section 172(1) statement

The directors have acted in a way that they have considered, in

good faith, to be most likely to promote the

success of Craven House Capital Plc for the benefit of its

members, and in doing so had regard, amongst

matters to:

-- the likely consequences of any decision in the long-term;

-- the Company has no employees;

-- the need to foster the Company's business relationships with

suppliers, customers and others;

-- the impact of the Company's operations on the community and the environment;

-- the desirability of the Company's maintaining a reputation

for high standards of business conduct;

-- and to act fairly between members of the Company

The directors also took into account the views and interests of

a wider set of stakeholders, the Government and non-government

organisations.

CRAVEN HOUSE CAPITAL PLC

STRATEGIC REPORT - continued

FOR THE YEARED 31 MAY 2023

Section 172(1) statement - continued

Considering the broad range of interests in the Company is an

important part of the way the Board makes decisions; however, in

balancing those different perspectives, it won't always be possible

to deliver everyone's desired outcome.

How does the Board engage with stakeholders?

The Board engages with its stakeholders in a number of

pre-planned ways, these include; review meetings with our brokers

and advisors, shareholders have the ability to email the Company

directly and the Board will reply to questions within the

regulatory limits, the Company issues both RNS Reach and RNS

communications on a regular basis and the Company's web site is

continuously updated to inform our stakeholders. The Company's

annual report is also an opportunity to update our

stakeholders.

The Board has also adopted a code of conduct and follows

specific guidance on all governance requirements which are

regularly reviewed with its advisors to ensure full compliance.

The Board considers and discusses information from across the

organisation to help it understand the impact of its operations,

and the interests and views of our key stakeholders.

As a result of these activities, the Board has an overview of

engagement with stakeholders, and other relevant factors, which

enables the directors to comply with their legal duty under section

172 of the Companies Act 2006.

Due to the nature of the Company, no decisions were made by the

directors during the reporting period which required them to have

regard to the matters set out in section 172 of the Companies Act

2006.

Mr M J Pajak - Director of behalf of the Board

Date: 29 November 2023

CRAVEN HOUSE CAPITAL PLC

REPORT OF THE DIRECTORS

FOR THE YEARED 31 MAY 2023

The directors present their annual report with the audited

financial statements of the Company for the year ended 31 May

2023.

DIVIDS

No dividends have been declared for the year ended 31 May

2023.

EVENTS SINCE THE OF THE YEAR

Information relating to events since the end of the year is

given in the note 16 to the financial statements.

DIRECTORS

The directors who held office during the year were:

Mr M J Pajak;

Mr B S Bindra; and

Mr C P Morrison.

Directors' remuneration and details of service contracts are

given in note 3 to the financial statements.

POLITICAL AND CHARITABLE CONTRIBUTIONS

No charitable or political donations were made during the

year.

FINANCIAL RISK MANAGEMENT POLICIES

Information on the use of financial instruments by the Company

and its management of financial risk is disclosed in note 13 to the

financial statements.

FUTURE DEVELOPMENTS

In the coming year the Company will continue to execute its

investment strategy. Details of post year end transactions are

disclosed in note 16.

SIGNIFICANT SHAREHOLDERS

Shareholders with holdings of more than 3% of the Company as of

the date of this report are as follows;

Evangelos Kalimtzis - 16.9%

WB Nominees Ltd - 22.8%

Interactive Brokers LLC - 11.7%

HSBC Global Custody Nominee (UK) Ltd - 7.5%

The Bank Of New York (Nominees) Limited - 7.1%

DIRECTOR SHAREHOLDINGS

Shareholdings in the Company by directors as of the date of this

report are as follows;

Mr M J Pajak indirect holdings (via Desmond Holdings Ltd) -

272,705 ordinary shares of $1.00

Mr B S Bindra - 14,440 ordinary shares of $1.00

Mr C P Morrison - 7,356 ordinary shares of $1.00

CRAVEN HOUSE CAPITAL PLC

REPORT OF THE DIRECTORS - continued

FOR THE YEARED 31 MAY 2023

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulations.

Company law requires the directors to prepare financial

statements for each financial year. Under that law the directors

have elected to prepare the financial statements in accordance with

International Financial Reporting Standards, UK adopted

international standards and applicable law. Under company law the

directors must not approve the financial statements unless they are

satisfied that they give a true and fair view of the state of

affairs of the Company, and of the profit or loss for that period.

In preparing these financial statements, the directors are required

to:

- select suitable accounting policies and then apply them consistently;

- make judgements and accounting estimates that are reasonable

and prudent;

- state whether applicable accounting standards have been followed,

subject to any material departures disclosed and explained in

the financial statements;

- prepare the financial statements on the going concern basis unless

it is inappropriate to presume that the Company will continue

in business.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements comply with the Companies Act 2006. They

are also responsible for safeguarding the assets of the Company and

hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities.

The directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the United Kingdom governing the

preparation and dissemination of the accounts and the other

information included in annual reports may differ from legislation

in other jurisdictions.

The Company is compliant with AIM Rule 26 regarding the

Company's website.

STATEMENT AS TO DISCLOSURE OF INFORMATION TO AUDITORS

So far as the directors are aware, there is no relevant audit

information (as defined by Section 418 of the Companies Act 2006)

of which the Company's auditors are unaware, and each director has

taken all the steps that he or she ought to have taken as a

director in order to make himself or herself aware of any relevant

audit information and to establish that the Company's auditors are

aware of that information.

AUDITOR

A resolution for the re-appointment of Edwards Veeder (UK)

Limited, Chartered Accountants & Business Advisors will be

proposed in accordance with Section 489 of the Companies Act 2006

at the forthcoming Annual General Meeting.

Mr M J Pajak - Director of behalf of the Board

Date: 29 November 2023

INDEPENT AUDITOR'S REPORT TO THE MEMBERS OF

CRAVEN HOUSE CAPITAL PLC

Opinion

We have audited the financial statements of Craven House Capital

Plc (the 'company') for the year ended 31 May 2023 which comprise

the statement of comprehensive income, the statement of financial

position, the statement of changes in equity, the statement of cash

flows and the related notes to the financial statements, including

a summary of significant accounting policies. The financial

reporting framework that has been applied in their preparation is

applicable law and UK adopted international standards.

