TIDMDSG

RNS Number : 6327Z

Dillistone Group PLC

25 September 2009

25 September 2009

DILLISTONE GROUP PLC

INTERIM RESULTS

FOR THE SIX MONTHS ENDED 30 JUNE 2009

Dillistone Group Plc ('Dillistone' or 'the Group'), the AIM listed global

supplier of executive recruitment software, announces interim results for the

six months ended 30 June 2009.

Commenting on the results, Chairman Jim McLaughlin said:

"The Group enjoys a high proportion of recurring income which has supported the

lower level of new systems sales so far this year and we have been diligent

about controlling our cost base to ensure that we continue to meet market

expectations.

"Operating profits, although lower than for the same period last year, exceeded

those recorded in the second half of 2008 when the full impact of the recession

was first reflected in the Group's financial performance."

Highlights for the period:

+---------------------------+----------------+----------------+------------------+

| |

+-------------------------------------------------------------+

| | 6 Months | 6 Months | 6 Months |

| | ended 30 June | ended 31 Dec | ended 30 June |

| | 2009 | 2008 | 2008 |

+---------------------------+----------------+----------------+------------------+

| * Revenue | GBP1.822m | GBP2.092m | GBP2.516m |

+---------------------------+----------------+----------------+------------------+

| * Operating profit | GBP0.466m | GBP0.440m | GBP0.932m |

+---------------------------+----------------+----------------+------------------+

| * Profit before tax | GBP0.471m | GBP0.477m | GBP0.949m |

+---------------------------+----------------+----------------+------------------+

| * Earnings per share | 6.42p | 6.18p | 12.30p |

| (basic) | | | |

+---------------------------+----------------+----------------+------------------+

| * Cash balances | GBP1.795m | GBP2.352m | GBP2.042m |

+---------------------------+----------------+----------------+------------------+

* Recurring revenues increased over 2008 by 12% to GBP1.203m;

* Maintained interim dividend of 3.5p per share;

* Clients in over 55 countries world wide;

* Resilient performance from US business;

* Improving Order Book;

On current trading and prospects, Mr McLaughlin added:

"Having established some stability in a very difficult market, it does appear

from recent orders received that the Group is likely to achieve its market

expectations for the year as a whole and, with cash reserves, a strong balance

sheet and increased recurring revenues, we are well positioned to take advantage

of any upturn in global economic activity."

Contacts:

Jim McLaughlin Dillistone Group Plc 01934 710 509

Chairman & Finance Director

Emily Morgan Blomfield Corporate Finance020 7489 4500

Director, Corporate Finance

Daniel Briggs Religare Hichens, Harrison 020 7382 7776

Tom Cooper/Paul Vann Winningtons 020 3043 4162

0797 122 1972

Notes to Editors:

Dillistone Group Plc is a leader in the supply and support of recruitment

software to the search and selection market. Dillistone was admitted to AIM, a

market operated by the London Stock Exchange plc, in June 2006.

Dillistone develops, publishes and supports FILEFINDER, its executive

recruitment software, for recruitment companies and in-house recruitment teams.

FILEFINDER is unique in providing tailored workflow and 24 hour support for

global users, to mirror the profile and demands of an executive search

assignment. FILEFINDER has been adopted by around 1,000 companies in more than

55 countries.

Chairman's Statement

I said in my report for the year ended 31 December 2008 that the Group would see

the impact of the recession in its 2009 results, and that has been the case. The

year ended December 2008 saw a marked downturn in the second half when compared

to the first half of that year. I am very pleased to be able to report that, as

a result of strong recurring revenues, and in spite of a reduction in new system

sales, operating profits for the 6 months ended 30 June 2009 exceeded those seen

in the second half of 2008, when the full impact of the recession was first

reflected in the financial performance of the Group.

Financial Performance

Revenue in the 6 months ended 30 June 2009 amounted to GBP1,821,940 (2008 -

GBP2,515,902), a reduction of 28% when compared with the same period in 2008.

Operating profits for the 6 months ended 30 June 2009 were GBP465,655 (2008 -

GBP931,631) and profits before tax fell to GBP471,461, (2008 - GBP948,577).

However, when compared to the second half of 2008, operating profits increased

slightly from GBP439,770 to GBP465,655, despite a reduction in revenue from

GBP2.092m in the second half of 2008 to GBP1.822m in the period under review.

