TIDMDLN

RNS Number : 3531H

Derwent London PLC

03 December 2020

Derwent London plc ("Derwent London" / "the Group")

TRANSFERWISE PICKS TEA BUILDING FOR ITS FURTHER EXPANSION

Derwent London is pleased to announce that TransferWise has

agreed to extend and expand its occupation at the iconic Tea

Building in Shoreditch E1.

TransferWise currently occupies 31,700 sq ft on a lease due to

expire in December 2023 with a tenant break in May 2021 and has

committed to a new five-year lease on 48,950 sq ft, an increase of

54%. The new rent is in line with the passing rent and ERV. There

is an overall rental incentive equivalent to an 11-month rent-free

period.

This is a further expansion of this very successful innovative

business having moved to 24,300 sq ft in the building in 2016 and

reflects a longstanding relationship between the parties.

Once occupied by the Lipton Tea factory, the Tea Building was

originally a block of early twentieth century warehouses. These

have been creatively refurbished to provide a number of high

quality open spaces allowing businesses to stamp their own

distinctive mark on each unit. Rolling refurbishments, including

our Green Tea sustainability initiative that now covers 72% of the

offices, have upgraded the space and we have recently enhanced the

entrance creating additional amenities.

Paul Williams, Chief Executive of Derwent London, said:

"We pride ourselves in our long-term customer relationships and

are delighted that we have been able to accommodate TransferWise in

their extraordinary business development. The Tea Building has also

had a remarkable journey from a spartan warehouse to a thriving

Shoreditch hub, and one that continues with the recently remodelled

entrances and our ongoing Green Tea environmental initiatives."

Darren Graver, Office Expansions Lead at TransferWise, said:

"TransferWise is continuing to grow, and making sure we have the

right space for our people is crucial for our future plans. As many

people mix working from home, the office, and remotely, we know

just how important flexibility is to our team. Following internal

workplace surveys and focus groups, we learned that our people

wanted a hybrid working model that caters to that as well as it

can. By expanding our office space, and offering more flexibility

for our teams to work however and wherever suits them best, we can

ensure we're equipped for the future of work."

For further information, please contact:

Derwent London Paul Williams, Chief Executive

Tel: +44 (0)20 7659 3000 Emily Prideaux, Director of Leasing

Quentin Freeman, Head of Investor

Relations

Brunswick Group Nina Coad

Tel: +44 (0)20 7404 5959 Emily Trapnell

Notes to editors

Derwent London plc

Derwent London plc owns 83 buildings in a commercial real estate

portfolio predominantly in central London valued at GBP5.4 billion

(including joint ventures) as at 30 June 2020, making it the

largest London-focused real estate investment trust (REIT).

Our experienced team has a long track record of creating value

throughout the property cycle by regenerating our buildings via

development or refurbishment, effective asset management and

capital recycling.

We typically acquire central London properties off-market with

low capital values and modest rents in improving locations, most of

which are either in the West End or the Tech Belt. We capitalise on

the unique qualities of each of our properties - taking a fresh

approach to the regeneration of every building with a focus on

anticipating tenant requirements and an emphasis on design.

Reflecting and supporting our long-term success, the business

has a strong balance sheet with modest leverage, a robust income

stream and flexible financing.

As part of our commitment to lead the industry in mitigating

climate change, in October 2019, Derwent London became the first UK

REIT to sign a Green Revolving Credit Facility. At the same time,

we also launched our Green Finance Framework and signed the Better

Buildings Partnership's climate change commitment. The Group is a

member of the 'RE100' which recognises Derwent London as an

influential company, committed to 100% renewable power by

purchasing renewable energy, a key step in becoming a net zero

carbon business. Derwent London is one of only a few property

companies worldwide to have science-based carbon targets validated

by the Science Based Targets initiative (SBTi).

Landmark schemes in our 5.6 million sq ft portfolio include 80

Charlotte Street W1, Brunel Building W2, White Collar Factory EC1,

Angel Building EC1, 1-2 Stephen Street W1, Horseferry House SW1 and

Tea Building E1.

In 2020 the Group has won several awards for Brunel Building

with the most prominent being the BCO Best Commercial Workplace

award. In 2019 the Group won EG Offices Company of the Year, the

CoStar West End Deal of the Year for Brunel Building, Westminster

Business Council's Best Achievement in Sustainability award and

topped the real estate sector and was placed ninth overall in the

Management Today 2019 awards for 'Britain's Most Admired

Companies'. In 2013 the Company launched a voluntary Community Fund

and has to date supported over 100 community projects in the West

End and the Tech Belt.

The Company is a public limited company, which is listed on the

London Stock Exchange and incorporated and domiciled in the UK. The

address of its registered office is 25 Savile Row, London, W1S

2ER.

For further information see www.derwentlondon.com or follow us

on Twitter at @derwentlondon

About TransferWise

TransferWise is a global technology company that's building the

best way to move money around the world. Whether you're sending

money to another country, spending money abroad, or making and

receiving international business payments, TransferWise is on a

mission to make your life easier and save you money.

Co-founded by Taavet Hinrikus and Kristo Käärmann, TransferWise

launched in 2011. It is one of the world's fastest growing tech

firms having raised over $1 billion in primary and secondary

transactions from investors such as D1 Capital Partners, Lead Edge,

Lone Pine, Vitruvian, IVP, Merian Chrysalis Investment Company Ltd,

Andreessen Horowitz, Sir Richard Branson, Valar Ventures and Max

Levchin from PayPal.

Nine million people use TransferWise, which processes over $5

billion in cross-border payments every month, saving customers over

$1 billion a year.

Forward-looking statements

This document contains certain forward-looking statements about

the future outlook of Derwent London. By their nature, any

statements about future outlook involve risk and uncertainty

because they relate to events and depend on circumstances that may

or may not occur in the future. Actual results, performance or

outcomes may differ materially from any results, performance or

outcomes expressed or implied by such forward-looking

statements.

No representation or warranty is given in relation to any

forward-looking statements made by Derwent London, including as to

their completeness or accuracy. Derwent London does not undertake

to update any forward-looking statements whether as a result of new

information, future events or otherwise. Nothing in this

announcement should be construed as a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFSLESEESSEFE

(END) Dow Jones Newswires

December 03, 2020 02:01 ET (07:01 GMT)

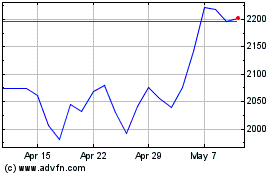

Derwent London (LSE:DLN)

Historical Stock Chart

From Jan 2025 to Feb 2025

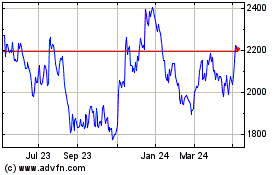

Derwent London (LSE:DLN)

Historical Stock Chart

From Feb 2024 to Feb 2025