In our opinion, the financial statements:

-- give a true and fair view of the state of the company's

affairs as at 31 May 2023 and of its loss for the year then

ended;

-- have been properly prepared in accordance with UK adopted international standards; and

-- have been prepared in accordance with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) ("ISAs (UK)") and applicable law. Our

responsibilities are described below. We have fulfilled our ethical

responsibilities under, and are independent of the company in

accordance with, UK ethical requirements including the FRC Ethical

Standard. We believe that the audit evidence we have obtained is a

sufficient and appropriate basis for our opinion.

Conclusions relating to going concern

In auditing the financial statements, we have concluded that the

directors' use of the going concern basis of accounting in the

preparation of the financial statements is appropriate.

Based on the work we have performed, we have not identified any

material uncertainties relating to events or conditions that,

individually or collectively, may cast significant doubt on the

company's ability to continue as a going concern for a period of at

least twelve months from when the financial statements are

authorised for issue.

Our responsibilities and the responsibilities of the directors

with respect to going concern are described in the relevant

sections of this report.

Key audit matters

Key audit matters are those matters that, in our professional

judgment, were of most significance in our audit of the financial

statements of the current period and include the most significant

assessed risks of material misstatement (whether or not due to

fraud) we identified, including those which had the greatest effect

on: the overall audit strategy, the allocation of resources in the

audit; and directing the efforts of the engagement team. These

matters were addressed in the context of our audit of the financial

statements as a whole, and in forming our opinion thereon, and we

do not provide a separate opinion on these matters.

Investment properties

Refer to Note 7 to the financial statements

The company measured its investments at fair value through

profit or loss with the changes in fair value recognised in the

profit or loss. This fair value measurement is significant to our

audit because the balance of investments at fair value through

profit or loss of approximately $1,136,000 as at 31 May 2023 and

the fair value loss of approximately $5,264,000 for the year then

ended are material to the financial statements. In addition, the

company's fair value measurement involves application of judgement

and is based on assumptions and estimates.

Our audit procedures included, among others:

-- Obtaining the valuation reports to discuss and challenge the

valuation process, methodologies used and market evidence to

support significant judgments and assumptions applied in the

valuation model;

-- Checking key assumptions and input data in the valuation model to supporting evidence; and

-- Checking arithmetical accuracy of the valuation model.

We consider that the Group's fair value measurement of the

investment properties is supported by the available evidence.

Our application of materiality

We apply the concept of materiality both in planning and

performing our audit and in evaluating the effect of misstatements.

We consider materiality to be the magnitude by which misstatements,

including omissions could influence the economic decisions of

reasonable users that are taken on the basis of the financial

statements. Importantly, misstatements below these levels will not

necessarily be evaluated as material, as we also take into account

the nature of identified misstatements, and the particular

circumstances of their occurrence, when evaluating their effect on

the financial statements as a whole.

Based on our professional judgement, we determined the

materiality for the financial statements as a whole to be $23,500

which is based on 2% of total assets. We considered this as an

appropriate benchmark.

We set performance materiality as 80% of the overall Financial

Statement materiality.

We report to the Audit Committee all identified unadjusted

errors in excess of $1,100 which is set at 5% of materiality.

Errors below that threshold would also be reported if, in our

opinion as auditor, disclosure was required on qualitative

grounds.

An overview of the scope of our audit

Our audit was scoped by obtaining an understanding of the

company and its environment, including controls and assessing the

risks of material misstatements.

We carried out a full scope audit of the company's financial

statements. This included specific audit procedures where the

extent of our audit work was based on our assessment of the risks

of material misstatement.

All audit work to respond to the risks of material misstatement

were performed directly by the audit engagement team. We set out

the key audit matters that had the greatest impact on our audit

strategy and scope within the key audit matters section.

Other information

The other information comprises the information included in the

Chairman's Statement, the Investment Manager's Report, the

Strategic Report and the Report of the Directors. The directors are

responsible for the other information. Our opinion on the financial

statements does not cover the other information and, except to the

extent otherwise explicitly stated in our report, we do not express

any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our

responsibility is to read the other information and, in doing so,

consider whether the other information is materially inconsistent

with the financial statements or our knowledge obtained in the

audit or otherwise appears to be materially misstated. If we

identify such material inconsistencies or apparent material

misstatements, we are required to determine whether there is a

material misstatement in the financial statements or a material

misstatement of the other information. If, based on the work we

have performed, we conclude that there is a material misstatement

of this other information, we are required to report that fact.

We have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act

2006

In our opinion, based on the work undertaken in the course of

the audit:

-- the information given in the Strategic Report and the Report

of the Directors for the financial year for which the financial

statements are prepared is consistent with the financial

statements; and

-- the Strategic Report and the Report of the Directors have

been prepared in accordance with applicable legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the company

and its environment obtained in the course of the audit, we have

not identified material misstatements in the Strategic Report or

the Report of the Directors.

We have nothing to report in respect of the following matters in

relation to which the Companies Act 2006 requires us to report to

you if, in our opinion:

-- adequate accounting records have not been kept, or returns

adequate for our audit have not been received from branches not

visited by us; or

-- the financial statements are not in agreement with the accounting records and returns; or

-- certain disclosures of directors' remuneration specified by law are not made; or

-- we have not received all the information and explanations we require for our audit.

Responsibilities of directors

As explained more fully in the Statement of Directors'

Responsibilities set out on page 8 the directors are responsible

for the preparation of the financial statements and for being

satisfied that they give a true and fair view, and for such

internal control as the directors determine is necessary to enable

the preparation of financial statements that are free from material

misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditor's report that includes our opinion. Reasonable assurance is

a high level of assurance, but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a

material misstatement when it exists. Misstatements can arise from

fraud or error and are considered material if, individually or in

the aggregate, they could reasonably be expected to influence the

economic decisions of users taken on the basis of these financial

statements.