Administrative costs were reduced to GBP1.296m in the 6 months ended 30 June

2009, when compared to GBP1.465m in the first half of 2008, and GBP1.569m in the

second half of that year.

Recurring revenues increased by 12% to GBP1.204m when compared to the GBP1.071m

earned in the first half of 2008, and by 2.5% over the GBP1.175m earned in the

second half of 2008. In the first half of 2009, recurring revenues comprised

some 66% of total sales, when compared to just 43% in the first half of 2008,

and 56% in the second half of 2008. There was a marked difference in performance

between the UK and Asia businesses, both of which suffered reductions in sales

of over 40% in total sales, and our European and USA businesses, which were much

less adversely affected. To illustrate the point, the USA business recorded an

increase in sales of 4% in the first half of this year as a result of recurring

ASP revenues. The USA business now earns some 70% of its revenues from recurring

sources.

Non recurring revenues, mainly arising from the sale of new systems, universally

suffered throughout the Group as orders from both existing and new clients were

more difficult to come by. However, since the start of the second half we have

seen what appears to be a significant improvement in the market, and this has

manifested itself in a number of valuable orders.

Regionally, the UK and Asia both suffered badly in their overall performance,

with the UK recording a 95% reduction in profits, and Asia 69%, both when

compared to the comparable period in 2008. Our Europe business showed a small

reduction in profitability of just 7%, whilst the USA increased its profits from

operations by some 13% partly as a result of a concentration in its business

towards the ASP model.

Cashflow in the 6 months ended 30 June 2009 showed an outflow of some GBP533,000

primarily as a result of dividends paid of GBP396,000 and investment in new

product development of GBP235,000 and reflects the decision to commit resources

to the further development of FILEFINDER. This latter cost compares to just

GBP38,000 in the first half of 2008. At 30 June 2009 we had cash reserves of

some GBP1.8m and a strong balance sheet, both of which stand the Group in good

stead and leave us well positioned to take advantage of any upturn.

Earnings per share amounted to 6.42p, compared with 12.30p for the corresponding

period in 2008, and 6.18p per share for the second half of 2008. As announced in

my annual report for 2008, the Board has decided to maintain the dividend for

2009 at the same level as was paid in respect of 2008, and accordingly, the

Board has decided to pay a dividend of 3.5p per share (2008-3.5p) on 30 October

2009 to holders on the register on 9 October 2009. Shares will trade ex-dividend

from 7 October 2009.

Prospects

Having established some stability in a very difficult market, it does appear

from recent orders received that the Group is likely to achieve its market

expectations for the year as a whole, and is well positioned to take advantage

of any upturn in global economic activity. The level of recurring revenue across

the Group, the cash reserves and strong balance sheet all place the Group as a

leading contender to emerge well from the current recession.