Irregularities, including fraud, are instances of non-compliance

with laws and regulations. We design procedures in line with our

responsibilities, outlined above, to detect material misstatements

in respect of irregularities, including fraud. The extent to which

our procedures are capable of detecting irregularities, including

fraud is detailed below:

-- Enquiries with management, about any known or suspected

instances of non-compliance with laws and regulations and

fraud.

-- Auditing the risk of management of override controls,

including through testing journal entries and other adjustments for

appropriateness.

-- Challenging assumptions and judgments made by management in

their significant accounting estimates.

Because of the field in which the client operates, we identified

that employment law, LSE listing rules and compliance with the

Companies Act 2006 are most likely to have a material impact on the

financial statements.

The group is subject to many other laws and regulations where

consequences of non-compliance could have material effect on

amounts or disclosures in the financial statements, for instance

through the imposition of fines. We identified the following areas

as most likely to have such an effect: The Listing Rules in certain

aspects of company legislation recognising the financial and

regulated nature of the Company's activities and its legal form.

Auditing standards limit required audit procedure to identify

non-compliance with these laws and regulations to inquiry of the

directors and other management and inspection of regulatory and

legal correspondence, if any. Through these procedures, we did not

become aware of actual or suspected non-compliance.

Owing to the inherent limitations of an audit, there's an

unavoidable risk that some material misstatements in the financial

statements may not be detected, even though the audit is properly

planned and performed in accordance with ISAs (UK). For instance,

the further removed non-compliances from the events and

transactions reflected in the financial statements, the less likely

the auditor is to become aware of it or to recognise the

non-compliance.

A further description of our responsibilities for the audit of

the financial statements is located on the Financial Reporting

Council's website at:

https://www.frc.org.uk/auditorsresponsibilities . This description

forms part of our auditor's report.

Use of our report

This report is made solely to the company's members, as a body,

in accordance with Chapter 3 of Part 16 of the Companies Act 2006.

Our audit work has been undertaken so that we might state to the

company's members those matters we are required to state to them in

an auditor's report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone other than the company and the company's members as a body,

for our audit work, for this report, or for the opinions we have

formed.

Lee Lederberg

Senior Statutory Auditor

for and on behalf of Edwards Veeder (UK) Limited

Chartered Accountants & Statutory Audit Firm

Ground Floor, 4 Broadgate,

Broadway Business Park,

Chadderton,

Greater Manchester,

United Kiingdom,

OL9 9XA

Date: 29 November 2023

CRAVEN HOUSE CAPITAL PLC

STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 MAY 2023

2023 2022

Notes $'000 $'000

CONTINUING OPERATIONS

Changes in fair value (5,264) -

Administrative expenses (186) (180)

(5,450) (180)

OPERATING LOSS

(65) (56)

Interest expense

LOSS BEFORE INCOME TAX 4 (5,515) (236)

Income tax 5 - -

---------- -------------

LOSS FOR THE YEAR AND TOTAL

COMPREHENSIVE INCOME (5,515) (236)

========== =============

Loss per share expressed

in cents per share:

Basic and diluted 6 (142.74) (6.11)

The notes on pages 18 to 35 form part of the financial

statements.

CRAVEN HOUSE CAPITAL PLC Company Number 05123368

STATEMENT OF FINANCIAL POSITION

AS AT 31 MAY 2023

2023 2022

Notes $'000 $'000

ASSETS

NON-CURRENT ASSETS

Investments at fair

value through

profit or loss 7 1,136 6,400

------------------ -------------

1,136 6,400

------------------ -------------

CURRENT ASSETS

Trade and other receivables 8 38 43

Cash and cash equivalents 9 4 1

------------------ -------------

42 44

------------------ -------------

TOTAL ASSETS 1,178 6,444

================== =============

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 10 3,802 3,802

Share premium 11,153 11,153

Accumulated deficit (15,339) (9,824)

------------------ -------------

TOTAL EQUITY (384) 5,131

------------------ -------------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 11 109 76

NON-CURRENT LIABILITES

Other payables 12 1,453 1,237

TOTAL LIABILITIES 1,562 1,313

------------------ -------------

TOTAL EQUITY AND LIABILITIES 1,178 6,444

================== =============

Approved and authorised for issue by the Board on

......................2023 and signed on its behalf by:

.................................................................

Mr M J Pajak - Director

The notes on pages 18 to 35 form part of the financial

statements.

CRAVEN HOUSE CAPITAL PLC

STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 MAY 2023

The notes on pages 18 to 35 form part of the financial statements.

Called Share Accumulated

up share premium deficit Total

capital $'000 $'000 $'000

$'000

Balance at 1 June

2021 3,802 11,153 (9,588) 5,367

Changes in equity

Issue of share capital - - - -

---------- ---------- -------------- --------

Transactions with owners 3,802 11,153 (9,588) 5,367

---------- ---------- -------------- --------

Loss for the year - - (236) (236)

Balance at 31 May

2022 3,802 11,153 (9,824) 5,131

---------- ---------- -------------- --------

Changes in equity

Issue of share capital - - - -

---------- ---------- -------------- --------

Transactions with owners 3,802 11,153 (9,824) 5,131

---------- ---------- -------------- --------

Loss for the year - - (5,515) (5,515)

---------- ---------- -------------- --------

Balance at 31 May

2023 3,802 11,153 (15,339) (384)

---------- ---------- -------------- --------

CRAVEN HOUSE CAPITAL PLC

STATEMENT OF CASH FLOWS

FOR THE YEARED 31 MAY 2023

2023 2022

Notes $'000 $'000

Cash flows from operating activities

Loss before income tax (5,515) (236)

Adjustments for non-cash items

Fair value adjustment arising on

investments 5,264 -

Decrease/(increase) in trade and

other receivables 5 (5)

Increase/(decrease) in trade and

other payables 33 (11)

Interest expense 65 56

Net cash outflow from operating

activities (148) (196)

Cash flows from financing activities

Loans received 151 192

Net cash inflow from financing

activities 151 192

--------- -------

Net increase/(decrease) in cash

and cash equivalents 3 (4)

Cash and cash equivalents at the

beginning

of the year 9 1 5

Cash and cash equivalents at the

end of the year 9 4 1

========= =======

The notes on pages 18 to 35 form part of the financial statements.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 31 MAY 2023

1. ACCOUNTING POLICIES

Basis of preparation

These financial statements have been prepared in accordance with International

Financial Reporting Standards and IFRIC interpretations and with those

parts of the Companies Act 2006 applicable to companies reporting under

UK adopted international standards.

Craven House Capital plc is a public company incorporated in the United

Kingdom under the Companies Act 2006. The address of the registered office

is given on the company information page. The Company is listed on the

AIM Market of the London Stock Exchange (ticker: CRV).

The directors have considered the definition of an investment entity in

IFRS 10 as well as the associated application guidance. The directors

consider that the Company has met the definition of an investment entity.

The significant judgments and assumptions made by the directors in determining

that the Company is an investment entity are that; it has obtained funds

from investors (its shareholders) and is providing those investors with

investment management services; it commits to its investors that its business

purpose is to invest funds solely for returns from capital appreciation,

investment income, or both; and it measures and evaluates the performance

of substantially all of its investments on a fair value basis.

The main accounting implications for the preparation of the accounts as

an investment entity are that the accounts are not prepared on a consolidated

basis. Instead the Company's investments in its subsidiaries are accounted

for at fair value through its profit and loss account.

The financial statements have been prepared under the historical cost

convention, except to the extent varied below for fair value adjustments

required by accounting standards, and in accordance with applicable UK

adopted international standards. The principal accounting policies are

set out below.

The financial statements are presented in US dollars which is the Company's

functional currency. Amounts are rounded to the nearest thousand, unless

otherwise stated.

Going concern

The Company's business activities, together with the factors likely to

affect its future development, performance and position are set out in

the Investment Manager's Report. The financial statements include the

Company's objectives, policies and processes for managing its capital;

its financial risk management objectives; details of its financial instruments;

and its exposures to credit risk and liquidity risk. The directors believe

that the Company is well placed to manage its business risks successfully.

The directors have a reasonable expectation that the Company has adequate

resources to continue in operational existence for the foreseeable future.

Thus they continue to adopt the going concern basis of accounting in preparing

the annual financial statements.

The Company maintains minimal cash reserves, however in addition to the

cash on the Company's statement of financial position, sufficient cash

is available to the Company via credit facilities to ensure it is able

to meet its liabilities as they fall due and there is therefore no risk

to the going concern status of the Company.

There are currently no commitments to provide support to any subsidiary,

however the Company may elect to provide capital to its subsidiaries at

any time to further its stated Investing Policy.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

1. ACCOUNTING POLICIES - continued

The Company has not been required to apply any new or revised

standards during the reporting period.

The following new and revised standards and interpretations have

not been adopted by the Company, whether endorsed by the European

Union or not

Amendments to IFRS 17 Insurance Contracts (effective for annual

periods beginning on or after 1 January 2023, endorsed by the

European Union on 19 November 2021).

Amendments to IAS 8 Accounting Policies, Changes in Accounting

Estimates and Errors: Definition of Accounting Estimates (effective

for annual periods beginning on or after 1 January 2023, endorsed

by the European Union on 2 March 2022).

Amendments to IAS 1 Presentation of Financial Statements and

IFRS Practice Statement 2: Disclosure of Accounting policies

(effective for annual periods beginning on or after 1 January 2023,

endorsed by the European Union on 2 March 2022).

Amendments to IFRS 17 Insurance Contracts: Initial Application

of IFRS 17 and IFRS 9 - Comparative Information (effective for

annual periods beginning on or after 1 January 2023, not yet

endorsed by the European Union).

Amendments to IAS 12 Income Taxes: Deferred Tax related to

Assets and Liabilities arising from a Single Transaction (effective

for annual periods beginning on or after 1 January 2023, not yet

endorsed by the European Union).

Amendments to IAS1 Presentation of Financial Statements:

Classification of Liabilities as Current or Non-current (effective

for annual periods beginning on or after 1 January 2023, not yet

endorsed by the European Union).

The Company has assessed the impact of the adoption of these

standards and interpretations on its financial statements on

initial adoption and do not expect these standards to have a

material impact.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

1. ACCOUNTING POLICIES - continued

Financial assets

Purchases or sales of financial assets are recognised at the

date of the transaction. Where appropriate criteria are met, the

Company makes use of the option of measuring non current

investments upon initial recognition as financial assets at fair

value through profit or loss. These criteria include that the fixed

asset investment should meet the Company's published Investing

Policy and form part of the Company's managed portfolio or similar

investments. Such financial assets are carried at fair value and

movements in fair value are recognised through profit and loss. For

quoted securities, fair value is either the bid price or the last

traded price, depending on the convention of the exchange on which

the investment is quoted.

Impairment of financial assets

A financial asset not classified at fair value through profit or

loss is assessed at each reporting date to determine whether there

is objective evidence that it is impaired. A financial asset is

impaired if objective evidence indicates that a loss event has

occurred after the initial recognition of the asset, and that the

loss event had a negative effect on the estimated future cash flows

of that asset that can be estimated reliably.

The new impairment model requires forward looking information,

which is based on assumptions for the future movement of different

economic drivers and how these drivers will affect each other. It

also requires management to assign probability to various

categories of receivables. Probability of default constitutes a key

input in measuring an ECL and entails considerable judgment; it is

an estimate of the likelihood of default over a given time horizon,

the calculation of which includes historical data, assumptions and

expectation of future conditions.