Jim McLaughlin

25th September 2009

+---------------------------------+-------------+-------------+--------------+

| CONSOLIDATED INCOME STATEMENTS | | |

+-----------------------------------------------+-------------+--------------+

| | | | Year Ended |

+---------------------------------+-------------+-------------+--------------+

| | 6 Months ended 30 June | 31 December |

+---------------------------------+---------------------------+--------------+

| | 2009 | 2008 | 2008 |

+---------------------------------+-------------+-------------+--------------+

| | Unaudited | Unaudited | Audited |

+---------------------------------+-------------+-------------+--------------+

| | GBP | GBP | GBP |

+---------------------------------+-------------+-------------+--------------+

| Revenue | 1,821,940 | 2,515,902 | 4,608,197 |

+---------------------------------+-------------+-------------+--------------+

| Cost of sales | (60,434) | (119,473) | (202,997) |

+---------------------------------+-------------+-------------+--------------+

| Gross profit | 1,761,506 | 2,396,429 | 4,405,200 |

+---------------------------------+-------------+-------------+--------------+

| Administrative expenses | (1,295,851) | (1,464,798) | (3,033,799) |

+---------------------------------+-------------+-------------+--------------+

| | | | |

+---------------------------------+-------------+-------------+--------------+

| Result from operating | 465,655 | 931,631 | 1,371,401 |

| activities | | | |

+---------------------------------+-------------+-------------+--------------+

| Financial income | 5,806 | 16,946 | 54,171 |

+---------------------------------+-------------+-------------+--------------+

| Profit before tax | 471,461 | 948,577 | 1,425,572 |

+---------------------------------+-------------+-------------+--------------+

| | | | |

+---------------------------------+-------------+-------------+--------------+

| Tax expense | (119,724) | (284,573) | (427,672) |

+---------------------------------+-------------+-------------+--------------+

| Profit for the period/year | 351,737 | 664,004 | 997,900 |

+---------------------------------+-------------+-------------+--------------+

| | | | |

+---------------------------------+-------------+-------------+--------------+

| Earnings per share (pence) | | | |

+---------------------------------+-------------+-------------+--------------+

| Basic | 6.42 | 12.30 | 18.48 |

+---------------------------------+-------------+-------------+--------------+

| Diluted | 6.17 | 11.60 | 17.50 |

+---------------------------------+-------------+-------------+--------------+

| | | | |

+---------------------------------+-------------+-------------+--------------+

+----------------------------------+------------+------------+------------+----------+

| CONSOLIDATED BALANCE SHEETS | | |

+----------------------------------+-------------------------+-----------------------+

| | | As at |

+----------------------------------+-------------------------+------------+

| | As at 30 June | 31 |

| | | December |

+----------------------------------+-------------------------+------------+

| | 2009 | 2008 | 2008 |

+----------------------------------+------------+------------+------------+

| | Unaudited | Unaudited | Audited |

+----------------------------------+------------+------------+------------+

| ASSETS | GBP | GBP | GBP |

+----------------------------------+------------+------------+------------+

| Non-current assets | | | |

+----------------------------------+------------+------------+------------+

| Intangible assets | 911,540 | 655,862 | 707,396 |

+----------------------------------+------------+------------+------------+

| Property plant & equipment | 132,222 | 147,877 | 158,443 |

+----------------------------------+------------+------------+------------+

| | 1,043,762 | 803,739 | 865,839 |

+----------------------------------+------------+------------+------------+

| Current assets | | | |

+----------------------------------+------------+------------+------------+

| Inventories | 31,003 | 21,506 | 50,628 |

+----------------------------------+------------+------------+------------+

| Trade and other receivables | 1,311,385 | 1,333,539 | 1,306,748 |

+----------------------------------+------------+------------+------------+

| Cash and cash equivalents | 1,795,323 | 2,041,885 | 2,352,794 |

+----------------------------------+------------+------------+------------+

| | 3,137,711 | 3,396,930 | 3,710,170 |

+----------------------------------+------------+------------+------------+

| Total Assets | 4,181,473 | 4,200,669 | 4,576,009 |

+----------------------------------+------------+------------+------------+

| | | | |

+----------------------------------+------------+------------+------------+

| | | | |

+----------------------------------+------------+------------+------------+

| EQUITY AND LIABILITIES | | | |

+----------------------------------+------------+------------+------------+

| Equity | | | |

+----------------------------------+------------+------------+------------+

| Share capital | 282,976 | 270,000 | 270,000 |

+----------------------------------+------------+------------+------------+

| Share premium | 28,947 | - | - |

+----------------------------------+------------+------------+------------+

| Share option reserve | 9,254 | 36,476 | 40,427 |

+----------------------------------+------------+------------+------------+

| Retained earnings | 1,620,667 | 1,489,027 | 1,633,923 |

+----------------------------------+------------+------------+------------+

| Translation reserve | 99,084 | 82,939 | 123,749 |

+----------------------------------+------------+------------+------------+

| Total Equity | 2,040,928 | 1,878,442 | 2,068,099 |

+----------------------------------+------------+------------+------------+

| | | | |

+----------------------------------+------------+------------+------------+

| Liabilities | | | |

+----------------------------------+------------+------------+------------+

| Current liabilities | | | |

+----------------------------------+------------+------------+------------+

| Trade and other payables | 2,014,617 | 1,982,768 | 2,328,489 |

+----------------------------------+------------+------------+------------+

| Current tax payable | 122,928 | 336,459 | 176,421 |

+----------------------------------+------------+------------+------------+

| | 2,137,545 | 2,319,227 | 2,504,910 |

+----------------------------------+------------+------------+------------+

| Non-current liabilities | | | |

+----------------------------------+------------+------------+------------+

| Deferred tax liability | 3,000 | 3,000 | 3,000 |

+----------------------------------+------------+------------+------------+

| Total Liabilities | 2,140,545 | 2,322,227 | 2,507,910 |

+----------------------------------+------------+------------+------------+

| | | | |

+----------------------------------+------------+------------+------------+

| Total liabilities and equity | 4,181,473 | 4,200,669 | 4,576,009 |

+----------------------------------+------------+------------+------------+----------+

+-----------------+------------------+------------------+-----------------+

| The financial statements were approved by the board of directors and |

| authorised for issue on 25th September 2009. |

| They were signed on its behalf by: |

+-------------------------------------------------------------------------+

| | | | |

+-----------------+------------------+------------------+-----------------+

| | | | |

+-----------------+------------------+------------------+-----------------+

| | | | |

+-----------------+------------------+------------------+-----------------+

| J S Starr | | J McLaughlin | |

+-----------------+------------------+------------------+-----------------+

+--------------------------------------+------------+------------+--------------+

| CONSOLIDATED CASH FLOW STATEMENTS | | |

+---------------------------------------------------+------------+--------------+

| | | | Year ended |

+--------------------------------------+------------+------------+--------------+

| | 6 Months ended 30 | 31 December |

| | June | |

+--------------------------------------+-------------------------+--------------+

| | 2009 | 2008 | 2008 |

+--------------------------------------+------------+------------+--------------+

| | Unaudited | Unaudited | Audited |

+--------------------------------------+------------+------------+--------------+

| | GBP | GBP | GBP |

+--------------------------------------+------------+------------+--------------+

| Operating Activities | | | |

+--------------------------------------+------------+------------+--------------+

| Profit from operations | 465,655 | 931,631 | 1,371,401 |

+--------------------------------------+------------+------------+--------------+

| Less taxation paid | (173,217) | (248,937) | (552,074) |

+--------------------------------------+------------+------------+--------------+

| Adjustment for | | | |

+--------------------------------------+------------+------------+--------------+

| Depreciation | 71,610 | 52,938 | 132,712 |

+--------------------------------------+------------+------------+--------------+

| Share option expense | - | 9,698 | 13,649 |

+--------------------------------------+------------+------------+--------------+

| Operating cash flows before | | | |

| movements | | | |

+--------------------------------------+------------+------------+--------------+

| in working capital | 364,048 | 745,330 | 965,688 |

+--------------------------------------+------------+------------+--------------+

| Decrease / (Increase) in receivables | (4,637) | (49,349) | (22,558) |

+--------------------------------------+------------+------------+--------------+

| Decrease / (Increase) in inventories | 19,625 | (19,172) | (48,294) |

+--------------------------------------+------------+------------+--------------+

| (Decrease) / Increase in payables | (313,872) | 134,730 | 480,451 |

+--------------------------------------+------------+------------+--------------+

| | | | |

+--------------------------------------+------------+------------+--------------+

| Net cash generated from operating | 65,164 | 811,539 | 1,375,287 |

| activities | | | |

+--------------------------------------+------------+------------+--------------+

| | | | |

+--------------------------------------+------------+------------+--------------+

| Investing Activities | | | |

+--------------------------------------+------------+------------+--------------+

| Interest received | 5,806 | 16,946 | 54,171 |

+--------------------------------------+------------+------------+--------------+

| Purchases of property plant and | (14,088) | (22,941) | (71,747) |

| equipment | | | |

+--------------------------------------+------------+------------+--------------+

| Investment in product development | (235,445) | (38,400) | (131,579) |

+--------------------------------------+------------+------------+--------------+

| | | | |

+--------------------------------------+------------+------------+--------------+

| Net cash used in investing | (243,727) | (44,395) | (149,155) |

| activities | | | |

+--------------------------------------+------------+------------+--------------+

| | | | |

+--------------------------------------+------------+------------+--------------+

| Financing Activities | | | |

+--------------------------------------+------------+------------+--------------+

| Proceeds from issue of share capital | 41,923 | - | - |

+--------------------------------------+------------+------------+--------------+

| Dividends paid | (396,166) | (324,000) | (513,000) |

+--------------------------------------+------------+------------+--------------+

| Net cash used by financing | (354,243) | (324,000) | (513,000) |

| activities | | | |

+--------------------------------------+------------+------------+--------------+