The directors have determined that the application of IFRS 9's

impairment requirements does not have a material impact on the

financial statements.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

1. ACCOUNTING POLICIES - continued

Measurement

Financial assets at fair value through profit or loss are

initially recognised at fair value. Transaction costs are expensed

through profit and loss. Subsequent to initial recognition, all

financial assets at fair value through profit or loss are measured

at fair value in accordance with International Private Equity and

Venture Capital Valuation ("IPEVCV") guidelines, as the Company's

business is to invest in financial assets with a view to profiting

from their total return in the form of capital growth and income.

Gains and losses arising from changes in the fair value of the

financial assets at fair value through profit or loss are presented

in the year in which they arise.

Valuation of investments

A number of the Company's assets are measured at fair value for

financial reporting purposes. The Investment Manager determines the

appropriate valuation techniques and inputs for fair value

measurements.

In estimating the fair value of an asset, the Investment Manager

uses market-observable data to the extent it is available. The

Investment Manager reports its findings to the Board of Directors

of the Company every quarter to explain the cause of fluctuations

in the fair value of the assets.

Information about the valuation techniques and inputs used in

determining the fair value of various assets and liabilities are

disclosed in notes 7 and 13.

Financial instruments that are measured subsequent to initial

recognition at fair value are grouped into Levels 1 to 3 based on

the degree to which the fair value is observable:

Level 1 fair value measurements are those derived from quoted

prices (unadjusted) in active markets for identical assets or

liabilities;

Level 2 fair value measurements for those derived from inputs

other than quoted prices included within Level 1 that are

observable for the assets or liability, either directly or

indirectly; and Level 3 fair value measurements are those derived

from inputs that are not based on observable market data.

a) Quoted investments

Where investments are quoted on recognised stock markets and an

active market in the shares exists, the company values those

investments at closing mid-market price on the reporting date.

Where an active market does not exist those quoted investments are

valued by the application of an appropriate valuation methodology

as if the relevant investment was unquoted.

b) Unquoted investments

In estimating the fair value for an unquoted investment, the

Company applies a methodology that is appropriate in light of the

nature, facts and circumstances of the investment and its

materiality in the context of the total investment portfolio using

reasonable data, market inputs, assumptions and estimates. Any

changes in the above data, market inputs, assumptions and estimates

will affect the fair value of an investment.

Financial liabilities and equity

Financial liabilities are recognised when the Company becomes

party to the contractual provisions of the financial instrument and

are measured initially at fair value adjusted for transaction

costs. Financial liabilities are measured subsequently at amortised

cost using the effective interest method.

An equity instrument is any contract that evidences a residual

interest in the assets of the Company after deducting all its

liabilities.

In accordance with IFRIC 19, when a financial liability is

extinguished by the issue of equity, the equity instrument issued

is measured at fair value and any difference between the financial

liability extinguished and the measurement of the equity instrument

is recognised in profit and loss.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

1. ACCOUNTING POLICIES - continued

Current and deferred tax

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from net profit as reported in the

income statement because it excludes items of income or expense

that are taxable or deductible in other years and it further

excludes items that are never taxable or deductible. The Company's

liability for current tax is calculated using tax rates that have

enacted by the statement of financial position date.

Deferred tax is recognised in respect of all timing differences

that have originated but not reversed at the statement of financial

position date where transactions or events that result in an

obligation to pay more tax in the future or a right to pay less tax

in the future have occurred at the statement of financial position

date. Timing differences between the Company's taxable profits and

its results as stated in the financial information that arises from

the inclusion of gains and losses in tax assessments in periods

different from those in which they are recognised in the financial

information.

A deferred tax asset is only recognised for an unused tax loss

carried forward if it is considered probable that there will be

sufficient future taxable profits against which the loss can be

utilised.

Foreign currencies

In preparing the financial statements of the Company,

transactions in currencies other than the entity's functional

currency are recorded at the rates of exchange prevailing at the

dates of the transactions. At each statement of financial position

date, monetary items denominated in foreign currencies are

retranslated at the rates prevailing at the date when the fair

value was determined. Non-monetary items that are measured in terms

of historical cost in a foreign currency are not retranslated.

Exchange differences are recognised in profit or loss in the

period in which they arise except for exchange differences on

monetary items receivable from or payable to a foreign operation

for which settlement is neither planned nor likely to occur; which

form part of the net investment in a foreign operation and which

are recognised in the foreign currency translation reserve.

For the purposes of presenting US dollar financial statements,

the assets and liabilities of the Company's foreign operations are

expressed using exchange rates prevailing at the statement of

financial position date. Income and expense items are translated at

the average exchange rate for the period, unless exchange rates

fluctuated significantly during that period, in which case the

exchange rates at the dates of the transactions are used. Exchange

differences arising, if any, are classified as equity and

recognised in a foreign currency translation reserve.

Segment reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the directors. The directors, who

are responsible for allocating resources and assessing performance

of the operating segments, have been identified as the senior

management that make strategic decisions.

Critical accounting estimates and judgements

Preparation of financial statements in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets, liabilities, income and expenses. The estimates

and associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making

judgements about carrying values of assets and liabilities that are

not readily apparent from other sources. Further information

regarding the assumptions relied upon and sensitivity analysis

around these assumptions is provided in note 13 below.

In particular, significant areas of estimation, uncertainty and

critical judgements in applying accounting policies that have the

most significant effect on the amount recognised in the financial

statements relate to the valuation of investments.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

1. ACCOUNTING POLICIES - continued

Critical accounting estimates and judgements - continued

The Company has made a number of investments in the form of

equity instruments in private companies operating in emerging

markets. The investee companies are generally at a key stage in

their development and operating in an environment of uncertainty in

capital markets. Should planned development prove successful, the

value of the Company's investment is likely to increase, although

there can be no guarantee that this will be the case. Should

planned development prove unsuccessful, there is a material risk

that the Company's investments may be impaired. The carrying

amounts of investments are therefore highly sensitive to the

assumption that the strategies of these investee companies will be

successfully executed.