| | | | |

+--------------------------------------+------------+------------+--------------+

| | | | |

+--------------------------------------+------------+------------+--------------+

| Net change in cash and cash | (532,806) | 443,144 | 713,132 |

| equivalents | | | |

+--------------------------------------+------------+------------+--------------+

| Cash and cash equivalents at | | | |

| beginning of the | | | |

+--------------------------------------+------------+------------+--------------+

| Period | 2,352,794 | 1,533,649 | 1,533,649 |

+--------------------------------------+------------+------------+--------------+

| | | | |

+--------------------------------------+------------+------------+--------------+

| Effect of foreign exchange rate | (24,665) | 65,092 | 106,013 |

| changes | | | |

+--------------------------------------+------------+------------+--------------+

| | | | |

+--------------------------------------+------------+------------+--------------+

| | | | |

+--------------------------------------+------------+------------+--------------+

| Cash and cash equivalents at end of | 1,795,323 | 2,041,885 | 2,352,794 |

| period | | | |

+--------------------------------------+------------+------------+--------------+

+-----------------------------+----------+---------+------+---+------------+----------+------------+

| CONSOLIDATED STATEMENT OF CHANGES IN EQUITY | | | | |

+---------------------------------------------------------+---+------------+----------+------------+

| | | | | | | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| | | | Share | | | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| | Share | Share | option | Retained | Foreign | Total |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| | capital | premium | reserve | earnings | exchange | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| | GBP | GBP | GBP | GBP | GBP | GBP |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Balance at 31 December 2007 | 270,000 | - | 26,778 | 1,149,023 | 17,736 | 1,463,537 |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| | | | | | | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Profit for the 6 months | - | - | - | 664,004 | - | 664,004 |

| ended 30 June 2008 | | | | | | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| | | | | | | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Share option expense | - | - | 9,698 | - | - | 9,698 |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Exchange differences on | | | | | | |

| translation | | | | | | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| of overseas operations | - | - | - | - | 65,203 | 65,203 |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Dividends paid | - | - | - | (324,000) | - | (324,000) |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Balance at 30 June 2008 | 270,000 | - | 36,476 | 1,489,027 | 82,939 | 1,878,442 |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| | | | | | | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Profit for the 6 months | - | - | - | 333,896 | - | 333,896 |

| ended 31 | | | | | | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| December 2008 | | | | | | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Share option expense | - | - | 3,951 | - | - | 3,951 |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Exchange differences on | | | | | | |

| translation | | | | | | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| of overseas operations | - | - | - | - | 40,810 | 40,810 |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Dividends paid | - | - | - | (189,000) | - | (189,000) |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Balance at 31 December 2008 | 270,000 | - | 40,427 | 1,633,923 | 123,749 | 2,068,099 |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| | | | | | | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Profit for the 6 months | - | - | - | 351,737 | - | 351,737 |

| ended 30 June 2009 | | | | | | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| | | | | | | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Issue of share capital | 12,976 | 28,947 | - | - | - | 41,923 |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Share option release | - | - | (31,173) | 31,173 | - | - |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Exchange differences on | | | | | | |

| translation | | | | | | |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| of overseas operations | - | - | - | - | (24,665) | (24,665) |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Dividends paid | - | - | - | (396,166) | - | (396,166) |

+-----------------------------+----------+---------+----------+------------+----------+------------+

| Balance at 30 June 2009 | 282,976 | 28,947 | 9,254 | 1,620,667 | 99,084 | 2,040,928 |

+-----------------------------+----------+---------+------+---+------------+----------+------------+

+------------------------------------------------------------------------+

| NOTES TO THE INTERIM REPORT |

+------------------------------------------------------------------------+

1.Basis of Preparation

The financial information for the six months ended 30 June 2009 included in this

interim report comprises the consolidated income statement, the consolidated

balance sheet, the consolidated cash flow statement, the consolidated statement

of changes in equity and the related notes. This statement has been prepared in

accordance with IAS 34 "Interim Financial Reporting".

This interim financial information is unaudited but has been reviewed by the

auditors and their review opinion is included in this interim report. The

financial information set out in this report does not constitute statutory

accounts as defined by the Companies Act 2006. The comparative figures for the

year ended 31 December 2008 were derived from the statutory accounts for that

year which have been delivered to the Registrar of Companies. Those accounts

received an unqualified audit report which did not contain statements under

sections 498(2) or (3) (accounting record or returns inadequate, accounts not

agreeing with records and returns or failure to obtain necessary information and

explanations) of the Companies Act 2006.

The interim financial statements have been prepared on the basis of the

accounting policies set out in the December 2008 financial statements of

Dillistone Group Plc.

2.Share Based Payments

The Company operates two share option schemes. The fair value of the options

granted under these schemes is recognised as an employee expense with a

corresponding increase in equity. The fair value is measured at grant date and

spread over the period at the end of which the option holder may exercise the

option.

The fair value of the options granted is measured using the Black-Scholes model,

adjusted to take into account sub-optimal exercise factor and other flaws in

Black-Scholes, and taking into account the terms and conditions upon which the

incentives were granted.

3.Segment reporting

+----------------------------------+-------+-------+-------+------------+-------------+

| Geographical segments | | | |

+------------------------------------------+---------------+------------+-------------+

| The following table provides an analysis of the Group's sales by geographical |

| market. |

+-------------------------------------------------------------------------------------+

| | | | |

+----------------------------------+---------------+--------------------+-------------+

| | | | Year ended |

+----------------------------------+---------------+--------------------+-------------+

| | 6 Months ended 30 June | 31 December |

+----------------------------------+------------------------------------+-------------+

| | 2009 | 2008 | 2008 |

+----------------------------------+---------------+--------------------+-------------+

| | GBP | GBP | GBP |

+----------------------------------+---------------+--------------------+-------------+

| UK | 720,668 | 1,285,633 | 2,256,516 |

+----------------------------------+---------------+--------------------+-------------+

| Europe | 527,791 | 570,005 | 1,008,035 |

+----------------------------------+---------------+--------------------+-------------+

| USA | 423,936 | 407,702 | 832,527 |

+----------------------------------+---------------+--------------------+-------------+

| Asia Pacific | 149,545 | 252,562 | 511,120 |

+----------------------------------+---------------+--------------------+-------------+

| | 1,821,940 | 2,515,902 | 4,608,198 |

+----------------------------------+---------------+--------------------+-------------+

| | | | |

+----------------------------------+---------------+--------------------+-------------+

| Business Segment | | | |

+----------------------------------+---------------+--------------------+-------------+

| The following table provides an analysis of the Group's sales by business segment. |

+-------------------------------------------------------------------------------------+

| | | | |

+----------------------------------+---------------+--------------------+-------------+

| | | | Year ended |

+----------------------------------+---------------+--------------------+-------------+

| | 6 Months ended 30 June | 31 December |

+----------------------------------+------------------------------------+-------------+

| | 2009 | 2008 | 2008 |

+----------------------------------+---------------+--------------------+-------------+

| | GBP | GBP | GBP |

+----------------------------------+---------------+--------------------+-------------+

| Recurring | 1,203,759 | 1,071,388 | 2,245,943 |

+----------------------------------+---------------+--------------------+-------------+

| Non Recurring | 618,181 | 1,444,514 | 2,362,254 |

+----------------------------------+---------------+--------------------+-------------+

| | 1,821,940 | 2,515,902 | 4,608,197 |

+----------------------------------+---------------+--------------------+-------------+

| | | | |

+----------------------------------+---------------+--------------------+-------------+

| Recurring income includes all support services, and web hosting income. Non |

| recurring income includes sales of new licenses, and income derived from installing |

| those licenses including training, installation, and data translation. |

+----------------------------------+-------+-------+-------+------------+-------------+