The directors have also determined that the Company meets IFRS

10's definition of an investment company and that the functional

currency is appropriate given that underlying transactions, events

and conditions that are most likely to impact on the Company's

performance are more closely linked to the US dollar than GB

sterling.

Share capital and share premium

Share capital represents the nominal (par) value of shares that

have been issued.

Share premium includes any premium received on issue of share

capital. Any transaction costs associated with the issuing of

shares are deducted from share premium.

2. SEGMENTAL REPORTING

The operating segment has been determined and reviewed by the

directors to be used to make strategic decisions. The directors

consider there to be a single business segment being that of

investing activities, therefore there is only one reportable

segment.

3. EMPLOYEES AND DIRECTORS

2023 2022

$'000 $'000

Wages and salaries - directors' remuneration - -

====== ======

The average monthly number of employees (including directors)

during the year was as follows:

2023 2022

Directors 3 3

===== =====

The Company has no employees other than the directors.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

3. EMPLOYEES AND DIRECTORS - continued

The service contracts of the directors who served during the

year are as follows:

Basic annual fee

Mr M J Pajak $nil

Mr B S Bindra $5,000**

Mr C P Morrison $5,000**

** Payable in new ordinary shares of the company at $1.00 per

share and issued on a bi-annual basis.

Desmond Holdings Ltd is the Company's Investment Manager. The

directors are the key management of the Company. There were no

directors (2022: none) to whom retirement benefits were accruing

under money purchase schemes.

4. LOSS BEFORE INCOME TAX

The loss before income tax is stated after charging:

2023 2022

$'000 $'000

Fees payable to the Company's auditor

for the audit of the Company's annual

accounts 17 17

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

5. INCOME TAX

Analysis of charge in the year

2023 2022

$'000 $'000

Current tax: - -

Deferred tax - -

Tax on loss on ordinary activities - -

====== ======

2023 2022

$'000 $'000

Loss on ordinary activities before

tax (5,515) (236)

======== ======

Analysis of charge in the year

2023 2022

$'000 $'000

Loss on ordinary activities multiplied

by the Company's rate of corporation

tax in the UK of 19% (2022: 19%) (1,048) (45)

Effects of:

Losses carried forward 1,048 45

---------- -------

Current tax charge for the year - -

as above

========== =======

At 31 May 2023, the Company had UK tax losses of $5,811,364

(2022: $5,488,630) available to be carried forward and utilised

against future taxable profits. A deferred tax asset of $1,104,159

2022: $1,042,840) has not been recognised due to uncertainties over

the timing of when taxable profits will arise.

6. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the period.

Diluted earnings per share has not been disclosed as the

inclusion of the unexercised warrants would be non-dilutive.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

6. EARNINGS PER SHARE - continued

Reconciliations are set out below.

2023

Earnings Weighted average Per-share amount

$'000 number of shares cents

Basic EPS

Earning attributable

to ordinary shareholders (5,515) 3,863,590 (142.74)

2022

Earnings Weighted average Per-share amount

$'000 number of shares cents

Basic EPS

Earning attributable

to ordinary shareholders (236) 3,863,590 (6.11)

7. INVESTMENTS

Investments at fair value through profit or loss

The Company adopted the valuation methodology prescribed in the

IPEVCV guidelines to value its investments at fair value through

profit and loss.

The Company had the following holdings at 31 May 2023:

Principal Place Ownership

Name Holding of Business Interest

Garimon Limited Direct UK / Sweden 29.9%

Stormfjord Limited Direct UK / Sweden 25.5%

Honeydog Limited Direct UK / Sweden 29.9%

Rosedog Limited Direct UK / Sweden 28.6%

Bio Vitos Medical Limited Direct UK / Sweden 24.5%

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

7. INVESTMENTS -continued

Investments at fair value through profit or loss

Quoted Unquoted

equity investments equity investments

$'000 $'000 Total

$'000

At 1 June 2021 - 6,400 6,400

Fair value movement - - -

--------------------- -------------------- ----------

At 31 May 2022 - 6,400 6,400

------------------ -------------------- ----------

Fair value movement - (5,264) (5,264)

------------------ -------------------- ----------

At 31 May 2023 - 1,136 1,136

------------------ -------------------- ----------

The value of Investments at 31 May 2023 represents the Company's

acquisitions during 2020 of interests in the above-named five UK

entities. These are all unquoted investments and have therefore

been measured on a Level 3 basis as no observable market data is

available. Further information on each investment holding is as

follows;

Shares in Garimon Limited are valued at $nil representing a

29.9% holding. Garimon Limited is the owner of "Magazinos.com", an

on-line media magazine and periodical content provision service.

Despite the potential future value of this investment, the fair

value has been impaired to zero due to the current absence of

tangible arm's length or market-based valuation metrics.

Shares in Stormfjord Limited are valued at $nil representing a

25.5% holding. Stormfjord is the owner of the domain www.onebas.com

, an optimised search engine providing a portal to music content

freely circulating online. Despite the potential future value of

this investment, the fair value has been impaired to zero due to

the current absence of tangible arm's length or market-based

valuation metrics.

Shares in Honeydog Limited are valued at $nil representing a

29.9% holding. Honeydog Limited is the 25% owner of the entity

which owns the licence to manufacture and distribute the

chemotherapy drug, Temodex, which is used in the treatment of brain

tumours. Despite the potential future value of this investment, the

fair value has been impaired to zero due to the current absence of

tangible arm's length or market-based valuation metrics.

Shares in Rosedog Limited are valued at $nil representing a

28.6% holding, unchanged from the prior year. Rosedog Limited is

the owner of TV Zinos (www.tvzinos.com), a website which offers a

number of free-to-view television channels. Despite the potential

future value of this investment, the fair value has been impaired

to zero due to the current absence of tangible arm's length or

market-based valuation metrics.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

7. INVESTMENTS - continued

Shares in Bio Vitos Medical Limited are valued at $1,136,256 representing

a 24.5% holding. Bio Vitos is the owner of the licence to market

a patented heart drug 'Succifer' (also marketed as 'Inofer'). The

drug has been demonstrated to improve iron uptake in patients with

chronic heart conditions. The valuation of this shareholding is

supported by an RTO undertaken by BioVitos during the period into

Hemcheck Sweden AB (a Swedish medical technology company, listed

on the Stockholm Stock Exchange) in a transaction which values Succifer

at $5,000,000. As a result BioVitos will be issued 259,654,000 shares

in Hemcheck.