+----------------------------------+--------------+------------+--------------+

| Result | | | |

+----------------------------------+--------------+------------+--------------+

| | | | Year ended |

+----------------------------------+--------------+------------+--------------+

| | 6 Months ended 30 June | 31 December |

+----------------------------------+---------------------------+--------------+

| | 2009 | 2008 | 2008 |

+----------------------------------+--------------+------------+--------------+

| | GBP | GBP | GBP |

+----------------------------------+--------------+------------+--------------+

| UK | 22,737 | 456,307 | 523,611 |

+----------------------------------+--------------+------------+--------------+

| Europe | 408,923 | 440,668 | 729,318 |

+----------------------------------+--------------+------------+--------------+

| USA | 176,841 | 156,840 | 324,377 |

+----------------------------------+--------------+------------+--------------+

| Asia Pacific | 44,396 | 141,860 | 307,447 |

+----------------------------------+--------------+------------+--------------+

| | 652,897 | 1,195,675 | 1,884,753 |

+----------------------------------+--------------+------------+--------------+

| Unallocated Expenses | (187,242) | (264,044) | (513,352) |

+----------------------------------+--------------+------------+--------------+

| Profit from Operations | 465,655 | 931,631 | 1,371,401 |

+----------------------------------+--------------+------------+--------------+

+----------------------------------+------------+------------+---------------+

| Total assets | As at | As at | As at |

+----------------------------------+------------+------------+---------------+

| | 30 June | 30 June | 31 December |

| | 2009 | 2008 | 2008 |

+----------------------------------+------------+------------+---------------+

| | GBP | GBP | GBP |

+----------------------------------+------------+------------+---------------+

| UK | 2,595,856 | 2,792,493 | 3,438,892 |

+----------------------------------+------------+------------+---------------+

| Europe | 716,558 | 539,621 | 338,609 |

+----------------------------------+------------+------------+---------------+

| US | 554,072 | 684,360 | 583,553 |

+----------------------------------+------------+------------+---------------+

| Asia Pacific | 314,987 | 184,195 | 214,955 |

+----------------------------------+------------+------------+---------------+

| | 4,181,473 | 4,200,669 | 4,576,009 |

+----------------------------------+------------+------------+---------------+

4.Dividends

A final dividend of 7p per share in respect of the year ended 31 December 2008

was paid on 9 June 2009. The total cost of this dividend was GBP396,166.

The Board has decided to pay an interim dividend of 3.5 pence per share (2008:

3.5p) on 30 October 2009 to holders on the register on 9 October 2009. Shares

will trade ex-dividend from 7 October 2009.

5.Earnings per Share

+-----------------------------------+--------------+-------------+--------------+

| | | | Year ended |

+-----------------------------------+--------------+-------------+--------------+

| | 6 Months ended 30th June | 31 December |

+-----------------------------------+----------------------------+--------------+

| | 2009 | 2008 | 2008 |

+-----------------------------------+--------------+-------------+--------------+

| Basic earnings per share | | | |

+-----------------------------------+--------------+-------------+--------------+

| Profit attributable to ordinary | GBP351,737 | GBP664,004 | GBP997,900 |

| shareholders | | | |

+-----------------------------------+--------------+-------------+--------------+

| | | | |

+-----------------------------------+--------------+-------------+--------------+

| Weighted average number of shares | 5,480,739 | 5,400,000 | 5,400,000 |

+-----------------------------------+--------------+-------------+--------------+

| | | | |

+-----------------------------------+--------------+-------------+--------------+

| Basic earnings per share (pence) | 6.42 | 12.30 | 18.48 |

+-----------------------------------+--------------+-------------+--------------+

| | | | |

+-----------------------------------+--------------+-------------+--------------+

| Diluted Earnings per share | | | |

+-----------------------------------+--------------+-------------+--------------+

| Profit attributable to ordinary | GBP351,737 | GBP666,427 | GBP997,900 |

| shareholders | | | |

+-----------------------------------+--------------+-------------+--------------+

| | | | |

+-----------------------------------+--------------+-------------+--------------+

| Diluted weighted average number | 5,701,325 | 5,745,449 | 5,702,087 |

| of shares | | | |

+-----------------------------------+--------------+-------------+--------------+

| | | | |

+-----------------------------------+--------------+-------------+--------------+

| Diluted earnings per share | 6.17 | 11.60 | 17.50 |

| (pence) | | | |

+-----------------------------------+--------------+-------------+--------------+

6.Related party transactions

The company has a related party relationship with its subsidiaries, its

directors, and other employees of the company with management responsibility.

There were no transactions with these parties during the period outside the

usual course of business. There were no transactions with any other related

parties.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ZZLFLKKBZBBB

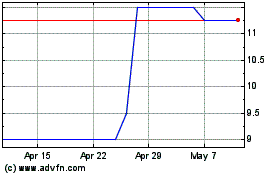

Dillistone (LSE:DSG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Dillistone (LSE:DSG)

Historical Stock Chart

From Feb 2024 to Feb 2025