The businesses of all of the above portfolio investments are presently

loss-making although their cost bases are low and there is minimal

committed future expenditure, meaning that the extent and timing

of the Company's further investment in the businesses are highly

controllable. The Company and the incumbent management teams of

the investee companies will continue to work together with the aim

that these businesses become financially self-sustaining and generating

surpluses within the short- to medium-term and to crystallise additional

capital value for shareholders through strategic, third-party partnerships.

8. TRADE AND OTHER RECEIVABLES

2023 2022

$'000 $'000

Current:

Prepayments and accrued income 38 43

------ ------

38 43

====== ======

9. CASH AND CASH EQUIVALENTS 2023 2022

$'000 $'000

Cash at bank 4 1

====== ======

The amounts disclosed in the statement of cash flows in respect

of cash and cash equivalents are in respect of the following statement

of financial position amounts:

Year ended 31 May 2023

31.5.23 1.6.22

$'000 $'000

Cash and cash equivalents 4 1

Year ended 31 May 2022

31.5.22 1.6.21

$'000 $'000

Cash and cash equivalents 1 5

======== =======

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

10. CALLED UP SHARE CAPITAL

Allotted, called up and

fully paid

Equity Nominal 2022 2021

shares

Number: Class: Value: $'000 $'000

3,863,590 (2021:

3,863,590) Ordinary $1.00 3,802 3,802

3,802 3,802

====== ========

The aggregate nominal values of shares include exchange

differences arising from the translation of shares at historic

rates and the translation at the rate prevailing at the date of the

change in functional currency.

11. TRADE AND OTHER PAYABLES

2023 2022

$'000 $'000

Current:

Trade payables 72 46

Accruals and deferred income 37 30

109 76

====== ======

12. OTHER PAYABLES

2023 2022

$'000 $'000

Non-current:

Other payables 1,453 1,237

1,453 1,237

====== ======

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

13. FINANCIAL INSTRUMENTS

Financial risk management objectives and policies

Management has adopted certain policies on financial risk management

with the objective of:

i. ensuring that appropriate funding strategies are adopted to meet

the Company's short-term and long-term funding requirements taking

into consideration the cost of funding, gearing levels and cash

flow projections;

ii. ensuring that appropriate strategies are also adopted to manage

related interest and currency risk funding; and

iii. ensuring that credit risks on receivables are properly managed.

Financial instrument by category

The accounting policies for financial instruments have been applied

to the line items below:

Financial assets at fair value through profit or loss

Financial instruments that are measured subsequent to initial recognition

at fair value are grouped into Levels 1 to 3 based on the degree

to which the fair value is observable:

Level 1 fair value measurements are those derived from quoted prices

(unadjusted) in active markets for identical assets or liabilities;

Level 2 fair value measurements for those derived from inputs other

than quoted prices included within Level 1 that are observable for

the assets or liability, either directly or indirectly; and

Level 3 fair value measurements are those derived from inputs that

are not based on observable market data.

Unquoted equity investments held at fair value through profit or

loss are valued in accordance with the IPEVCV guidelines as follows;

2023 2022

Investment valuation methodology $'000 $'000

Market approcah (adjusted

for current facts and circumstances)

(level 3) 1,136 6,400

1,136 6,400

======== =======

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

13. FINANCIAL INSTRUMENTS - continued

IFRS 13 and IFRS 7 requires the directors to consider the impact

of changing one or more of the inputs used as part of the valuation

process to reasonable possible alternative assumptions.

The Level 3 valuations listed above include inputs based on non-observable

market data as outlined in note 7 above. The Investment Manager

has derived a fair value for these investments based on the value

of the underlying net assets of the respective investments and

/ or has considered prospective enterprise values for these investments

from the perspective of a market participant.

The directors have considered a number of reasonable possible alternative

assumptions regarding the value of the Level 3 investments. IFRS

13 requires an entity to disclose quantitative information about

the significant unobservable inputs used.

A summary of the unobservable inputs, judgements and estimates

made in relation to the Level 3 investments is as follows:

As of the year end, the valuation the Company's minority shareholdings

in each its investee companies has been valued on a Price of Recent

Investment basis, adjusted for current facts and circumstances

which the directors consider represents the best indication of

the fair value at the year end. All five of these businesses are

presently loss-making although their cost bases are low and there

is minimal committed future expenditure, meaning that the extent

and timing of the Company's further investment in the businesses

are highly controllable.

However, each business operates in a competitive market place and

there can be no guarantee that any of the investee companies will

ultimately be successful and that the future carrying value of

these companies will not need to be impaired.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

13. FINANCIAL INSTRUMENTS - continued

The valuation method applied to each equity investment is that which

is considered most appropriate with regard to the stage of development

of the investee business and the IPEVCV guidelines.

All other financial instruments, including cash and cash equivalents,

trade and other receivables, trade and other payables and loans

and borrowings, are measured at amortised cost.

Due to their short-term nature, the carrying values of cash and

cash equivalents, trade and other receivables, trade and other payables

and loans and borrowings approximates their fair value.

Credit risk

The Company's credit risk is primarily attributable to other receivables.

Management has a credit policy in place and the exposure to credit

risks is monitored on an ongoing basis. In respect of other receivables,

individual credit evaluations are performed whenever necessary.

The Company's maximum exposure to credit risk is represented by

loans, both those held as unquoted investments and included in other

receivables, and cash balances. The Company monitors the financial

position of borrowing entities on an ongoing basis and is satisfied

with the quality of the debt. Investment of surplus cash balances

are reviewed on an annual basis by the Company and it is satisfied

with the choice of institution. The directors have assessed the

amounts owed to connected parties for impairment in accordance with

IFRS 9 and concluded that there is no material impact.

Interest rate risk

The Company currently operates with positive cash and cash equivalents

as a result of issuing share capital in anticipation of future funding

requirements. As the Company has no borrowings from the bank and

the amount of deposits in the bank are not significant, the exposure

to interest rate risk is not significant to the Company.

Liquidity risk

The Company manages its liquidity requirements by the use of both

short-term and long-term cash flow forecasts. The Company's policy

to ensure facilities are available as required is to issue equity

share capital in accordance with agreed settlement terms with vendors

or professional firms, and are typically due within one year unless

otherwise stated.

The Company maintains minimal cash reserves, however in addition

to the cash on the Company's statement of financial position, sufficient

cash is available to the Company via credit facilities to ensure

it is able to meet its liabilities as they fall due.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEARED 31 MAY 2023

13 . FINANCIAL INSTRUMENTS - continued

The table below summarises the maturity profile of the Company's

financial liabilities based on contractual discounted payments.

Less 3 to

On than 12 More than

Demand 3 months months 12 Months Total

Year ended 31

May 2023 $'000 $'000 $'000 $'000 $'000

Trade payables 72 - - - 72

Other payables - - - 1,453 1,453

Accruals and deferred

income 37 - - - 37

109 - - 1,453 1,562

------- --------- ------- ---------- ------

Year ended 31 May

2022

Trade payables 46 - - - 46

Other payables - - - 1,237 1,237

Accruals and deferred

income 30 - - - 30

76 - - 1,237 1,313

------- --------- ------- ---------- ------

Price risks

The Company's securities are susceptible to price risk arising

from uncertainties about future value of its investments. This

price risk is the risk that the fair value of future cash flows

will fluctuate because of changes in market prices, whether those

changes are caused by factors specific to the individual investment

or financial instrument or its holder or factors affecting all

similar financial instruments or investments traded in the

market.

During the year under review, the Company did not hedge against

movements in the value of its investments. A 10% increase/decrease

in the fair value of investments would result in a $113,600 (2022:

$640,000 increase/decrease in the net asset value).

While investments in companies whose business operations are

based in emerging markets may offer the opportunity for significant

capital gains, such investments also involve a degree of business

and financial risk, in particular for unquoted investments.

Generally, the Company is prepared to hold unquoted investments

for a medium to long time frame, in particular if an admission to

trading on a stock exchange has not yet been planned. Sale of

securities in unquoted investments may result in a discount to the

book value.

Currency risks

The Company is exposed to foreign currency risk on its

investments held at fair value and adverse movements in foreign

exchange rates will reduce the values of these investments. There

is no systematic hedging in foreign currencies against such

possible losses on translation/realisation.

Foreign exchange volatility is significantly reduced following

the transition to US Dollar as the Company's currency exposures are

now more closely matched to its functional and reporting currency.

The Company's exposure to other foreign currency changes is not

deemed to be material as the Company's investments are US Dollar

based.

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEAR ENDED 31 MAY 2023

13. FINANCIAL INSTRUMENTS - continued

Capital management

The Company's financial strategy is to utilise its resources to

further grow its portfolio. The Company keeps investors and the

market informed of its progress with its portfolio through periodic

announcements and raises additional equity finance at appropriate

times. The Company regularly reviews and manages its capital

structure for the portfolio companies to maintain a balance between

the higher shareholder returns that might be possible with certain

levels of borrowing for the portfolio and the advantages and

security afforded by a sound capital position, and makes

adjustments to the capital structure of the portfolio in the light

of changes in economic conditions. Although the Company has

utilised loans from shareholders to acquire investments, it is the

Company's policy as far as possible to finance its investing

activities with equity and not to have gearing in its

portfolio.

At the statement of financial position date the capital

structure of the Company consisted of cash and cash equivalents and

equity comprising issued capital and reserves.

The table below sets out the Company's classification of each

class of financial assets/liabilities, their fair values (where

appropriate) and under which valuation method they are valued:

Total carrying

amount and

Level Level Level Fair

1 2 3

Notes $'000 $'000 $'000 Value

$'000

31 May 2023

Loans and receivables

Trade and other receivables 8 - - 38 38

Cash and cash equivalents 9 4 - - 4

--------- --------- --------- ----------------

4 - 38 42

Liabilities at amortised

cost

--------- --------- --------- ----------------

Trade and other payables 11&12 - - (1,562) (1,562)

--------- --------- --------- ----------------

Fair value through

profit and loss

Investments 7 - - 1,136 1,136

4 - (388) (384)

--------- --------- --------- ----------------

31 May 2022

Loans and receivables

Trade and other receivables 8 - - 43 43

Cash and cash equivalents 9 1 - - 1

--------- --------- --------- ----------------

1 - 43 44

Liabilities at amortised

cost

--------- -------------- --------- ----------------

Trade and other payables 11&12 - - (1,313) (1,313)

Fair value through

profit and loss

Investments 7 - - 6,400 6,400

1 - 5,130 5,131

--------- -------------- --------- ----------------

CRAVEN HOUSE CAPITAL PLC

NOTES TO THE FINANCIAL STATEMENTS - continued

FOR THE YEAR ENDED 31 MAY 2023

14. RELATED PARTY DISCLOSURES

During the year, Craven Industrial Holdings Plc made loans to

and incurred costs on behalf of the Company.

Loan interest charged for the year at 5% amounted to $65,355

(2022: $55,615).

At the year end, a balance of $1,453,408 (2022: $1,236,190) was

due from the Company to Craven Industrial Holdings Plc.

Despite the common director in Mr M J Pajak, the board of Craven

House Capital Plc do not believe that Craven House Capital Plc or

Craven Industrial Holdings Plc are able to exert control or

influence over each other and neither are accustomed to act in

accordance with instructions from the other.

Directors and key management

All key management personnel are directors and appropriate

disclosure with respect to them is made in note 3 of the financial